How has Medicare changed over the years?

This change began in 1988 with the creation of programs to help lower-income enrollees pay for their Medicare premiums and other costs. Additional programs to help people pay for their Medicare coverage were added through the 1990s.

When did Medicare start?

But it wasn’t until after 1965 – after legislation was signed by President Lyndon B Johnson – that Americans started receiving Medicare health coverage when Medicare’s hospital and medical insurance benefits launched for the following 12 months. Today, Medicare continues to provide health care for those in need.

Where does Medicare get its funding?

Medicare Part A, which covers hospital and inpatient care, receives most of its funding, 89%, from payroll taxes. Medicare Part B, which covers outpatient services, obtains most of its funding, 74%, from general revenue. General revenue is money taken in by the federal government from taxes and nontax sources to fund government programs.

What happened to the number of Medicare contracts held by insurers?

After the introduction of risk contracting in 1985, the number of Medicare contracts held by health insurers grew, then fell at the end of that decade partly because of market consolidation (e.g., two insurers in a single state merged) ( Physician Payment Review Commission 1995 ), and then grew again during the mid-1990s (see Figure 2 ).

What is the difference between Part C and Part D Medicare?

Medicare Part C is an alternative to original Medicare. It must offer the same basic benefits as original Medicare, but some plans also offer additional benefits, such as vision and dental care. Medicare Part D, on the other hand, is a plan that people can enroll in to receive prescription drug coverage.

What is the Medicare Part B premium for 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

What is Medicare Part B mean?

Medicare Part B helps cover medically-necessary services like doctors' services and tests, outpatient care, home health services, durable medical equipment, and other medical services. Part B also covers some preventive services. Look at your Medicare card to find out if you have Part B.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

Will 2022 Part B premium be reduced?

About half of the larger-than-expected 2022 premium increase, set last fall, was attributed to the potential cost of covering the Alzheimer's drug Aduhelm.

How much will Social Security take out for Medicare in 2022?

NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

What is covered by Medicare Part C?

Medicare Part C outpatient coveragedoctor's appointments, including specialists.emergency ambulance transportation.durable medical equipment like wheelchairs and home oxygen equipment.emergency room care.laboratory testing, such as blood tests and urinalysis.occupational, physical, and speech therapy.More items...

What is the Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Who pays for Medicare Part A?

Most people receive Medicare Part A automatically when they turn age 65 and pay no monthly premiums. If you or your spouse haven't worked at least 40 quarters, you'll pay a monthly premium for Part A.

What is the average cost of Medicare Part C?

Currently insured? For 2022, a Medicare Part C plan costs an average of $33 per month. These bundled plans combine benefits for hospital care, medical treatment, doctor visits, prescription drugs and frequently, add-on coverage for dental, vision and hearing.

Does Medicare Part C replace A and B?

Part C (Medicare Advantage) Under Medicare Part C, you are covered for all Medicare parts A and B services. Most Medicare Advantage plans also cover you for prescription drugs, dental, vision, hearing services, and more.

What is Medicare Part D used for?

The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans (PDPs) to supplement traditional Medicare and Medicare Advantage prescription drug plans (MA-PDs) ...

Q: What are the changes to Medicare benefits for 2022?

A: There are several changes for Medicare enrollees in 2022. Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that...

How much will the Part B deductible increase for 2022?

The Part B deductible for 2022 is $233. That’s an increase from $203 in 2021, and a much more significant increase than normal.

Are Part A premiums increasing in 2022?

Roughly 1% of Medicare Part A enrollees pay premiums; the rest get it for free based on their work history or a spouse’s work history. Part A premi...

Is the Medicare Part A deductible increasing for 2022?

Part A has a deductible that applies to each benefit period (rather than a calendar year deductible like Part B or private insurance plans). The de...

How much is the Medicare Part A coinsurance for 2022?

The Part A deductible covers the enrollee’s first 60 inpatient days during a benefit period. If the person needs additional inpatient coverage duri...

Can I still buy Medigap Plans C and F?

As a result of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), Medigap plans C and F (including the high-deductible Plan F) are n...

Are there inflation adjustments for Medicare beneficiaries in high-income brackets?

Medicare beneficiaries with high incomes pay more for Part B and Part D. But what exactly does “high income” mean? The high-income brackets were in...

How are Medicare Advantage premiums changing for 2021?

According to CMS, the average Medicare Advantage (Medicare Part C) premiums for 2022 is about $19/month (in addition to the cost of Part B), which...

Is the Medicare Advantage out-of-pocket maximum changing for 2022?

Medicare Advantage plans are required to cap enrollees’ out-of-pocket costs for Part A and Part B services (unlike Original Medicare, which does no...

How is Medicare Part D prescription drug coverage changing for 2022?

For stand-alone Part D prescription drug plans, the maximum allowable deductible for standard Part D plans is $480 in 2022, up from $445 in 2021. A...

When did Medicare start putting new brackets?

These new brackets took effect in 2018, bumping some high-income enrollees into higher premium brackets.

When will Medicare Part D change to Advantage?

Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that beneficiaries can change during the annual fall enrollment period that runs from October 15 to December 7.

Is the Medicare Advantage out-of-pocket maximum changing for 2022?

Medicare Advantage plans are required to cap enrollees’ out-of-pocket costs for Part A and Part B services (unlike Original Medicare, which does not have a cap on out-of -pocket costs). The cap does not include the cost of prescription drugs, since those are covered under Medicare Part D (even when it’s integrated with a Medicare Advantage plan).

How much will the Part B deductible increase for 2022?

The Part B deductible for 2022 is $233. That’s an increase from $203 in 2021, and a much more significant increase than normal.

Are Part A premiums increasing in 2022?

Part A premiums have trended upwards over time and they increased again for 2022.

Can I still buy Medigap Plans C and F?

As a result of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), Medigap plans C and F (including the high-deductible Plan F) are no longer available for purchase by people who become newly-eligible for Medicare on or after January 1, 2020. People who became Medicare-eligible prior to 2020 can keep Plan C or F if they already have it, or apply for those plans at a later date, including for 2022 coverage.

What is the maximum out of pocket limit for Medicare Advantage?

The maximum out-of-pocket limit for Medicare Advantage plans is increasing to $7,550 for 2021. Part D donut hole no longer exists, but a standard plan’s maximum deductible is increasing to $445 in 2021, and the threshold for entering the catastrophic coverage phase (where out-of-pocket spending decreases significantly) is increasing to $6,550.

When did Medicare expand to include people with disabilities?

The addition of coverage for people with disabilities in 1972. In 1972, former President Richard Nixon expanded Medicare coverage to include people with disabilities who receive Social Security Disability Insurance. He also extended immediate coverage to people diagnosed with end stage renal disease (ESRD).

When did everyone pay the same amount for Medicare?

Before 1988, everyone paid the same amount for Medicare, regardless of income. Today people with higher incomes might pay more, while people with lower incomes might pay less.

What are some examples of Medicare programs?

Some examples of these programs include the Extra Help program, which helps those with low income pay for their medications, and four different Medicare savings programs to help pay for premiums and other Medicare expenses.

What is a Medigap insurance?

Medigap, also known as Medicare supplement insurance, helps you pay the out-of-pocket costs of original Medicare, like copays and deductibles.

How many people will be covered by Medicare in 2021?

That first year, 19 million Americans enrolled in Medicare for their healthcare coverage. As of 2019, more than 61 million Americans were enrolled in the program.

How does Medicare Advantage work?

Medicare Advantage plans work with a network of providers. Their coverage model is more similar to employer coverage than original Medicare.

What age does Medicare cover?

When Medicare first began, it included just Medicare Part A and Medicare Part B, and it covered only people ages 65 and over. Over the years, additional parts — including Part C and Part D — have been added. Coverage has also been expanded to include people under age 65 who have certain disabilities and chronic conditions.

How many people are on medicare in 2018?

Medicare is a widely used program. In 2018, nearly 60,000 Americans were enrolled in Medicare. This number is projected to continue growing each year. Despite its popularity, Medicare can be a source of confusion for many people. Each part of Medicare covers different services and has different costs.

What are the parts of Medicare?

Each part covers different healthcare services you might need. Currently, the four parts of Medicare are: Medicare Part A. Medicare Part A is hospital insurance. It covers you during short-term inpatient stays in hospitals and for services like hospice.

How long do you have to sign up for Medicare if you have delayed enrollment?

Special enrollment period. If you delayed Medicare enrollment for an approved reason, you can later enroll during a special enrollment period. You have 8 months from the end of your coverage or the end of your employment to sign up without penalty.

What is the maximum amount you can pay for Medicare in 2021?

In 2021, the out-of-pocket maximum for plans is $7,550. Note.

What is Medicare Part A?

Part A coverage. Medicare Part A covers the care you receive when you’re admitted to a facility like a hospital or hospice center. Part A will pick up all the costs while you’re there, including costs normally covered by parts B or D. Part A coverage includes: hospital stays and procedures. hospice care.

What age does Medicare cover?

Medicare is a health insurance program for people ages 65 and older , as well as those with certain health conditions and disabilities.

How old do you have to be to get Medicare?

You can enroll in Medicare when you meet one of these conditions: you’re turning 65 years old. you’ve been receiving Social Security Disability Insurance (SSDI) for 24 months at any age. you have a diagnosis of end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS) at any age.

When did Medicare start?

But it wasn’t until after 1966 – after legislation was signed by President Lyndon B Johnson in 1965 – that Americans started receiving Medicare health coverage when Medicare’s hospital and medical insurance benefits first took effect. Harry Truman and his wife, Bess, were the first two Medicare beneficiaries.

How many people will have Medicare in 2021?

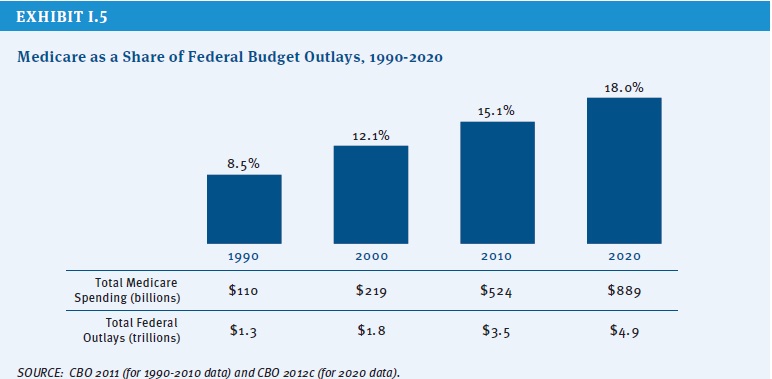

As of 2021, 63.1 million Americans had coverage through Medicare. Medicare spending is expected to account for 18% of total federal spending by 2028. Medicare per-capita spending grew at a slower pace between 2010 and 2017. Discussion about a national health insurance system for Americans goes all the way back to the days ...

What is a QMB in Medicare?

These individuals are known as Qualified Medicare Beneficiaries (QMB). In 2016, there were 7.5 million Medicare beneficiaries who were QMBs, and Medicaid funding was being used to cover their Medicare premiums and cost-sharing. To be considered a QMB, you have to be eligible for Medicare and have income that doesn’t exceed 100 percent of the federal poverty level.

What is Medicare and CHIP Reauthorization Act?

In early 2015 after years of trying to accomplish reforms, Congress passed the Medicare and CHIP Reauthorization Act (MACRA), repealing a 1990s formula that required an annual “doc fix” from Congress to avoid major cuts to doctor’s payments under Medicare Part B. MACRA served as a catalyst through 2016 and beyond for CMS to push changes to how Medicare pays doctors for care – moving to paying for more value and quality over just how many services doctors provide Medicare beneficiaries.

How many QMBs were there in 2016?

In 2016, there were 7.5 million Medicare beneficiaries who were QMBs, and Medicaid funding was being used to cover their Medicare premiums and cost-sharing. To be considered a QMB, you have to be eligible for Medicare and have income that doesn’t exceed 100 percent of the federal poverty level. The ’90s.

How much was Medicare in 1965?

In 1965, the budget for Medicare was around $10 billion. In 1966, Medicare’s coverage took effect, as Americans age 65 and older were enrolled in Part A and millions of other seniors signed up for Part B. Nineteen million individuals signed up for Medicare during its first year. The ’70s.

What is the Patient Protection and Affordable Care Act?

The Patient Protection and Affordable Care Act of 2010 includes a long list of reform provisions intended to contain Medicare costs while increasing revenue, improving and streamlining its delivery systems, and even increasing services to the program.

How many parts are there in Medicare?

There are four different parts of Medicare: Part A, Part B, Part C, and Part D — each part covering different services. Understanding how these parts and services work (together and separately) is the key to determining which ones fit your unique health care needs and budget. There are two main paths for Medicare coverage — enrolling in Original ...

How long do you have to be on Medicare if you are 65?

For those younger than 65, you are only eligible to receive Medicare benefits if you: Have received Social Security or Railroad Retirement Board (RRB) disability benefits for 24 months.

What are the benefits of Medicare Advantage Plan?

Additional benefits that many Medicare Advantage plans include are: Vision coverage. Hearing coverage. Dental coverage. Medicare Part D prescription drug coverage. If you’re eligible for Medicare Part A and Part B, and do not have ESRD, you can join a Medicare Advantage Plan. Medicare beneficiaries have the option of receiving health care benefits ...

What is Medicare Advantage?

Medicare Advantage (Part C) is an alternative to Original Medicare. It allows you to receive Part A and Part B benefits — and in many cases, other benefits — from a private health insurance plan. At the very least, your Medicare Advantage plan must offer the same benefits as Original Medicare. The only exception is hospice care, which is still ...

When do you get Medicare for ALS?

If you’re under 65, it’s the 25th month you receive disability benefits. ALS patients are automatically enrolled in Medicare coverage when their Social Security disability benefits begin, regardless of age. If you have end-stage renal disease (ESRD), you must manually enroll.

When do you get a disability if you are 65?

If you’re under 65, it’s the 25th month you receive disability benefits.

Does Medicare Advantage include Part D?

Many Medicare Advantage plans also include Part D coverage. If you're looking for Medicare prescription drug coverage, you can consider enrolling in a Medicare Advantage plan that includes drug coverage, or you can consider enrolling in a Medicare Part D plan. You can compare Part D plans available where you live and enroll in a Medicare ...

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What medical equipment is ordered by your doctor for use in the home?

Certain medical equipment, like a walker, wheelchair, or hospital bed, that's ordered by your doctor for use in the home.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

Why did Medicare lose money in the 2000s?

Between 1997 and 2003 Medicare continued to lose money on those beneficiaries who enrolled in MA plans, partly because of the payment floors and partly because of favorable selection into Part C. Indeed, the continued favorable selection overwhelmed the ability of risk adjustment to pay less for less expensive beneficiaries. An analysis of the Medicare Current Beneficiary Survey found that in the early 2000s, MA enrollees were less likely than TM enrollees to report that they were in fair or poor health, that they had functional limitations, or that they had heart disease or chronic lung disease ( Riley and Zarabozo 2006 /2007). But the analysis found no difference in reported rates of diabetes or cancer.

When did Medicare contracting start?

After the introduction of risk contracting in 1985, the number of Medicare contracts held by health insurers grew, then fell at the end of that decade partly because of market consolidation (e.g., two insurers in a single state merged) ( Physician Payment Review Commission 1995 ), and then grew again during the mid-1990s (see Figure 2 ). Cawley, Chernew, and McLaughlin (2005) found that the entry of HMO plans in a county MA market was positively associated with AAPCC payment levels and negatively associated with Medicare Part A (hospital) spending, thus suggesting that plans avoided counties with relatively sicker Medicare beneficiaries and that their risk adjustment was inadequate. During the mid-1990s, managed care grew rapidly in the private market, and HMOs' participation in Part C was positively associated at the county level with commercial HMO penetration rates ( Welch 1996 ).

How many Medicare Advantage contracts were there in 2009?

Not surprisingly, Medicare's new-found generosity increased the number of Medicare Advantage contracts, to more than six hundred in 2009 ( Figure 2 ). The number of PFFS plans, in particular, grew over this period as their ability to reimburse providers at TM rates, along with the ratchet in Part C payments, created an opportunity for plans to profit and for large employers with dispersed retirees to obtain better health benefits for them and/or to lower their costs by shifting them from TM to PFFS. Some PFFS payments were thus effectively transferred to employers, who shifted their retirees' health insurance program to Medicare Advantage PFFS plans (which were available at lower premiums than the alternatives). By 2009, 91 percent of beneficiaries had access to an MA coordinated care plan (HMO or PPO) ( Figure 3 ), and all beneficiaries had access to a PFFS plan ( MedPAC 2010c ).

Why did Medicare expand to include risk based private plans?

The reason that Medicare expanded to include risk-based private plans was to share the gains realized from managed care in other settings. Research at the time found that prepaid group practices paid by capitation and serving those under sixty-five could provide more comprehensive coverage at less total expense than conventional health insurance could, largely by economizing on inpatient stays. Manning and colleagues (1985) compared the cost to those participants (all under sixty-five) of the RAND Health Insurance Experiment (HIE) who were randomly assigned to the Group Health Cooperative of Puget Sound (GHC) in Seattle, which also was the site of the earlier Medicare demonstration projects, with those people who were assigned to comparable coverage in fee-for-service care. The overall imputed costs were 28 percent lower at GHC, driven by a 40 percent difference in hospital costs, a finding that was consistent with the nonexperimental comparisons reviewed in influential papers by Luft (1978, 1982). There was no systematic evidence that the HMOs' reductions in use affected health outcomes in the HIE, although the satisfaction of those patients randomly assigned to the HMO was lower than that of those in fee-for-service care, suggesting that traditional indemnity insurance's wide choice of providers was valued ( Newhouse and the Insurance Experiment Group 1993, 306). This difference in satisfaction was not surprising, though, since many of those assigned to the HMO had had the opportunity to join it at work but had refused. Indeed, the satisfaction of a control group of patients who already had selected the HMO as their source of care did not differ from those in the fee-for-service system. Thus, for a substantial number of persons—all those in Seattle whose employers offered a choice of plan and who chose GHC—the loss of utility from the network restrictions was offset by the savings in out-of-pocket costs and premiums in the managed care plans.

How would moving Medicare to a defined contribution model affect the elderly?

Moving Medicare to a defined-contribution model from a defined-benefit model would have profoundly altered its nature. In effect, it would have protected Medicare, meaning (mostly nonelderly) taxpayers, while possibly exposing beneficiaries to higher costs. Opponents worried not only about the possibility of higher cost to the elderly but also about HMOs' restrictions on access to specialists and reductions in inpatient care, which could have adverse effects on the elderly's health. Critics pointed out that the elderly were a more vulnerable population than the privately employed and that inadequacies in the AAPCC's risk-adjustment system would favor selection and the likely overpayment of private plans ( Oberlander 1997 ).

Why are major changes needed in Medicare Advantage?

Conclusions: Major changes in Medicare Advantage's payment rules are needed in order to simultaneously encourage the participation of private plans, the provision of high-quality care, and to save Medicare money.

What would 95 percent of the TM cost do for Medicare?

In principle, paying 95 percent of the local risk-adjusted TM average cost could achieve the goals of both expanding choice and reducing program cost. Any supply of HMOs at the regulated price would increase the options for at least some beneficiaries, relative to those before 1985. And if the risk-adjusted formula captured the average costs for those beneficiaries who actually enrolled in MA, as opposed to the beneficiaries remaining in TM, the 95 percent rule would save Medicare money.