Does Medicaid pay the Part B deductible?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How to collect a part B deductible?

- The beneficiary was later determined to have been entitled to Medicare benefits;

- The beneficiary’s entitlement period fell within the time the provider’s agreement with CMS was in effect; and

- Such amounts exceed the beneficiary’s deductible, coinsurance or non covered services liability. ...

What is the maximum premium for Medicare Part B?

The standard monthly premium for Part B, which covers outpatient care and durable equipment ... or offers a different copay and an out-of-pocket maximum (a Medicare Advantage Plan). The Aduhelm situation highlights the ripple effect that expensive drugs ...

What are the rules for Medicare Part B?

Fact sheet FACT SHEET: Most Favored Nation Model for Medicare Part B Drugs and Biologicals Interim Final Rule with Comment Period

- Background. High drug prices are impacting the wallets of Medicare beneficiaries through increased premiums and out-of-pocket costs.

- Model Design

- Participants. ...

What is the 2021 Medicare deductible?

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

What is the Medicare Part B deductible for 2020?

$198 in 2020The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019.

What will the 2022 Medicare Part B deductible be?

The 2022 Medicare deductible for Part B is $233. This reflects an increase of $30 from the deductible of $203 in 2021.

Does Medicare Part B pay 80% of covered expenses?

For most services, Part B medical insurance pays only 80% of what Medicare decides is the approved charge for a particular service or treatment. You are responsible for paying the other 20% of the approved charge, called your coinsurance amount.

What is the new Medicare Part B deductible for 2021?

$203Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

How much does Social Security deduct for Medicare?

If your 2020 income was $91,000 to $408,999, your premium will be $544.30. With an income of $409,000 or more, you'll need to pay $578.30....Medicare Part B.Income on Individual Tax ReturnIncome on Joint Tax ReturnMonthly Premium$114,001 to $142,000$228,001 to $284,000$340.205 more rows•Feb 24, 2022

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

How do I find out what my Medicare deductible is?

Deductibles for Original Medicare You can find out if you've met your Medicare Part A or Part B deductible for the year at MyMedicare.gov.

What is the Medicare Plan G deductible for 2022?

$2,490Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses. Medicare Supplement Insurance plans are sold by private insurance companies.

Does Medicare Part B cover 100 percent?

Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

Does Medicare Part B cover blood work?

Medicare Part B costs Medicare Part B also covers medically necessary outpatient blood tests. You have to meet your annual deductible for this coverage as well. In 2021, the deductible is $203 for most people.

Does Medicare Part B pay for prescriptions?

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. covers a limited number of outpatient prescription drugs under certain conditions. A part of a hospital where you get outpatient services, like an emergency department, observation unit, surgery center, or pain clinic.

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

How much does Medicare cover if you have met your deductible?

If you already met your deductible, you’d only have to pay for 20% of the $80. This works out to $16. Medicare would then cover the final $64 for the care.

Does Medicare Advantage have coinsurance?

They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage.

Medicare Deductible: Part A

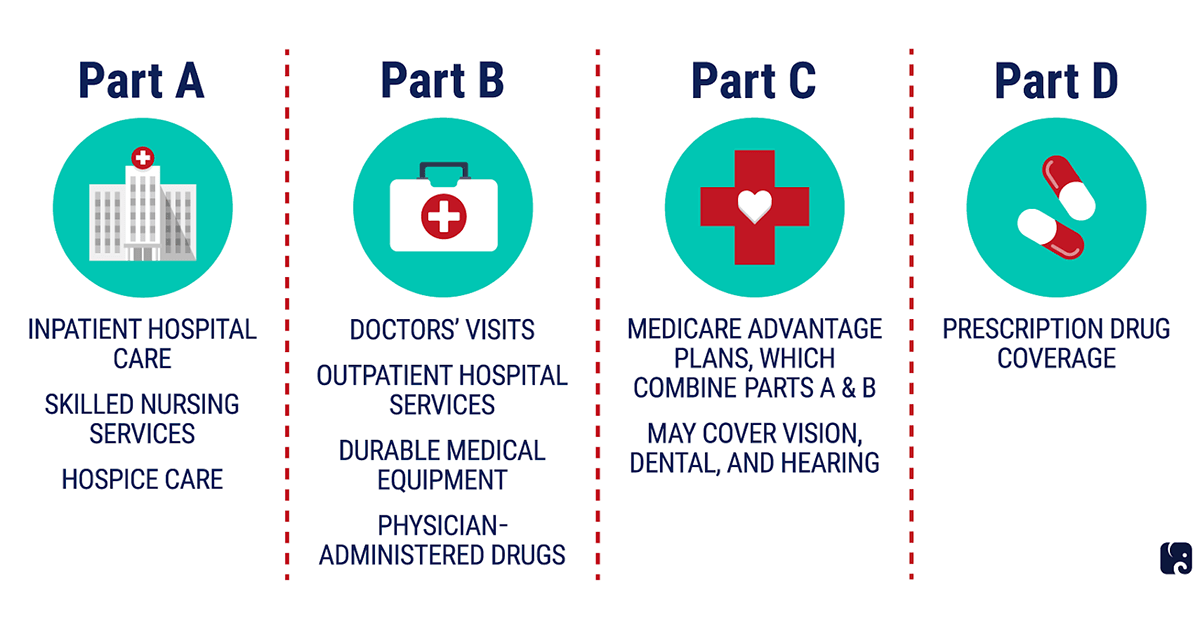

Medicare Part A benefits include inpatient hospital care, skilled nursing facility care, home health services, and hospice.

How Much Does Original Medicare Cost

You usually do not pay a monthly premium for Part A coverage if you or your spouse paid Medicare taxes while working. For Part B, most people pay a standard monthly premium, but some people may pay a higher Part B premium based on their income.

The Information We Collect And How We Collect It

Personally Identifiable Information. The HealthPlanOne.com website collects two kinds of information that relates to you. The first, and most important to you, is information that is personally identifiable to you. This is information like your name, telephone number, email address, home address and social security number.

What Does Medicare Plan F Cover

Youll need to investigate the different Medigap plans to determine the right one for you. The comparison chart below will help.

An Overview Of Aarp Medicare Supplement Plans

AARP Medicare supplement plans are offered through UnitedHealthcare Insurance. Eligible people use these plans to supplement their Medicare plan if they think that their plan may not provide all the health coverage they need. AARP has offered health plans for its group members for more than 50 years.

Deductibles For Drug Coverage And Medicare Advantage

Deductibles for Medicare Part C, also known as Medicare Advantage plans, and Medicare Part D prescription drug coverage varies based on the plan you purchase. Both Medicare Advantage and Part D plans are sold by private insurers that have contracts with the Medicare program.

What Is Medicare Part B Medical Insurance

Medicare Part B provides outpatient/medical coverage. The list below provides a summary of Part B-covered services and coverage rules:

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

What is Part B for 2021?

The 2021 Part B total premiums for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, ...

Is Medicare Advantage the lowest in 14 years?

The Medicare Advantage average monthly premium will be the lowest in fourteen years (since 2007). Premiums and deductibles for Medicare Advantage and Medicare Part D Prescription Drug plans are already finalized and are unaffected by this announcement.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What does Medicare Part B cover?

Part B also covers preventive services, including diagnostic tests and a host of screenings.

What is the income limit for Medicare Part B?

Medicare Part B enrollees with income above $87,000 (single) / $174,000 (married) pay higher premiums than the rest of the Medicare population (this threshold was $85,000/$170,000 prior to 2020, but it was adjusted for inflation starting in 2020; it will be $88,000/$176,000 in 2021). The 2020 Part B premiums for high-income beneficiaries range ...

What income bracket did Medicare change?

The income levels for the various brackets changed in 2018, which means that people with unchanged income might have found themselves in a higher Part B premium bracket in 2018, and the adjustment resulted in more enrollees paying the highest premiums. The bracket changes only affected Medicare beneficiaries with income above $107,000 ($214,000 for a married couple), but the premium increases were substantial for people who were bumped into a higher bracket as a result of the changes.

What percentage of Medicare deductible is paid in 2021?

After the deductible, enrollees also pay 20 percent of the Medicare-approved amount for care that’s covered under Part B. (The Part B deductible will increase to $203 in 2021.) But most enrollees have supplemental coverage — from an employer plan, Medicaid, or Medigap — that covers some or all of the out-of-pocket costs ...

How much is the 2020 Medicare Part B deductible?

Enrollees who receive treatment during the year must also pay a Part B deductible, which is $198 in 2020 (and will be $203 in 2021). Failing to enroll in Medicare Part B during your open enrollment could raise your Part B premium later on. If you have health insurance through your employer, or through your spouse’s employer, ...

What is the highest income bracket for Medicare?

In 2018, the highest income bracket was $160,000 and up ($320,000 and up for a married couple). But a new bracket was created as of 2019 for the highest-income Medicare Part B (and D) enrollees.

How much did Medicare pay in 2016?

People who were new to Medicare for 2016 (but who were protected for 2017 by the provision that prevents net Social Security checks from declining) were paying $121.80/month in 2016. Their premium increase for 2017 averaged about 4 percent, since it was limited by the COLA that applied to their Social Security checks.

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $170.10 per month. The maximum cost of Medicare Part B premiums is $578.30 per month in 2022, and that's for individuals reporting half a million dollars or more in income in 2020.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022.

How much is Medicare Part B deductible for 2021?

The Medicare Part B deductible in 2021 is $203 per year. You must meet this deductible before Medicare pays for any Part B services. Unlike the Part A deductible, Part B only requires you to pay one deductible per year, no matter how often you see the doctor. After your Part B deductible is met, you typically pay 20 percent ...

What percentage of Medicare deductible is paid?

After your Part B deductible is met, you typically pay 20 percent of the Medicare-approved amount for most doctor services. This 20 percent is known as your Medicare Part B coinsurance (mentioned in the section above).

What is a copay in Medicare?

A copay is your share of a medical bill after the insurance provider has contributed its financial portion. Medicare copays (also called copayments) most often come in the form of a flat-fee and typically kick in after a deductible is met. A deductible is the amount you must pay out of pocket before the benefits of the health insurance policy begin ...

How much is Medicare coinsurance for days 91?

For hospital and mental health facility stays, the first 60 days require no Medicare coinsurance. Days 91 and beyond come with a $742 per day coinsurance for a total of 60 “lifetime reserve" days.

How much is Medicare Part A 2021?

The Medicare Part A deductible in 2021 is $1,484 per benefit period. You must meet this deductible before Medicare pays for any Part A services in each benefit period. Medicare Part A benefit periods are based on how long you've been discharged from the hospital.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

What is Medicare approved amount?

The Medicare-approved amount is the maximum amount that a doctor or other health care provider can be paid by Medicare. Some screenings and other preventive services covered by Part B do not require any Medicare copays or coinsurance.