Medicare Supplement Insurance prices in Iowa

| Plan Type | Premium Range |

| Plan F | $109-$225 |

| Plan G | $99-$210 |

| Plan N | $73-$160 |

Full Answer

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

Which Medicare supplement plan should I Choose?

Some people also refer to these plans as Medigap. As with traditional Medicare, the CMS divides Medicare supplement plans by letter. People new to Medicare in 2021 can choose from plans A, B, D, G, K, L, M, and N. Not all insurers offer the same plans in all areas of the country, however.

What is the best Medicare supplement insurance plan?

- United Healthcare: 26%

- Humana: 18%

- BCBS plans: 15%

- CVS (Aetna): 11%

- Kaiser Permanente: 7%

- Centene: 4%

- Cigna: 2%

- Other companies: 18%

What are the best Medicare plans?

... Jerry represent most of the supplement plan and drug -plan carriers and all Medicare advantage plan carriers. Sign up today for a FREE virtual event and let Silver Supplements Solutions help you understand your best option for your own peace of mind!

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

What is the highest rated Medicare Supplement company?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Pricing: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

How much does Medicare Part B cost in Iowa?

$170.10 per monthPart B costs $170.10 per month but can be more if you have higher income. There are 64 Medicare Advantage Plans in the state that are an alternative to Original Medicare. Learn more about your Medicare options in Iowa.

How much do Medicare Supplement plans usually cost?

Medicare Supplement Plans have premiums that cost anywhere from around $70/month to around $270/month. Typically, plans with higher monthly premiums will have lower deductibles.

How do I choose a Medicare Supplement plan?

Follow the steps below to purchase your Medigap plan:Enroll in Medicare Part A and Part B. ... Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.Compare costs between companies. ... Select a Medigap plan that works best for you and purchase your policy.

What is the most comprehensive Medicare Supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Are all Plan G Medicare supplements the same?

Because all Medicare Supplement Plan G policies provide the exact same coverage or benefits. This is what people mean when they say these plans are “standardized.” That said, not all Plan G policies cost the same. Insurance companies are free to charge what they want for them, and so they do.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

What is the monthly premium for Plan G?

How much does Medicare Plan G cost? Medicare Plan G costs between $120 and $364 per month in 2022 for a 65-year-old. You'll see a range of prices for Medicare supplement policies because each insurance company uses a different pricing method for plans.

Is Plan F better than Plan G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

What is the deductible for Plan G in 2022?

$2,490Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses. Medicare Supplement Insurance plans are sold by private insurance companies.

What are the Top 5 Medicare Supplement Plans in Iowa?

Each Medigap policy offers the same set of basic benefits. From there, plan options vary. Here’s an overview of the top five plans in Iowa.

What is the Best Supplemental Insurance to go with Medicare?

The best Medigap plan is one that balances coverage and cost specific to your health care needs. Here are a few guidelines to keep in mind as you compare plans.

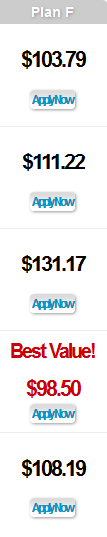

What is the Average Cost for a Medicare Supplement Plan in Iowa for 2021?

The cost of a Medicare Supplement plan in Iowa varies based on age, demographics, insurance carrier, and zip code. The average cost of a Medigap policy in Iowa is $137. Here’s what a 65-year-old female, nonsmoker, living in Dubuque (zip code 52001) might pay:

Common Iowa Medicare Supplement Plan Questions

Private insurance companies sell Medigap policies. Three consistently rank high in terms of service, pricing, and AM Best financial ratings:

Ready to learn more?

My Medigap Plans is a rapidly growing resource for Medicare beneficiaries. We specialize in educating consumers on their options and guiding them through the process of plan selection. We work closely with some of the nations top rated carriers such as Aetna, Cigna and Mutual of Omaha.

What Are Medigap Plans?

Medigap plans are Medicare Supplement Insurance offered by Medicare-approved private insurance companies to help cover cost sharing requirements of Original Medicare Parts A and B.

What Medicare Supplement Plans Cover

Medigap policies serve as your secondary source of insurance after Medicare pays. Medigap fills in the “gaps” between what Medicare pays for covered services and what you are charged. Some plans offer extended coverage for Part B excess charges and foreign travel emergency costs.

What Medigap Plans Cost in Iowa

Expect to pay about $65 to $342 each month for a Medigap plan A, G, or N in Iowa if you enroll during your open enrollment period. Premiums will vary depending on your insurer and how your premium is rated.

Medigap vs. Medicare Advantage Plans

Medigap and Medicare Advantage Plans are very different. You are eligible for either type of plan when you are enrolled in Medicare Part A and B, but you cannot have both at the same time. Both Medigap and Medicare Advantage Plans are offered by Medicare-approved private insurance companies.

Types of Medigap Plans in Iowa

Every standardized type of Medigap plan is offered in Iowa, but Plans F and G offer the most comprehensive coverage and are the most popular. Plans F and G also come in a high-deductible version. Here are some highlights and difference among some of the plans:

When to Sign Up for Medicare Supplement Plans in Iowa

In general, you will get the best price for Medicare Supplement Insurance if you purchase a plan as soon as you are eligible for Medicare and enrolled in Parts A and B.

How to Choose a Medigap Plan in Iowa

Consider these factors as you compare Medicare Supplement Insurance plans available in your area:

What is Medicare Supplement Insurance?

Buying Medicare supplement insurance is a way to protect yourself from some of the costs not covered by Medicare. It is also called “Medigap” or “Med Supp” insurance. There are 10 standardized Medicare supplement plans identified by the letters "A" through "N." Plans F and G are also available as a high deductible plans.

Is Medicare a good plan?

Medicare is a good start to maintaining health care coverage, but it’s just a start. SHIIP-SMP can help you sort through dozens of supplemental coverage plans. Below you'll find a number of resources to help you. I am turning 65 and going on Medicare.

What is Medigap insurance?

Medigap plans are standardized insurance plans that are regulated by the government.

What is the deductible for Medicare Plan F?

With this option, you must pay for Medicare-covered costs ( coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren’t available to people who were newly eligible for Medicare on or after January 1, 2020.)

Is Iowa Medicare Supplement Plan the same as Iowa Medicare Supplement Plan?

It is important to know that even though the coverage for Iowa Medicare Supplement Plans are the same, the rates are not . You need to compare the plan letters from company to company. For example, compare Medicare Supplement Plan G from multiple companies.

Medicare Supplement Insurance in Iowa

Medicare Supplement Insurance in Iowa is health insurance that covers medical expenses and health care related supplies.

What is the best Medicare Supplement plan in Iowa for 2022?

There are 5 plans that are the best supplemental insurance in Iowa and they are: Medicare Plan F, G, N, High Deductible Plan F, and High Deductible Plan G.

How much does a Medigap plan cost in Iowa?

The average cost will depend on the insurer because their pricing will be based on community ratings, issue age, and attained age,

When can I apply for a Medicare Supplement plan?

You can apply within the 6 month Medigap Open Enrollment period. This will be the best time to gain Medicare benefits because during this period pricing and plan options from a Medicare insurance company are better. For age specifics, see below.

When can I apply for a Iowa Medicare Supplement plan?

Changing Medigap plans can be done at any point. However, when applying outside the initial enrollment period, you could be denied coverage or have your rates increased due to a health condition or medical issues.

Ready to Learn More?

We help educate Medicare beneficiaries on their Medigap options and help them go through the process of reviewing and comparing plans. We work with most of the nations top-rated Medigap carriers such as Aetna, Cigna, Mutual of Omaha and Florida Blue Medicare plans.

Iowa State Links

Also known as Medigap, Medicare Supplement insurance pays coinsurance, deductibles, co-payments and other expenses that Medicare beneficiaries are supposed to pay.