How much is the Medicare Part B deductible?

The 2014 Medicare Part A premium for those who are not eligible for premium free Medicare Part A is $426. The Medicare Part A deductible for all Medicare beneficiaries is $1,216 . 2014 Part B (Medical) Monthly Premium & Deductible

How much are Medicare taxes for Medicare Part A?

PART A. Per benefit period, 90 covered inpatient. Hospital Days: Inpatient hospital deductible: $1,184.00 (2013) $1,216.00 (2014) (single deductible for days 1-60) Inpatient hospital coinsurance: $ 296.00 (2013) $ 304.00 (2014) (daily coinsurance for days 61-90)

How much does Medicare pay after you meet your deductible?

· The Medicare Part A inpatient hospital deductible will go up by $32 to $1,216 in calendar year 2014, CMS has announced. CMS Announces 2014 Medicare Part A Premiums, Deductible Becker's Healthcare:

How much does Medicare Part C cost?

· Medicare and medical expense costs above 7.5%-10% of your income may be tax deductible. Premiums, deductibles, and co-insurance may qualify. 1-800-995-4219 Get Quotes

What is the deductible for Medicare Part B in 2014?

If you have to pay a higher amount for your Part B premium and you disagree, you can appeal the IRMAA. The 2014 Medicare Part B annual deductible remains $147 (unchanged from 2013). *If you pay a late-enrollment Penalty, your monthly premium is higher.

How much is Medicare Part A 2014?

The 2014 Medicare Part A premium for those who are not eligible for premium free Medicare Part A is $426.

How much is the 2014 Part D premium?

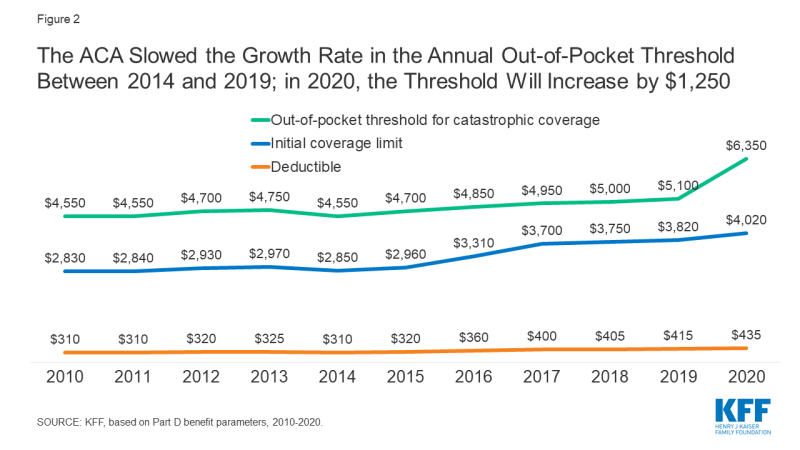

The 2014 Part D plan premiums range from $3 to $175. The 2014 standard Part D plan deductible is $310, however the actual plan deductible can be anywhere from $0 to $310 .

What is modified adjusted gross income?

Your modified adjusted gross income is your adjusted gross income plus your tax exempt interest income. Each year, Social Security will notify you if you have to pay more than the standard premium. The amount you pay can change each year depending on your income. If you have to pay a higher amount for your Part B premium and you disagree, you can appeal the IRMAA.

What is the age limit for a Part B?

You’re 65 or older, and you have (or are enrolling in) Part B and meet the citizenship and residency requirements.

What is Medicare Advantage 2014?

2014 Part C (Medicare Advantage) Monthly Premium. Medicare Advantage plan premiums*, deductibles, and benefits will depend on the Medicare Advantage plans available in your service area (county or ZIP code). Along with your Medicare Advantage plan premium, you must continue to pay your Part B premium ...

Do you pay Social Security if your adjusted gross income is above a certain amount?

However, if your modified adjusted gross income as reported on your IRS tax return from 2 years ago (the most recent tax return information provided to Social Security by the IRS) is above a certain amount (see chart below), you may pay more.

News not so bad related to 2014 Medicare Premiums and deductibles

Anyone who has been enrolled in Medicare for a while knows that this is the time of year when CMS announces any changes in Medicare Premiums and deductibles.

2014 Medicare premiums

The following table shows Part B premiums based on income. The vast majority of people pay $104.90 per month. The 2014 Part B premiums are remaining at the same level as 2013 premiums.

How much of your AGI can you deduct for medical expenses?

If you and your spouse were born after January 2, 1950: You can deduct medical expenses that amount to more than 10% of your AGI.

How long do you keep Medicare receipts?

You may not have to submit the receipts, but you should keep the receipts for 3 years in case the IRS questions your tax return.

Can you include dental insurance on taxes?

For example, if you see a dentist without dental insurance for a qualifying medical expense, you can include this on your taxes.

Is Medigap a medical expense?

If you are enrolled in an optional Medigap policy, your premiums may qualify as a medical expense, unless your employer or another third party paid for them.

Can you include Medicare payroll tax?

You cannot include the Medicare payroll tax or any premiums paid for by an employer, insurance provider, or other third party.

Can you deduct Medicare premiums?

You can deduct your Medicare Part A premiums if you voluntarily enrolled in Medicare Part A and you are not covered under Social Security, according to the IRS. Most people do not pay the Medicare Part A premium because they paid the Medicare payroll tax during their working years.

Where to tally medical expenses for federal taxes?

The place to tally your medical expenses for federal taxes is on Schedule A of Form 1040.

How much will Medicare premiums be in 2021?

People who buy Part A will pay a premium of either $259 or $471 each month in 2021 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B. In most cases, if you choose to buy Part A, you must also: Have. Medicare Part B (Medical Insurance)

What is covered benefits and excluded services?

Covered benefits and excluded services are defined in the health insurance plan's coverage documents. from Social Security or the Railroad Retirement Board. You're eligible to get Social Security or Railroad benefits but haven't filed for them yet. You or your spouse had Medicare-covered government employment.

What does Part B cover?

In most cases, if you choose to buy Part A, you must also: Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Contact Social Security for more information about the Part A premium. Learn how and when you can sign up for Part A. Find out what Part A covers.

Do you pay monthly premiums on Medicare?

You usually don't pay a monthly. premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for. Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Is Part A premium free?

Most people get premium-free Part A.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover prescription drugs?

Option al benefits for prescription drugs available to all people with Medicare for an additional charge. This coverage is offered by insurance companies and other private companies approved by Medicare.

How much did Medicare deductible increase in 2014?

The Centers for Medicare and Medicaid Services also announced that the Medicare Part A deductible, which people pay when admitted to the hospital, will increase by $32 in 2014, to $1,216.

How much was Medicare Part B in 2014?

How much will I pay in premiums for Medicare Part B in 2014? And is there still a high-income surcharge for Part B and Part D prescription-drug coverage? The monthly premium for Medicare Part B remains $104.90 for most people in 2014 – the same as in 2013.

What is the Part B and Part D surcharge based on?

Both the Part B and Part D surcharges are based on your income in 2012, which is the last tax return the government has on file for most people.

What is the income limit for seniors in 2012?

Seniors whose 2012 adjusted gross income (plus tax-exempt interest income) was more than $170,000 if married filing jointly or $85,000 if single will continue to pay higher premiums, as they have since 2007. The high-income surcharges remain the same as in 2013.