What is the best Medicare Supplement?

| Plan K | Plan L | |

| Medicare Part A coinsurance | 100% | 100% |

| Medicare Part B coinsurance | 50% | 75% |

| Blood (3 pints) | 50% | 75% |

| Part A hospice care coinsurance | 50% | 75% |

Full Answer

What is the best and cheapest Medicare supplement insurance?

3 rows · Mar 24, 2022 · As you can see in the table above, Medicare Supplement insurance plans can cover the following ...

What are the top 5 Medicare supplement plans?

Feb 22, 2022 · We chose AARP as best for its set pricing for Medicare Supplement coverage because it doesn’t charge more as you grow older.

How to pick the best Medicare supplement plan?

Feb 09, 2022 · AM Best 2021 rating: A+. Medigap plans offered: A, F, HD-F, G and N. Also offers Medicare Part D for prescription drug coverage. In business for over 100 years, Mutual of Omaha offers coast-to ...

What is the best Medicare supplement?

10 rows · Feb 26, 2020 · Medicare Supplement Plan G is the best overall plan that provides the most coverage for ...

Who is the best Medicare Supplement provider?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Pricing: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

Which Medicare Supplement plan is the most popular?

Plan G will cover almost everything except the Part B deductible. This means that you would be responsible for paying the entire Medicare Part B deductible — $233 for 2022 — before insurance benefits will begin to pay for your health care. Plan G is the most popular Medicare Supplement for new enrollees.Mar 16, 2022

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

What is the most popular Medigap plan for 2021?

Medigap Plans F and G are the most popular Medicare Supplement plans in 2021.Oct 6, 2021

What is the least expensive Medicare Supplement plan?

Plan N is one of the more affordable Medicare plans due to its cost-sharing but provides fewer benefits. It offers coverage for the Part A deductible, medical emergencies while traveling abroad, and the 20% not covered by Medicare.Oct 7, 2021

What is the monthly premium for Plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

What is Humana star rating?

Humana increased the number of contracts that received a 5-star rating on CMS's 5-star rating system from one contract in 2021 to four contracts in 2022, the most in the company's history, including HMO plans in Florida, Louisiana, Tennessee and Kentucky covering approximately 527,000 members.Oct 8, 2021

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Do Medigap premiums increase with age?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

What is the average cost of a Medicare Supplement plan?

The average cost of a Medicare supplemental insurance plan, or Medigap, is about $150 a month, according to industry experts. These supplemental insurance plans help fill gaps in Original Medicare (Part A and Part B) coverage.

Is Medicare Plan G good?

Is Medicare Plan G worth it? Absolutely, Plan G is worth the cost because it covers the expenses you'd otherwise pay. The policy is especially beneficial when your health starts to decline or when you need routine care.

Which Medicare Supplement plan is the best?

For most people, we recommend Medigap Plan G from AARP/UnitedHealthcare, which costs about $159 per month for a 65-year-old. This plan will give yo...

How much do Medicare Supplement plans usually cost?

A Medicare Supplement plan costs about $163 per month for 2022. However, the range of costs is especially wide because of the variety of plans avai...

What's the most popular Medicare Supplement plan?

Plan F and Plan G are the two most popular Medigap plans. Plan F is only available to those who qualified for Medicare before 2020, but because of...

What's the least expensive Medicare Supplement plan?

Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022. For those who are only interested in protecting themselves aga...

What is a Medicare Supplement Plan?

A Medicare Supplement Plan, also called a Medigap plan, is a plan sold by private companies, separate from Medicare. Medicare Supplement plans pay for the costs, or “gaps,” in coverage that are not paid for by Original Medicare. These can include prescriptions, doctor visits, vision and dental care, and more.

Does Medicare Supplement cover out of pocket costs?

As the cost of healthcare continues to increase, so do the out-of-pocket costs for services that are not covered by Original Medicare. Because it can be difficult to predict your exact health care needs and costs, Medicare Supplement plans are used to cover many of the services you may need.

What is a SHIP program?

13 Also known as SHIP, they provide free local health coverage counseling to people with Medicare.

Does Aetna offer Medicare Supplement?

Aetna stands out because it offers several Medicare Supplement plans, including Parts A, B, C, D, F, G, and N, with each plan’s information and coverage clearly laid out on the company website. Consumers are supplied with ample details to really understand the options before making a decision.

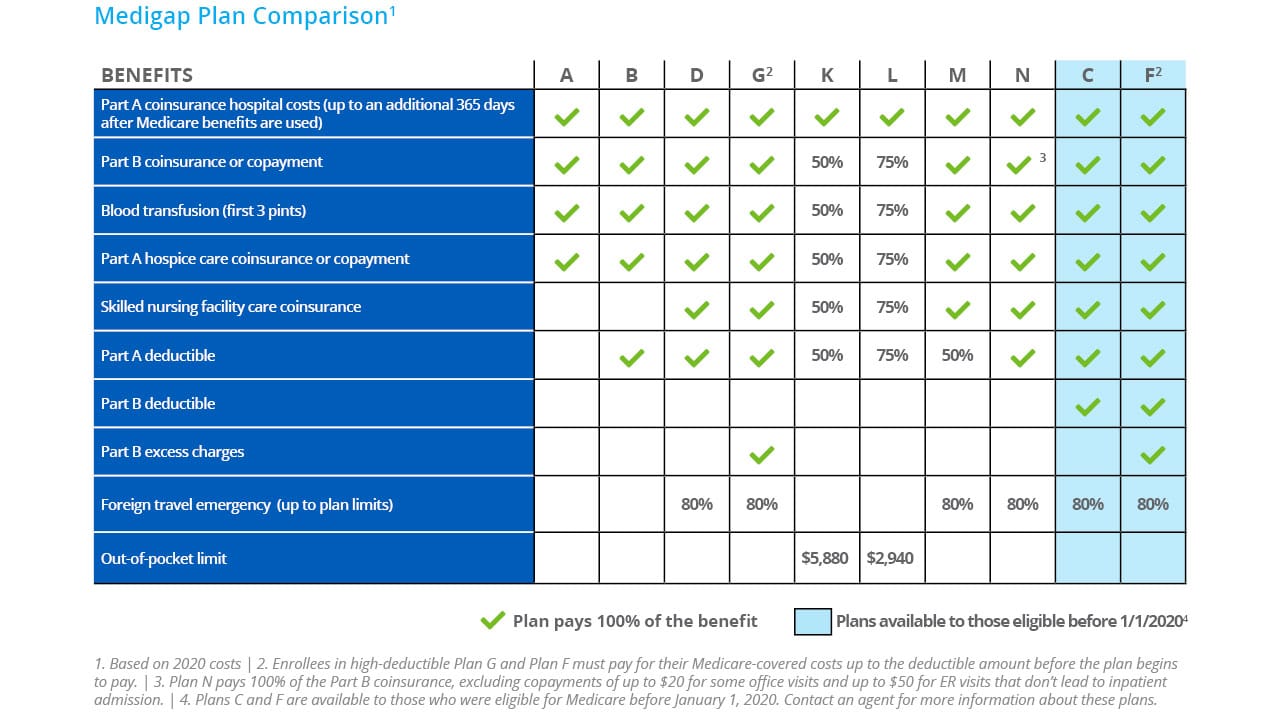

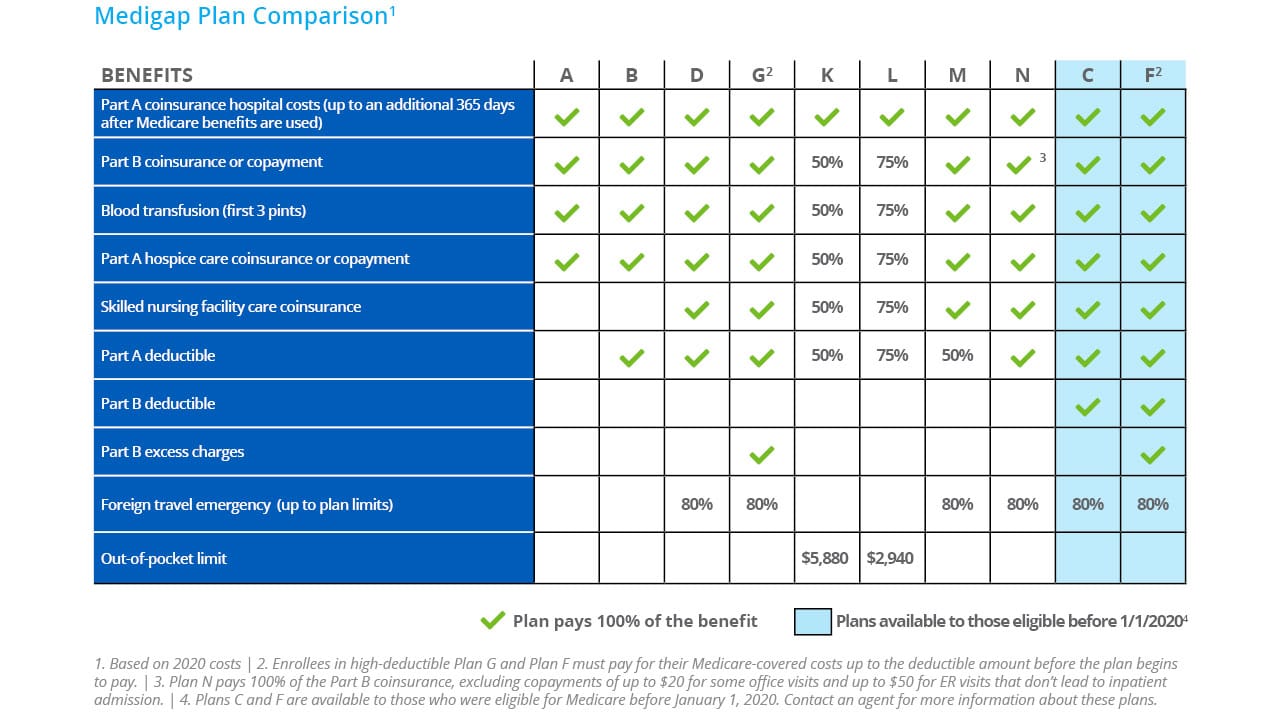

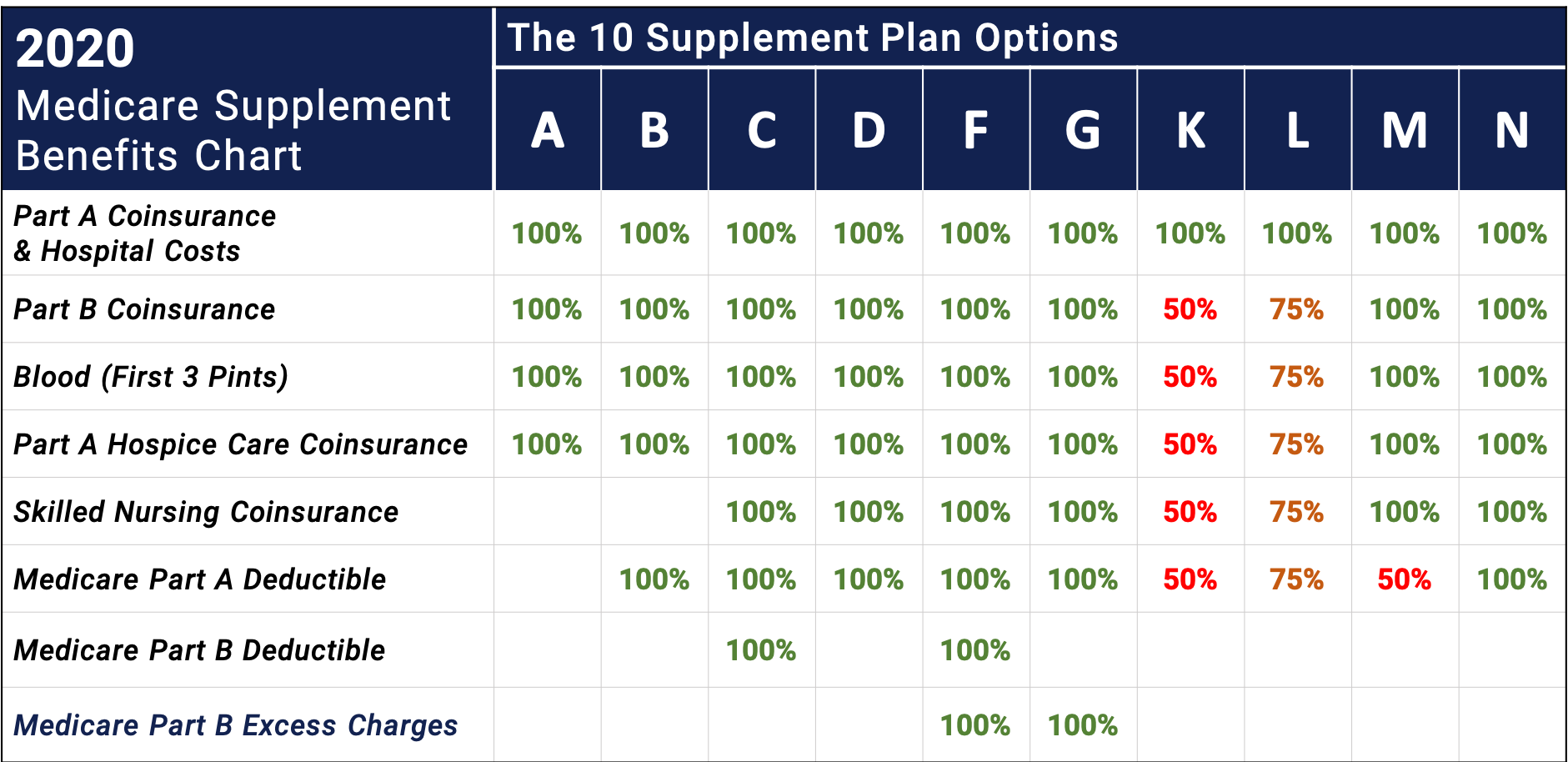

Do all Medicare Supplement plans have the same benefits?

No matter which insurance company offers a particular Medicare Supplement plan, all plans with the same letter cover the same basic benefits. For instance, all Plan C policies have the same basic benefits no matter which company sells the plan.

Is Medicare Advantage the same as Medigap?

Both Medicare Advantage and Medigap plans are supplements to Original Medicare, but they are different. Medicare Advantage is an alternative Medicare plan. Medicare Advantage has a low or $0 monthly charge and covers most prescription medicine, though the choice of doctors and networks may be limited.

Who is Stephanie Trovato?

Stephanie Trovato is a writer who specializes in researching consumer topics, and creating easy-to-understand articles to help consumers make informed decisions. Her experience in healthcare includes e-commerce, insurance advisements, mental health wellness and vitamin and supplement information.

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company?

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company? First, there's no guarantee that any insurance company will always have the most affordable plan for your needs. United Medicare Advisors gives you access to a vast range of companies. They constantly monitor premiums and plans so that you can get the provider and the plan that best fits your needs.

What is SelectQuote Senior?

SelectQuote Senior is one of several brokers that refers prospective clients to various insurance companies for Medicare Supplement Plans. You'll get quotes for 20+ different providers through this service, depending on which companies are issuing policies where you live. Those companies may include Aetna, Cigna, Anthem and Humana; all insurers with whom they partner are at least A- rated. The business itself has an "A+" rating and accreditation from the BBB, which means that in the company's 36 years in operation, they've done a good job of treating their clients fairly and honestly.

How many states does United Medicare Advisors work in?

While this is fairly common in today's internet age, it's still something to note. Another fact is that United Medicare Advisors is active in 44 states, leaving out Alaska, California, Hawaii, Massachusetts, New York and Rhode Island. If you live in one of those states, you should keep reading further in our reviews.

Who are United Medicare Advisors?

United Medicare Advisors specializes in Medicare and related supplemental plans, giving you unbiased information and access to many different insurance companies. In business since 2009, they have enrolled hundreds of thousands of Medicare Supplement policies across the country. They work with over 20 carriers, including some of the major names in the industry (such as Aetna, Mutual of Omaha, and Humana).

Is United Medicare Advisors a good company?

United Medicare Advisors has an excellent reputation. The company enjoys accreditation and an "A+" rating from the Better Business Bureau. Also, we found more than 20,000 5-star ratings from customers who appreciate their quality service and significant savings over other brokers. Clients said that the information they received was thorough and genuinely focused on their individual circumstances, not on pushing a particular service or plan. People also praised the friendly, helpful reps and describe their experiences as being quick, easy, and a perfect match for their insurance needs.

What about once you've selected your Medicare Supplement Plan?

What about once you've selected your Medicare Supplement Plan? According to our agent, all servicing is handled directly with Aetna - or whichever insurance company you choose. She suggested that customers check in with Medicare-Plans in the future to do price comparisons as rates may change. If you like a "don't call me, I'll call you" arrangement, that might be ideal. But, if you want a broker that will give you support once you've enrolled, or that will keep track of rates and other changes on your behalf, you won't find that with this service.

How long has Aetna been around?

Aetna. Aetna has been around for a LONG time: over 160 years, as a matter of fact. And, as the insurer most often quoted during our process of finding Medicare Supplement Plans, Aetna is an obvious company to consider for your coverage needs.

What is the deductible for Medicare Supplement 2021?

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible.

How much is Medicare Part B deductible in 2021?

This means that you would be responsible for paying the entire Medicare Part B deductible — $203 a year for 2021 — before insurance benefits will begin to pay out. However, Plan G will have one of the highest monthly premiums among all the Medicare supplement policies: $473.

Which Medicare plan has the highest premiums?

Best overall Medicare supplement pre-2020: Plan F. Plan F has the highest Medicare supplement premiums compared to C, G and N. On the other hand, it will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

Is Plan F a good plan?

Plan F is a good option if you want a comprehensive policy that will give you peace of mind about day-to-day expenses, such as paying a copay for a doctor. The monthly premium for Plan F will be $221. Unfortunately, Plan F will not be available to new Medicare enrollees who become eligible after Jan. 1, 2020.

Is Medicare Supplement Plan G the same as Aetna?

This means that Medicare supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna. However, rates will change from company to company since each provider will choose a different pricing structure for their Medicare supplement plans.

Does Cigna offer a discount on Medicare?

Cigna Medicare supplement has some added benefits when compared to other companies, such as a household premium discount. The discount is available in most states when multiple family members in the same household enroll in the same Cigna Medigap plan.

What is Medicare Supplement Insurance?

Medicare supplement insurance is also known as “Medigap” because it covers gaps in Original Medicare coverage. This supplemental insurance, offered by private companies, covers costs including deductibles, copayments and coinsurance. You pay a monthly premium for this added coverage.

How long does it take to enroll in Medigap?

Medigap open enrollment starts on the first day of the month you are 65 or older and enrolled in Medicare Part B and lasts six months. Because you can enroll in Medicare Part B starting three months before you turn 65, you may have enrolled in Part B but may not yet be able to purchase a Medigap plan.

Does Mutual of Omaha offer dental insurance?

Enrollees can also receive hearing aid and vision care discounts. Mutual of Omaha also offers prescription drug plans, dental insurance and dental savings plans. Mutual of Omaha Medicare Supplemental Insurance. Keep your doctors and hospitals. Keep your coverage as long as you want.

What is Plan K for Medicare?

Plan K covers additional days in the hospital after Medicare benefits are exceeded and 50% of the following (up to a yearly out-of-pocket limit): Part B coinsurance, up to three pints of blood, hospice care coinsurance or copayments, coinsurance for skilled nursing facilities and the deductible for Part A.

Is Plan C still available for new Medicare recipients?

As of Jan. 1, 2020, Plan C is no longer available for new Medicare recipients.

What is Plan M?

Plan M covers additional days in the hospital after Medicare benefits are exceeded, Part B copayments and coinsurance, hospice care coinsurance and copayments, skilled nursing facility care coinsurance and up to three pints of blood. It also covers 50% of the Part A deductible and 80% of charges for care abroad.

Does Medicare cover Plan F?

Plan F covers everything covered by Plan C and also covers any excess charge by a doctor or hospital that Medicare does not cover. Due to the changes regarding the Part B deductible, newly eligible consumers can no longer enroll in Plan F.

What are the benefits of Medicare Advantage?

Medicare Advantage (also known as Part C) 1 Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. 2 Plans may have lower out-of-pocket costs than Original Medicare. 3 In many cases, you’ll need to use doctors and other providers who are in the plan’s network and service area for the lowest costs. 4 Most plans offer extra benefits that Original Medicare doesn’t cover—like vision, hearing, dental, and more.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

How much does diabetes cost?

Medical expenditures for people with diabetes are upwards of $9,600 per year. The same study concluded that people with diabetes have medical costs 2.3 times higher than those who don’t. Diabetes can cause blood circulation problems over time that elevate risk levels for other diseases.

Does Medicare cover diabetes?

Good health care can help those with diabetes manage the disease and prevent complications. Medicare Parts A, B, and D cover basic treatment such as anti-diabetic drugs; however, because diabetes is such a complex disease, the plans may not cover everything. Fortunately, supplemental medicare, or Medigap, plans can help fill in the gaps.

What does Medicare Part B cover?

Medicare Part B covers up to a certain amount of insulin test strips and lancets every few months. It also covers some preventative care like screenings for heart disease, glaucoma tests, and nutritional counseling.

Is Aetna a Medigap?

Aetna is one of the oldest and most reputable insurance companies in the country, and they provide a comprehensive range of Medigap plans. One thing I really like about Aetna is there are no network restrictions, so you can see any doctor you’d like. Additionally, coverage stays the same if you end up moving.

Does Mutual of Omaha pay Medicare?

You can choose any doctor or hospital you would like, and if you’re a globetrotter, your coverage follows you around the world. Mutual of Omaha also pays 98 percent of Medicare claims within 12 hours.