Medicare Advantage - Key Differences

- Price. The primary difference between the Medigap and Medicare Advantage plans come at a different cost. Generally speaking, Medigap plans have higher premiums than Medicare Advantage plans.

- Choice of Physicians. One key difference that might influence your decision to select Medigap or Medicare Advantage plan is the choice of physicians they offer.

- Location. One major determinant of which plan you choose is where you are located and your lifestyle. ...

Should you buy a Medigap or Medicare Advantage plan?

About 14.5 million beneficiaries are enrolled in a Medigap plan, which helps cover certain cost-sharing aspects of original Medicare ... "I've seen it a lot." If you work with an agent, you should ask how many insurance companies they work with (or ...

Should I Choose Medicare Advantage or Medigap?

If you want dental and vision coverage, then a Medicare Advantage plan may be the cheapest way to get it. If you are happy with your Part D plan, then a Medigap plan may be a simpler option to help you cover Original Medicare fees without losing your prescription drug plan.

What is Medicare Advantage vs supplement?

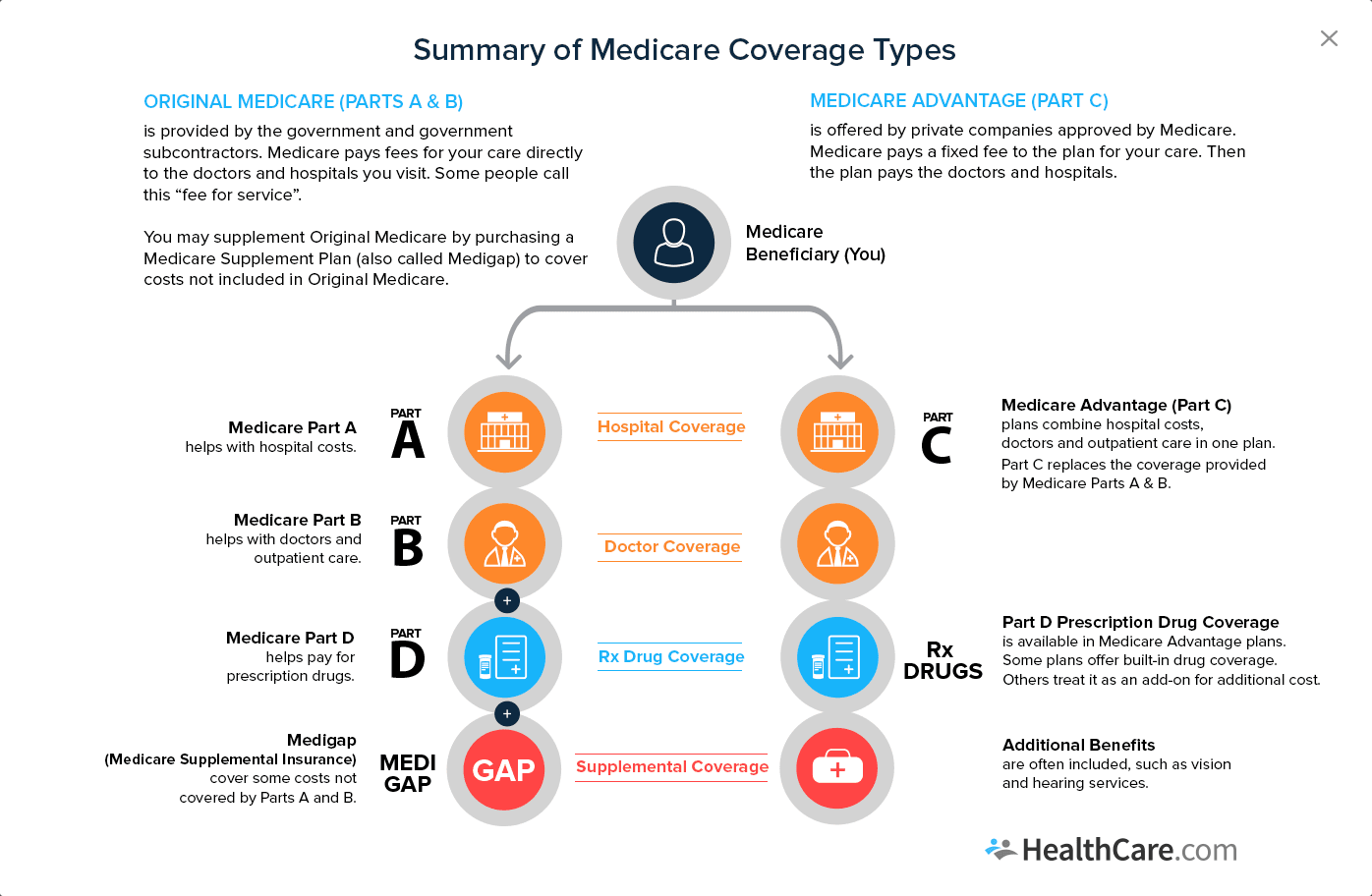

Medicare Advantage (Part C) and Medicare Supplement (Medigap) plans both offer coverage for out-of-pocket medical expenses. You cannot have both a Medicare Advantage and Medicare Supplement plan. Understanding your health and how you’ll use your plan will help you determine which one may fit your needs.

What is the difference between Medicare and advantage?

- Routine vision, including eye glasses, contacts, and eye exams

- Routine hearing, including hearing aids

- Routine dental care

- Prescription drugs and some over the counter medications

- Fitness classes and gym memberships

- Meal delivery to your home

- Transportation to doctor visits

- Other benefits

What is the difference between a Medigap policy and a Medicare Advantage plan?

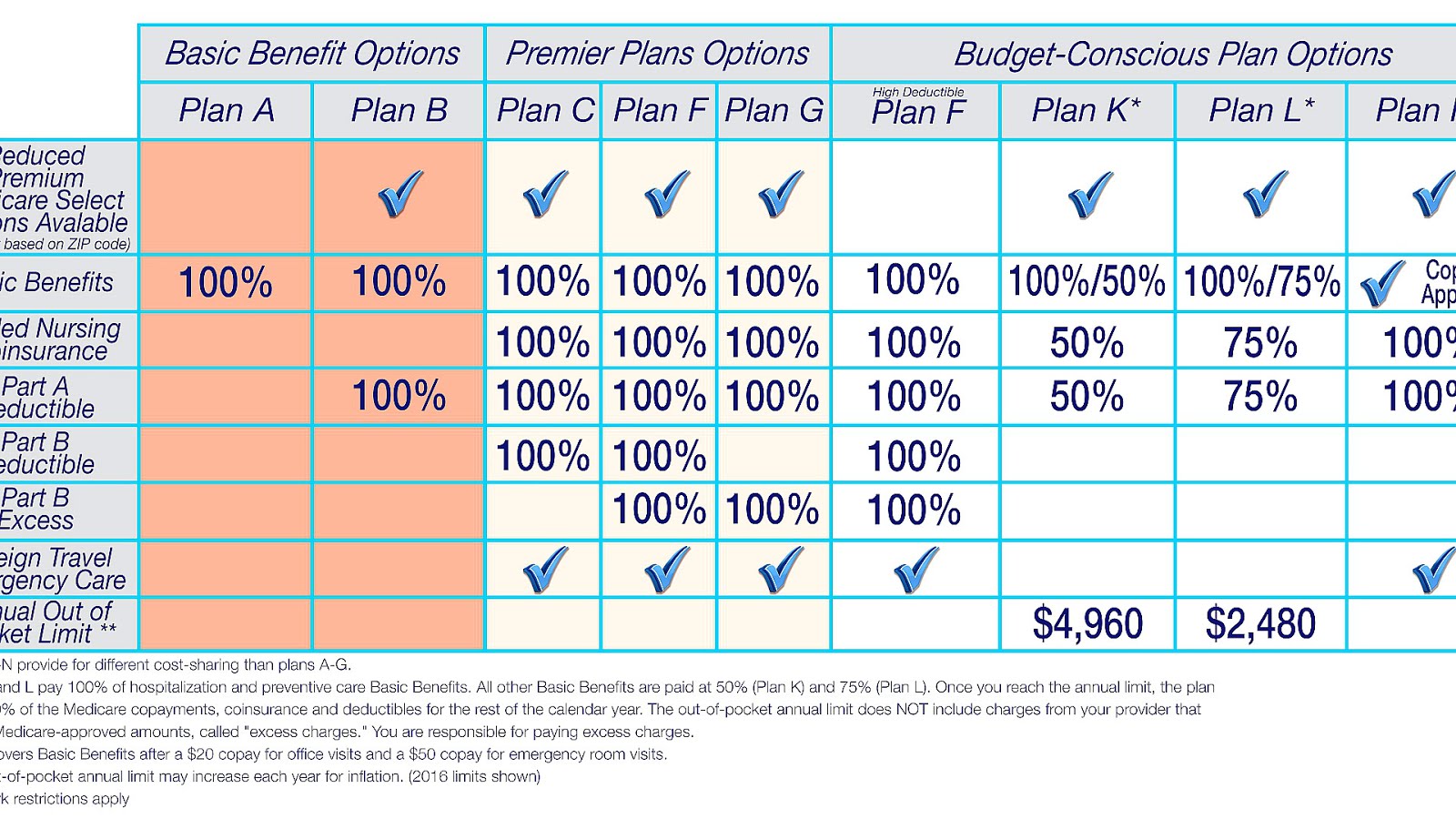

Medigap supplemental insurance plans are designed to fill Medicare Part A and Part B coverage gaps. Medicare Advantage, also referred to as Medicare Part C plans, often include benefits beyond Medicare Parts A and B. Private, Medicare-approved health insurance companies offer these plans.

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What are the advantages and disadvantages of Medigap plans?

Medigap Pros and ConsMedigap ProsMedigap ConsAll plans offer an additional 365 days in hospitalNot all plans cover hospital deductibleSome plans offer extras like excess charges, foreign travel, and Silver Sneakers programDoes not include drug coverageNationwide coverageDoesn't cover acupuncture3 more rows•Jun 4, 2015

How Much Is Medigap per month?

In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization.

Can I switch from Medicare Advantage to Medigap?

Most Medicare Advantage Plans offer prescription drug coverage. , you may want to drop your Medigap policy. Your Medigap policy can't be used to pay your Medicare Advantage Plan copayments, deductibles, and premiums.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

Who pays for Medigap?

You pay the private insurance company a monthly premium for your Medigap plan in addition to the monthly Part B premium you pay to Medicare. A Medigap plan only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

Do Medigap plans have a maximum out-of-pocket?

Medigap plans don't have a maximum out-of-pocket because they don't need one. The coverage is so good you'll never spend $5,000 a year on medical bills.

Why should I choose a Medigap plan?

Medigap policies are sold by private companies, and can help pay for some of the costs that Original Medicare doesn't, like copayments, coinsurance, and deductibles. Some Medigap policies also cover certain benefits Original Medicare doesn't cover, like emergency foreign travel expenses.

Who are Medigap plans good for?

Who Is Eligible for Medigap Plans? To be eligible for a Medigap plan, you must be enrolled in Original Medicare Parts A and B, but not a Medicare Advantage plan. You must also be in one of the following categories: Age 65 and older.