The Best Medicare Supplement Plans for Low-Income Seniors

- Cigna Medicare Supplement Insurance Plans : Best Overall Plans

- Aetna Medicare Supplement Plans : Widest Range of Coverage

- Mutual of Omaha Medigap Plans : Best Customer Service

- State Farm Medicare Supplement Insurance : Best Bundled Discounts

- AARP Medicare Supplement Insurance Plans : Best Educational Tools

Full Answer

What are the best health insurance plans for seniors?

Jan 07, 2021 · What Is the Best Medicare Plan for Seniors? Original Medicare. Original Medicare consists of Medicare parts A and B. For many Americans, this covers most necessary medical expenses. However, ... Medicare Advantage. Medicare Part D. Medigap.

What is the best medical insurance for seniors?

May 06, 2020 · The best Medicare plan will depend on a person’s income, needs, and priorities. Medicare Part A covers hospitalization. This includes inpatient care in a hospital, along with skilled nursing ...

What is the best medical plan for seniors?

What Is the Best Medicare Plan for Seniors in 2022? Medicare Part A. Part A covers hospital services, including emergency room visits, inpatient care, and outpatient services. It covers limited home ... Medicare Part B. Medicare Part C (Medicare Advantage) Medicare Part D. Medigap.

What are the top 5 Medicare supplement plans?

Sep 07, 2021 · The Aetna Medicare Advantage plans are number one on our list. Aetnais one of the largest health insurance carriers in the world. They have earned the title of an AM Best A Rated Company. These plans have options- HMO or PPO, zero or …

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Is AARP Medicare cheaper?

Despite the large price differences, AARP Medicare Supplement plans are usually a good value. For example, a 65-year-old may pay slightly more for an AARP Medigap plan, but the slower age-based price increases could mean they'll have the cheapest plan when they're in their 80s and 90s.Jan 24, 2022

How do I choose the right Medicare plan?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What is the difference between a Medicare supplement plan and a Medicare Advantage plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

What is the average cost of a Medicare supplement plan?

The average cost of a Medicare supplemental insurance plan, or Medigap, is about $150 a month, according to industry experts. These supplemental insurance plans help fill gaps in Original Medicare (Part A and Part B) coverage.

What is the difference between Plan G and Plan N?

When you compare Plan G vs Plan N, you'll see that Plan G comes with more coverage. However, Plan N will come with a lower monthly premium. In exchange for a lower monthly premium, you agree to pay small copays when visiting the doctor or hospital.

Why does AARP recommend UnitedHealthcare?

From our long-standing relationship with AARP to our strength, stability, and decades of service, UnitedHealthcare helps make it easier for Medicare beneficiaries to live a happier, healthier life.

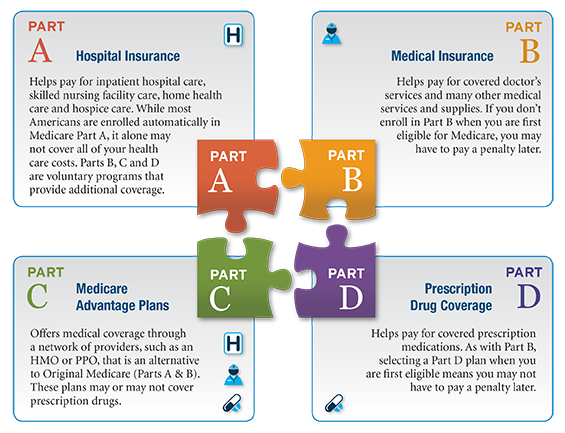

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

How long before you turn 65 do you apply for Medicare?

3 monthsGenerally, you're first eligible starting 3 months before you turn 65 and ending 3 months after the month you turn 65. If you don't sign up for Part B when you're first eligible, you might have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B.

Does Medicare Part D cover prescriptions?

Medicare Part D, the prescription drug benefit, is the part of Medicare that covers most outpatient prescription drugs. Part D is offered through private companies either as a stand-alone plan, for those enrolled in Original Medicare, or as a set of benefits included with your Medicare Advantage Plan.

What is the best Medicare plan?

The best Medicare plan is one that covers all your necessary medical and financial needs. There are advantages and disadvantages to each Medicare plan option, ranging from cost-effectiveness to provider limitations, and more.

What to consider when choosing a Medicare plan?

Here are some important things to consider when choosing the best Medicare plan for you: The type of coverage you already have.

How long after your 65th birthday can you enroll in Medicare?

To ensure that you enroll on time to avoid coverage gaps and late penalties, pay close attention to the following Medicare enrollment periods: Your 65th birthday. You can enroll in Medicare any time within the 3 months before or after your 65 th birthday. Six months following your 65th birthday.

How long do you have to enroll in Medicare Part C?

Special enrollment period. Under some circumstances, you may qualify for a special enrollment period. During your special enrollment period, you’ll have 8 months to enroll in a plan.

What is Medicare Part D?

Medicare Part D. Part D offers additional prescription drug coverage for any medications that aren’t included under original Medicare. A Medicare Advantage plan can take the place of Part D. If you don’t want Medicare Advantage, Part D is a great alternative.

Does Medicare cover vision?

Original Medicare consists of Medicare parts A and B. For many Americans, this covers most necessary medical expenses. However, original Medicare doesn’t cover prescription drugs, vision, dental, or other services.

Do people with Medicare have an advantage plan?

of people enrolled in Medicare have a Medicare Advantage plan. While most Advantage plans can cost more up front, they can also help to save money in the long run. There are other factors to consider when choosing whether to enroll in Medicare Advantage.

When is Medicare available for older adults?

Medicare is available when a person turns 65 and in some other specific circumstances. However, older adults have different health concerns and conditions, so finding the right plan is an individual choice. A key benefit of traditional Medicare — which ...

Which is more expensive, Medicare or Medigap?

Traditional Medicare with Medigap likely offers the most coverage, but it may be the most expensive. A person can consider their income and how much they are able to spend before choosing a Medicare plan. Traditional Medicare with Medigap also offers a lot of flexibility when choosing a doctor or specialist.

How does Medigap differ from Medicare Advantage?

Medigap differs from Medicare Advantage in a key way. Medicare Advantage plans are an alternative to traditional Medicare, while Medigap is a supplement to traditional Medicare. To enroll in Medigap, a person must be enrolled in traditional Medicare.

What is Medicare Part B?

Medicare Part B also covers: ambulance services. limited outpatient prescription medications. inpatient and outpatient mental health services. In addition, Part B covers medical equipment, such as: canes. crutches.

What are the disadvantages of Medicare Advantage?

The main disadvantage of Medicare Advantage plans is that a person’s choice of providers is more restricted than with traditional Medicare. A person must choose doctors and hospitals that are within the plan’s network. If they pick out-of-network providers, they face higher costs.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What are the advantages and disadvantages of Medicare?

The primary disadvantage associated with traditional Medicare is that it may cost more than Medicare Advantage.

What percentage of people in Medicare have an Advantage plan?

Medicare Advantage. Roughly 31 percentTrusted Source of people enrolled in Medicare have a Medicare Advantage plan. While most Advantage plans can cost more up front, they can also help to save money in the long run. There are other factors to consider when choosing whether to enroll in Medicare Advantage.

What is Medicare Advantage?

Most Medicare Advantage plans are either HMO or PPO plans, both of which have some provider limitations. Other plan offers may also come with additional provider limitations. State-specific coverage. Medicare Advantage plans cover you within the state you enrolled, typically the state you live in.

What is single coverage?

Single coverage. It is a single-user policy, which means that your spouse won’t be covered. If you and your spouse both require supplemental insurance, you’ll need to enroll in separate plans.

What are the advantages of Medicare Part D?

Advantages of Medicare Part D. Standardized coverage . When you enroll in a Part D plan, each plan must follow a set amount of coverage defined by Medicare. No matter how much your medications cost, you can rest assured that your plan will cover a set amount.

How much is Medicare Part B in 2021?

The monthly premium for Medicare Part B starts as low as $148.50 in 2021. If you receive Social Security payments, your monthly Medicare costs can be automatically deducted. Provider freedom. With original Medicare, you can visit any provider that accepts Medicare, including specialists.

What are the disadvantages of Medicare?

Disadvantages of original Medicare. Lack of additional coverage. Original Medicare only covers hospital and medical services. This can lead to coverage gaps for services such as vision, dental, and more. No out-of-pocket maximum. Original Medicare has no yearly out-of-pocket maximum cost.

Is Medigap a private insurance?

It is a supplemental private insurance option which can help pay for Medicare costs i.e deductibles, copays, and coinsurance. Medigap isn’t necessarily an alternative to Medicare Advantage. It is a cost-effective alternative for those who choose not to enroll in Medicare Advantage.

Which company offers the best Medicare Advantage Plan?

Cigna. These long-standing companies offer the best Medicare Advantage plans year after year. But, since Medicare isn’t free, it’s a good idea to have other options for coverage. One option is a Medicare Advantage plan. These plans will take the place of Medicare. When you go to the doctor, your Medicare Advantage Plan ID card is your main card ...

What is Medicare Advantage Plan ID?

When you go to the doctor, your Medicare Advantage Plan ID card is your main card for Medicare. These plans have Part D, which can make keeping track of your healthcare easier. Some plans even include things like routine dental, routine eye care, and silver-sneakers fitness programs.

What is the lowest out of pocket cost for Humana?

For example, some maximum out-of-pockets are as low as $2,200. If this plan is in your service area, that would mean the most you can spend on copayments and coinsurances for the year is $2,200.

What are the benefits of Humana Part C?

Most Advantage plans are including fitness programs and access to more than 13,000 fitness centers, convenient mail-order pharmacy services, and a 24/7 nurse advice line.

Do some states have more Medicare Advantage plans than others?

Choosing a reliable company to handle your Medicare Advantage benefits is essential. Some states have more Medicare Advantage plan enrollees than other states. For example, fewer beneficiaries in Louisiana have Medicare Advantage than the percentage of enrollees in Florida.

Does Cigna have special needs plans?

That is why Cigna offers many plan options, including Special Needs Plans. Cigna has special needs plans for people in nursing homes or skilled nursing care, or people with diabetes, cardiovascular issues, and options for people with Medicare and Medicaid. Cigna has over 86 million members worldwide.

Can you join Medicare Advantage at any time?

Things to Know About Medicare Advantage Plans. You can only join at certain times during the year unless you qualify for a Special Election Period. In most cases, you enroll in a plan for a year. The Medicare Advantage Open Enrollment Period allows beneficiaries to switch to another plan.

What is the best Medicare Part D provider?

The best Medicare Part D providers include AARP, Humana Medicare Rx, WellCare, and Cigna-HealthSpring. If you’re eligible for Part D coverage, the three main considerations you’re likely to make are your current health, budget, and any medicine you take.

What are the deductibles for Medicare?

Deductibles apply to services covered under Part A and B. Medicare Part C (Medicare Advantage Plans) and Medicare Part D are optional and have their own premiums. If you live in a low income household, you may qualify for a subsidy to reduce the overall cost of Medicare.

What is the Medicare Part D deductible for 2020?

In 2020, the allowable Medicare Part D deductible is $435. Depending on the provider you choose, plans may either charge the full deductible, a partial, or waive the deductible (zero deductible). You pay the network discounted price for prescription drugs until your plan equals the deductible.

What is a Part D plan?

The best Medicare Part D plans not only help you manage the cost of prescription drugs, they also play a role in ensuring medicines stay affordable and they can protect against future price hikes. Roughly 70% of Americans signed up for Medicare supplement with a Part D plan, ...

How long does Medicare Part D last?

There are three different enrollment periods for Medicare Part D, as follows: Initial enrollment period: This covers a total of seven months - three months before you turn 65, your birthday month itself, and then the three months directly after your 65th birthday. So seven months in total.

Is AARP a good Medicare plan?

AARP Medicare Rx, with services provided by United Healthcare, is an excellent all-round provider of Medicare Part D plans and is the only range of plans backed by AARP. This is the best Medicare Part D plan option for seniors as it mixes low co-pays with competitive premiums and has a network of preferred providers.

Does Medicare Part D have monthly premiums?

Similar to other commercial health insurance plans, Medicare Part D Prescription Drug Plans vary with the monthly premiums, depending on the company and the coverage and the prescriptions you need covered. Expert Advice.

What is the best Medicare plan for 2021?

SilverScript. Humana. Cigna. Mutual of Omaha. UnitedHealthcare. The highest rating a plan can have is 5-star. Just because a policy is 5-star in your area doesn’t mean it’s the top-rated plan in the country. There is no nationwide plan that has a 5-star rating.

What are the preferred pharmacies for Choice Plan?

For those with the Choice plan, there are fewer options. For example, the Choice plan preferred pharmacies are CVS, Walmart, and thousands of community-based independent drug stores. Then, the Plus plan includes CVS, Walmart, Publix, Kroger, Albertsons, as well as many grocery stores and retailers.

What is the SilverScript plan?

SilverScript Medicare Prescription Drug Plans. There are three different plans available with SilverScript. The Choice, the Plus plan, and the SmartRx plan. All policies are a great option, depending on the medications you take, one could be more beneficial to you than the other.

How much is Value Plan deductible?

The Value policy has no deductible on the first two tiers at preferred pharmacies. But, the Value plan has a $445 deductible on all other tiers. The Plus Plan has a deductible of $445 that applies to all tiers. However, the Plus plan has a broader range of drugs that have coverage.

Does Humana Part D have a deductible?

Humana Part D Reviews. Many generics with Humana have a $0 deductible. Further, they have a variety of plan options, something for everyone. The high deductible on brand name medications isn’t that great, and you have to go to Walmart to get the best savings.

What is the difference between Essential and Extra?

Secure-Extra. The “Essential” policy is the lowest premium option, and the “Extra” has a higher premium than the other two. Like all insurance, the best plan for your neighbor might not be the most suitable for you. To find the most suitable coverage, comparing all available options is necessary.

When will Medicare Part D be updated?

Home / FAQs / Medicare Part D / Top 5 Part D Plans. Updated on June 3, 2021. Medicare prescription drug plan changes in 2021 are noteworthy. Also, by knowing what to expect, you can stay ahead of the game. Drugs can be costly, and new brand-name drugs can be the most expensive. With age, you’re more likely to require medications.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.