- Original Medicare and Medicare Advantage both cover hospitalization, medical appointments, and other healthcare costs; however, they are not the same.

- Original Medicare is a government-run option and not sold by private insurance companies.

- Medicare Advantage is managed and sold by private insurance companies. ...

How does Medicare Advantage compare to Medicare?

Typically, studies have shown that Medicare Advantage plans cost no more than Original Medicare plans and still offer more freebies and extra services because private companies provide them.

Is Medicare Advantage better than Medicare?

The MA program helps address social determinants of health and improve health equity: "...over 95 percent of Medicare Advantage beneficiaries have access to meal services, telehealth, transportation, dental, fitness, vision, and hearing benefits.

Why Advantage plans are bad?

disadvantage of medicare advantage plans

- Networks

- Referrals

- Prior Authorizations

- Frequent Expenses

- Out-of-Pocket Maximums

- Plan Changes

- Medicare is no longer managing your healthcare

What are the advantages and disadvantages of Medicare Advantage plans?

Your recent article on Medicare Advantage plans provided a good overview but omitted essential information. Traditional Medicare coverage includes a well-defined set of benefits, rules and regulations with regards to coverage. Adverse coverage determinations can be appealed. The appeals process is well defined.

What is the difference between Medicare Advantage and just plain Medicare?

Original Medicare covers most medically necessary services and supplies in hospitals, doctors' offices, and other health care facilities. Original Medicare doesn't cover some benefits like eye exams, most dental care, and routine exams.

Is Medicare Advantage better than regular Medicare?

Under Medicare Advantage, you will get all the services you are eligible for under original Medicare. In addition, some MA plans offer care not covered by the original option. These include some dental, vision and hearing care. Some MA plans also provide coverage for gym memberships.

What are the pros and cons of Medicare Advantage VS Original Medicare?

Original Medicare doesn't cover all your medical expenses, while Advantage plans have cost-sharing requirements but then cap your out-of-pocket costs. Plus, you have low premiums and the simplicity of all-in-one coverage.

Is Medicare Advantage cheaper than original Medicare?

The costs of providing benefits to enrollees in private Medicare Advantage (MA) plans are slightly less, on average, than what traditional Medicare spends per beneficiary in the same county. However, MA plans that are able to keep their costs comparatively low are concentrated in a fairly small number of U.S. counties.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What percent of seniors choose Medicare Advantage?

[+] More than 28.5 million patients are now enrolled in Medicare Advantage plans, according to new federal data. That's up nearly 9% compared with the same time last year. More than 40% of the more than 63 million people enrolled in Medicare are now in an MA plan.

What Medicare Advantage plans do not cover?

Most Medicare Advantage Plans offer coverage for things Original Medicare doesn't cover, like fitness programs (like gym memberships or discounts) and some vision, hearing, and dental services. Plans can also choose to cover even more benefits.

Can I switch from Medicare Advantage to original Medicare?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Can you have Medicare and Medicare Advantage at the same time?

Can I combine Medicare Supplement with Medicare Advantage? If you already have Medicare Advantage plan, you can generally enroll in a Medicare Supplement insurance plan under one condition – your Medicare Advantage plan must end before your Medicare Supplement insurance plan goes into effect.

What does it mean to have Original Medicare?

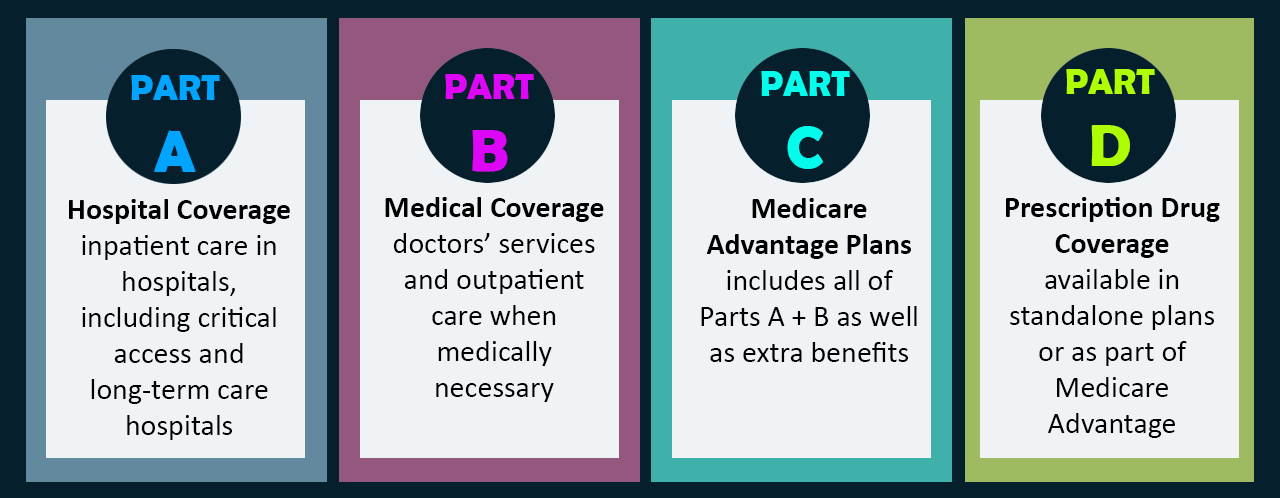

Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). out-of-pocket costs.

Do Medicare Advantage plans have a deductible?

Medicare plans have deductibles just like individual or employer health insurance plans do. Both Original Medicare and, typically, Medicare Advantage Plans, require you to meet a deductible—an amount you pay for healthcare or for prescriptions—before your healthcare plan begins to pay.

Original Medicare vs. Medicare Advantage: What’S The Difference?

In order to understand the differences between the two programs, it’s important to understand how each one works.Original Medicare, Part A and Part...

Are There Different Types of Medicare Advantage Plans?

Many people like the flexibility that Medicare Advantage plans provide. Unlike Original Medicare, which is the same for everyone, there are several...

How Can I Find Which Medicare Advantage Plans Are Available in My area?

I’m available to help you understand your options. If you prefer, you can request information via email or schedule a phone call at your convenienc...

How much is Medicare 2021?

You’ll have certain set costs associated with your coverage under parts A and B. Here are some of the costs associated with original Medicare in 2021: Cost. Original Medicare amount. Part A monthly premium. $0, $259, or $471 (depending on how long you’ve worked) Part A deductible. $1,484 each benefit period.

What takes the place of original Medicare add-ons?

Medicare Advantage takes the place of original Medicare add-ons, such as Part D and Medigap.

What is Medicare Part A?

Inpatient hospital services ( Medicare Part A ). These benefits include coverage for hospital visits, hospice care, and limited skilled nursing facility care and at-home health care.

How long before you can apply for medicare?

You can also apply for Medicare 3 months before your 65th birthday and up to 3 months after you turn age 65. If you decide to wait to enroll until after that period, you may face late enrollment penalties.

How long do you have to have prescriptions for Medicare?

No matter what option you choose, you’re required to have some form of prescription drug coverage within 63 days of enrolling in Medicare, or you’ll be required to pay a permanent late enrollment penalty.

Does Medicare cover prescription drugs?

Original Medicare generally doesn’t cover prescription drug costs. To receive coverage for prescription drugs, you need a Medicare Part D plan or Medicare Advantage plan with prescription drug coverage.

Does Medicare Advantage cover dental exams?

However, if you’re someone who wants coverage for yearly dental, vision, or hearing exams, many Medicare Advantage plans offer this type of coverage.

Medicare Advantage

You can go to any doctor or hospital that takes Medicare, anywhere in the U.S.

Medicare Advantage

Out-of-pocket costs vary – plans may have different out-of-pocket costs for certain services.

Medicare Advantage

Original Medicare covers most medically necessary services and supplies in hospitals, doctors’ offices, and other health care facilities. Original Medicare doesn’t cover some benefits like eye exams, most dental care, and routine exams.

Can You Switch Between Original Medicare and Medicare Advantage?

As a final note, no matter which option you decide is right for you, you can switch from Original Medicare to Medicare Advantage or vice versa. The two main times you can switch are the Medicare Annual Enrollment Period and the Medicare Special Enrollment Period for qualifying life events, if you qualify.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What is the difference between Medicare Advantage and Original?

With Original Medicare you can go to any hospital and see any doctor or provider within the U.S. who accept Medicare. You do have limited coverage in foreign countries, though.

Why would Medicare premiums be higher with Original Medicare?

You could have higher monthly premium payments with Original Medicare than with Medicare Advantage, because you might want to add a Part D prescription drug plan and/or a Medicare supplement plan. Consider how often you leave home.

What is a low cost Medicare plan?

A low-cost or $0 plan premium. A plan deductible (not all Medicare Advantage plans have one) Copays for covered health services and items. A note about financial protection: A really great benefit with a Medicare Advantage plan though is there is a limit on your out-of-pocket costs (deductibles, coinsurance and copays).

Why would you pay more with Medicare Advantage or Original?

You could have higher monthly premium payments with Original Medicare than with Medicare Advantage, because you might want to add a Part D prescription drug plan or other additional coverage. You may pay more copays with Medicare Advantage than with Original Medicare.

What are the costs of Medicare Advantage?

Costs with Medicare Advantage vary but may include: 1 The Part B premium 2 A low-cost or $0 plan premium 3 A plan deductible (not all Medicare Advantage plans have one) 4 Copays for covered health services and items

What is Medicare buffet?

If you elect to go with original Medicare, your buffet will include Part A (hospital care), Part B (doctor visits, lab tests and other outpatient services) and Part D (prescription drugs). If you decide to go with Part C, a Medicare Advantage plan, it will be more like a set menu, since a private insurer has already bundled together parts A and B and almost always D into one comprehensive plan.

What is Medicare Advantage?

Under Medicare Advantage, you will essentially be joining a private insurance plan like you probably had through your employer. The most common ones are health maintenance organizations (HMOs) and preferred provider organizations (PPOs). Medicare Advantage employs managed care plans and, in most cases, you would have a primary care physician who would direct your care, meaning you would need a referral to a specialist. HMOs tend to have more restrictive choices of medical providers than PPOs.

How to find out what out of pocket costs are?

To help you get an idea of what your out-of-pocket costs would be, you can consult the Centers for Medicare & Medicaid Services’ out-of-pocket cost calculator, which can help you compare your estimated out-of-pocket expenses .

What percentage of doctors accept Medicare?

According to the Kaiser Family Foundation, 93 percent of primary physicians participate in Medicare. That means chances are pretty good that any doctor you are currently seeing will accept Medicare and you won't have to change providers.

Is Medicare Advantage a one stop shop?

Medicare Advantage is a one-stop-shopping program that combines Part A and Part B into one plan. In addition, about 90 percent of MA plans also include prescription drugs, which means you wouldn't have to enroll in a separate Part D plan. There are no Medigap policies for Advantage plans.

Does Medicare have an annual cap?

Many beneficiaries who elect original Medicare also purchase a supplemental – or Medigap – policy to help defray many out-of-pocket costs, which Medicare officials estimate could run in the thousands of dollars each year. There is no annual cap on out-of-pocket costs.

Does Medicare cover dental?

While Medicare will cover most of your medical needs, there are some things the program typically doesn't pay for -— like cosmetic surgery or routine dental, vision and hearing care. But there are also differences between what services you get help paying for.

Medicare vs. Medicare Advantage: The Basics

If you have original Medicare, the goverment directly pays for your Medicare benefits. In contrast, with Medicare Advantage plans, you receive your benefits from private medical insurance companies that Medicare has approved. There are several types of Medicare Advantage Plans:

Medicare vs. Medicare Advantage: Differences

Both Medicare and Medicare Advantage will fund most basic health costs, including doctor's visits and hospital stays. The specific cost of each plan, as well as the out-of-pocket copays and other costs, vary. Some key differences between the two programs include:

Why Choose Medicare Advantage?

Medicare Advantage plans must offer benefits comparable to original Medicare. The government regulates these plans, ensuring that they meet certain basic care requirements. The costs and copays for various services, however, may be different. For some people, Medicare Advantage is a better choice. You might choose Medicare advantage because:

How many people are on Medicare in 2018?

More than 59 million people were on Medicare in 2018. Forty million of those beneficiaries chose Original Medicare for their healthcare needs. 2 . Access to a broader network of providers: Original Medicare has a nationwide network of providers.

What is the maximum out of pocket spending for Medicare?

This was to discourage private insurance from taking advantage of their beneficiaries. For Medicare Advantage plans, those limits are set at $6,700 for in-network services when you are on a Health Maintenance Organization (HMO) plan and $10,000 for in- and out-of-network services combined when you are on a Preferred Provider Organization (PPO) plan. Monthly premiums are excluded from that amount as are any services that would not be covered by Original Medicare. Unfortunately, that means any spending on supplemental benefits does not count towards your cap. Spending on prescription medications, even if they are included in your Medicare Advantage plan, are also considered separately. After you spend the full amount in out of pocket expenses, your Medicare Advantage plan will be responsible for any additional costs over the remainder of the year. Original Medicare does not have an out of pocket spending limit.

How did the government try to decrease expenditures from the Medicare Trust Fund?

In an attempt to decrease expenditures from the Medicare Trust Fund, the government tried to shift the cost of care to the private sector. Insurance companies contract with the government to be in the Medicare Advantage program, and the government pays the plan a monthly stipend for each beneficiary that signs up.

What is part A in nursing?

In simple terms, Part A covers inpatient care you receive in a hospital, skilled nursing facility (SNF) stays after an inpatient hospitalization, hospice care regardless of your location, and a limited number of home health services.

When is Medicare open enrollment?

Whether you are new to Medicare or are looking to change your plan during the Medicare Open Enrollment Period (October 15 - December 7) , you have an important decision to make. Is Original Medicare or Medicare Advantage the right choice for you? To understand your choices, you need to understand how they differ.

Does Medicare cover travel to a foreign country?

borders, on cruise ships within six hours of a U.S. port, and for direct travel between Alaska and the continental U.S., but foreign travel is otherwise not covered. Medicare Advantage plans can extend that reach as one of their supplemental benefits. That being the case, Medigap plans can also add coverage for emergency care when traveling in foreign countries. A beneficiary will need to decide whether Original Medicare with a Medigap plan or a Medicare Advantage plan alone would offer them better coverage for their travel needs.

Does Medicare Supplement cover medical bills?

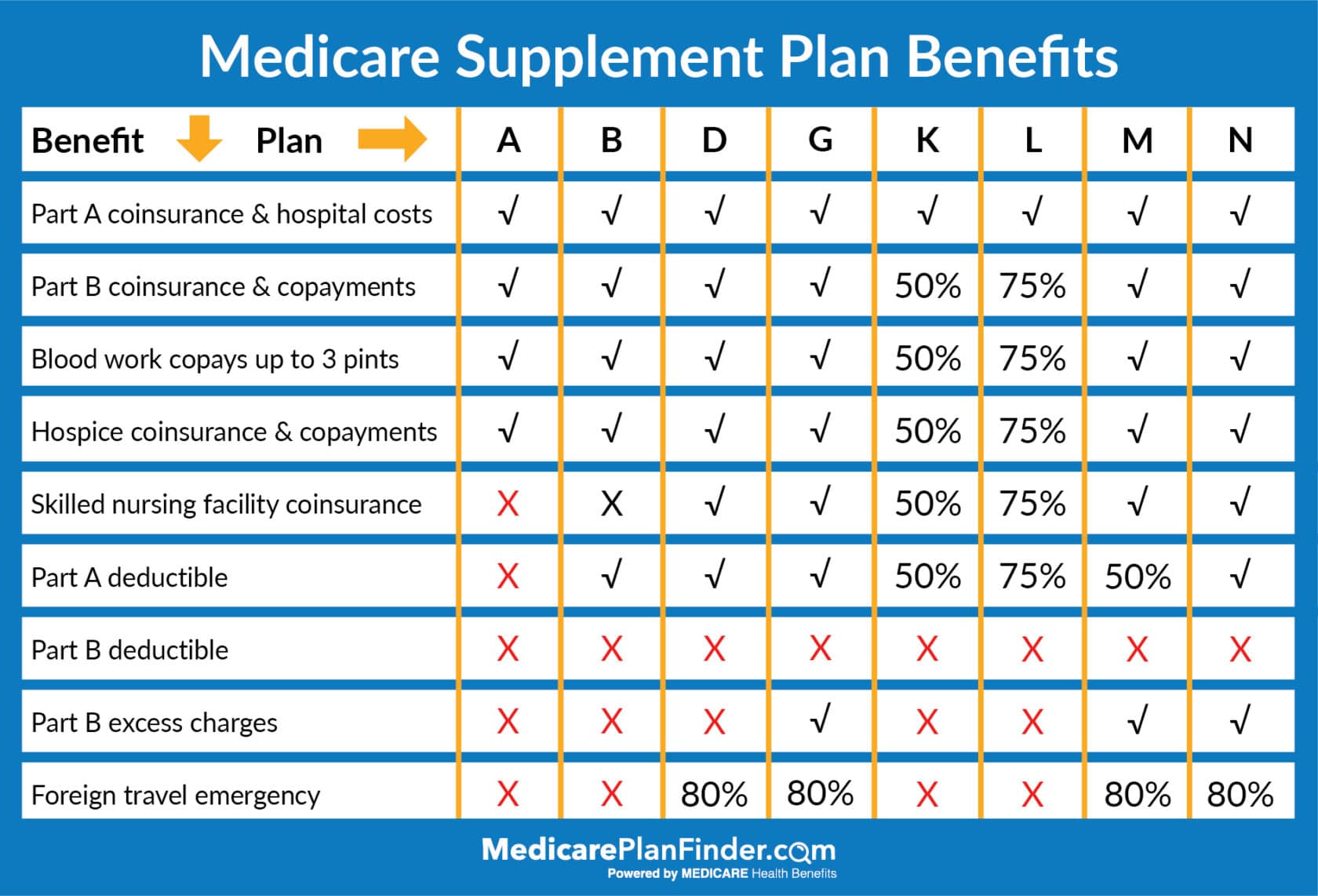

That's where a Medicare Supplement plan, also known as a Medigap plan, can come into play. These supplement plans do not cover health care directly but help to pay off any costs Original Medicare leaves on the table, i.e., deductibles, coinsurance, copays, and even emergency care in a foreign country.