Which is better a Medigap

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Can you switch from Medicare Advantage to Medigap?

Dec 20, 2021 · A Medicare Advantage plan may be a better choice if it has an out-of-pocket maximum that protects you from huge bills. Regular Medicare plus a Medigap insurance plan generally allows you more ...

What is the difference between Medicare and advantage?

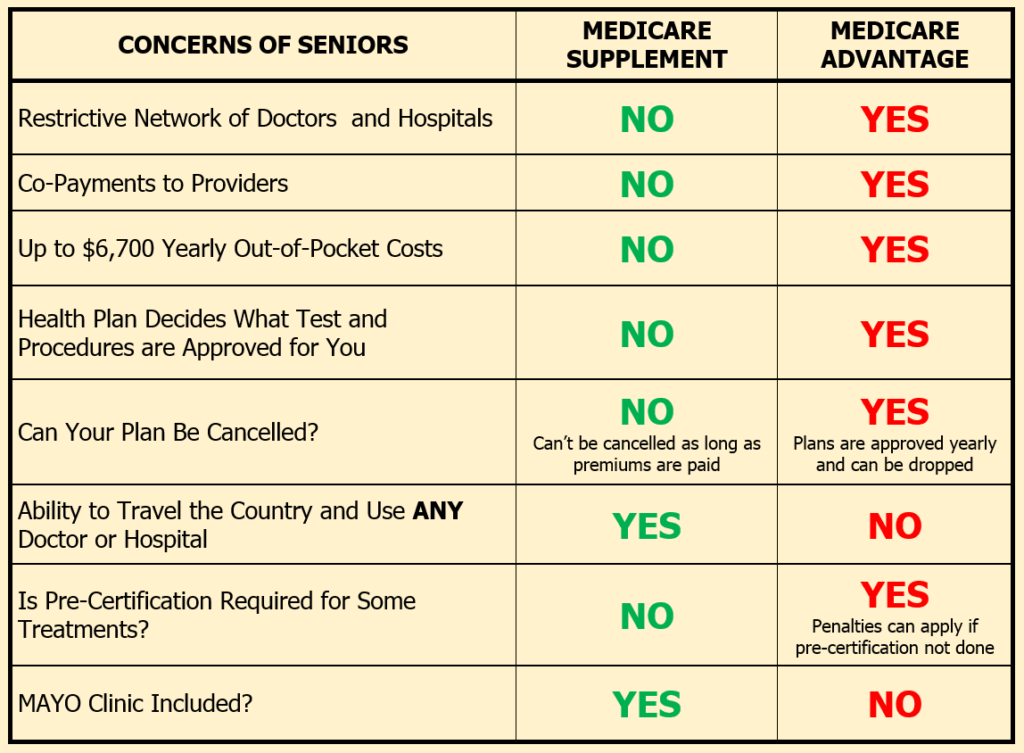

Jan 17, 2022 · There are plenty of differences between Medigap and Medicare Advantage including doctor networks, coverage benefits, and the need for referrals. Of course, the cost is different, but we’ll get to that. If you want coverage that gives you the most flexibility, a Medigap plan could be your ideal policy.

Why Choose Medicare Advantage over Medicare?

Feb 11, 2021 · Medigap is supplemental insurance for people who have original Medicare. Medicare Advantage, also known as Medicare Part C, is an alternative to this plan. Key factors that a person may wish to ...

Is Medicare Advantage better than Medicare?

Dec 08, 2021 · Comparing Medigap and Medicare Advantage plan costs. Medicare Advantage plans tend to be less expensive on average than Medigap plans. In 2018, beneficiaries paid an average of $35.55 per month for a Medicare Advantage plan.¹. The average cost of Medigap Plan F — which offers the most standardized Medigap benefits — was $143 per month in 2018.²

What are the disadvantages of a Medicare Advantage plan?

- Restrictive plans can limit covered services and medical providers.

- May have higher copays, deductibles and other out-of-pocket costs.

- Beneficiaries required to pay the Part B deductible.

- Costs of health care are not always apparent up front.

- Type of plan availability varies by region.

What is the downside to Medigap plans?

What is the difference between Medigap and Medicare Advantage plans?

What is the highest rated Medicare plan?

Why should I choose a Medigap plan?

Why is Medigap so expensive?

Can I switch from Medicare Advantage to Medigap?

Can I switch from a Medigap plan to a Medicare Advantage plan?

Can you be denied a Medicare supplement plan?

What is the most popular Medicare Advantage plan?

What are 4 types of Medicare Advantage plans?

- Health Maintenance Organization (HMO) Plans.

- Preferred Provider Organization (PPO) Plans.

- Private Fee-for-Service (PFFS) Plans.

- Special Needs Plans (SNPs)

What company has the best Medicare Advantage plan?

What is the difference between Medicare Advantage and Medigap?

The main difference between the two is how they work alongside original Medicare. Medigap plans work alongside original Medicare’s Part A and Part B to help with out-of-pocket expenses, such as deductibles, coinsurance, and copayments.

How does Medicare Advantage work?

Medicare Advantage plans work in different ways, so it is advisable for people to compare all the available plans in their area. They can do this using Medicare’s find-a-plan tool. After deciding on a specific plan, a person can enroll by doing one of the following: enrolling through the company’s website.

When is the best time to buy a Medigap plan?

The best time to buy a Medigap plan is during the 6-month open enrollment period (OEP). This window automatically begins the month a person reaches the age of 65 years.

What is a Medigap plan?

Medigap plans are standardized, which means that they all provide the same basic benefits. However, some plans may offer additional benefits. Once a person decides on a plan, Medicare will provide contact information for the company administering the plan.

What are the parts of Medicare Advantage?

Medicare Advantage plans combine original Medicare’s parts A and B, and the majority include coverage for prescription drugs . Advantage plans often also include other benefits not available with original Medicare, including vision, dental, or hearing coverage.

Does Medicare cover all of the medical expenses?

Although original Medicare pays for many of a person’s eligible healthcare expenses, it may not cover the entire amount. Medigap is an insurance plan that supplements Medicare parts A and B. It can help fill the gaps that copayments, deductibles, and coinsurances can create.

When does Medicare Advantage OEP end?

During the Medicare Advantage OEP: This OEP runs from January 1 to March 31 each year. Between these dates, a person can drop their Medicare Advantage plan, return to original Medicare, or enroll in a Medigap plan.

What is Medicare Advantage?

Medicare Advantage plans provide the same benefits of Original Medicare (Part A hospital insurance and Part B medical insurance) combined into one single plan. Many Medicare Advantage plans may also offer additional coverage for things like dental, vision, hearing, prescription drugs and more. To put it simply, Medigap plans are used in addition ...

What is a Medigap plan?

To put it simply, Medigap plans are used in addition to Original Medicare and provides coverage for health care expenses. Medicare Advantage plans are used as an alternative to Original Medicare and provides coverage for health care services.

Does Medicare Advantage pay out of pocket?

The higher cost of Medigap plans can be offset by the money saved on deductibles, coinsurance and other out-of-pocket costs. Medicare Advantage beneficiaries still pay many of these out-of-pocket costs, depending on their plan, but they may be lower than what Original Medicare includes.

Does Medicare Advantage cover dental?

Some Medicare Advantage plans offer $0 monthly premiums, though $0 premium plans are not available in all locations. Medigap plans do not cover prescription drugs or dental services, some of which might be covered by a Medicare Advantage plan. Deciding which type of Medicare plan is right for you will depend on how you plan to use your Medicare ...

Does Medicare cover prescription drugs?

A Medigap plan does not help you cover the cost of medications. However, prescription drug coverage is one the more common extra benefits covered by some Medicare Advantage plans. Medicare Advantage plans that include prescription drug coverage are known as “MA-PD” plans, or “ Medicare Advantage Prescription Drug ” plans.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is Medicare Advantage?

Medicare Advantage, which is also referred to as Medicare Part C, is an alternative to Original Medicare. MA plans are offered by private companies that are approved by Medicare, and they provide coverage for services covered by Original Medicare Parts A and B. Some MA plans also cover extra services like dental, hearing, vision and prescription drugs.

What is a Medigap policy?

Medigap is supplemental health insurance that is purchased from private health insurance companies licensed to sell Medigap policies. These plans aren't connected with or endorsed by the federal Medicare program. With the exception of emergency medical benefits during foreign travel, they don't cover additional healthcare services and instead fill the gaps in Medicare Part A coverage. Some costs that a Medigap policy might cover include deductibles, co-pays and coinsurance.Medigap plans are labeled as Plans A, B, C, D, E, F, G, K, L, M and N, each with a different standardized set of benefits. As of January 2020, new Medigap plans don't cover the Part B deductible. Additionally, policies sold after January 2006 aren't allowed to cover prescription drugs.

Does Medicare have out of pocket limits?

Unlike Original Medicare, Medicare Advantage plans have maximum annual out-of-pocket limits, which can save policyholders with chronic health conditions a lot of money. On the other hand, those with Medicare Advantage plans are often more limited in where they can receive care. Another thing to consider is whether expensive drugs or equipment, such as supplies for managing diabetes, are covered by the Medicare prescription drug plan or if there's a Medicare Advantage plan that provides the necessary coverage.

What is the factor to consider when evaluating health insurance?

When evaluating how much a health insurance plan costs, the monthly premium is just one factor to consider. Other factors include whether the plan covers extra benefits and what cost-sharing expenses, such as co-pays and deductibles, are required.

How many Medigap plans are there?

There are 12 Medigap plans, lettered A-N. Each lettered plan covers the core policy benefits. Depending on the letter plan you enroll in, you will have coverage for out-of-pocket medical costs such as deductible, copays, and coinsurance.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare. You can also find her over on our Medicare Channel on YouTube as well as contributing to our Medicare Community on Facebook.