Is the Medicare Part D donut hole going away in 2021?

What will the donut hole be in 2021?

How long does the Medicare Part D donut hole last?

Does Medicare Part D still have a donut hole?

Will there be a Medicare donut hole in 2022?

Does the Medicare donut hole reset each year?

What will the donut hole be in 2022?

How do I avoid the Medicare donut hole?

- Buy generic prescriptions. Jump to.

- Order your medications by mail and in advance. Jump to.

- Ask for drug manufacturer's discounts. Jump to.

- Consider Extra Help or state assistance programs. Jump to.

- Shop around for a new prescription drug plan. Jump to.

How do you get out of the Medicare donut hole?

Has the Donut Hole been eliminated?

How does Medicare Part D calculate donut holes?

- Plan deductible.

- Coinsurance/copayments for your medications.

- Any discount you get on brand-name drugs. For example, if your plan gives you a manufacturer's discount of $30 for a medication, that $30 counts toward the Medicare Part D donut hole (coverage gap).

Why does Medicare Part D have a donut hole?

What is a donut hole in Medicare?

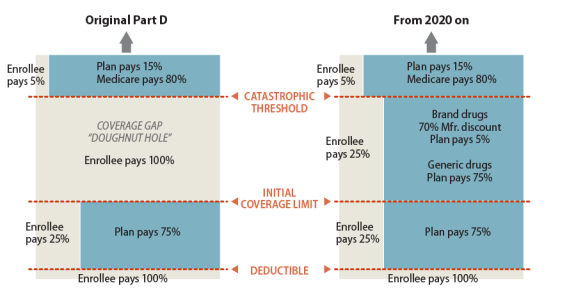

What Is the Medicare Part D “Donut Hole”? Most Medicare Part D prescription drug plans have a coverage gap. More commonly, this has been known as the “donut hole.”. The “donut hole” essentially refers to where a drug plan may reach its limit on what it will cover for drugs. Once you and your Medicare Part D plan have spent a certain amount on ...

What is the Medicare Part D coverage gap?

Most Medicare Part D prescription drug plans have a coverage gap. More commonly, this has been known as the “donut hole. ”. The “donut hole” essentially refers to where a drug plan may reach its limit on what it will cover for drugs.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What is the coverage gap for Medicare?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs. Once you and your plan have spent $4,130 on ...

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. , coinsurance, and copayments. The discount you get on brand-name drugs in the coverage gap. What you pay in the coverage gap.

How much will Medicare cover in 2021?

Once you and your plan have spent $4,130 on covered drugs in 2021, you're in the coverage gap. This amount may change each year. Also, people with Medicare who get Extra Help paying Part D costs won’t enter the coverage gap.

What is out of pocket cost?

out-of-pocket costs. Health or prescription drug costs that you must pay on your own because they aren’t covered by Medicare or other insurance. to help you get out of the coverage gap. What you pay and what the manufacturer pays (95% of the cost of the drug) will count toward your out-out-pocket spending.

How much does Medicare pay for generic drugs?

Generic drugs. Medicare will pay 75% of the price for generic drugs during the coverage gap. You'll pay the remaining 25% of the price. The coverage for generic drugs works differently from the discount for brand-name drugs. For generic drugs, only the amount you pay will count toward getting you out of the coverage gap.

What is a donut hole in Medicare?

When Medicare Part D prescription drug plans first became available , there was a built-in gap in coverage. This coverage gap opened after initial plan coverage limits had been reached and before catastrophic coverage kicked in. While in this gap, plan members had to pay the full cost of their covered drugs until their total costs qualified them for catastrophic coverage. The phrase “donut hole” was commonly used to describe this gap. 1

What is the gap in Medicare?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap, and it doesn’t apply to members who get Extra Help to pay for their Part D costs. Once in the gap, you’ll pay no more than 25% ...

What is phase 3 coverage gap?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap, and it doesn’t apply to members who get Extra Help to pay for their Part D costs. Once in the gap, you’ll pay no more ...

What is phase 4 of Part D?

Phase 4 – catastrophic coverage. In this last phase of Part D plan coverage, you’ll only pay a small coinsurance amount or copayment for covered drugs for the rest of the year. When your new plan year begins, you start over at phase 1.

Does Medicare have a donut hole?

For those that qualify, there is also a program called Medicare Extra Help that helps you pay your premiums and have reduced or no out-of-pocket costs for your drugs. Needless to say, for most people with Medicare Part D, the donut hole presents serious financial challenges.

How much do you pay for a drug deductible?

You pay 100% of your drug costs until you reach the $310 deductible amount. After reaching the deductible, you pay 25% of the cost of your drugs, while the Part D plan pays the rest, until the total you and your plan spend on your drugs reaches $2,800.

What is Medicare for people over 65?

If you aren’t familiar with Medicare, it is a health insurance program for people 65 or older, people under 65 with certain disabilities, and people with End-Stage Renal Disease (permanent kidney failure). People with Medicare have the option of paying a monthly premium for outpatient prescription drug coverage.

How Does the Medicare Donut Hole Work?

Prescription drug coverage consists of multiple stages. The first stage starts when the year begins and involves reaching your deductible, which can be up to $445. You are responsible for paying 100% of this cost. Then, you reach the initial coverage stage, when you’re only responsible for copayments.

How Do I Get Out of the Donut Hole?

You’ll get out of the gap when your costs for prescriptions during the gap period reach $6,550. You’re fully responsible for reaching this amount, but your drugs are also discounted while in the donut hole.

Do Medicare Advantage Plans Cover the Donut Hole?

Private insurance companies manage Part C plans, which often include prescription drug benefits. These plans work similarly to standard Part D plans. Thus, they still involve coverage gaps. An Advantage plan might cover some generic medications in the donut hole, but these don’t serve to close the gap faster due to their lower prices.

What is Donut Hole Prescription Assistance?

Ask your doctor if any other medicine on your plan’s formulary would be as effective for your condition as the ones you’re currently using. Using lower-cost drugs, like generics or similar drugs, will substantially lower your costs.

Get Quote

Compare rates side by side with plans & carriers available in your area.

What is a donut hole?

The term donut hole is a metaphoric reference to the coverage gap in drug costs for Medicare recipients. The four stages of this yearly cycle are: Understanding what costs are applied during the different stages of the yearly Medicare cycle of drug coverage is paramount in lowering out-of-pocket costs. Medicare drug plans mask the true cost of ...

Does Medicare cover copays?

Medicare drug plans mask the true cost of medications behind copays. Once in the donut hole, standard copays are no longer relative and you become responsible for 25% of the retail cost of drugs whether they are generic or brand name. For example: If your drug costs $425 per month at retail prices, it can land you in the donut hole after ...

Who is Ron Elledge?

Ron Elledge is a seasoned Medicare consultant and author of “Medicare Made Easy.”. As a Medicare expert, he regularly consults beneficiaries on Medicare rules, regulations, and strategies.