Medicare Part D

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs through prescription drug insurance premiums. Part D was originally propo…

Full Answer

Does Medicare Advantage have deductible?

Dec 14, 2021 · There are thousands of different Medicare Advantage plans sold by dozens of insurance companies, and each carrier is free to set their own deductibles for each of their plans. Medicare Advantage deductibles can range from $0 to several thousand dollars. Medicare Advantage plans that include prescription drug coverage will often have two separate …

What do you pay in a Medicare Advantage plan?

Mar 16, 2021 · Generally, you may be able to deduct only the amount of your medical and dental expenses that is more than 7.5% of your adjusted gross income. The IRS defines adjusted gross income (AGI) as gross income minus adjustments to income. You can refer to your past income tax return to get a quick estimate of your AGI. Let’s say your AGI is $60,000.

How much does Medicare Advantage plan cost?

May 06, 2021 · Medicare Advantage plans out of pocket cost: Deductibles. A deductible is the amount you must pay out of pocket for health care before your plan begins to pay. For example, if your deductible is $1,000, you could pay $1,000 out of pocket before you plan begins to cover your health care costs. Some Medicare Advantage plans have $0 annual deductibles.

Is there a copay with Medicare?

Medicare Advantage Plans cover almost all Part A and Part B services. However, if you’re in a Medicare Advantage Plan, Original Medicare will still cover the cost ... deductibles, and services. The plan (rather than Medicare) decides how much you pay for the covered services you get. What you pay the plan may change only once a year, on ...

Do Medicare Advantage plans have a deductible?

Medicare Advantage plans out of pocket costs: deductibles Some Medicare Advantage plans have $0 medical deductibles, $0 prescription drug deductibles, and $0 premiums.

What is the average deductible for a Medicare Advantage plan?

Average Cost of Medicare Advantage Plans in Each StateStateMonthly PremiumPrescription Drug DeductibleCalifornia$48$377Colorado$49$343Connecticut$79$318Delaware$64$23946 more rows•Mar 21, 2022

What is the Medicare Advantage deductible for 2020?

According to eHealth research, the average Medicare Advantage plan annual deductible went down from $145 in 2018, to $133 in 2019, to $129 in 2020. All of the plans in this study included prescription drug coverage.Dec 20, 2021

Do Medicare Advantage plans pay 100 %?

Medicare Advantage plans must limit how much their members pay out-of-pocket for covered Medicare expenses. Medicare set the maximum but some plans voluntarily establish lower limits. After reaching the limit, Medicare Advantage plans pay 100% of eligible expenses.Jan 7, 2022

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

Do Medicare Advantage plans have an out-of-pocket maximum?

The US government sets the standard Medicare Advantage maximum out-of-pocket limit every year. In 2019, this amount is $6,700, which is a common MOOP limit. However, you should note that some insurance companies use lower MOOP limits, while some plans may have higher limits.Oct 1, 2021

Do you still pay Medicare Part B with an Advantage plan?

Who Pays the Premium for Medicare Advantage Plans? You continue to pay premiums for your Medicare Part B (medical insurance) benefits when you enroll in a Medicare Advantage plan (Medicare Part C). Medicare decides the Part B premium rate.Nov 8, 2021

Can you write off Medicare Part B premiums from your taxes?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it's not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense.

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

How much is Medicare Advantage 2021?

The standard Part B premium is $148.50 monthly in 2021.

How much of your medical expenses can you deduct on your taxes?

Generally, you may be able to deduct only the amount of your medical and dental expenses that is more than 7.5% of your adjusted gross income. The IRS defines adjusted gross income (AGI) as gross income minus adjustments to income.

Does Medicare Advantage cover hospice?

If you have Original Medicare (Part A and Part B), you may have an option to get your Medicare benefits in another way – through a Medicare Advantage plan, offered by a Medicare-approved private insurance company. Medicare Advantage must cover everything Original Medicare covers, except for hospice care, which is still covered by Original Medicare ...

What is a deductible for Medicare?

A deductible is the amount you must pay out of pocket for health care before your plan begins to pay. For example, if your deductible is $1,000, you could pay $1,000 out of pocket before you plan begins to cover your health care costs. Some Medicare Advantage plans have $0 annual deductibles.

What is Medicare premium?

A premium is the amount you pay monthly or annually to have the plan, whether or not you receive services. Some Medicare Advantage plans have premiums as low as $0 but you must continue to pay your Medicare Part B premium.

What is coinsurance and copayment?

Coinsurance and copayment is the amount you pay every time you see a doctor or use a service. Coinsurance is usually a percentage and a copayment is a set dollar amount. For example, you could pay a $15 copayment every time you visit the doctor.

Does Medicare Advantage cover hospice?

Medicare Advantage plans must cover everything that Original Medicare (Part A and Part B) cover with the exception of hospice care, which is still covered by Part A. Unlike Original Medicare, Medicare Advantage plans have out of pocket limits, capping what you spend yearly on covered medical services. Medicare Advantage plans may save you money ...

How much is the deductible for Medicare Advantage 2020?

Enrolling in a plan with a low MOOP limit could be another way to lower your Medicare costs. The average Medicare Advantage deductible decreased 22% from $129 in 2020 to $116 in 2021 among the plans studied, according to eHealth research.*.

Does Medicare cover out of network?

It is important to note that most annual out-of-pocket spending limits apply only to in-network Medicare provider s. If you choose to go out-of-network for services, you may either be subject to a higher out-of-network MOOP limit or your payments may not be figured into your annual expenditures at all.

Does Medicare Advantage have a deductible?

Medicare Advantage plans frequently offer more benefits than Original Medicare and may have lower out-of-pocket costs. Your health insurance rate and out-of-pocket costs will depend on the particular Medicare Advantage plan you choose. Some plans charge monthly premiums, and many plans have an annual deductible.

Do dental plans have a deductible?

Some plans charge monthly premiums, and many plans have an annual deductible. Other costs may include copayments for each doctor or hospital visit, and premiums for optional benefits, such as vision, hearing, and/or dental coverage.

Does Medicare pay for Part B?

Medicare Part B premiums must be paid directly to Medicare. The monthly cost may increase based on your annual household income from two years prior. In addition to the Medicare Part B premium, Medicare Advantage plans often charge a monthly premium for coverage. You may even find a Medicare Advantage plan in your area with a monthly premium as low ...

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

What is Medicare Advantage?

Medicare Advantage. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage. Most MA plans will have an annual out-of-pocket maximum limit. Extra Help Program. Finally, the Extra Help program is something low-income Medicare ...

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

What is 20% coinsurance?

In this instance, you’d be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%. The coinsurance amount you pay is 20% of the amount Medicare approved. This approved amount is the maximum amount your healthcare provider is allowed to charge you for an item or service. If you refer back to your broken arm example.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

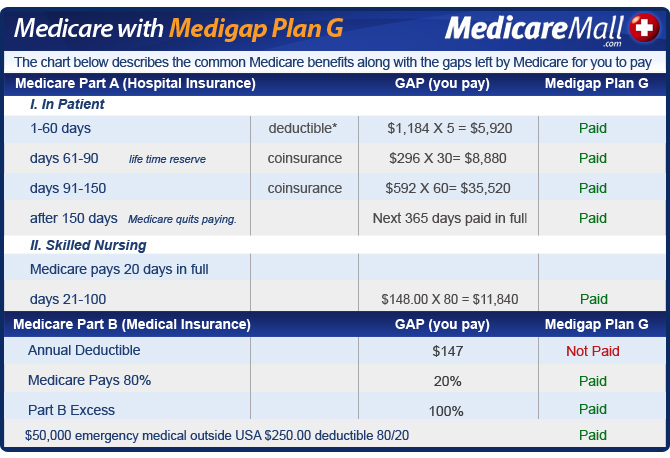

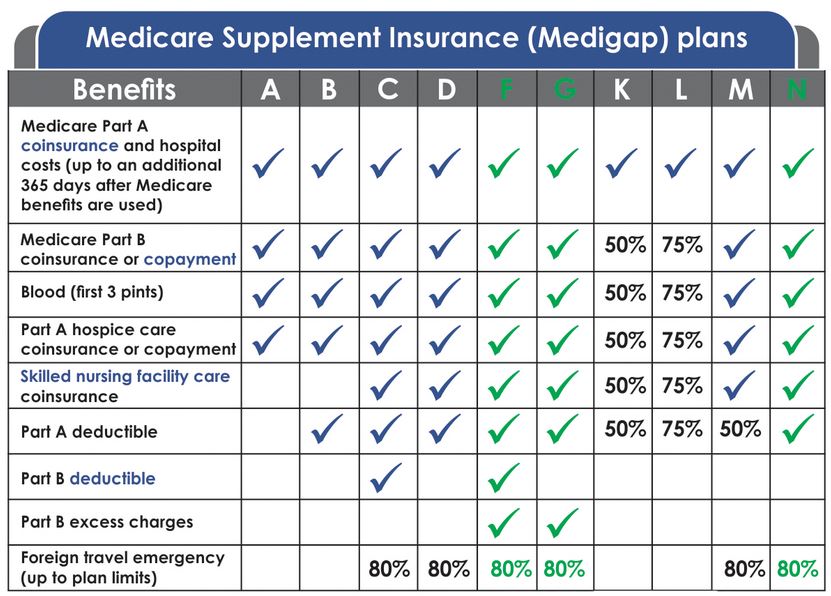

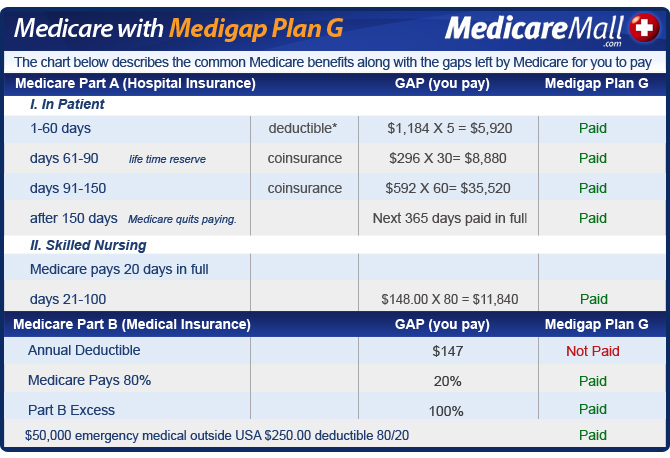

What is Medicare Supplement?

Medicare Supplement, or Medigap, insurance plans are sold by private insurance companies to help pay some of the costs that Original Medicare does not. They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. Medicare Advantage. An alternative to Original Medicare, a Medicare ...

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . Many Medicare Advantage Plans have a $0 premium. If you enroll in a plan that does charge a premium, you pay this in addition to the Part B premium. Whether the plan pays any of your monthly.

What is Medicare assignment?

assignment. An agreement by your doctor, provider, or supplier to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance. if: You're in a PPO, PFFS, or MSA plan. You go.

What is out of network Medicare?

out-of-network. A benefit that may be provided by your Medicare Advantage plan. Generally, this benefit gives you the choice to get plan services from outside of the plan's network of health care providers. In some cases, your out-of-pocket costs may be higher for an out-of-network benefit. .

What is a medicaid?

Whether you have. Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid.

What is copayment in medical terms?

copayment. An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).

What are the costs of Medicare Advantage?

Medicare Advantage plans typically cover medically necessary procedures, office visits, hospitalizations and prescription drugs. Sometimes there can be higher deductibles and other costs for services that are not covered by ...

How much can you pay out of pocket for Medicare?

The average out-of-pocket limit for in-network services in 2019 Medicare Advantage plans was $5,059.

How much is Medicare Part B 2021?

The standard Medicare Part B premium for 2021 is $148.60, but it can be higher, depending on your income level. Be sure to pay your Medicare Part B and Medicare Advantage premiums on time, so you won’t lose coverage. You could use automatic deductions to avoid missing a payment.

Does Medicare Advantage have a monthly premium?

Medicare. Provide a Valid ZipCode. See Plans. Some Medicare Advantage plans require a monthly premium payment, but others don’t. In fact, more than nine out of 10 beneficiaries (93%) will have access to a Medicare Advantage plan with prescription drug coverage with no monthly premium in 2020.

Can Medicare Advantage plan change?

Medicare Advantage plans can change their features, including cost-sharing and in-network doctors, each year. So, the plan that worked well for you this year might not be the best plan for you next year. Depending on the specific changes, you could save money by switching plans.

How many people will be enrolled in Medicare Advantage in 2020?

Enrollment in Medicare Advantage plans has doubled during the last decade, while monthly premiums have decreased. In 2020, 34% of all Medicare beneficiaries are enrolled in a Medicare Advantage plan. Researchers expect this trend to continue.

Who is James Yoo?

About James Yoo. James is a writer and editor for HealthCare.com and its web properties. He is a former newspaper journalist. James has an MA in journalism from Syracuse University and a BA in history from the University of Pennsylvania.