Another major difference is that Original Medicare doesn't have an out-of-pocket maximum. That means there's no annual cap on how much you pay for your health care. Almost all other health insurance plans have this feature. Before Medicare, you and your spouse may have been on the same health plan. But Medicare doesn't work that way.

Is Medicare better than insurance?

When comparing coverages between Original Medicare and private health Insurance, private insurance wins. You can build a product with Medicare that is as good if not better than private insurance by adding options such as Medicare Advantage or Medicare Supplement products.

How is Medicare different from other health insurance?

- Medicare Cost Plans

- Demonstrations/Pilot Programs

- Programs of All-inclusive Care for the Elderly (PACE)

Can I use private health insurance instead of Medicare?

You can also have both Medicare and private insurance to help cover your health care expenses. In situations where there are two insurances, one is deemed the “primary payer” and pays the claims first. The other becomes known as the “secondary payer” and only applies if there are expenses not covered by the primary policy.

What is the difference between Medicare and private health insurance?

There are multiple parts to Medicare:

- Part A: This is hospital insurance and includes emergency room visits and inpatient care in addition to home healthcare, skilled nursing facility care and hospice care.

- Part B: This is medical insurance for your doctor and specialist. ...

- Part C: Medicare Advantage. ...

- Part D: Prescription drug coverage. ...

Is Medicare separate from insurance?

Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). You can join a separate Medicare drug plan to get Medicare drug coverage (Part D).

Is Medicare the same as healthcare?

Medicare isn't part of the Health Insurance Marketplace®. If you have Medicare coverage you don't have to make any changes. You're considered covered under the health care law.

What type of insurance is Medicare?

Medicare is the federal government program that provides health care coverage (health insurance) if you are 65+, under 65 and receiving Social Security Disability Insurance (SSDI) for a certain amount of time, or under 65 and with End-Stage Renal Disease (ESRD).

What does Medicare not normally cover?

Medicare doesn't provide coverage for routine dental visits, teeth cleanings, fillings, dentures or most tooth extractions. Some Medicare Advantage plans cover basic cleanings and X-rays, but they generally have an annual coverage cap of about $1,500.

Does everyone get Medicare?

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant). Medicare has two parts, Part A (Hospital Insurance) and Part B (Medicare Insurance).

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Does Medicare pay 100 of hospital bills?

According to the Centers for Medicare and Medicaid Services (CMS), more than 60 million people are covered by Medicare. Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

Does Medicare pay for everything?

Original Medicare (Parts A & B) covers many medical and hospital services. But it doesn't cover everything.

What benefits do you get from Medicare?

Medicare Part B (medical insurance) helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Does Medicare cover emergency room visits?

Private hospital emergency department services are claimable under Medicare from 1 March 2020. If you're an Overseas policy holder, please visit our Overseas webpage to confirm if you're eligible to claim a benefit for outpatient services under your level of cover.

Does Medicare cover surgery?

Does Medicare Cover Surgery? Medicare covers surgeries that are deemed medically necessary. This means that procedures like cosmetic surgeries typically aren't covered. Medicare Part A covers inpatient procedures, while Part B covers outpatient procedures.

Does Medicare cover eye exams?

Eye exams (routine) Medicare doesn't cover eye exams (sometimes called “eye refractions”) for eyeglasses or contact lenses. You pay 100% for eye exams for eyeglasses or contact lenses.

Why does Medicare cost more?

However, Medicare plans may cost more because they do not have an out-of-pocket limit, which is a requirement of all Medicare Advantage plans.

What is Medicare Advantage?

Medicare Advantage plans, which replace original Medicare , may offer coverage that more closely resembles that of a private insurance plan. Many Medicare Advantage plans offer dental, vision, and hearing care and prescription drug coverage.

What is Medicare approved private insurance?

The health insurance that Medicare-approved private companies provide varies among plan providers, but it may include coverage for the following: assistance with Medicare costs, such as deductible, copays, and coinsurance. prescription drug coverage through Medicare Part D plans.

How much is the deductible for Medicare Part A?

Medicare Part A: $1,484. Medicare Part B: $203. As this shows, the deductible for Medicare Part A is lower than the average deductible for private insurance plans.

How many employees does Medicare have?

For example, Medicare is the primary payer when a person has private insurance through an employer with fewer than 20 employees. To determine their primary payer, a person should call their private insurer directly.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What are the factors that affect the cost of private insurance?

Other factors affecting the cost of private insurance include: the age of the person. where they live. the benefits of the plan. the out-of-pocket expenses. Generally, private insurance costs more than Medicare. Most people qualify for a $0 premium on Medicare Part A.

What is the difference between Medicare Advantage and Original Medicare?

Another major difference is that Original Medicare doesn't have an out-of-pocket maximum. That means there's no annual cap on how much you pay for your health care.

Does Medicare cover spouse?

Almost all other health insurance plans have this feature. Before Medicare, you and your spouse may have been on the same health plan. But Medicare doesn't work that way. Each plan only covers one person, so you and your spouse have to enroll separately. To look more deeply at how Medicare compares to other health insurance, choose a question below.

Is vision covered by Medicare?

With Original Medicare, that's not the case. You get medical and hospital coverage from the government. You get prescription coverage from private companies. And dental and vision care isn't covered at all. If you're looking for health insurance that's similar to what you're used to with your group coverage, a Medicare Advantage plan might be right ...

Is Medicare different from health insurance?

You've probably noticed that Medicare is somewhat different from health insurance plans you've had before. Before Medicare, your plan likely included medical and prescription coverage. And if you had health insurance through work, you probably had dental and vision coverage, too. Original Medicare, or Medicare you get from the government, ...

Does Medicare Advantage cover dental?

Most Medicare Advantage plans offer medical, hospital and Part D prescription drug coverage on one card. Many of these plans also offer dental and vision coverage. Medicare Advantage plans have an out-of-pocket maximum, which means there's a cap on how much you spend for health care each year. Plus, all your care is run through one company.

What is Medicare Advantage?

Medicare Advantage plans are a popular option for Medicare beneficiaries because they offer all-in-one Medicare coverage. This includes original Medicare, and most plans also cover prescription drugs, dental, vision, hearing, and other health perks.

How many tiers of private insurance are there?

There are four tiers of private insurance plans within the insurance exchange markets. These tiers differ based on the percentage of services you are responsible for paying. Bronze plans cover 60 percent of your healthcare costs. Bronze plans have the highest deductible of all the plans but the lowest monthly premium.

What is deductible insurance?

Deductible. A deductible is the amount that you must pay out of pocket before your insurance company begins paying its share. Generally, as your deductible goes down, your premium goes up. Plans with lower deductibles tend to pay out much faster than plans with high deductibles.

What is the difference between silver and gold?

Silver plans cover 70 percent of your healthcare costs. Silver plans generally have a lower deductible than bronze plans but with a moderate monthly premium. Gold plans cover 80 percent of your healthcare costs. Gold plans have a much lower deductible than bronze or silver plans but with a high monthly premium.

How much does Medicare Advantage cost in 2021?

The most a Medicare Advantage plan can charge in out-of-pocket costs is $7,550 in 2021.

What is private insurance?

Private insurance plans are responsible for covering at least your preventative healthcare visits. If you need additional coverage under your plan, you must choose one that offers all-in-one coverage or add on additional insurance plans.

Is Medicare a government or private insurance?

Medicare is government-funded health insurance that may help you save on your monthly medical costs but does not have a limit on how much you might pay out of pocket each year.

Medicare Advantage

You can go to any doctor or hospital that takes Medicare, anywhere in the U.S.

Medicare Advantage

Out-of-pocket costs vary – plans may have different out-of-pocket costs for certain services.

Medicare Advantage

Original Medicare covers most medically necessary services and supplies in hospitals, doctors’ offices, and other health care facilities. Original Medicare doesn’t cover some benefits like eye exams, most dental care, and routine exams.

What is Medicare Advantage Plan?

Individuals who have traditional Medicare, or a Medicare Advantage plan that does not include prescription drug coverage, who want Part D coverage, must purchase it separately. This is called a “stand-alone” Prescription Drug Plan (PDP). A Medicare Advantage plan that includes both health and drug coverage is referred to as a Medicare Advantage ...

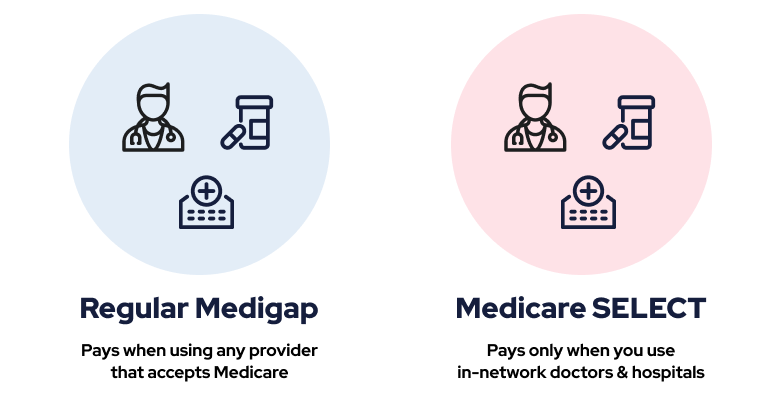

What is a Medigap plan?

Medigap plans (also known as Medicare Supplement Insurance), are private health insurance plans that help pay for the "gaps" in payment for Medicare-covered care left by traditional Medicare ; these include copayments, coinsurance, and deductibles. In many cases, someone with traditional Medicare must purchase a separate Part D drug plan as well as a Medigap plan to supplement their Medicare benefits. Medigap policies do not work with MA plans and it is illegal for anyone to sell an MA enrollee a Medigap policy unless they are switching to traditional Medicare.

Does Medicare have a cap on out-of-pocket expenses?

You may also have to pay for deductibles, coinsurance and copays. Traditional Medicare has no out-of-pocket maximum or cap on what you may spend on health care. With traditional Medicare, you will have to purchase Part D drug coverage and a Medigap plan separately (if you choose to purchase one). Medicare Advantage.

Do you need to buy a Medigap plan?

Some beneficiaries have employer or union coverage that pays costs that traditional Medicare does not cover; those who do not may need to buy a Medigap plan. Other individuals may be eligible for Medicaid that can also cover such costs and may not need Medigap.

Does Medicare Part B require monthly premiums?

Medicare Part B requires the payment of a monthly premium. You must elect to either accept or decline this coverage, but be aware that there may be penalties for not enrolling during your initial enrollment period. For more details, see our Eligibility and Enrollment page. Medicare Advantage.

Can you change providers in MA plan?

The MA plan can also change the providers in the network anytime during the year. Costs. Traditional Medicare. In traditional Medicare, Part A is free if you have worked and paid Social Security taxes for at least 40 calendar quarters (10 years).

Does Medicare cover prescription drugs?

Traditional Medicare does not offer coverage for prescription drugs. In traditional Medicare you may have to buy a Medigap plan as well as a separate Part D prescription drug plan.

How much more can you charge for Medicare?

This means they can charge you up to 15 percent more than the Medicare-approved amount for their services. These costs are known as Medicare Part B excess charges. If you had one of the two Medigap plans (Plan F or Plan G) that cover Part B excess charges, you wouldn’t have to pay for these additional costs.

What is Medicare Advantage?

Medicare Advantage plans are a type of private Medicare insurance that offers all of the same benefits as Original Medicare. Most Medicare Advantage also offer benefits that are not covered by Original Medicare. Benefits and plan availability can vary from plan to plan.

How does a Medigap plan work?

Here are a few examples of how a Medigap plan can work: You schedule a doctor’s appointment with a doctor for services that are covered by Medicare Part B. The doctor accepts Medicare “assignment” — this means she accepts Medicare’s reimbursement rate for all covered services as payment in full.

What are the benefits of Medicare Part A and B?

Can offer additional benefits, such as dental, vision, hearing and prescription drug coverage, among other benefits.

How much is Medicare Part A deductible in 2021?

The Medicare Part A deductible is $1,484 per benefit period in 2021. The Medicare Part A deductible is not annual — you could potentially need to meet this deductible more than once in a given year. Medicare Part B deductible. The Medicare Part B deductible is $203 per year in 2021.

How many Medicare Supplement plans will be available in 2021?

Medicare Supplement Insurance. Availability. 3,550 different plans available nationwide in 2021 1. 10 standardized plans available in most states, though all 10 may not be available to you in every state. Eligibility. Available to beneficiaries enrolled in Original Medicare who live in the plan’s service area.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (also called Medigap) and Medicare Advantage plans (Medicare Part C) are two very different private Medicare options that you may consider. This guide highlights the differences between Medicare Supplement Insurance and Medicare Advantage so you can better understand these two private Medicare coverage options.

What is Medicare insurance?

Medicare. Medicare is an insurance program. Medical bills are paid from trust funds which those covered have paid into. It serves people over 65 primarily, whatever their income; and serves younger disabled people and dialysis patients. Patients pay part of costs through deductibles for hospital and other costs.

Do you pay for medical expenses on medicaid?

Patients usually pay no part of costs for covered medical expenses. A small co-payment is sometimes required. Medicaid is a federal-state program. It varies from state to state. It is run by state and local governments within federal guidelines.

Is Medicare a federal program?

Small monthly premiums are required for non-hospital coverage. Medicare is a federal program. It is basically the same everywhere in the United States and is run by the Centers for Medicare & Medicaid Services, an agency of the federal government.