Some of the major differences include:

- All Medicare Advantage plans have required cost sharing, while Medicare Supplement insurance often has little or zero cost sharing.

- Since Medicare Supplement Insurance works with Original Medicare, there are no networks or referrals needed. ...

- Medicare Advantage usually has lower premiums than Medicare Supplement insurance.

Full Answer

Which is better Medicare Advantage or Medicare supplement?

Medicare Advantage may also be a good option for seniors who want prescription drug coverage or want additional coverage options like routine dental care. Seniors who have significant health problems and a lot of medical expenses are generally better off with Medicare supplement plans.

Is Medicare supplement better than advantage?

Medicare Advantage plans generally have lower premiums than Medicare supplements. There are some areas where Medicare Advantage plans have no monthly premiums at all. That is usually offset by higher co-pays and deductibles. This is one reason the MA plans have gotten so popular. But don’t be fooled by the premium.

Is Medicare Advantage better than Medicare?

The MA program helps address social determinants of health and improve health equity: "...over 95 percent of Medicare Advantage beneficiaries have access to meal services, telehealth, transportation, dental, fitness, vision, and hearing benefits.

When to choose Original Medicare vs. Medicare Advantage?

You may want to choose between Original Medicare and Medicare Advantage for financial reasons, but you may also want to consider access to certain healthcare services. The important thing is to understand the differences between each type of Medicare before you commit yourself to a plan for the coming year.

Whats the difference between a Medicare Supplement plan and an Advantage plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What are the advantages and disadvantages of Medicare Supplement plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

Why would someone choose a Medicare Advantage plan?

Consider if you want coverage for dental, vision and other extra benefits. Medicare Advantage plans cover everything Original Medicare covers plus more, so if you want things like dental, vision or fitness benefits, a Medicare Advantage plan may be the right choice. Think about what your total costs could be.

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Can I switch from an Advantage plan to a supplement?

If you have a Medicare Advantage plan, it is against the law for a company to sell you a Medicare Supplement insurance plan, unless you are planning to switch to Original Medicare.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

What is the downside to Medigap?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

What is the out-of-pocket maximum for Medicare Advantage plans?

The US government sets the standard Medicare Advantage maximum out-of-pocket limit every year. In 2019, this amount is $6,700, which is a common MOOP limit. However, you should note that some insurance companies use lower MOOP limits, while some plans may have higher limits.

What will Medicare not pay for?

Generally, Original Medicare does not cover dental work and routine vision or hearing care. Original Medicare won't pay for routine dental care, visits, cleanings, fillings dentures or most tooth extractions. The same holds true for routine vision checks. Eyeglasses and contact lenses aren't generally covered.

What is Medicare Part C?

Here is another easy one. Medicare Part C and Medicare Advantage are the same thing. This article will use “Medicare Advantage”. So far, so good.

What plan is more affordable?

Medicare Advantage plans will have lower out-of-pocket expenses because they manage the resources that you use. The cost of prescription drugs is usually included in the plan. Some plans offer other benefits too —such as vision, dental, and fitness programs. What you give up is the ability to see out-of-network providers at the same low cost.

What is the difference between Medicare Advantage and Original?

When you are eligible for Medicare, you have two primary options. One is Original Medicare, which includes Part A and Part B. The other option is Medicare Advantage, known as Part C. You can’t have Part C and Original Medicare. When you choose Part C, you are choosing to get your Medicare Part A and B coverage through the Medicare Advantage plan. That means you have to choose between them, which can be a challenge. This article will help you understand Original Medicare vs. a Medicare Advantage plan so you can choose the right one for your needs. Difference Between Original Medicare and Medicare Advantage Original Medicare is administered by the government and it can be used at any doctor in the U.S. who accepts Medicare. Generally, most folks get Part A for free and pay a monthly premium for Part B. Original Medicare coverage will not vary depending on which state or area you live in. Your out-of-pocket costs, after your deductible, are generally 20% of the Medicare-approved costs for services. Original Medicare does not cover hearing, vision, or dental care. If you want prescription drug coverage, you have to add Medicare Part D and pay a separate premium. Medicare Advantage is sold by private insurance companies who have a contract with the Federal government. Theremay be limitations on the medical providers you can use depending on where you live. Most Medicare Advantage plans include prescription drug coverage and additional benefits. You might be able to get vision coverage or a discount to a local health club. Most importantly for many beneficiaries, Medicare Advantage has more predictable out-of-pocket costs. Instead of paying a percentage of the service cost, which is impossible to know in advance, you generally pay specific deductibles and copayments. You can often get Medicare Advantage for the same cost as Original Medicare, although some Advantage plans cost more. Is Original Medicare Better Than Medicare Advantage? Like any choice, there are pros and cons of Medicare Advantage plans vs. Original Medicare. For instance, Medicare Advantage plans can be better for those who want more predictable out-of-pocket costs or are looking for additional benefits. However, Original Medicare is better for those who travel frequently or use doctors who are not in the same medical network. You won’t need referrals to see specialists and being able to see any doctor you choose can bring peace of mind. You can make Original Medicare out-of-pocket costs easier to manage if you add a Medigap policy. It’s important to think about your specific needs before you choose between Medicare Advantage and Original Medicare. Only you can decide which is best for your situation. Cost Difference Between Original Medicare and Medicare Advantage When you have Original Medicare, you’ll pay a monthly premium for Part B and there is also a deductible each year. If you need prescription drugs, you may need Part D as well.. Once you reach the deductible for Part B, you’ll pay 20% of the Medicare-approved cost of the medical care you receive. There is no out-of-pocket maximum. For prescription drugs, after the deductible, there are specific copayments each time you need medication. While Medicare Advantage may also have a monthly premium, there are many plans with $0 premiums. Therefore, many plans won’t cost any more than you already pay for Medicare Part B, and they already include prescription drugs. Each Medicare Advantage plan has its own out-of-pocket costs, including deductibles, copayments, and coinsurance. You’ll want to compare plans before making your final decision. Most Medicare Advantage plans also have an out-of-pocket cost maximum each year, after which the plan covers 100%. Can You Switch From Medicare Advantage to Original Medicare? You can switch from Medicare Advantage and Original Medicare in two different enrollment periods each year. The first is Open Enrollment, which is between October 15th and December 7th each year. You can make any changes to your Medicare plan that you like during this timeframe. The second time you can switch plans is during the Medicare Advantage Annual Enrollment Period, which is between January 1st and March 31st each year. If you have a Medicare Advantage plan during this time, you can choose a different Medicare Advantage plan or switch from Medicare Advantage to Original Medicare. Some circumstances create a special enrollment period, where you can make changes to your Medicare coverage outside of the normal windows. For instance, if you move out of your Medicare Advantage coverage area, you have an opportunity to choose a new plan or switch to Original Medicare. Learn More About Original Medicare vs. Medicare Advantage Understanding the differences between Medicare Advantage and Original Medicare is essential to making the right decision for your needs. However, it often helps to talk to a licensed insurance agent as well. If you have questions about your Medicare coverage and want to compare plans, contact us today!

Why was Medicare Supplement Insurance created?

Meanwhile, Medicare Supplement insurance was created to help Original Medicare recipients cover more of their out-of-pocket expenses.

What does it mean to switch from Medicare Advantage to Medigap?

Switching from Medicare Advantage to Medigap means you need to go back to Original Medicare. Instead of having coverage under Medicare Part C (Medicare Advantage), you’ll have coverage under Medicare Part A and Part B, with Medigap added on.

How much is Medicare Part A?

But you would have to pay a $471 monthly premium for Medicare Part A if you only paid Medicare taxes for 29 quarters or less (about 7.25 years). And if you paid Medicare taxes between 30-39 quarters (7.5 years to 9.75 years), the standard Part A premium is $259.

What is Medicare Part A?

Medicare Part A is hospital insurance. It helps cover inpatient care, skilled nursing facility care, hospice care, and home healthcare. In most cases, there is no cost for care, but there is a deductible of $1,484 in 2021.

When is Medicare open enrollment?

The Medicare Advantage Open Enrollment Period is between January 1st and March 31st each year.

When do you get Medicare Part A and Part B?

Many people are automatically enrolled in Medicare Part A and Part B when they turn 65 and begin to receive Social Security retirement benefits.

What is Medicare Advantage?

Medicare Advantage combines Medicare Part A and B for comprehensive coverage, all in one plan. It often includes Part D Prescription Drug coverage, too. These are also called Part C plans.

Which states have Medicare Supplement Plans?

In the following states, all Medicare Supplement plans are available to persons eligible for Medicare because of disability: California, Colorado, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Kansas, Kentucky, Louisiana, Maine, Minnesota, Mississippi, Missouri, Montana, New Hampshire, Oregon, Pennsylvania, South Dakota, Tennessee, Vermont, and Wisconsin.

Does Medicare Supplement work with Original Medicare?

Do you want financial protection from unexpected out-of-pocket costs, such as deductibles, copays, and coinsurance? If yes, Medicare Supplement plans work with Original Medicare and can help cover some of the remaining out-of-pocket expenses that Original Medicare doesn’t cover.

Is Medicare Advantage better than Medicare Supplement?

Considering Medicare Advantage vs. Medicare Supplement? One is not better than the other. They provide different types of coverage. Finding the right fit for you depends on what kind of Medicare coverage you’re seeking, as well as your health care needs. Review all details of plans when shopping and be open to considering alternatives when your needs change.

Can you change from a Medicare Advantage plan to a Medicare Supplement plan?

During the Annual Enrollment Period, which runs from October 15 to December 7 each year, you are free to reconsider your Medicare coverage. If you decide you want to try a Medicare Supplement plan vs. Medicare Advantage plan, you can make that change during this period. 4

What is Medicare Supplement Insurance?

Medicare supplement insurance, also called Medigap, helps fill in the gaps in original Medicare’s coverage, including some copayments, deductibles, and coinsurance. Some supplement insurance, or Medigap, policies cover added services, such as those a person receives while travelling outside the country.

What is Medicare Advantage?

Medicare supplement plans can only be used with original Medicare. Medicare Advantage insurance combines the benefits of Medicare parts A and B. It can also provide prescription drug coverage. A person with this type of plan pays a premium, copayments, and a deductible.

What are the different types of Medicare?

Medicare has several parts, each of which covers different aspects of healthcare. Though there are exceptions and nuances, the general breakdown is as follows: 1 Part A covers hospital care. 2 Part B covers outpatient services. 3 Part C is also called Medicare Advantage. 4 Part D covers prescription drugs.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What is a copayment for Medicare?

Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is fee for service plan?

Private fee-for-service plans: This type limits how much a person pays to any given service provider, and it removes the requirement of a referral to see a specialist.

Do you have to give your Medicare number?

A person must give their Medicare number and information about when parts A and B began for them when they sign up for a Medigap policy. This information is on a person’s Medicare card. A company should never ask for financial information, including credit card or banking information, over the phone.

How much is Medicare Supplement vs Advantage?

Choosing Medicare Supplement vs. Advantage. $3,400 to $6,700 a year in deductibles and co-pays, depending on the plan. Most or all Part A & B out-of-pocket costs are covered. Part A & B benefits covered in place of Original Medicare. Most plans have Part D coverage.

What is Medicare Advantage?

Medicare Advantage refers to Medicare Part C and provides the same benefits as Part A and B, except for hospice care, a service covered by Part A. Under this plan, members would continue paying their Part B premium. Many Advantage plans offer Part D, which covers prescription drugs.

What is Medicare Supplement?

Medicare Supplement or Medigap, is private plan coverage that pays for most of your out-of-pocket costs like co-pays, deductibles, and premiums and picks up where Original Medicare stops. Medicare Supplement has 10 sub-plans in 47 states, while three states—Wisconsin, Minnesota, and Massachusetts have their own customized plans.

What is a private supplemental plan?

Private supplemental coverage that pays all or most Part A & B out-of-pocket costs. Private health plan that provides Part A & B benefits directly in place of Original Medicare. 1st 6 months after enrolling in Part B and being 65 years old, as a minimum age. One Medicare Advantage card.

What are the letters on a Medigap plan?

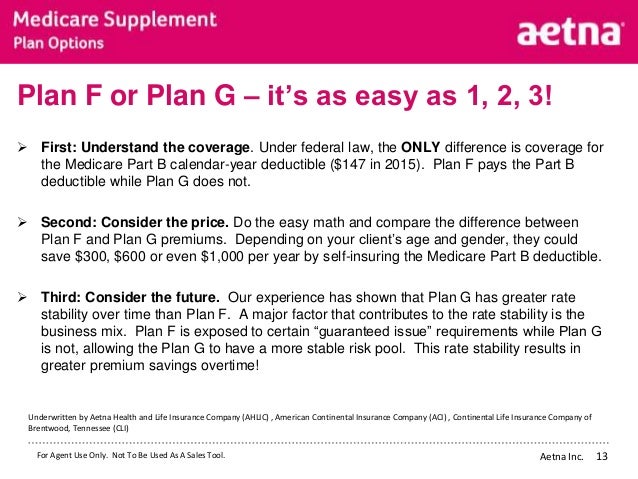

The 10 standard Medigap plans are marked by the letters A, B, C, D, F, G, K, L, M, N . Once enrolled in Medigap, your plan will cover the portion of your bill, once Original Medicare has paid its claims.

Does Medicare Advantage have co-pays?

Medicare Advantage usually requires co-pays and deductibles. However, unlike Original Medicare, these payments put annual limits on how much you pay out-of-pocket. Once you’ve reached that limit, the plan will cover your medical bills for the remainder of the year.

Who manages Medicare Advantage?

Medicare Advantage is managed and sold by private insurance companies . These companies set the prices, but Medicare regulates the coverage options. Original Medicare and Medicare Advantage are two insurance options for people age 65 and older living in the United States.

What is Medicare Part A?

Inpatient hospital services ( Medicare Part A ). These benefits include coverage for hospital visits, hospice care, and limited skilled nursing facility care and at-home health care.

How much is Medicare 2021?

You’ll have certain set costs associated with your coverage under parts A and B. Here are some of the costs associated with original Medicare in 2021: Cost. Original Medicare amount. Part A monthly premium. $0, $259, or $471 (depending on how long you’ve worked) Part A deductible. $1,484 each benefit period.

What takes the place of original Medicare add-ons?

Medicare Advantage takes the place of original Medicare add-ons, such as Part D and Medigap.

How long before you can apply for medicare?

You can also apply for Medicare 3 months before your 65th birthday and up to 3 months after you turn age 65. If you decide to wait to enroll until after that period, you may face late enrollment penalties.

How long do you have to have prescriptions for Medicare?

No matter what option you choose, you’re required to have some form of prescription drug coverage within 63 days of enrolling in Medicare, or you’ll be required to pay a permanent late enrollment penalty.

Does Medicare Advantage cover dental exams?

However, if you’re someone who wants coverage for yearly dental, vision, or hearing exams, many Medicare Advantage plans offer this type of coverage.

What is the difference between Medicare Supplement and Medicare Advantage?

The two biggest differences between Medicare Supplement and Medicare Advantage are coverage and cost sharing. Medicare Advantage plans do not allow for nationwide coverage.

What is Medicare Supplement?

Medicare Supplement insurance and Medicare Advantage are the two pillars of private Medicare insurance. It can be difficult to choose between them. Medicare Supplement insurance is offered by private insurance companies. These policies, which are also known as Medigap, fill in some of the gaps in Original Medicare (Parts A and B).

Why do people choose Medigap?

This freedom to choose any doctor is one of the primary reasons people choose Medigap coverage. As mentioned earlier, Medicare Advantage plans tend to have cost sharing that resembles Original Medicare. This means that when you receive services, you’ll have to pay a copayment or coinsurance.

How long does it take to enroll in Medicare Supplement?

Everyone has the right to enroll in Medicare Supplement during their Medigap open enrollment period. This window lasts for six months and begins when both of the following criteria have been met: You are at least 65 years old. You are enrolled in Medicare Part B.

What are the disadvantages of Medicare Advantage?

Generally requires referrals. You will pay something for most services or procedures. Potential disadvantages of Medicare Supplement insurance: More expensive than Advantage plans.

Does Medicare Supplement Insurance work with Original Medicare?

Since Medicare Supplement Insurance works with Original Medicare, there are no networks or referrals needed. This means that you can see any doctor in the country who takes Medicare patients. Medicare Advantage usually has lower premiums than Medicare Supplement insurance.

Does Medicare Advantage have a cap?

Medicare Advantage plans usually require you to pay copays and coinsurance for the services you receive, just like Original Medicare. But Medicare Advantage plans have a fixed cap on spending (called an out-of-pocket maximum) each year. Many Medicare Advantage plans also include prescription drug coverage.

How much does Medicare pay monthly?

Generally, you pay a low or $0 monthly plan premium (in addition to your Part B premium). When you use services, you pay copays, coinsurance, and deductibles up to a set out-of-pocket limit. For Medicare-approved doctor and hospital services, you’ll pay a monthly plan premium in addition to your Part B premium.

What is a Medigap plan?

Medigap Plans. Doctors and hospitals. You may be required to use doctors and hospitals in the plan network. You can select your own doctors and hospitals that accept Medicare patients. Referrals. You may need referrals and may be required to use network specialists, depending on the plan.

Is prescription drug coverage included in most insurance plans?

Prescription drug coverage is included with most plans .

Is non emergency care covered by Medicare?

Non-emergency care might depend on your plan’s service area. Emergency care is generally covered for travel within the United States and sometimes abroad. Enrollment. Generally, there are specific periods during the year when you can enroll in or switch to a different Medicare Advantage plan.

Do you have to use doctors in a health insurance plan?

You may be required to use doctors and hospitals in the plan network.

Do you have to be an AARP member to enroll in Medicare Supplement Plan?

You must be an AARP member to enroll in an AARP Medicare Supplement Plan.