What is the cost of Medicare Part B in 2019?

Part B premiums. The standard Part B premium amount in 2019 is $135.50. Most people will pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What is a Medicare Part B premium?

Part B premiums. Most people will pay the standard premium amount. If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How much does Medicare Part B cost in 2022?

The Medicare Part B premium changes each year and is calculated based on data collected by the Centers for Medicare and Medicaid Services (CMS). The standard amount for Part B coverage in 2022 is $170.10 per month. If your income is high enough, you may pay more for your Part B premium each month.

Do Medicare Part B rebates pay more than the standard premium?

Some of the Medicare Part B rebates will pay slightly more than the standard Part B premium, but none come close to matching the income-tested premium. Every family’s situation is unique, but for those subject to these higher premiums, the case for enrolling in Part B is far weaker under any of the four strategies.

Do federal retirees with FEHB need Medicare Part B?

If you are working and have FEHB or you are covered under your spouse's group health insurance plan, then you do not have to enroll in Part B when you turn 65. You will have a special enrollment period when you retire or your spouse retires to enroll in Part B without paying a penalty.

Why do I need Medicare Part B if I have FEHB?

FEHB premiums are not reduced if you enroll in Medicare, but having Medicare Part A and B can allow you to switch to a less expensive version of your current FEHB plan, because some FEHB insurers waive cost-sharing (like deductibles, co-pays and coinsurance) when you have Medicare Parts A and B.

What is the cost of Part B Medicare for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How much does Medicare Part B normally cost?

$170.10 each monthCosts for Part B (Medical Insurance) $170.10 each month (or higher depending on your income). The amount can change each year. You'll pay the premium each month, even if you don't get any Part B-covered services. Who pays a higher premium because of income?

Do federal retirees have to go on Medicare?

Most Federal employees do not need to enroll in the Medicare drug program, since all Federal Employees Health Benefits Program plans will have prescription drug benefits that are at least equal to the standard Medicare prescription drug coverage.

Should I keep FEHB when I retire?

Keeping FEHB in Retirement is Very Important Being able to continue FEHB into retirement allows you more flexibility in your retirement planning. You get to keep better coverage for a lower cost, and the government will continue to pay for the lion's share of your premium costs.

Is Medicare Part B based on income?

If You Have a Higher Income If you have higher income, you'll pay an additional premium amount for Medicare Part B and Medicare prescription drug coverage. We call the additional amount the “income-related monthly adjustment amount.” Here's how it works: Part B helps pay for your doctors' services and outpatient care.

Does Social Security count as income for Medicare premiums?

(Most enrollees don't pay for Medicare Part A, which covers hospitalization.) Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

What is the deductible for Part B for 2022?

$233Medicare Part B Deductible in 2022 For 2022, your Medicare Part B deductible is $233. That's a $30 increase over 2021.

What is the Part B deductible for 2021?

$203Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

How much does Social Security deduct for Medicare?

If your 2020 income was $91,000 to $408,999, your premium will be $544.30. With an income of $409,000 or more, you'll need to pay $578.30....Medicare Part B.Income on Individual Tax ReturnIncome on Joint Tax ReturnMonthly Premium$114,001 to $142,000$228,001 to $284,000$340.205 more rows•Feb 24, 2022

Can I get financial help for the cost of Medicare Part B?

Your state may be able to help you pay your Medicare Part B premium through programs such as Medicaid, the Medicare Savings Programs (MSP) and the...

Can I enroll in Part B during a Special Enrollment Period (SEP)?

You may be able to enroll in Part B during an SEP if you postponed Medicare due to having employer-sponsored coverage, whether on your own or throu...

How can I avoid Part B late enrollment penalties?

You can avoid Medicare Part B late enrollment penalties by making sure you apply for Medicare when you first become eligible, during your initial e...

What Is the Cost of Medicare Part B for 2022?

Have you ever asked a friend or family member: “How much does Medicare Part B cost?” If so, they probably responded with their monthly premium amou...

What is the Maximum Cost of Medicare Part B?

Typically, the cost of your Medicare Part B coverage comes down to several costs, starting with your monthly premium and annual Medicare Part B ded...

Is Medicare Part B Free for Seniors?

If you have Original Medicare (Parts A and B), you’ll likely pay for your Part B plan. Medicare beneficiaries that worked 10 or more years often re...

How is Medicare Part B premium calculated?

The Medicare Part B premium changes each year and is calculated based on data collected by the Centers for Medicare and Medicaid Services (CMS). Th...

How do I pay my Part B premium?

Your Medicare Part B premium is a monthly payment. It may be deducted automatically for you if you receive the following benefits:

What does Medicare Part B cover exactly?

Medicare Part B generally covers the medical treatments you receive. But Part B won’t cover everything — your treatments or services must either be:

How to enroll in Medicare Part B?

Are you or a loved one turning 65 and looking to enroll in Medicare? You’ll want to know when to enroll, and how. As a starting point, find your In...

How does Medicare calculate my Part B premium and Income Related Monthly Adjustment Amount (IRMAA)?

When you enroll, your IRMAA, if you pay one, will be based on your tax returns from two years prior. That year’s income will be used to determine h...

Do Part B costs remain the same after I enroll? Or do they increase each year?

Your Part B costs will change each year based on data collected by the Centers for Medicare and Medicaid Services (CMS). This generally means incre...

If I enroll in Medicare Advantage, will I still pay a Part B premium?

This depends on your plan. Some insurance companies will include the Part B premium in what you pay each month for your Medicare Advantage policy....

What is Medicare Part B?

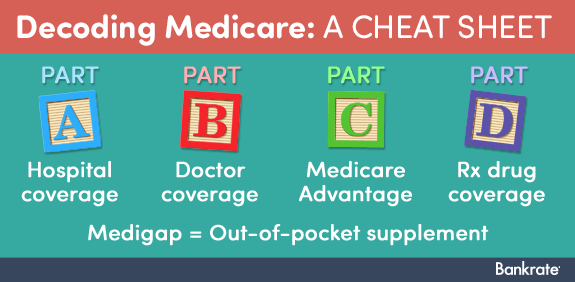

Medicare Part B provides coverage for medical needs such as outpatient care and doctor visits. This health insurance policy and Medicare Part A combine to make up what is known as Original Medicare. Eligibility for the federal health insurance program requires you to be over the age of 65, to have a disability or to have a life-threatening disease.

How much is Medicare Part B deductible in 2021?

Medicare Part B comes with an annual deductible amount that must be met before coinsurance or copay benefits kick in. In 2021, the deductible amount is $203, meaning after you pay out of pocket for expenses that total $203, cost sharing will begin.

How does Medicare Part B work?

How it Works Premiums & Deductibles Coverage & Enrollment FAQs. Medicare Part B provides the medical portion of your Medicare coverage . Part B has costs, including a premium, deductible and coinsurance. Together, they make up the overall cost of Medicare Part B. But the costs aren’t the same for everyone.

What is Medicare premium?

A premium is a fee you pay to your insurance company for a health plan coverage. This is usually a monthly cost. A deductible is the amount you pay out of pocket before your insurance company covers its ...

What is coinsurance on medical insurance?

Coinsurance is the percentage of your medical costs that you pay after you meet your deductible. The remaining amount is paid by your insurance company.

What is premium insurance?

A premium is a fee you pay to your insurance company for a health plan coverage. This is usually a monthly cost. and annual deductible. A deductible is the amount you pay out of pocket before your insurance company covers its portion of your medical bills. For example: If your deductible is $1,000, your insurance company will not cover any costs ...

Does Medicare Supplement Insurance cover Part B?

Medicare Supplement Insurance (Medigap) has several policies that will help cover your Part B costs, including premiums, deductibles and out-of-pocket costs.

Is Medicare Part B based on income?

Unlike the Part B premium, this amount isn’t based on income. Everyone enrolled in Original Medicare pays the same Part B deductible. That means no matter how high your income is, you’ll pay the standard Medicare Part B deductible amount.

Is Medicare Part B the same as Medicare Advantage?

But Part B coverage isn’t exclusive to Original Medicare; you’ll receive at least the same benefits with Medicare Advantage (Part C).

What is Part B in Medicare?

Part B may provide coverage for goods and services for which FEHB give zero or limited coverage. Part B allows you to seek care any health care providers in the U.S. who accepts Medicare, while FEHB policies generally restrict you to a network of participating providers. Because Medicare coordinates benefits with FEHB, ...

How to compare Medicare Advantage plans?

If you’re considering enrolling in a Medicare Advantage plan or a Medicare prescription drug plan, you can compare plans online for free or over the phone with the help of a licensed insurance agent. Learn about the costs, coverage and benefits of plans that may be available in your area.

Is FEHB a Medicare Part A?

There is coordination of benefits between Medicare and FEHB, so the FEHB policy acts as supplemental coverage to Medicare Part A. If you wish to enroll in other types of Medicare coverage such as Medicare Advantage, Medicare Part D or Medigap, you will need to be enrolled in Part A.

Can you have both Medicare Advantage and Medicare Supplement at the same time?

Medigap plans and Medicare Advantage plans are very different, and you cannot have both types of policies at the same time.

Does Medicare Advantage cover prescriptions?

Medicare Advantage plans provide all of the same basic benefits as Medicare Part A and Part B, and most plans also cover prescription drugs, which Original Medicare doesn’t cover. Many Medicare Advantage plans may also offer routine dental, vision and hearing coverage.

Do you have to be enrolled in Part B or Part C for Medicare Advantage?

If you wish to join a Medicare Advantage (Medicare Part C) plan that offers dental or vision coverage (which are not always included in FEHB plans), you must be enrolled in Part B.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

When does Medicare Part B start?

If you do not enroll in Medicare Part B during your initial enrollment period, you must wait for the general enrollment period (January 1- March 31 of each year) to enroll, and Part B coverage will begin the following July 1 of that year. If you wait 12 months or more, after first becoming eligible, your Part B premium will go up 10 percent ...

How long does it take for Part B to go up?

If you wait 12 months or more, after first becoming eligible, your Part B premium will go up 10 percent for each 12 months that you could have had Part B but didn't take it. You will pay the extra 10 percent for as long as you have Part B.

Do I have to take Medicare Part B?

Medicare Part B Coverage. Do I Have to Take Part B Coverage? You don't have to take Part B coverage if you don't want it, and your FEHB plan can't require you to take it . There are some advantages to enrolling in Part B: You must be enrolled in Parts A and B to join a Medicare Advantage plan.

Is orthopedic covered by Part B?

Some services covered under Part B might not be covered or only partially covered by your plan, such as orthopedic and prosthetic devices, durable medical equipment, home health care, and medical supplies (check your plan brochure for details).

Does FEHB waive coinsurance?

You have the advantage of coordination of benefits (described later) between Medicare and your FEHB plan, reducing your out-of-pocket costs. Your FEHB plan may waive its copayments, coinsurance, and deductibles for Part B services.

How much is the Part B premium for 2021?

In 2021, the standard Part B premium is $148.50. Your premium will be higher if your income is over $88,000. You’ll pay this premium in addition to the premium of your FEHB plan if you use both together. Even though you’ll be paying two premiums, using FEHBs and Part B together is often a good choice.

What percentage of Medicare pays for FEHB?

Medicare Part B pays 80 percent for covered services. When you use Part B along with an FEHB plan, your FEHB plan may cover the 20 percent you’d be responsible for with Part B alone.

How long do you have to be in FEHB to retire?

The second requirement is that you’ll need to have been enrolled in your current FEHB plan for at least 5 years or the entire period of time since you were first eligible to sign up. So, if you don’t start a federal job until later in your career, you can retire sooner than 5 years and still keep your FEHB plan.

What is FEHB insurance?

The Federal Employee Health Benefit (FEHB) program provides health insurance to federal employees and their dependents. Federal employers are eligible to keep FEHB after retirement. FEHBs can cover spouses and children up to age 26 even during retirement. FEHBs and Medicare can be used together to cover medical services.

What is Medicare Part A?

Medicare Part A is hospital coverage. It provides coverage for stays in the hospital or at long-term care facilities. As long as you’ve worked for at least 10 years and earned enough Social Security work credits, Part A will be premium-free. This means you’ll have an extra layer of coverage without needing to pay any additional premium.

How many health insurance options are there for federal employees?

The Federal Employee Health Benefit (FEHB) program includes over 276 health insurance choices for federal employees. While some plans are only available for employees in certain roles, such as the military, most federal employees will have multiple options to choose from. You also may be able to use both your Federal Employee Health Benefits ...

Does Medicare Advantage cover vision?

Medicare Advantage plans cover all the services of original Medicare and often add coverage for medications, vision care, dental care, and more. You might not need your FEHB plan if you choose to enroll in a Medicare Advantage plan. Since a Medicare Advantage plan takes the place of original Medicare and has more coverage, ...

What does a plus sign mean on a FEHB?

The amounts shown below indicate what you will pay for each class of service. When you see a plus sign (+), it means you must pay the stated coinsurance AND any difference between your Plan’s allowance and the provider’s billed amount. When a “yes” appears indicating that there is coverage for a specific service, you must check the plan brochure for your cost share. NOTE: HDHP plans require that the combined medical and pharmacy deductible be met before traditional coverage begins. traditional coverage begins.#N#Costs & Network#N#Disclaimer: In some cases, the enrollee share of premiums for the Self Plus One enrollment type will be higher than for the Self and Family enrollment type. Enrollees who wish to cover one eligible family member are free to elect either the Self and Family or Self Plus One enrollment type. Check premiums on our website at www.opm.gov/fehbpremiums .

What does a plus sign mean on a coinsurance plan?

When you see a plus sign (+), it means you must pay the stated coinsurance AND any difference between your Plan’s allowance and the provider’s billed amount.

What is annual deductible?

Annual Deductible. Annual Deductible: The amount you may have to pay for covered health care services before the plan begins to pay. Some plans have both an overall deductible for all or most covered items/services, but some also have separate deductibles for specific types of services (e.g. prescription services).