Fraud defined Bookmark Medicare fraud occurs when someone knowingly deceives Medicare to receive payment when they should not, or to receive higher payment than they should. Committing fraud is illegal and should be reported.

Which is considered Medicare abuse?

What Is Medicare Abuse? Abuse describes practices that may directly or indirectly result in unnecessary costs to the Medicare Program. Abuse includes any practice that does not provide patients with medically necessary services or meet professionally recognized standards of care.

What do you need to know about Medicare fraud?

“Medicare fraud” is actually a blanket term encompassing different fraudulent activities related to the Medicare system. What is perhaps most staggering is the amount of money alleged to be falsely billed by this collection of once-trusted medical professionals and agencies. The total? Somewhere around $1.3 billion.

What are the penalties for Medicaid fraud?

The Medicaid Fraud Control Unit found that $10,363,511 had been improperly ... to modify its reporting and to pay the state of Arkansas one million dollars in civil penalties and costs. In addition to the $1 million in civil penalties and costs, the ...

How do I report fraud, waste or abuse of Medicare?

You can report suspected fraud or corruption by:

- completing our reporting suspect fraud form

- completing our health provider fraud tip-off form

- calling our fraud hotline – 1800 829 403

- writing to us

What is Medicare fraud quizlet?

Terms in this set (29) What is Medicare Fraud? Knowingly submitting, or causing to be submitted, false claims or making misrepresentations of fact to obtain a Federal health care payment for which no entitlement would otherwise exist. Difference between fraud and abuse per chris bond.

What is the Medicare definition of fraud?

Medicare fraud occurs when someone knowingly deceives Medicare to receive payment when they should not, or to receive higher payment than they should. Committing fraud is illegal and should be reported. Anyone can commit or be involved in fraud, including doctors, other providers, and Medicare beneficiaries.

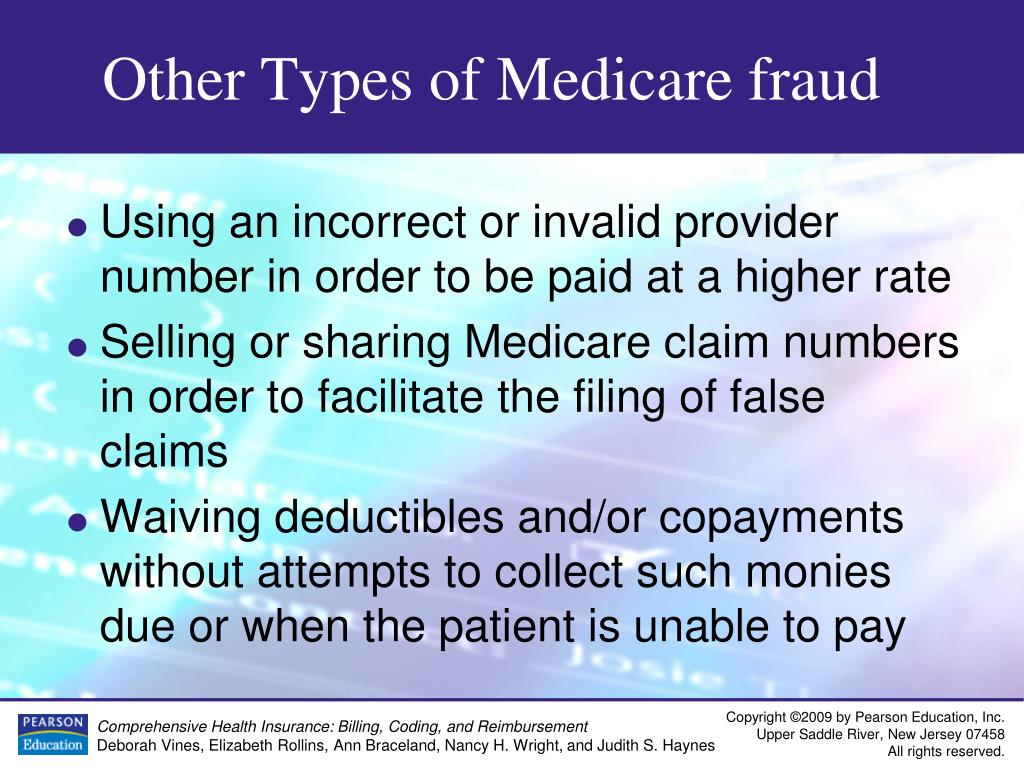

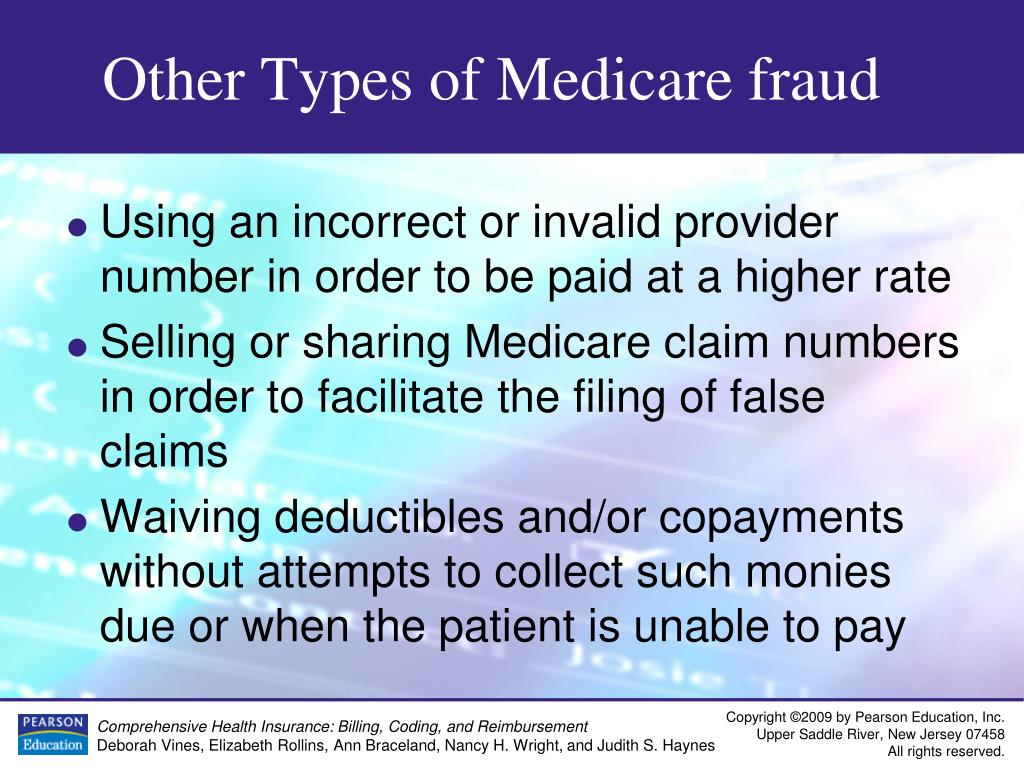

What are factors for Medicare fraud?

Looking out for Medicare fraud Pressure you into buying higher-priced services. Charge Medicare for services or equipment you have not received or aren't entitled to. Charge you for copayments on services that are supposed to be covered 100% by Medicare.

What is healthcare fraud quizlet?

Health Care Fraud. An intentional deception or misrepresentation that an individual or entity makes knowing that the misrepresentation could result in unauthorized benefit to the individual, to the entity, or to some third party.

What is the difference between fraud waste and abuse?

Well, fraud is when someone intentionally lies to a health insurance company, Medicaid or Medicare to get money. Waste is when someone overuses health services carelessly. And abuse happens when best medical practices aren't followed, leading to expenses and treatments that aren't needed.

How do you identify Medicare fraud?

Billing ScamsBills from hospitals you did not visit.Bills from providers you do not know.Bills for services you did not receive.

When opening a new account what factors are red flags for Medicare fraud?

Documents provided for identification appearing altered or forged. Photograph on ID inconsistent with appearance of customer. Information on ID inconsistent with information provided by person opening account. Information on ID, such as signature, inconsistent with information on file at financial institution.

What are the major types of healthcare fraud and abuse?

Some of the most common types of fraud and abuse are misrepresentation of services with incorrect Current Procedural Terminology (CPT) codes; billing for services not rendered; altering claim forms for higher payments; falsification of information in medical record documents, such as International Classification of ...

What is the biggest difference between fraud and abuse?

Fraud is an intentional deception or misrepresentation of fact that can result in unauthorized benefit or payment. Abuse means actions that are improper, inappropriate, outside acceptable standards of professional conduct or medically unnecessary.

Which of the following actions is considered under the False Claim Act?

Examples of practices that may violate the False Claims Act if done knowingly and intentionally, include the following: Billing for services not rendered. Knowingly submitting inaccurate claims for services. Taking or giving a kickback for a referral.

Which of the following acts contains a section concerning the prevention of fraud and abuse in healthcare?

Introduction: The Health Insurance Portability and Accountability Act of 1996 establishes and funds a program to combat fraud and abuse committed against all health plans, both public and private.

How long can you go to jail for Medicare fraud?

The penalties for violating this law are fines and up to 10 years in prison or longer if the action results in serious bodily injury to death. **Medicare fraud can also be committed by person who are neither providers nor consumers of healthcare. Professional criminals or even organizations may be involved.

What does abuse mean in CMS?

CMS provides this definition: "Abuse involves payment for items or services when there is no legal entitlement to that payment and the health care provider has not knowingly and/or intentionally misrepresented facts to obtain payment."

What is waste in Medicare?

CMS provides this definition in its compliance guidance for Medicare plans: "WASTE is the overutilization of services, or other practices that, directly or indirectly, result in unnecessary costs to the Medicare program. Waste is generally not considered to be caused by criminally negligent actions, but rather the misuse of resources.

What does subcontractor mean in Medicare?

Subcontractor means. Click card to see definition 👆. Tap card to see definition 👆. **An individual or entity that provides services on behalf of a Medicare plan sponsor. This includes individuals and organizations with DIRECT relationship with the plan sponsor or individuals or organizations with INDIRECT relationship, ...

What are the negative effects of Medicare?

These costs take the form of not only lost dollars, but also of a negative impact on the quality of life of Medicare beneficiaries. Fraud, waste, and abuse can inflict real physical and emotional harm.

What are the penalties for defrauding a healthcare benefit program?

The penalties for violating this law are fines and up to 10 years in prison or longer if the action results in serious bodily injury to death.

What is a claim that a person knows or should know?

Example: Presenting a claim that a person knows or should know is for a service that was NOT provided as claimed or is false and fraudulent.

How does Medicare use prospective payment?

A prospective payment system is one in which the health care institution receives a set amount of money for each episode of care provided to a patient, regardless of the actual amount of care used . The actual allotment of funds is based on a list of diagnosis-related groups (DRG). The actual amount depends on the primary diagnosis that is actually made at the hospital. There are some issues surrounding Medicare's use of DRGs because if the patient uses less care, the hospital gets to keep the remainder. This, in theory, should balance the costs for the hospital. However, if the patient uses more care, then the hospital has to cover its own losses. This results in the issue of "up coding," when a physician makes a more severe diagnosis to hedge against accidental costs.

What is the 72 hour rule for Medicare?

72 Hour Rule. Violation of the 72 Hour Rule could lead to exclusion from the Medicare Program, criminal fines and imprisonment, and civil liability.

How long is a Medicare benefit period?

Medicare Part A 7. The benefit period ends with the close of a period of 60 consecutive days during which the patient was neither an inpatient of a hospital nor of a SNF. To determine the 60 consecutive day period, begin counting with the day the individual was discharged. Medicare Part A 8.

What is Medicare for people over 65?

Medicare is a health insurance program for: people age 65 or older, . people under age 65 with certain disabilities, and . people of all ages with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a kidney transplant) Medicare has: Part A Hospital Insurance . Part B Medical Insurance.

What field is Y in Medicare?

Anytime a Medicare /Medicaid outpatient or emergency account is re-billed, Y must be entered in the APC Critical Bypass Field. If charges are entered after Medicare or Medicaid has paid on an outpatient account and intend to re-bill the account, enter Y in the APC Critical Bypass Field.

When does a Medicare benefit period begin?

A benefit period begins with the first day (not included in a previous benefit period) on which a patient is furnished inpatient hospital or extended care services by a qualified provider in a month for which the patient is entitled to hospital insurance benefits. Medicare Part A 7.

When does Medicare start?

Medicare entitlement starts the 1st of the month that the patient turns 65.

What is Medicare fraud?

Medicare fraud occurs when someone knowingly deceives Medicare to receive payment when they should not, or to receive higher payment than they should. Committing fraud is illegal and should be reported. Anyone can commit or be involved in fraud, including doctors, other providers, and Medicare beneficiaries.

How to report Medicare fraud?

To report fraud, contact 1-800-MEDICARE (633-4227), the Senior Medicare Patrol (SMP) Resource Center (877-808-2468), or the Inspector General’s fraud hotline at 1-800-HHS-TIPS (447-8477). Medicare will not use your name while investigating if you do not want it to.

Which Medicare programs prohibit fraudulent conduct?

In addition to Medicare Part A and Part B, Medicare Part C and Part D and Medicaid programs prohibit the fraudulent conduct addressed by

What is Medicare abuse?

Abuse includes any practice that does not provide patients with medically necessary services or meet professionally recognized standards of care.

What is the role of third party payers in healthcare?

The U.S. health care system relies heavily on third-party payers to pay the majority of medical bills on behalf of patients . When the Federal Government covers items or services rendered to Medicare and Medicaid beneficiaries, the Federal fraud and abuse laws apply. Many similar State fraud and abuse laws apply to your provision of care under state-financed programs and to private-pay patients.

Why do doctors work for Medicare?

Most physicians try to work ethically, provide high-quality patient medical care, and submit proper claims. Trust is core to the physician-patient relationship. Medicare also places enormous trust in physicians. Medicare and other Federal health care programs rely on physicians’ medical judgment to treat patients with appropriate, medically necessary services, and to submit accurate claims for Medicare-covered health care items and services.

What is heat in Medicare?

The DOJ, OIG, and HHS established HEAT to build and strengthen existing programs combatting Medicare fraud while investing new resources and technology to prevent and detect fraud and abuse . HEAT expanded the DOJ-HHS Medicare Fraud Strike Force, which targets emerging or migrating fraud schemes, including fraud by criminals masquerading as health care providers or suppliers.

Is there a measure of fraud in health care?

Although no precise measure of health care fraud exists, those who exploit Federal health care programs can cost taxpayers billions of dollars while putting beneficiaries’ health and welfare at risk. The impact of these losses and risks magnifies as Medicare continues to serve a growing number of beneficiaries.

Is CPT copyrighted?

CPT codes, descriptions and other data only are copyright 2020 American Medical Association. All Rights Reserved. Applicable FARS/HHSAR apply. CPT is a registered trademark of the American Medical Association. Applicable FARS/HHSAR Restrictions Apply to Government Use. Fee schedules, relative value units, conversion factors and/or related components are not assigned by the AMA, are not part of CPT, and the AMA is not recommending their use. The AMA does not directly or indirectly practice medicine or dispense medical services. The AMA assumes no liability of data contained or not contained herein.

How much is Medicare fraud penalty?

Your coverage should be more important than profits. Penalties for committing Medicare fraud can reach nearly $100,000 and result in extraction from all government health care programs.

How to report Medicare fraud?

To help fight Medicare fraud, waste, and abuse report any suspicious activity to 1-800-HHS-TIPS (1-800-447-8477). You can also describe the incident in up to ten pages and email it to [email protected].

Why does the government lose millions of dollars in Medicare?

The government loses millions each year due to Medicare fraud, waste, and abuse, causing prices to rise. Medicare fraud, waste, and abuse come from a series of laws designed to protect all parties involved in Medicare and Medicaid.

Can a doctor make a referral to a health care company?

Physician Self-Referral Law (Stark Law) – Doctors cannot make referrals to health care companies in which they have an interest. Criminal Health Care Fraud Statute – Cannot defraud; bill for unnecessary medical goods and services (like drugs that are not needed or wheelchairs for those who are not impaired). [clickToTweet tweet=”The government ...