Medicare Supplement Insurance Plans are offered by Blue Cross and Blue Shield of Illinois, a Division of Health Care Service Corporation, a Mutual Legal Reserve Company, an Independent Licensee of the Blue Cross and Blue Shield Association.

What you can do to help Medicaid in Illinois?

Oct 12, 2018 · Medicare Supplement plans in Illinois, as elsewhere in the United States, are designed to work alongside Medicare to fill in some of the “gaps” in Medicare coverage—such as deductibles, coinsurance, and copayments. For this reason, Medicare Supplement insurance is often referred to as “Medigap” insurance. You can buy one of 10 standardized Medicare …

What does Medicaid cover in Illinois?

What Companies Sell Medicare Supplement Plans in Illinois? 1. Cigna – For a Medigap plan in Illinois, this company is trusted by many and is very knowledgeable about the Medicare enrollment process. Cigna has over 165 million customers and is well established.

Which is the best Medicare supplement?

Feb 23, 2022 · Senior Health Insurance Program (SHIP): This program provides free counseling to people on Medicare. Contact SHIP at 1-800-252-8966 or [email protected] . Illinois Department of Insurance: If you have an issue with your Medicare Supplement plan, contact the Department of Insurance. You can file a complaint online .

What does health insurance cost in Illinois?

Oct 26, 2020 · As of January 2022, Illinois implemented a birthday rule for Medicare Supplement plans. The rule allows Medicare Supplement beneficiaries ages 65 to 75 to change to a lesser or equal benefits plan with the same carrier. This change must occur during a window starting on your birthday and lasting 45 days.

Who is the largest Medicare supplement insurance company?

How Much Does Medicare Plan G cost in Illinois?

What Medicare supplement is no longer available?

How many Medicare supplement companies are there?

Also, you should be aware that while there are 10 different plans out there, the 3 most popular are Plans F, G and N. That's because these offer some of the most comprehensive coverage.Nov 1, 2021

Can you be denied a Medicare supplement plan?

Is there a waiting period on Medicare supplement plans?

Is AARP plan f still available?

What is the most comprehensive Medicare supplement plan?

Why was plan F discontinued?

Who regulates Medicare supplement plans?

Are all Plan G Medicare supplements the same?

Who owns Medico Insurance Company?

What Medicare Parts are available in Illinois?

In Illinois, if you’ve been receiving SSDI for 2 years, you are automatically eligible to enroll in Medicare Parts A, B, and D.

Which company is the best for Medigap in Illinois?

1. Cigna – For a Medigap plan in Illinois, this company is trusted by many and is very knowledgeable about the Medicare enrollment process. Cigna has over 165 million customers and is well established.

What are the most popular Medigap plans in Illinois?

The most popular Medigap plans in Illinois are Plans F, G, N, D, and C.

Why are Medigap plans called Medigap?

Because these plans fill in the gaps in coverage of Original Medicare, they are also known as Medigap plans. Each company must offer the same benefits for a given plan. However, companies can set their own rates for a plan, so it pays to compare.

What is Medicare Plan G?

Medicare Plan G is the most popular and very comprehensive for individuals with an effective date post 1/1/20. If you compare this plan to Plan F, it is affordable, especially if you can choose either one.

What age do you have to be to get Medicare?

If you are signing up with Social Security, they will automatically enroll you into Medicare Part A and Medicare Part B at 65. The Federal Centers for Medicare & Medicaid Services handles the Federal Medicare Program.

Does Illinois have a Medicare enrollment period?

Medicare supplement plans do not have enrollment periods. A Medigap plan in Illinois or in any state can be purchased at any time. Enrollment periods only apply to Part D Plans or Medicare Advantage plans. They also apply to someone aging into the Federal Medicare Program, retiring from group coverage, or someone losing a Medicare Advantage plan.

In this Article

When Can You Enroll? Most Popular Plans How Do You Choose? What Are Alternatives? Resources Next Steps

What Are Medicare Supplement Plans in Illinois?

Medicare is a health insurance plan for people age 65 or older and younger people with disabilities and end-stage renal disease (ESRD). It has two parts: Medicare Part A, which is your hospital insurance, and Part B, which is your medical insurance. You pay a monthly premium for Part B. 1 2

When Can You Enroll in a Medigap Policy?

You can apply for a Medigap policy any time after you’re eligible for Medicare. Insurance companies can use medical underwriting to determine your eligibility unless you’re in your Medigap Open Enrollment Period or you have guaranteed issue rights.

What Are the Most Popular Medicare Supplement Plans?

After you decide which lettered plan, A-N, might best meet your needs, check several insurers to see which ones in your area of Illinois offer the best price.

How Do You Choose a Medicare Supplement Plan?

To choose a Medicare Supplement plan, start by reviewing your plan options. Remember, plans are standardized, so a Plan N has the same benefits no matter which company you purchase it from.

Do Medicare Supplement Plans Include Prescription Coverage?

Medigap policies do not include prescription coverage. For prescription benefits, consider enrolling in a Medicare Part D plan. 10

What If You Want to Change Your Medigap Policy?

You can apply for a different Medigap policy at any time. Keep in mind that insurance can decline your application or charge you more based on your health unless you have guaranteed issue rights. 11

What is the best Medicare Advantage plan in Illinois?

Top-Rated Medicare Advantage Plans in Illinois: Humana Gold Plus (HMO) Aetna Medicare Value (PPO) AARP Medicare Advantage Walgreens (PPO) Most people consider Part C plans an “ all-in-one ” solution. But, it’s important to look at the fine print. Just because the plan covers dental, doesn’t mean that it covers the dentures you may need.

How much does Medicare cost in Illinois?

The best part about 5-star plans is the ability to enroll in one using a Special Enrollment Period. Advantage plans cost anywhere from $0 up to $350 a month in Illinois. Depending on your doctor network, medications, and the flexibility you need from your policy, ...

What is the lowest Medicare plan in Illinois?

Medicare Part D Plans in Illinois. The lowest premium Part D plan in the state of Illinois is the Humana Walmart policy. But, this policy is usually the lower premium option in most states. Costs for Part D premiums can range from about $13 up to $136 each month. Every plan has a formulary or list of drugs it’ll cover.

How many open enrollment periods are there for Medicare?

Those that have Medicare before age 65 will have access to two Medigap Open Enrollment Periods. One when first eligible and the second upon turning 65.

Does Medicare cover oxygen?

If you meet the requirements for oxygen, Medicare will help cover the costs. Oxygen falls under the Durable Medical Equipment category. So, you can expect to pay Part B coinsurance and deductibles.

Do some medications have a higher deductible?

Some medications may have prior authorization or quantity limit requirements. Also, some plans have a higher deductible than others. For certain people, a higher premium policy could save them money in the long run.

Does Illinois require Medigap?

Many states require insurance companies to offer Medigap plans to those under 65 on disability. Illinois is one of those states, but the policy will cost substantially more than it would for someone 65 or older.

How many Medicare beneficiaries are there in Illinois?

Nearly 1 million Medicare beneficiaries have opted to enroll in one of the Medicare Supplement insurance plans in Illinois. To be eligible for a Medigap plan, you must first be enrolled in Medicare Part A and Part B. If you’re a Illinois Medicare beneficiary looking for additional medical protection, here’s what you need to know about Medicare ...

What is Medicare Supplemental Insurance?

Medicare Supplemental Insurance, also called Medigap health plans, pays for out-of-pocket costs such as deductibles and copays that the federal Medicare program doesn’t cover. Medicare enrollees buy Medicare Supplement plans in Illinois through a private insurance company. Insurance agents sometimes refer to an insurance carrier ...

What is open enrollment for Medicare in Illinois?

This is known as your Medigap Open Enrollment Period . Here’s how open enrollment works:

What is Medicare Advantage?

Medicare Advantage is an alternative way to receive your Part A and Part B Medicare benefits. Medigap insurance is additional insurance that supplements your Original Medicare coverage.

How does Medicare Supplement cost vary?

The cost of a Medicare Supplement policy can vary between geographic areas based on the cost of living. For example, rates for Medigap policies in one state might be more or less than policies in another state.

What happens if you have a Medicare Advantage policy?

If you have a Medicare Advantage policy and it’s discontinued. If you have a Medicare Advantage policy and you move out of its coverage area. If you have Original Medicare and you’re retiring from group coverage. If your Medigap insurance company decides not to renew your policy.

What is the most enrollee plan in Illinois?

In Illinois, Plan F has the most enrollees. However, this plan isn’t available to beneficiaries whose Medicare effective date is after Jan. 1, 2020. For enrollees new to Medicare after Jan. 1, 2020, Plan G is quickly rising to the top.

What is Medicare Supplement?

Medicare Supplement insurance, also known as Medigap, is offered by private insurance companies. There are up to 10 standardized policy options in most states, each one marked with a letter. Plans of the same letter offer the same benefits no matter which insurance company offers the plan, but prices may vary.

How long do you have to be a resident of Illinois to qualify for Medicare?

To qualify for Medicare, you must be either a United States citizen or a legal permanent resident of at least five continuous years. The Medicare enrollment process is the same in all states. Illinois residents can be enrolled automatically when they turn 65, provided they are receiving retirement benefits ...

What is Medicare Advantage Plan?

Medicare Advantage plans, also called Medicare Part C, are required to offer the same amount of coverage as Original Medicare (with the exception of hospice care), and some plans may include additional benefits, such as routine vision, dental, prescription drug coverage, and health wellness programs. Medicare Advantage plan details and costs are ...

What is Medicare Part A and B?

Medicare Part A covers inpatient hospital care, skilled nursing facility care, nursing home care (as long as custodial care isn’t the only care you need), home health services , and hospice care. Medicare Part B covers physician services, durable medical equipment, and preventive care.

Does Illinois have Medicare Advantage?

Medicare beneficiaries in Illinois can receive their coverage through Original Medicare, Part A and Part B, and add coverage in the form of a stand-alone Medicare Part D Prescription Drug Plan and/or a Medicare Supplement (Medigap) insurance plan. Beneficiaries may also enroll in a Medicare Advantage plan, which lets them get their Original Medicare, Part A and Part B, coverage (with the exception of hospice care) through a private insurance company that is approved by Medicare. These plans could also include routine vision, dental, and even prescription drug coverage.

Can you get prescriptions through Medicare Advantage?

They can also get prescription coverage through a Medicare Advantage plan that includes drug benefits (known as a Medicare Advantage Prescription Drug plan); in this case, they would get their Medicare Part A, Part B, and Part D coverage all under a single plan.

Do you have to pay Medicare Part B in Illinois?

These plans could also include routine vision, dental, and even prescription drug coverage. If you choose to enroll in a Medicare Advantage plan in Illinois, you must continue to pay your Medicare Part B premium.

What is a Medigap plan in Illinois?

Because these plans are designed to fill in the gaps left by Part A and Part B Medicare, they are referred to as Medigap plans. Illinois offers the same 10 Medigap plans that are available throughout the nation. These plans are named with a single letter and include A, B, C, D, F, G, K, L, M and N.

How many Medigap plans are there?

Ten Medigap Plans are available for state residents to choose from. Each of the health plans may be purchased from a wide variety of private insurance companies, with the price being set by the specific carrier.

What is the first dollar plan for medicare?

The favorite Medigap plan in the state has been Plan F. This plan is considered to be first-dollar coverage because it includes everything, even the $198 Part B deductible. A bipartisan bill enacted by Congress on April 16, 2015 (the Medicare Access and CHIP Reauthorization Act or MACRA), included a plan to phase out the first-dollar health plans in order to cut down on Medicare spending. This change discontinues Medicare Part C and Medicare Part F for beneficiaries who become eligible on or after January 1, 2020.

What is the population of Illinois in 2018?

The population of Illinois in 2018 was 12,741,080, with about 15.2 percent being over the age of 65. Medicare recipients are typically 65 or older, although Medicare is available to people with disabilities and those with End-Stage Renal Disease.

When does Medicare open enrollment start?

An open enrollment period (OEP) begins on the first day of the month an enrollee turns 65 and lasts for six months.

Can you choose a Medigap plan with no medical underwriting?

During this period, you can choose any insurance company and Medigap Plan with guaranteed issue rights and no medical underwriting required. The insurance company cannot charge higher rates due to pre-existing conditions during this enrollment period.

Can Medicare Part A and Part B be combined?

Recipients of original medicare Part A and Part B can get partial or full coverage of out of pocket expenses that are Medicare-Approved by adding a Medicare Supplement. Out of pocket costs can be debilitating for some senior citizens.

Who sells Medicare Supplement Insurance?

Medicare Supplement Insurance plans (also called Medigap) are sold by dozens of private insurance companies all over the U.S. When shopping for coverage, it’s important to find the right plan for your unique needs and also to find the right insurance company. Different companies may sell Medigap plans that have different prices and terms, ...

When will Medicare Supplement Plan F be available?

Medicare Supplement Plan F and Plan C are not available for sale to Medicare beneficiaries who became eligible for Medicare on or after Jan. 1, 2020.

What is the number 13 Cigna?

Cigna. Cigna is ranked number 13 on the Fortune 500 list. 2. Depending on your location, the Medicare Supplement Insurance plans you may be able to apply for from Cigna* may include: Plan G. Plan N.

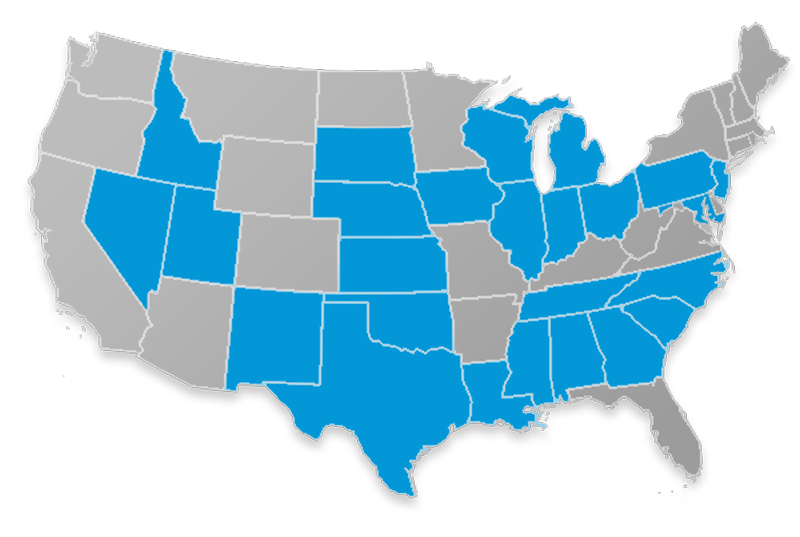

What states have Medigap plans?

Their costs and the availability of the types of plans, however, may vary. Medigap plans in Massachusetts, Minnesota and Wisconsin are standardized differently than they are in every other state. Learn more about Medigap plans in your state.

What is a BCBS?

Blue Cross Blue Shield (BCBS) is among the leading health insurance carriers in the U.S., and BCBS companies were the very first to work in conjunction with Medicare. There are now 36 different locally operated BCBS companies administering coverage in all 50 states.

Does Aetna offer Medigap?

Aetna offers a diverse portfolio of insurance products that includes Medigap plans. Over 1 million people trust Aetna for their Medicare Supplement Insurance. 3. Aetna offers several different types of Medigap plans. Plan availability may vary based on your location.

Is Wellcare the same as Medigap?

It’s important to keep in mind that although each company’s plan selection and pricing may differ, the coverage included in each type of Medigap plan remains the same, no matter where you purchase it.

Does Medicare Supplement Insurance sell insurance?

The American Association for Medicare Supplement Insurance does NOT sell any insurance products.

Do AAMSI agents screen?

It's your choice who you contact (if anyone). To cover costs Insurance agents pay AAMSI a nominal fee to be listed on the directory and AAMSI does not screen or vet agents prior to them being posted.