Medicare SELECT plans pay for the same costs that the standard version of the same type of Medigap plan covers. For example, Medicare SELECT Plan G covers the same out-of-pocket costs as standard Medigap Plan G. The difference is that a Medicare SELECT plan limits the doctors and hospitals you can access for health care.

What is the difference between a Medicare plan and Medicare select?

The difference is that a Medicare SELECT plan limits the doctors and hospitals you can access for health care. Medicare SELECT plans negotiate with these doctors and hospitals for better pricing.

What should I know about Medicare select before choosing a doctor?

Before deciding on Medicare SELECT, find out whether the doctors and hospitals you like to use are in the policy. If you want to see the doctor out of the network, you save a small amount of premium but end up paying more than a regular Medigap plan.

How many people have Medicare select plans?

Medicare SELECT policies were introduced in 1990, according to the Kaiser Family Foundation (KFF). About 900,000 people had Medicare SELECT plans in 2010.

How is Medicare select like an HMO?

You usually need a referral from your primary care doctor to see a specialist or go to the hospital. In this way, Medicare SELECT operates much like an HMO. Medicare SELECT plans are not in every state. Insurance companies decide whether they want to offer this type of policy in a particular area. How Do I Enroll in Medicare Select?

What is the difference between Medicare and Medicare Select?

There are similarities. These plans are available in specific areas; also, they restrict doctors and hospitals. Select plans are different from Medicare Advantage plans because they don't have a copayment schedule like the Medicare Advantage plans. Also, SELECT plans don't include Part D, dental, or any other benefits.

What does Medicare Select do?

A Medicare SELECT policy is a Medigap policy that limits your coverage to a network of doctors and hospitals. SELECT plans negotiate rates with a network of providers. These providers charge less for the services they provide to members.

What does Standard mean in Medicare Supplement?

Medicare Supplement insurance plans are standardized, mean that that each plan of the same letter (designated A through N) must offer the same basic benefits, regardless of which insurance company sells it.

What are the 2 types of Medicare plans?

There are 2 main ways to get Medicare: Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). If you want drug coverage, you can join a separate Medicare drug plan (Part D).

What is a Medicare Select policy does all of the following except?

A Medicare SELECT policy does all of the following EXCEPT... Prohibit payment for regularly covered services if provided by non-network providers. In which of the following situations would Social Security Disability benefits NOT cease?

What is AARP Medicare Select?

Answer. Medicare Select is a type of Medigap policy that requires insureds to use specific hospitals and in some cases specific doctors (except in an emergency) in order to be eligible for full benefits.

What is the most comprehensive Medicare Supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

How do I choose a Medicare Supplement plan?

Follow the steps below to purchase your Medigap plan:Enroll in Medicare Part A and Part B. ... Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.Compare costs between companies. ... Select a Medigap plan that works best for you and purchase your policy.

What is the most widely accepted Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What medical expenses do you cover?

We follow all Medicare guidelines. You will need to contact them at 800-633-4227 for specific procedures or codes.

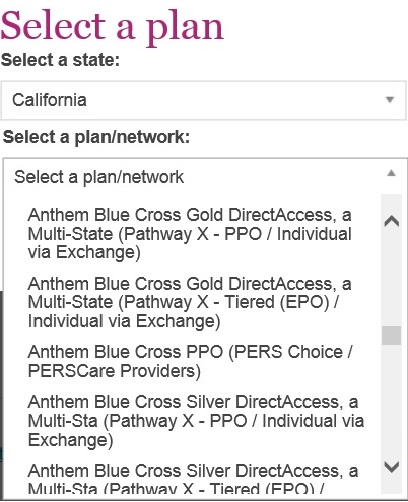

Which facilities are included in the USA Senior Care Network?

Sentinel Security Life is proud to partner with USA Senior Care Networks. USA MEDIGAP CPR® Network offers a network of respected facilities catering to the particular needs of the American Medicare market. The provided link will take you to the facilities that are participating in each state.

What payment methods are accepted for premium payments?

We only allow bank drafts or personal checks from the policy owner. No 3rd party checks are accepted.

How do I cancel my policy and get a refund for unused premium?

Send a letter signed by the policy owner with proof of effective date from the new insurance carrier.

By how much or what percentage does the premium increase each year?

We’re unable to give a specific amount or percentage. Each state sees different increases/decreases each year.

What happens if my premium payment is late?

You are allowed a 30 day grace period to get premium to us. If you are past 30 days you will need to call us to get reinstatement paperwork.

I received an EOB from sentinel that says I received a discount from the USA MCO network. However, the provider is still billing me. What should I do?

USA MCO discounts are arranged between your provider and USA MCO. Your provider will need to contact them directly.

What is the difference between a select plan and a Medicare select plan?

The difference is that a Medicare SELECT plan limits the doctors and hospitals you can access for health care . Medicare SELECT plans negotiate with these doctors and hospitals for better pricing. Limiting the provider network allows the plan to control costs, resulting in lower monthly premiums.

What is Medicare Select?

As with other types of Medigap plans, Medicare SELECT helps you pay for costs that Medicare parts A and B doesn’t cover, such as: Medicare Part A deductible for inpatient care (which is $1,484 per benefit period in 2021) Coinsurance payments for Medicare Parts A and B. Hospital costs for up to 365 days past Original Medicare’s coverage.

What happens if you enroll in Medigap while you have a guaranteed issue right?

If you apply for a Medigap plan while you have a guaranteed issue right, insurance companies cannot use medical underwriting to charge you higher plan premiums or deny you coverage altogether based on your health.

What is a select plan in Medicare?

Medicare SELECT plans pay for the same costs that the standard version of the same type of Medigap plan covers. For example, Medicare SELECT Plan G covers the same out-of-pocket costs as standard Medigap Plan G. The difference is that a Medicare SELECT plan limits the doctors and hospitals you can access for health care.

Why is Medicare Select a good choice?

It is called SELECT because it is selective in the number of local hospitals and doctors you can choose from to provide your medical care. Limiting choices to a local network can make these types of plans more affordable and a good choice for some people.

What does it mean when a provider is outside of the select network?

Getting care from a provider that is outside of the approved Medicare SELECT network will mean you must pay the 20% of costs Medicare Part B doesn’t cover, along with all other costs not covered by your Original Medicare coverage (Part A and Part B).

How long does coinsurance last for Medicare?

Coinsurance payments for Medicare Parts A and B. Hospital costs for up to 365 days past Original Medicare’s coverage. Three pints of blood. Foreign travel insurance. Every Medigap plan is different and covers different amounts of these costs, and some plans may not offer the benefits listed above.

How does Medicare Select work?

How Does a Medicare SELECT Plan Work? Much like standard Medicare Supplement plans, Medicare SELECT plans pay the remaining portion of the bill for services that Original Medicare covers. Depending on the plan that you select, this could include coinsurance, copayments, and deductibles. Because SELECT plans are versions ...

How to choose a Medicare Supplement Plan?

You may want to consider a traditional Medicare Supplement plan if: 1 You want access to a nationwide network 2 Your preferred healthcare providers aren’t in the SELECT carrier’s network 3 You travel 4 You won’t save very much in premiums by choosing a SELECT plan, or the savings in premiums isn’t worth the restrictions

What are the restrictions of select plans?

There are two major restrictions with SELECT plans that separate them from traditional Medigap plans. Network: Rather than being able to see any healthcare provider on the nationwide Medicare network, SELECT plans limit your network to specific providers in your area for non-emergency treatment.

What is select plan?

Because SELECT plans are versions of the standardized Medicare Supplement plans, the coverage offered is the same as its traditional counterpart. For example, Medicare Supplement Plan G and it’s SELECT option cover the same benefits, such as: While the coverage is the same, if you’re considering a SELECT plan you should be aware ...

What is a Part A coinsurance?

Part A hospice care coinsurance or copayment. Skille d nursing facility care coinsurance . Medicare Part A deductible. Medicare Part B excess charges. Foreign travel emergency (up to plan limits) While the coverage is the same, if you’re considering a SELECT plan you should be aware that they do have some limitations.

Can you travel with Medicare Supplement?

You don’t travel. You can save a significant amount of money in premiums by choosing the SELECT plan instead of its traditional counterpart. You may want to consider a traditional Medicare Supplement plan if: You want access to a nationwide network. Your preferred healthcare providers aren’t in the SELECT carrier’s network. You travel.

Is select plan right for me?

Depending on your situation, a SELECT plan may be right for you. Keep in mind, not every carrier offers SELECT plans. If there isn’t a carrier in your area that offers them, you won’t be able to purchase one. You may want to consider a SELECT plan if: You like the healthcare providers in the carrier’s network.

What is Medicare Select?

Medicare Select is a type of Medicare supplement (Medigap) plan that requires the policyholder to receive services from within a defined network of hospitals doctors.

Is Medicare Select Plan the same as Medigap?

Medicare Select plans are standardized in the same way as regular Medigap plans ( ie, Plans A-N ), and premiums for Medicare Select plans can be lower than the premiums for a regular Medigap plan that provides the same benefits (ie, a Medicare Select Plan G versus a regular Medigap Plan G).

Everything You Need to Know About Medicare SELECT Medigap Policies

Learn about Medicare SELECT. Explore how this type of Medicare Supplement plan from a private health insurance company can benefit you and pay for your out-of-pocket Medicare costs.

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

Learn about Medicare Supplement plans available where you live

Zia Sherrell is a digital health journalist with over a decade of healthcare experience, a bachelor’s degree in science from the University of Leeds and a master’s degree in public health from the University of Manchester.

What is a select policy?

A Medicare SELECT policy is a Medigap policy that limits your coverage to a network of doctors and hospitals. SELECT plans negotiate rates with a network of providers. These providers charge less for the services they provide ...

Does Medicare offer select plans?

Medicare SELECT plans are not offered everywhere. It is up to the individual insurance companies to decide whether they will offer SELECT policies and where they will offer them.

Does Medicare Select cover gaps?

Many hospitals and treatment facilities will be out of network. Your Medicare SELECT supplement will not cover the gaps in Medicare for treatment received at those places. You must receive care from the network except for emergencies.

What is Medicare Select?

Medicare Select is a type of Medigap policy that requires insureds to use specific hospitals and in some cases specific doctors (except in an emergency) in order to be eligible for full benefits. Other than the limitation on hospitals and providers, Medicare Select policies must meet all the requirements that apply to a Medigap policy.

Is Medicare select coverage limited to the geographic areas of the state?

The availability of Medicare Select coverage is limited to the geographic areas of the state service d by the particular policy’s network of hospitals and doctors. See a list of Insurance companies offering Medicare Select insurance.

Does Medicare select have lower premiums?

Other than the limitation on hospitals and providers, Medicare Select policies must meet all the requirements that apply to a Medigap policy. Medicare Select policies may have lower premiums because of this requirement. When you use the Medicare Select network hospitals and providers, Medicare pays its share of approved charges and ...

Does Medicare pay for supplemental care?

When you use the Medicare Select network hospitals and providers, Medicare pays its share of approved charges and the insurance company is responsible for all supplemental benefits in the Medicare Select policy. In general, Medicare Select policies are not required to pay any benefits if you do not use a network provider for non-emergency services.

Medicare Advantage

You can go to any doctor or hospital that takes Medicare, anywhere in the U.S.

Medicare Advantage

Out-of-pocket costs vary – plans may have different out-of-pocket costs for certain services.

Medicare Advantage

Original Medicare covers most medically necessary services and supplies in hospitals, doctors’ offices, and other health care facilities. Original Medicare doesn’t cover some benefits like eye exams, most dental care, and routine exams.

What is preferred Medigap?

Preferred Medigap: Is when you enroll in your initial Medigap enrollment period or typically when you enroll in a special Medigap enrollment period *, when preexisting conditions are not factored in. You have another opportunity, as well.

How long do you have to wait to get Medicare Part B?

This is the first six months in which you qualify for Medicare Part B. That way you have a lower monthly premium than if you wait, and remember you if you wait you may still be turned away. For further questions about enrolling in a Medigap plan call 800-930-7956 or contact Senior65.

Does Medigap cover coinsurance?

But you may not have heard of standard and preferred Medigap. First thing to know is both must cover the same standard benefits.