Average Cost of Medicare Advantage Plans by State

| State | Monthly Cost | Rank from least expensive (1) to most ex ... |

| Arkansas | $26.46 | 19 |

| California | $32.87 | 25 |

| Colorado | $19.98 | 13 |

| Connecticut | $39.20 | 28 |

Full Answer

What is the cheapest state to buy Medicare?

We ranked each state 1 to 50 on the following factors:

- Median House Cost

- Monthly Home Owner Cost

- Cost Of Living

- Medicare Advantage Cost

- State Medicare Spend Per Person

Why is my Medicare so expensive?

- Tier 1 is generally for low-cost generic drugs; these usually have very low copays or coinsurance percentages.

- Tier 2 is for preferred brand-name medications and non-preferred generic drugs; these have a low-to-moderate copayment or coinsurance amount.

- Tier 3 is for non-preferred brand-name prescription drugs and has moderate-to-high copayments.

What states have the best Medicare coverage?

Only 15 weekdays are left for Medicare recipients to choose or change their plans. Only 15 days left for choosing the best Medicare coverage | News | annistonstar.com Thank you for reading! Please log in, or sign up for a new account andpurchase a subscription to continue reading.

What is the cheapest Medicare plan?

- New York City: Plan G is $268 to $545 High-deductible Plan G: $69 to $91

- Tampa, Florida: Plan G is $176 to $263 High-deductible Plan G: $52 to $92

- Houston, Texas: Plan G is $128 to $434 High-deductible Plan G: $36 to $86

- Albuquerque, New Mexico: Plan G is $105 to $355 High-deductible Plan G: $30 to $59

How much does Medicare cost in California?

Part B – Medical Insurance Premiums & DeductiblesFor 2022For 2021Annual Deductible$233$203Your Annual IncomeYour Monthly Premium*Your Monthly Premium*Single: up to $91,000 Couple: up to $182,000$170.10$148.50Single: $91,001 to $114,000 Couple: $182,001 to $228,000$238.10$207.903 more rows

How much is deducted from Social Security for Medicare?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

What is the monthly Medicare fee?

$170.10 each month (or higher depending on your income). The amount can change each year. You'll pay the premium each month, even if you don't get any Part B-covered services.

How much does Medicare cost for the average 65 year old?

Most people pay the standard premium amount of $144.60 (as of 2020) because their individual income is less than $87,000.00, or their joint income is less than $174,000.00 per year. Deductibles for Medicare Part B benefits are $198.00 as of 2020 and you pay this once a year.

Why is my first Medicare bill so high?

If you're late signing up for Original Medicare (Medicare Parts A and B) and/or Medicare Part D, you may owe late enrollment penalties. This amount is added to your Medicare Premium Bill and may be why your first Medicare bill was higher than you expected.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Are Medicare premiums based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How much does Medicare Part D cost in 2021?

If your filing status and yearly income in 2019 was:File individual tax returnFile joint tax returnYou pay each month (in 2021)above $170,000 and less than $500,000above $340,000 and less than $750,000$71.30 + your plan premium$500,000 or above$750,000 and above$77.90 + your plan premium4 more rows

How much does the average retiree pay for Medicare?

According to an AARP report released in December 2021, retirees with traditional Medicare ended up spending an average of $6,168 per year on covering the costs of insurance premiums and medical services.

How much do most seniors pay for Medicare?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

What will Medicare cost in 2021?

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

Which states have the lowest Medicare premiums?

Florida, South Carolina, Nevada, Georgia and Arizona had the lowest weighted average monthly premiums, with all five states having weighted average plan premiums of $17 or less per month. The highest average monthly premiums were for Medicare Advantage plans in Massachusetts, North Dakota and South Dakota. *Medicare Advantage plans are not sold in ...

What is the second most popular Medicare plan?

Medigap Plan G is, in fact, the second-most popular Medigap plan. 17 percent of all Medigap beneficiaries are enrolled in Plan G. 2. The chart below shows the average monthly premium for Medicare Supplement Insurance Plan G for each state in 2018. 3.

How to contact Medicare Advantage 2021?

New to Medicare? Compare Medicare plan costs in your area. Compare Plans. Or call. 1-800-557-6059. 1-800-557-6059 TTY Users: 711 to speak with a licensed insurance agent.

How much is Medicare Part B 2021?

In 2021, the standard monthly Part B premium amount is $148.50 ($1,782 per year). If you earn over $88,000 a year, you will pay a higher premium. If the premium is deducted from your Social Security benefits, you will pay a lower premium. Your total annual costs for Medicare Part B premium can be up to $6,058.80.

How much is coinsurance for a hospital?

Here are the Part A coinsurance amounts: Days 91 and on: $742 per day, until you have used up your lifetime reserve days. You get 60 reserve days over the course of your life.

How much is catastrophic coverage for 2021?

Catastrophic coverage in Part D for 2021: $6,550. Once you have paid $6,550 in medications, your costs for medications will be $3.70 per generic drug and $9.20 or 5% (whichever is greater) per brand-name drug.

Does Medicare Part D cover prescriptions?

Our Medicare Part D prescription drug coverage will save you money in the long run. This coverage helps you lower the cost of your prescription medications. The out-of-pocket costs you should expect with Medicare Part D include:

How many Medicare Advantage plans are there in California in 2021?

Local Resources. There are 140 different California Medicare Advantage Prescription Drug (MAPD) plans in 2021. 1 Plan selection can vary by location, however. Call to speak with a licensed insurance agent who can help you compare the benefits and costs of Medicare Advantage plans that are available where you live in California.

How many stars are there in Medicare Advantage 2021?

In order for a Medicare Advantage plan to be considered a top-rated plan, it must have four or more stars out of five stars. There are 90 top-rated 2021 MAPD plans in California that are rated four stars or higher. This is a high percentage of 2021 MA plans available in California, at 75 percent. Medicare Star Ratings.

When is the Medicare enrollment period?

Medicare Annual Enrollment Period (AEP): October 15 – December 7. During Medicare AEP, you may enroll in a Medicare Advantage plan or switch from one Medicare Advantage plan to another. AEP (also called the Annual Election Period) lasts from Oct. 15 to Dec. 7 each year.

When is Medicare open enrollment?

Medicare Advantage Open Enrollment Period: January 1 – March 31. If you already have a Medicare Advantage plan, you may be able to switch Medicare Advantage plans or drop your Medicare Advantage plan and return to Original Medicare from Jan. 1 to March 31 each year.

Does Medicare Advantage offer private insurance?

Private insurance companies offer Medicare Advantage plans that may be unique to the plan area they serve . Call to speak with a licensed insurance agent who can help you compare Medicare Advantage plans that are sold by insurance companies in your area.

Does Medicare offer Advantage in California?

Several insurance companies may offer Medicare Advantage plans in your area of California, though the selection of plans can vary. Depending on where you live, there may only be one insurance company that offers MA plans (if there are plans available in your county).

Which states have the lowest Medicare premiums?

States with the lowest average premiums: Wisconsin, Hawaii, Iowa, New Mexico, North Carolina. Medicare Supplement Insurance provides coverage for deductibles, copayments and other out-of-pocket expenses brought on by Part A and Part B. Learn more about Medicare Supplement Insurance plans in your state.

Is Christian Worstell a medicare supplement?

It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums. Christian Worstell is a health care and policy writer for MedicareSupplement.com. He has written hundreds of articles helping people better understand their Medicare coverage options.

Is Medicare Advantage available in Alaska?

These plans provide the same benefits offered by Original Medicare, and many Medicare Advantage plans offer additional benefits such as prescription drug coverage and routine hearing and dental care. *Medicare Advantage is not sold in Alaska, and data was not made available for Wyoming or Washington, D.C. State. Monthly Cost.

How do health plans determine costs?

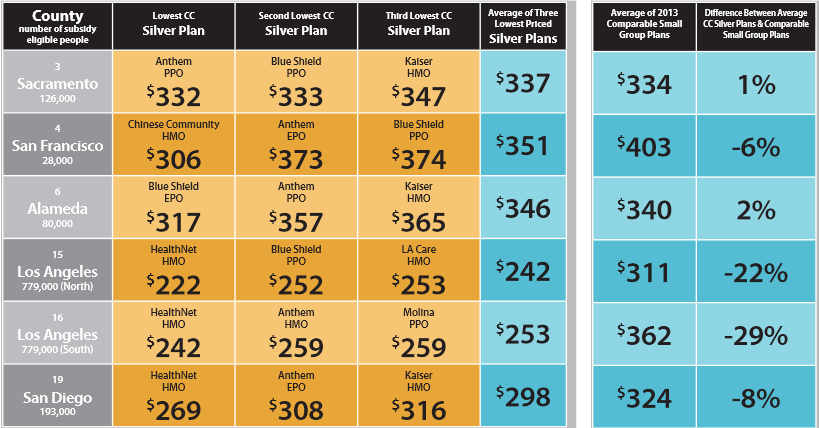

Health plans determine health care costs by evaluating the price of services and how often those services are used by members, commonly referred to as utilization . This means health plans evaluate how often their members are seeing a doctor, being hospitalized, using prescription drugs and other services, and how much these services are projected ...

How has the DMHC saved California?

Since January 2011, the DMHC has saved Californians hundreds of millions of dollars in health care premiums through its premium rate review program. Under state law, proposed premium rate changes for individual or small group health plans must be filed with the DMHC.

What is MLR in health insurance?

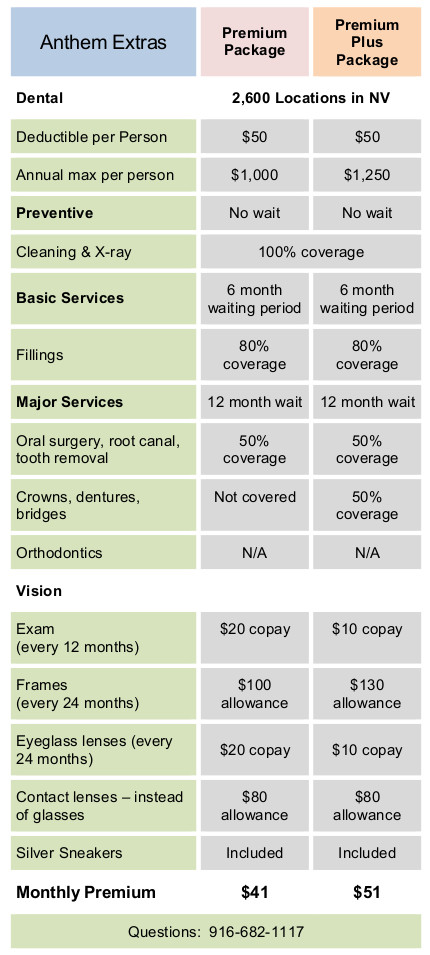

Medical Loss Ratio (MLR) is the percentage of premiums that a health plan spends on medical services and quality improvement efforts . Health plans in the individual and small group market must spend at least 80 percent of premiums on medical services and quality improvement efforts. Health plans in the large group market must spend at least 85 percent of premiums on medical services and quality improvement efforts. Plans may use the remaining 15-20 percent of premiums to pay administrative costs to keep the plan running and to generate profit. Administrative costs may include the cost of employees, such as salaries and benefits, as well as office and marketing expenses, taxes, and other fees.

How often do large group health plans update?

Health coverage offered to businesses with more than 100 employees. In the large group market, health plans generally update premium rates annually. Large group employers that purchase coverage are charged a consistent rate for a period of at least 12 months.

What percentage of health insurance premiums must be spent on quality improvement?

Health plans in the individual and small group market must spend at least 80 percent of premiums on medical services and quality improvement efforts. Health plans in the large group market must spend at least 85 percent of premiums on medical services and quality improvement efforts. Plans may use the remaining 15-20 percent ...

How long does a small business have to pay for health insurance?

Small businesses that purchase coverage are charged a consistent rate for a period of at least 12 months.

What are administrative costs?

Administrative costs may include the cost of employees, such as salaries and benefits, as well as office and marketing expenses, taxes, and other fees. If playback doesn't begin shortly, try restarting your device. Full screen is unavailable. Learn More.