Part A costs

| Type of Cost | 2017 Cost (Change From 2016) |

| Hospital deductible | $1,316 (up $28) |

| Coinsurance for days 61-90 of hospital s ... | $329 (up $7) |

| Coinsurance for days 91 and beyond of ho ... | $658 (up $14) |

| Coinsurance for skilled nursing facility ... | $164.50 (up $3.50) |

Full Answer

How much will I pay for Medicare premiums?

4 rows · Nov 10, 2016 · For the remaining roughly 30 percent of beneficiaries, the standard monthly premium for Medicare ...

How should I Pay my Medicare premiums?

6 rows · If you’ve accumulated 40 quarter credits (and most people do), then you can enroll in Part A for ...

How to calculate Medicare premiums?

4 rows · Dec 24, 2016 · Medicare predicts that the average person who qualifies for the hold-harmless rule will pay about ...

How much are Medicare premiums?

Nov 26, 2020 · What did Medicare cost in 2017? Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount. How much does Medicare cost in 2018?

What was the monthly cost of Medicare in 2017?

Days 101 and beyond: all costs. Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What was the cost of Medicare in 2018?

$134 per monthAnswer: The standard premium for Medicare Part B will continue to be $134 per month in 2018....What You'll Pay for Medicare in 2018.Income (adjusted gross income plus tax-exempt interest income):$85,001 to $107,000$170,001 to $214,000$187.505 more rows

What was Medicare deductible for 2017?

CMS also announced that the annual deductible for all Medicare Part B beneficiaries will be $183 in 2017 (compared to $166 in 2016). Premiums and deductibles for Medicare Advantage and prescription drug plans are already finalized and are unaffected by this announcement.Nov 10, 2016

What will Medicare cost in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

How much were Medicare premiums in 2019?

$135.50The standard monthly premium will be $144.60 for 2020, which is $9.10 more than the $135.50 in 2019. The annual deductible for Part B will rise to $198, up $13 from $185 this year. About 7% of beneficiaries will pay extra from income-related adjustment amounts.Nov 11, 2019

How much are Medicare premiums for 2019?

$135.50 per monthThe standard premium is set to rise to $135.50 per month in 2019, up $1.50 per month from 2018. A small number of participants will pay less than this if the increases in their Social Security benefits in recent years have been insufficient to keep up with the rising cost of Medicare premiums.Jan 3, 2019

What is Medicare Part B premium 2017?

For the 70 percent of Medicare Part B enrollees who currently pay a lower monthly premium due to a “hold harmless” legal provision, their monthly cost will rise by as much as $25 to $134, from the 2017 average of $109, according to information released Friday by the Centers for Medicare and Medicaid.Nov 17, 2017

What are the Irmaa brackets for 2017?

If Your Yearly Income Is2017 Medicare Part B IRMAA$85,000 or below$170,000 or below$0.00$85,001 - $107,000$170,000 - $214,000$53.50$107,001 - $160,000$214,000 - $320,000$133.90$160,001 - $214,000$320,000 - $428,000$214.303 more rows•Jul 31, 2016

What is the standard Medicare Part B premium for 2016?

$104.90Medicare Part B has an annual deductible ($166 in 2016). The deductible amount is the same across the board for all Medicare Part B beneficiaries, but the monthly premium depends on your situation . If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

What was the Medicare Part B premium for 2015?

Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums. The Part B deductible will also remain the same for 2015, at $147.Oct 10, 2014

What was the Medicare Part B premium for 2018?

The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017. However, a statutory “hold harmless” provision applies each year to about 70 percent of enrollees.Nov 17, 2017

What is Medicare Part B 2015?

As a result of the Bipartisan Budget Act of 2015, the Part B monthly premium will be increasing for 30 percent of Part B enrollees from $104.90 in 2015 to $121.80 in 2016—a 16 percent increase, but far less than the increase initially projected by the Medicare actuaries (Figure 1).Nov 11, 2015

Why did Medicare premiums go up in 2016?

The Centers for Medicare & Medicaid Services (CMS) cited several reasons for the price hike, including paying off mounting debt from past years and ensuring funding for future coverage. But another important factor was that 2016 saw no cost-of-living adjustment (COLA) for Social Security benefits. For 70 percent of Medicare beneficiaries, this meant that premium rates would stay the same in 2016. The remaining 30 percent — about 15.6 million enrollees — faced higher monthly premiums. And everyone who signs up for Medicare in 2016, regardless of enrollment status or income, will pay a higher annual deductible.

How much does Medicare Part B cost?

Most recipients pay an average of $109 a month for coverage, but certain beneficiaries pay the standard premium of $134 a month. If you meet one of the following conditions, then you’ll pay the standard amount ($134) or more:

What is Medicare Advantage?

Medicare Advantage offers a bevy of benefits to seniors who are looking for more comprehensive coverage. These plans must include at least the same benefits offered through Parts A and B, and many (but not all) plans cover prescription drugs. Because these plans are sold through private insurers instead of directly through the federal government, Medicare Advantage has different costs that vary by plan. As with any insurance plan, costs rise each year. If you want to learn more about this type of coverage, then check out our guide to Medicare Advantage.

Is Medigap the same as Medicare?

In all but three states, Medigap plans are the same. They are organized into plans A through N. These plans are offered by private insurance companies and are not part of Medicare. They offer the same things Medicare does and then some.

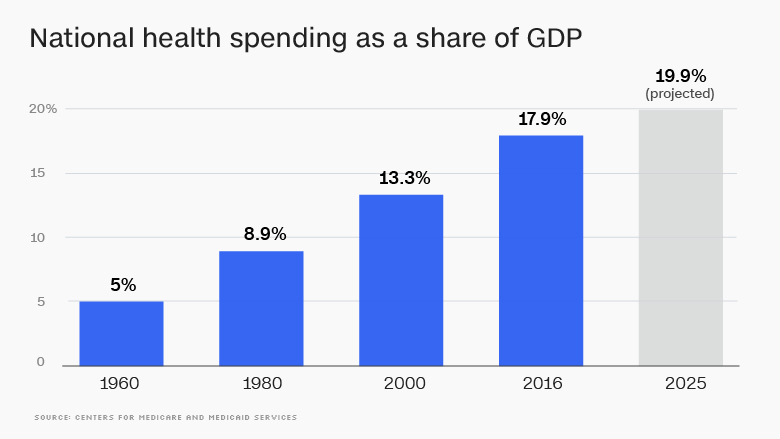

Annual increases will hit those who rely on Medicare for their healthcare coverage

Medicare covers more than 57 million Americans, providing the healthcare coverage they need. Every year, though, the cost of Medicare typically goes up, and the program passes through those increases to its participants in the form of higher premiums, deductibles, and other expenses.

Part A costs

Most Medicare participants get hospital insurance coverage under Part A without paying a premium. However, for those who didn't collect enough credits for paying Medicare taxes during their career and don't have a qualifying spouse, Medicare charges a monthly premium of up to $413 per month. That's $2 higher than the maximum amount for 2016.

Part B costs

Medical care coverage under Medicare Part B will also see cost increases in 2017. The deductible that you have to pay on doctors' visits and other outpatient services goes up to $183 per year in 2017, climbing $17 from 2016.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What will Medicare cost in 2017?

Among this group, the average 2017 premium will be about $109.00, compared to $104.90 for the past four years. For the remaining roughly 30 percent of beneficiaries, the standard monthly premium for Medicare Part B will be $134.00 for 2017, a 10 percent increase from the 2016 premium of $121.80.

What will Medicare Part B cost 2018?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018. However, even though the standard premium remains the same, many people will have to pay much more for Part B in 2018 than they did in 2017.

Will Medicare premiums go up in 2022?

The Medicare Part D monthly premium could rise to approximately $33.37 in 2022, the agency projected. August 02, 2021 – CMS estimates that the average monthly premium for Medicare Part D coverage will increase in 2022.

What is the standard Medicare Part B premium for 2017?

Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What will the SS increase be for 2022?

Based on this year’s price hikes, The Senior Citizens League is projecting that Social Security benefits could be boosted by 6.1% for 2022.

What is the Medicare Part a deductible for 2017?

About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,316 per benefit period in 2017, an increase of $28 from $1,288 in 2016.

Do you have to pay Medicare premiums for 2017?

Because of the “hold harmless” provision covering the other 70 percent of beneficiaries, premiums for the remaining 30 percent must cover most of the increase in Medicare costs for 2017 for all beneficiaries.

What are the most expensive conditions in hospital?

Four of the 20 most expensive conditions during hospital stays with an expected payer of Medicare were related to injuries and complications: Fracture of the neck of the femur (hip), initial encounter. Complication of cardiovascular device, implant or graft, initial encounter.

Is Medicaid the only expected payer?

Medicaid was the only expected payer for which 3 of the top 20 most expensive conditions were related to mental and substance use disorders. Figure 1. Aggregate hospital costs and hospital stays by primary expected payer, 2017. a Self-pay/No charge: includes self-pay, no charge, charity, and no expected payment.