:max_bytes(150000):strip_icc()/GettyImages-182800841-5894f4825f9b5874ee438219.jpg)

Full Answer

What are the best Blue Cross Blue Shield insurance plans?

financial strength (IFS) rating of Blue Cross Blue Shield of Minnesota (BCBSM), as well as the company's Baa1 senior unsecured debt rating. The outlook on the ratings has been revised to negative from stable. capital. It also recognizes the company’s leading, albeit declining, market share in Minnesota and

Does Blue Cross cover nursing home costs?

It also covers physician services, speech and physical therapy, durable medical equipment, diagnostic tests, supplemental Medicare coverage for skilled nursing facility care, home health care approved services and hospice care. In cases where service costs exceed $250, this plan covers 80 percent to a maximum of $50,000 in lifetime, except for foreign travel emergency care, states BlueCross BlueShield of Illinois.

Does Blue Cross Insurance pay for Viagra?

This allows us to help CPAP patients with different insurance carriers in all 50 states, instead of being limited to one service area..It means they have medication coverage A drug list, is a list of drugs available to Blue Cross and Blue Shield of Illinois (BCBSIL) members.Sponsored and administered by: The Blue Cross and Blue Shield does federal blue cross blue shield cover viagra Association and participating Blue Cross and Blue Shield Plans.Visit your primary care physician 2020 Blue ...

How much does Blue Cross Blue Shield pay?

Blue Cross Blue Shield employees earn $52,000 annually on average, or $25 per hour, which is 24% lower than the national salary average of $66,000 per year. According to our data, the highest paying job at Blue Cross Blue Shield is a Senior Director at $141,000 annually while the lowest paying job at Blue Cross Blue Shield is a CSR at $23,000 ...

See more

How much do Medicare supplement plans usually cost?

The average cost of a Medicare Supplement plan is $163 per month in 2022. However, rates can vary widely from $50 to more than $400 per month.

Does Medicare cover full cost?

You have to pay all costs beyond 90 days per benefit period if you use up your lifetime reserve days. If you have a qualifying stay in a skilled nursing facility, Medicare can cover the first 20 days, but you'll have to pay coinsurance for days 21 to 100, at $194.50 a day in 2022, and all costs beyond day 100.

Which Medicare plan offers the best coverage?

Best Medicare Advantage Providers RatingsProviderForbes Health RatingsCoverage areaBlue Cross Blue Shield5.0Offers plans in 48 statesCigna4.5Offers plans in 26 states and Washington, D.C.United Healthcare4.0Offers plans in all 50 statesAetna3.5Offers plans in 44 states1 more row•Jun 8, 2022

Why do I have to pay for Part B Medicare?

You must keep paying your Part B premium to keep your supplement insurance. Helps lower your share of costs for Part A and Part B services in Original Medicare. Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

What is the average out-of-pocket cost for Medicare?

A: According to a Kaiser Family Foundation (KFF) analysis of Medicare Current Beneficiary Survey (MCBS), the average Medicare beneficiary paid $5,460 out-of-pocket for their care in 2016, including premiums as well as out-of-pocket costs when health care was needed.

What does the average retiree pay for Medicare?

The Center for Medicare and Medicaid Services estimates that the average monthly premium will be $19 in 2022, down from $21.22 in 2021.

What is taken out of Social Security for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

What will Medicare not pay for?

Generally, Original Medicare does not cover dental work and routine vision or hearing care. Original Medicare won't pay for routine dental care, visits, cleanings, fillings dentures or most tooth extractions. The same holds true for routine vision checks. Eyeglasses and contact lenses aren't generally covered.

What is the average cost of AARP Medicare supplement insurance?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan A$158Plan B$242Plan C$288Plan F$2566 more rows•Jan 24, 2022

How much does Social Security take out for Medicare each month?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

Does Medicare get deducted from your Social Security check?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Is Medicare free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Is Blue Cross Blue Shield a government agency?

No, BCBS is not a government agency. However, BCBS is a Medicare contractor for the federal government.

Where are Blue Cross Blue Shield Medigap policies accepted?

In most cases, Medigap coverage through BCBS is accepted anywhere that accepts Medicare.

Does Blue Cross Blue Shield cover hearing aids?

Some Blue Cross Blue Shield companies offer add-on plans that cover routine hearing exams and hearing aid purchases through TruHearing. Program ava...

Do I need supplemental insurance if I have medicare?

Supplemental insurance is optional for seniors who have Medicare Part A and Part B. However, it can help you save big bucks on your medical costs t...

How much is the 2021 Plan G deductible?

In 2021, Plan G has a $2,370 deductible.

Do you need to look elsewhere for health insurance when you retire?

Many adults rely on their job or their spouse's job for health insurance, but once you retire, you'll need to look elsewhere for coverage. In America, most retired seniors turn to Original Medicare. Having access to Medicare is certainly a perk, but it won't fully protect you against the rising costs of prescriptions and health care.

Is BCBS a single company?

Unlike other insurance companies, such as Aetna, BCBS isn't a single company. It's actually an umbrella term for an association of 36 locally operated BCBS companies. Here's where it can get confusing: Many of these companies go by a different name. Some of these names include: Highmark Blue Shield. Capital BlueCross.

Does Blue Cross Blue Shield offer Medigap?

If you're in the market for a Medigap plan, Blue Cross Blue Shield (BCBS) might be exactly what you're looking for. They offer all 10 available Medigap plans and support millions of seniors across the country. Depending on where you live, you may even have access to add-ons like hearing aid coverage or dental insurance.

Does BCBS offer all Medicare plans?

BCBS, as a whole, provides all 10 Medicare plans. Not every individual BCBS company offers every plan, though. You'll need to check with your local provider to see which plans are available to you. FYI: Plan C and Plan F are no longer available to new enrollees.

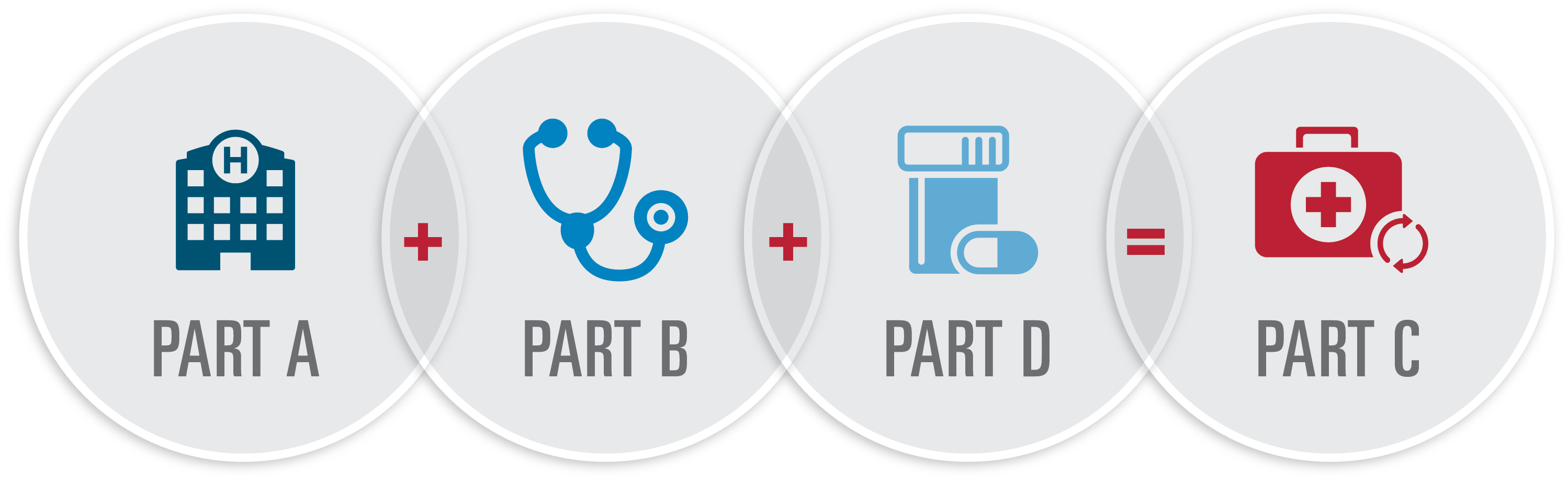

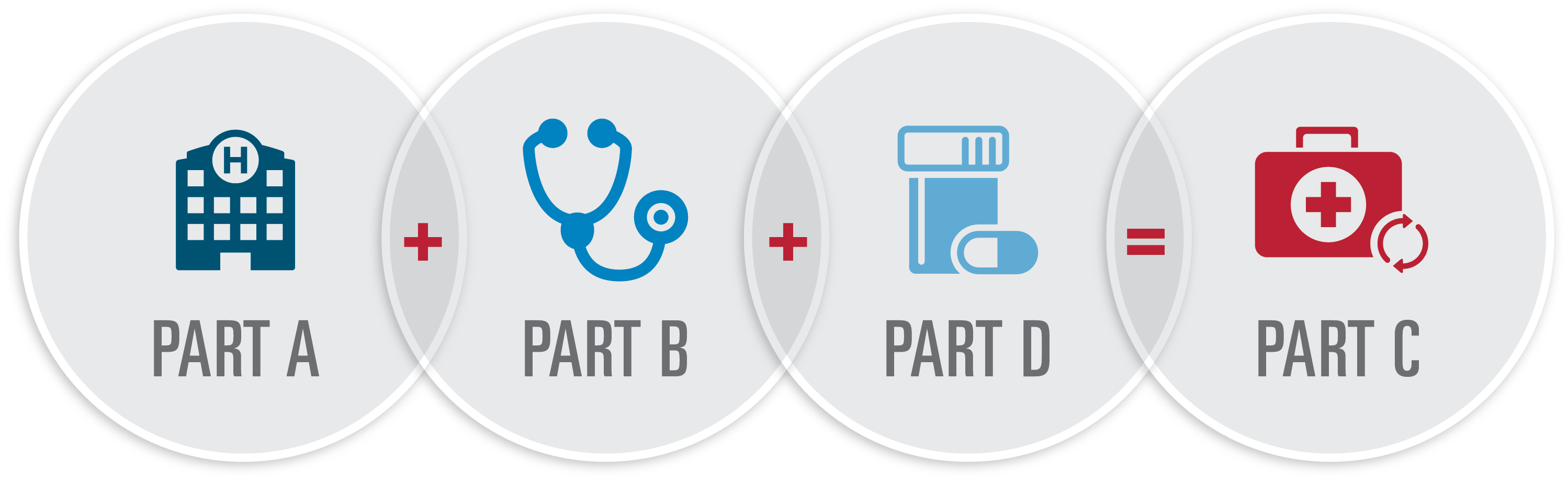

What is BCBS Medicare Advantage?

BCBS Medicare Advantage (Medicare Part C) Plans. Medicare Advantage plans replace Original Medicare and offer all of the same benefits that Part A and Part B offer. Many Medicare Advantage plans also offer prescription drug coverage, and some plans offer additional benefits that can include: Dental care.

What is BCBS report?

BCBS also creates and shares regular reports to inform community health industry leaders regarding data points that can help them more accurately make decisions. This can help them provide lasting, efficient and quality care and help improve the access to health care for millions of Americans.

How many standardized Medicare plans are there in 2021?

2021 BCBS Medicare Plans. There are 10 standardized Medigap plans available in most states. You can use the Medigap plans comparison chart below to see the standardized benefits offered by each type of plan. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

What is the most popular Medicare Supplement plan in 2021?

Depending on where you live, your local BCBS company may offer one of the following Medicare Supplement Insurance plans in 2021. Medigap Plan F is the most popular Medicare Supplement plan, and it is the only plan to offer all nine of the standardized Medigap benefits.

What is the deductible for 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

When did BCBS start?

In 1966 , BCBS companies were the first and only insurers in the nation who had the ability to administer Medicare, which had just been signed into law. That year, BCBS processed claims for close to 5 million Medicare beneficiaries.

When was BCBS founded?

The History of BCBS. BCBS was founded in 1929 and strives to help provide high-quality and affordable health care to all Americans. 1. Dallas public school teachers and loggers and miners in the Pacific Northwest were among the first groups to enjoy coverage by the companies that would later become BCBS.

Is your doctor in network?

Using a doctor (provider) in your network can help you save money. You’ll want to confirm your doctor, hospital or clinic is in your plan’s network before you get care.

Are your drugs covered?

For Platinum Blue Rx you get drug coverage. For Platinum Blue medical coverage you do not get drug coverage.

Register for a Medicare Workshop

Learn about Original Medicare and available plans based on the county you live in at a free, no obligation, in-person or virtual workshop.

What is BCBS insurance?

BCBS is an association of 36 locally-based insurance companies that offer Medigap plans across the country . Although the BCBS portfolio has a range of Medigap plans, people may not find all plans, nor all policies in their area. Medigap policies cover the out-of-pocket original Medicare (Parts A and Part B) expenses.

How many different Medigap plans are there?

There are 10 different Medigap plans, labeled by letter: A, B, C, D, F, G, K, L, M, and N, and each plan offers varying coverage levels. Medicare standardizes the policies, so each plan of the same letter provides the same benefits, no matter the provider or location. However, the premium differs between providers.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

Does Medigap have a deductible?

For example, none of the Medigap Plan As have a deductible, no matter the provider. Similarly, all Plan Cs must provide 80% coverage for foreign travel.

Does BCBS cover out of pocket costs?

There may also be out-of-pocket costs for services that original Medicare (parts A and B) or a person’s Medigap plan do not cover.

Does Medicare cover travel outside the US?

This includes copays, coinsurance, and deductibles that Medicare does not cover. Some Medigap plans cover health care for travel outside the US.

Does Blue Cross offer Medigap?

Blue Cross and Medigap: What to know. Private insurance companies, such as BlueCross BlueShield, offer Medigap policies to new enrollees. These policies help with Medicare out-of-pocket expenses, such as deductibles, copays, and coinsurance. According to America’s Health Insurance Plans, more than 13.5 million people in ...

What is a Medigap plan?

Medigap (Medicare Supplement) is an option for those with Original Medicare. It covers the out-of-pocket costs for the health expenses not typically covered by Medicare Parts A and B (Original Medicare). Individuals enrolled in Medicare Advantage do not need to purchase a Medigap plan.

Does Medicare Advantage cover emergency services?

On the other hand, Medicare Advantage plans typically have a network but will cover urgent and emergency services anywhere in the country. FAQ Item Question. Limited Coverage. FAQ Item Answer.

How many states does Blue Cross Blue Shield offer Medicare?

Blue Cross Blue Shield offers Medicare Advantage plans in 44 states, plus Washington, D.C., and Puerto Rico, and Medicare prescription drug plans in 46 states. Nationally, BCBS offers plans in 1,181 counties, or 37% of counties in the U.S. [2].

How many states does BCBS offer Medicare Advantage?

Wide network: With BCBS companies providing Medicare Advantage plans in 44 states, there’s a good chance you have access to a plan from a BCBS insurer. Low-cost plans available: BCBS companies offer plans with $0 premiums in 40 states.

What are the factors that determine the satisfaction of Medicare Advantage plans?

Power measured member satisfaction with Medicare Advantage plans based on six factors: coverage and benefits, provider choice, cost, customer service, information and communication, and billing and payment.

Does Blue Cross Blue Shield of Michigan have a highmark?

Power’s latest Medicare Advantage study. Depending on your location, you may not have access to a higher-rated Blue.

Does Blue Cross Blue Shield offer Medicare Advantage?

Blue Cross Blue Shield offers Medicare Advantage Prescription Drug plans, or MAPDs, as well as stand-alone Prescription Drug Plans and Medicare Advantage Plans without drug coverage. A health maintenance organization, or HMO, generally requires that you use a specific network of doctors and hospitals.

Does Blue Cross Blue Shield cover vision?

These plans generally include benefits that aren’t covered by Original Medicare, such as wellness programs, hearing aids and vision coverage.

Is BCBS a Medicare Advantage?

Not quite 6 in 10 BCBS customers are in a Medicare Advantage contract rated 4 or higher (out of 5) on the Medicare Star Rating scale.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

What is a health care provider?

Tell your doctor and other. health care provider. A person or organization that's licensed to give health care. Doctors, nurses, and hospitals are examples of health care providers. about any changes in your insurance or coverage when you get care.