What is the maximum premium for Medicare Part B?

4 rows · Nov 04, 2010 · The standard Medicare Part B monthly premium will be $115.40 in 2011, a $4.90 increase (or ...

Does Medicare Part B have a premium?

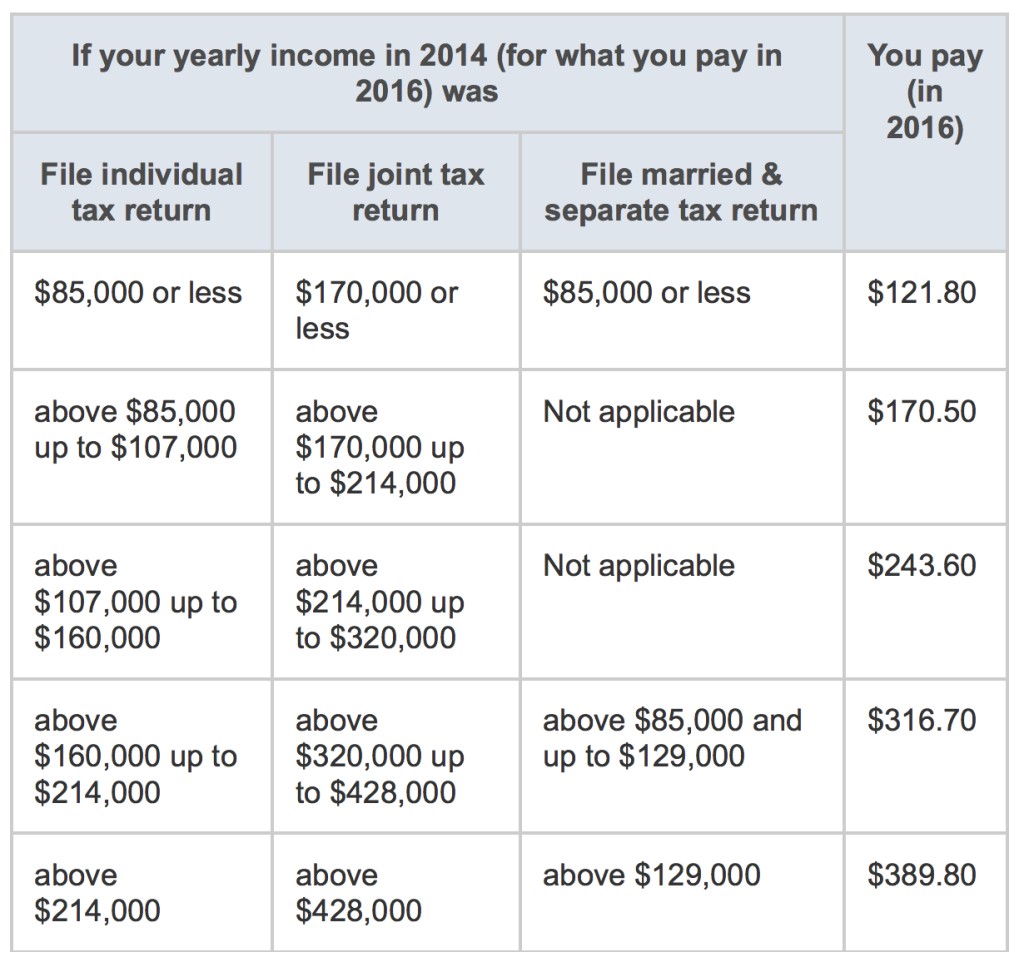

pay for their Part B premium in 2011. People with higher income (more than $85,000 for individuals and $170,000 for couples) pay higher premiums and are not subject to the “hold harmless” provision, and their premiums will increase in 2011. If you have a Medicare Savings Program (MSP), your premium will be $115.40 in 2011,

What determines your part B Medicare premium?

The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Do I have to pay Medicare Part B premium?

For all others, the standard Medicare Part B monthly premium will be $115.40 in 2011, which is a 4.4% increase over the 2010 premium. The Medicare Part B premium is increasing in 2011 due to possible increases in Part B costs.

What was the Medicare Part B premium in 2010?

Medicare Part B Premiums for 2010 The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $110.50 in 2010. However, most Medicare beneficiaries will not see an increase in their monthly Part B premiums in 2010 because of a “hold-harmless” provision in current law.

What was the Part B premium in 2012?

The standard Medicare Part B monthly premium will be $99.90 in 2012, a $15.50 decrease over the 2011 premium of $115.40. However, most Medicare beneficiaries were held harmless in 2011 and paid $96.40 per month. The 2012 premium represents a $3.50 increase for them.Oct 27, 2011

What was the cost of Medicare Part B in 2009?

$96.40The 2009 Part B premium of $96.40 is the same as the amount projected in the 2008 Medicare Trustees Report issued in March.Sep 19, 2008

Are Medicare Part B premiums calculated each year?

The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare.

How much did Medicare cost in 2011?

This premium will be $450 for 2011, a decrease of $11 from 2010....Fact sheet. MEDICARE PREMIUMS, DEDUCTIBLES FOR 2011.Beneficiaries who file an individual tax return with income:Beneficiaries who file a joint tax return with income:Income-related monthly adjustment amountGreater than $214,000Greater than $428,000$69.104 more rows•Nov 4, 2010

What was Medicare premium in 2013?

Today we announced that the actual rise will be lower—$5.00—bringing 2013 Part B premiums to $104.90 a month. By law, the premium must cover a percent of Medicare's expenses; premium increases are in line with projected cost increases.Nov 16, 2012

What was the Medicare Part B premium in 2008?

CMS ANNOUNCES MEDICARE PREMIUMS, DEDUCTIBLES FOR 2008 The standard Medicare Part B monthly premium will be $96.40 in 2008, an increase of $2.90, or 3.1 percent, from the $93.50 Part B premium for 2007.Oct 1, 2007

What year did Medicare start charging premiums?

July 30, 1965: With former President Harry S.

How much will Medicare B go up in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

How can I reduce my Medicare Part B premium?

To request a reduction of your Medicare premium, contact your local Social Security office to schedule an appointment or fill out form SSA-44 and submit it to the office by mail or in person.Mar 14, 2022

Is Medicare Part B premium automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

How can I reduce my Medicare premiums?

How Can I Reduce my Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.Aug 30, 2021

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is IRMAA in insurance?

IRMAA is an extra charge added to your premium. If your yearly income in 2019 (for what you pay in 2021) was. You pay each month (in 2021) File individual tax return. File joint tax return. File married & separate tax return. $88,000 or less. $176,000 or less. $88,000 or less.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

Medicare Premiums for 2011

Most people do not pay a monthly Part A premium because they or a spouse has 40 or more quarters of Medicare-covered employment.

Medicare Deductible and Coinsurance Amounts for 2011

Part A: (pays for inpatient hospital, skilled nursing facility, and some home health care) For each benefit period Medicare pays all covered costs except the Medicare Part A deductible (2011 = $1,132) during the first 60 days and coinsurance amounts for hospital stays that last beyond 60 days and no more than 150 days.

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

When did Medicare Part B start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

Who is Thomas Brock?

Thomas Brock is a well-rounded financial professional, with over 20 years of experience in investments, corporate finance, and accounting. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar.

Who is Dana Anspach?

Linkedin. Follow Twitter. Dana Anspach is a Certified Financial Planner and an expert on investing and retirement planning. She is the founder and CEO of Sensible Money, a fee-only financial planning and investment firm.

How much was coinsurance in 1989?

In 1989 the coinsurance amount was equal to 20 percent of the estimated national average daily cost of covered skilled nursing facility care, the beneficiary paid the coinsurance amount for the first 8 days of care during the year, and benefits were available for up to 150 days of care during the year. r.

What was the federal benefit increase in 2001?

General benefit increase. f. Benefits originally paid in 2000 and through July 2001 were based on federal benefit rates of $512 and $530, respectively. Pursuant to Public Law 106-554, monthly payments beginning in August 2001 were effectively based on the higher $531 amount.

When was the Social Security Act amended?

SOURCES: Social Security Act of 1935 (the Act), as amended through December 31, 2010; regulations issued under the Act; and precedential case decisions (rulings). Specific laws, regulations, rulings, legislation, and a link to the Federal Register can be found at the Social Security Program Rules page ...

When was Medicaid amended?

Medicaid. SOURCES: Social Security Act of 1935 (the Act), as amended through December 31, 2010; regulations issued under the Act; and precedential case decisions (rulings). Specific laws, regulations, rulings, legislation, and a link to the Federal Register can be found at the Social Security Program Rules page ...

Is a pathologist's inpatient care deductible?

Professional inpatient services of pathologists and radiologists not subject to deductible or coinsurance, but only when physician accepts assignment. o. Effective October 1, 1982, professional inpatient services of pathologists and radiologists are subject to deductible and coinsurance. p.

What percentage of Medicare beneficiaries are covered by Part B?

The Administration continues to urge Congressional action that would protect all beneficiaries from higher Part B premiums and eliminate the inequity of a high premium for the remaining 27 percent of beneficiaries. By law, the Centers for Medicare & Medicaid Services (CMS) is required to announce the Part A deductibles and Part B premium amount – ...

What is the Medicare Part B deductible for 2010?

In 2010, the Part B deductible will be $155. Part A Premium and Deductible. Today, CMS is also announcing the Part A deductible and premium for 2010. Medicare Part A pays for inpatient hospital, skilled nursing facility, hospice, and certain home health care services.

How much does Medicare cover?

Under the Medicare law, the standard premium is set to cover approximately one-fourth of the average cost of Part B services incurred by beneficiaries aged 65 and over. The remaining Part B costs are financed by Federal general revenues.

How much did Part B pay in 2009?

Most Part B enrollees will pay the same monthly premium that they paid in 2009 ($96.40 was the 2009 standard monthly premium). Approximately 27 percent of beneficiaries are not subject to the hold-harmless provision because they are new enrollees during the year (3 percent), they are subject to the income-related additional premium amount ...

How much is the 2010 deductible?

The $1,100 deductible for 2010, paid by the beneficiary when admitted as a hospital inpatient, is an increase of $32 from $1,068 in 2009. Beneficiaries must pay an additional $275 per day for days 61 through 90 in 2010, and $550 for lifetime reserve days. The corresponding amounts in 2009 are $267 and $534, respectively.

What percentage of physician fees were reduced in 2010?

First, the current law formula for physician fees, which will result in a reduction in physician fees of approximately 21 percent in 2010 and is projected to cause additional reductions in subsequent years, is one factor affecting the 2010 contingency margin.

When did Medicare Part B start?

As required in the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (MMA), beginning in 2007 the Part B premium a beneficiary pays each month is based on his or her annual income. Specifically, if a beneficiary’s “modified adjusted gross income” is greater than the legislated threshold amounts ...