What is the premium for Medicare Part A?

In 2021, the Medicare deductible for each benefit period is $1,484, which is $76 higher than in 2020. Coinsurance. Long-term care requires coinsurance. Medicare Part A enrollees have to pay a $371 coinsurance fee each day for days 61 through 90, increasing from $352 in 2020.

Is there a deductible for Medicare Part A?

Nov 16, 2020 · The inpatient Medicare Part A deductible is increasing by a whopping 5.4% for the calendar year 2021. This $76.00 increase will put the Part A deductible at $1,484 . This is the largest percentage increase I have seen in my career.

Does Medicare charge a deductible?

Medicare Part A deductibles work as follows, during a hospital stay: - Beneficiary pays deductible of $1,100 during days 1-60 of hospital stay. - Beneficiary then pays $275 per day for days 61-90 of hospital stay. - Beneficiary then pays $550 per day for days 91-150 of hospital stay.

Do I pay for Medicare Part?

Does Medicare Part A have a deductible?

Does Medicare have a deductible? Yes, you have to pay a deductible if you have Medicare. You will have separate deductibles to meet for Part A, which covers hospital stays, and Part B, which covers outpatient care and treatments.

What is the 2021 deductible for Medicare for A and B?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What is the standard deductible for Medicare Part A?

$1,556If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274. You pay: $1,556 deductible for each benefit period.

What is the Medicare Part A coinsurance for 2021?

2021 Medicare Premiums & DeductiblesPart A Deductible & Coinsurance AmountsType of Cost Sharing20202021Daily Coinsurance for 61st - 90th Day$352.00$371.00Daily Coinsurance for Lifetime Reserve Days$704.00$742.00Skilled Nursing Facility Coinsurance$176.00$185.501 more row

How often do you pay Medicare Part A deductible?

Key Points to Remember About Medicare Part A Costs: With Original Medicare, you pay a Medicare Part A deductible for each benefit period. A benefit period begins when you enter the hospital and ends when you are out for 60 days in a row. One benefit period may include more than one hospitalization.

What is the Part D deductible for 2022?

$480What is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.Mar 23, 2022

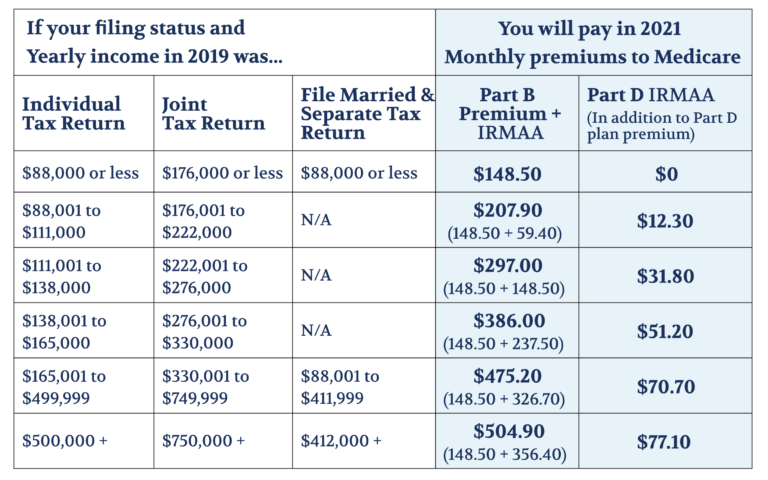

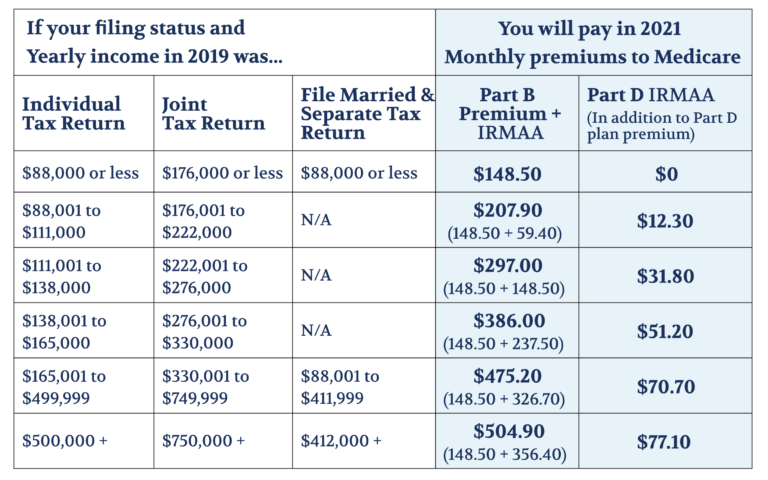

What are the Irmaa for 2021?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $111,000 but less than or equal to $138,000$297.00More than $138,000 but less than or equal to $165,000$386.10More than $165,000 but less than $500,000$475.20More than $500,000$504.9012 more rows•Dec 6, 2021

How do I find out my deductible?

A deductible can be either a specific dollar amount or a percentage of the total amount of insurance on a policy. The amount is established by the terms of your coverage and can be found on the declarations (or front) page of standard homeowners and auto insurance policies.

How much is deducted from Social Security for Medicare?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

How does the Medicare Part B deductible work?

Typically, you'll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year. In this instance, you'd be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%.

PinPoints

Medicare made some modifications to the 2021 deductible. The rising cost of healthcare necessitates an increase in Medicare premiums and deductibles.

What changes are made to Medicare Part A in 2021?

Medicare Part A covers hospitalization, nursing home care, and a portion of home healthcare.

The adjustments to Medicare Part B for 2021 are as follows

Part B of Medicare covers physician costs, outpatient treatments, some home health care services, medical equipment, and medications.

Medicare Part D will have the following changes in 2021

Medicare prescription medication coverage is another name for Medicare Part D.

What changes are coming to Medigap in 2021?

Supplemental Medicare or Medigap insurance covers a portion of your Medicare premiums. Supplements to Medicare can help pay the cost of premiums and deductibles.

To fight the coronavirus (COVID-19)

On March 20, 2020, Medicare was modified to fulfil the needs of enrollees.

Conclusion

Apart from increased Medicare premiums and deductibles, there are more ways to save money on healthcare.

How much is the Medicare deductible for 2021?

Assuming someone is ordered inpatient by a qualified practitioner and is a Medicare beneficiary, we can expect to get hit with a $1,484 deductible in 2021. This assumes the hospital stay is 60-days or less. *There are several nuances to the Medicare program that can’t always be anticipated.

What is Medicare Part A?

Medicare Part A is hospital insurance for Medicare beneficiaries. It is probably most well-known for covering services provided on an “inpatient” basis in the hospital. It also covers a few other skilled services I never want to use like hospice, home health, and skilled nursing care.

How long does Medicare last?

The benefit period only lasts for 60 inpatient days. So once the Medicare beneficiary ‘fills up’ their $1,484 bucket, Medicare covers them the rest of the way until they hit day 61. If the hospital stay goes on beyond 60 days, things get a little more complicated.

Does Medicare cover hospital stays?

Unfortunately, Medicare Part A does not cover the entire cost of the inpatient hospital stay. They pass the first $1,484 of the cost onto the Medicare beneficiary. So, an inpatient hospital stay will usually come hand-in-hand with the Medicare Part A deductible.

How long does Medicare Part A deductible last?

At the beginning of each benefit period, the Medicare Part A deductible must be paid by beneficiaries. A benefit period extends from the day a patient is admitted to the hospital until the final day treatment is received. If a beneficiary goes 60 days in a row without receiving treatment, the benefit period restarts and a deductible will have ...

What is Medicare for seniors?

Medicare was designed with the goal of providing all senior citizens in America with reliable and affordable health care coverage. The program also strives to provide senior citizens with quality coverage and while the program eliminates many costs associated with health care for seniors, the system still has premiums, co-insurances, ...