In general, you can deduct:

- Medicare Part A premiums. After age 65, most people get Medicare Part A without paying a premium. ...

- Medicare Part B premiums. Medicare Part B premiums are tax deductible as long as you meet the income rules.

- Medicare Part C premiums. ...

- Medicare Part D premiums. ...

- Medicare Supplement insurance (Medigap). ...

Does Medicare charge a deductible?

Medicare Deductible: Part B. The annual Medicare Part B deductible 2022 is $233. This amount represents an increase of $30 over the 2021 Part B deductible, which was $203. If you have Original Medicare, you will usually pay 20% of the Medicare-approved costs for healthcare after your deductible has been met.

Is there a deductible for Medicare Part A?

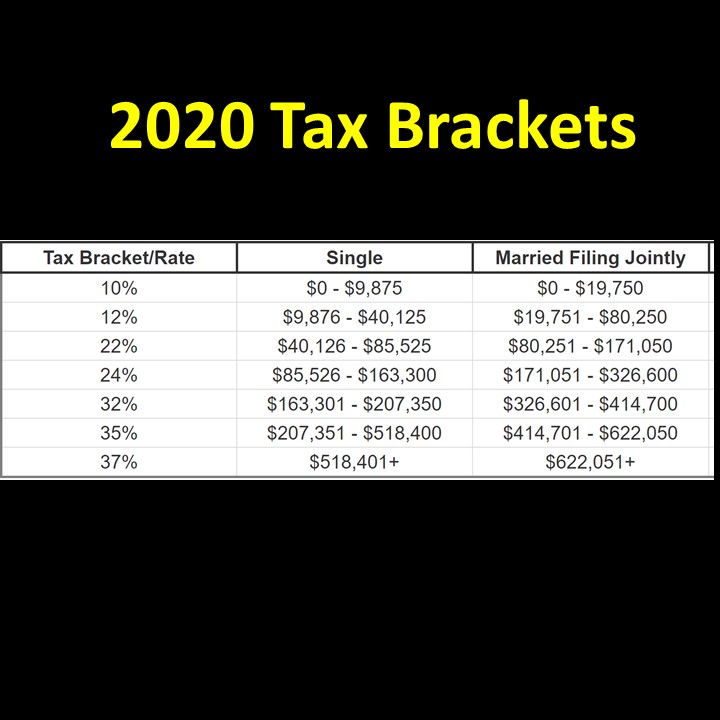

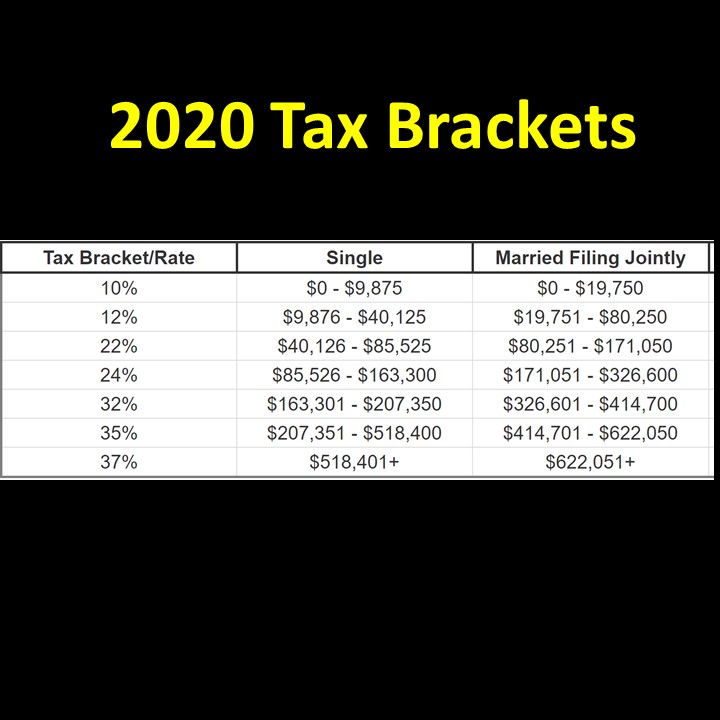

For 2020, the standard deduction amounts are $12,400 for single filers, $24,800 for married couples filing jointly and $18,650 for heads of household. If you have significant medical expenses, including Medicare health insurance premiums, they may add up to enough that it will be advantageous to itemize deductions and collect some tax savings.

What is the monthly premium for Medicare Part B?

Oct 19, 2021 · Under Original Medicare you will pay a $1484 per benefit period deductible if you are hospitalized. Medicare pays 100% of the associated hospital costs above the deductible. So far so good, right? Not so fast. With Medicare Part B you pay a $203 deductible and then 20% of all Medicare approved charges.

Is Medicare Part B deductible?

In 2021, the Medicare deductible for each benefit period is $1,484, which is $76 higher than in 2020. Coinsurance. Long-term care requires coinsurance. Medicare Part A enrollees have to pay a $371 coinsurance fee each day for days 61 through 90, increasing from $352 in 2020.

What is the 2021 Medicare deduction?

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What is the average Medicare deduction?

2022 costs at a glance If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274. You pay: $1,556 deductible for each benefit period. Days 1-60: $0 coinsurance for each benefit period.

What is the Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What is the Medicare annual deductible for 2020?

Medicare Advantage deductible in 2021 According to eHealth research, the average Medicare Advantage plan annual deductible went down from $145 in 2018, to $133 in 2019, to $129 in 2020.Dec 20, 2021

Is Medicare free for seniors?

Medicare is a federal insurance program for people aged 65 years and over and those with certain health conditions. The program aims to help older adults fund healthcare costs, but it is not completely free. Each part of Medicare has different costs, which can include coinsurances, deductibles, and monthly premiums.

Is Medicare cost based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Can you switch back and forth between Medicare and Medicare Advantage?

If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

What is the difference between Medicare Part B premium and deductible?

The standard Part B premium amount is $148.50 (or higher depending on your income) in 2021. You pay $203.00 per year for your Part B deductible in 2021. After your deductible is met, you typically pay 20% of the In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid.

How much Medicare premium is deducted from Social Security?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.Dec 1, 2021

What is the Medicare Deductible for 2022?

A deductible refers to the amount of money you must pay out of pocket for covered healthcare services before your health insurance plan starts to p...

Does Original Medicare Have Deductibles?

Original Medicare is composed of Medicare Part A and Medicare Part B. Both parts of Original Medicare have deductibles you will have to pay out of...

Do You Have to Pay a Deductible with Medicare?

You’ve probably heard the one about death and taxes. If you have Original Medicare, you can add deductibles to that list.

How much is the standard deduction for 2020?

For 2020, the standard deduction amounts are $12,400 for single filers, $24,800 for married couples filing jointly and $18,650 for heads of household. If you have significant medical expenses, including Medicare health insurance premiums, they may add up to enough that it will be advantageous to itemize deductions and collect some tax savings.

What is SSA-1099?

The SSA-1099 statement will show the premiums you paid for Part B, and you can use this information to itemize your premiums when you file your taxes. In addition, you will receive a form from Medicare called a Medicare Summary Notice.

Is Medicare Part B tax deductible?

Medicare Part B premiums are tax deductible as long as you meet the income rules. Medicare Part C premiums. You can deduct any Medicare Part C premiums if you meet the income rules. Medicare Part D premiums. As with Parts B and C, you can deduct your Part D premiums if you meet the income rules. Medicare Supplement insurance (Medigap).

Does Medicare Supplement Insurance give tax advice?

The American Association for Medicare Supplement Insurance does NOT offer or give any tax advice.

Is Medicare Advantage 100% free?

Many offer all Medicare options including Medicare Advantage, Medicare Supplement and Part D prescription drug plans. Access is 100% free and 100% private, You see their listing and contact information. NO ONE SEES YOUR INFORMATION until you decide to call or email one of the listed agents.

Can you deduct Medicare Supplement insurance premiums?

Medicare Supplement insurance (Medigap). Medigap premiums can also be tax deductible. For 2020 you can deduct medical expenses only if you itemize deductions and only to the extent that total qualifying expenses exceeded 7.5% of AGI (adjusted gross income).

Is The Medicare Part A Deductible Increasing For 2021

Part A has a deductible that applies to each benefit period . The deductible generally increases each year. In 2019 it was $1,364, but it increased to $1,408 in 2020. And it has increased to $1,484 for 2021.

Does Everyone Have To Pay The Part B Deductible

Some Medicare enrollees arent directly responsible for the Part B deductible:

How High Is The High Deductible

The insurance company sets the deductible. One company that I know of offers two different plan deductibles. This company offers one plan with a $5000 and another with an $8000 deductible. And each plan comes with a different annual deposit into the Medical Savings Account.

Are There Inflation Adjustments For Medicare Beneficiaries In High

Medicare beneficiaries with high incomes pay more for Part B and Part D. But what exactly does high income mean? The high-income brackets were introduced in 2007 for Part B and in 2011 for Part D, and for several years they started at $85,000 .

How Do Medicare Copays And Deductibles Work

by Christian Worstell | Published April 22, 2021 | Reviewed by John Krahnert

Do You Worry About Your Medicare Deductibles Premiums And Other Costs

Many Medicare beneficiaries are concerned about Medicare costs, like premiums, deductibles, and copayments/coinsurance, according to an eHealth study in 2020.

Is Original Medicare Enough

The short answer is that Original Medicare alone can leave you open to large medical bills. Unlike traditional health insurance, Medicare does not limit your maximum out-of-pocket medical costs.

PinPoints

Medicare made some modifications to the 2021 deductible. The rising cost of healthcare necessitates an increase in Medicare premiums and deductibles.

What changes are made to Medicare Part A in 2021?

Medicare Part A covers hospitalization, nursing home care, and a portion of home healthcare.

The adjustments to Medicare Part B for 2021 are as follows

Part B of Medicare covers physician costs, outpatient treatments, some home health care services, medical equipment, and medications.

Medicare Part D will have the following changes in 2021

Medicare prescription medication coverage is another name for Medicare Part D.

What changes are coming to Medigap in 2021?

Supplemental Medicare or Medigap insurance covers a portion of your Medicare premiums. Supplements to Medicare can help pay the cost of premiums and deductibles.

To fight the coronavirus (COVID-19)

On March 20, 2020, Medicare was modified to fulfil the needs of enrollees.

Conclusion

Apart from increased Medicare premiums and deductibles, there are more ways to save money on healthcare.

What percentage of your income is taxable for Medicare?

The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income.

What is the Social Security tax rate?

The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 ...

What is the FICA tax?

Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer.

Is Medicare payroll tax deductible?

If you are retired and still working part-time, the Medicare payroll tax will still be deducted from your gross pay. Unlike the Social Security tax which currently stops being a deduction after a person earns $137,000, there is no income limit for the Medicare payroll tax.

What Medicare tax deductions can you get each year?

Medicare costs can exceed what you have planned for each month. Fortunately, you might be able to claim some of your Medicare costs as deductions. These deductions provide you with a tax break, allowing you to reduce your tax obligation for the year.

List of Allowable Expenses for Medicare Coverage

You can obtain detailed records of eligible expenses by visiting the IRS website. The following are some examples of popular health services and benefits that are considered allowable expenses as a Medicare beneficiary.

How do the income limits for Medicare tax deductions work?

The IRS specifies requirements to determine if you qualify for Medicare tax deduction. Firstly, your eligible medical expenses should exceed 7.5 percent of your AGI (adjusted gross income). Then, add all the costs of the unreimbursed Medicare coverage and other health expenses to see if you’ve contributed enough to qualify for the tax deduction.

What expenses do not qualify for Medicare tax deduction?

The IRS provides a comprehensive list of tax-deductible medical expenses. You should, however, be aware of any payments that don’t fit your bills. Reimbursable Medicare expenses, for instance, are ineligible for a tax deduction.

Does supplemental insurance impact the Medicare tax deductions you can take?

Medicare supplementary insurance (also called Medigap policy) can assist you when you have significant out-of-pocket expenses. This additional coverage can fill the gaps left by original Medicare’s (Parts A and B) deductibles, copays, and coinsurance.

Is it possible to deduct Medicare Part B premiums from Social Security tax-free?

Typically, Part B premiums are automatically extracted from your Social Security health benefits. These premiums may be used to cover doctor visits, outpatient hospital services, and certain types of medical supplies.

Are Medicare premiums deductible monthly?

Medicare consists of four elements: Parts A, B, C (Medicare Advantage), and Part D. The type of additional coverage (if any) you select determines the cost of your monthly premiums.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.