How much does Medicare cost the federal government?

Sep 02, 2021 · Medicare is the second largest program in the federal budget: 2020 Medicare expenditures, net of offsetting receipts, totaled $776 billion — representing 12 percent of total federal spending. Medicare has a large impact on the overall healthcare market: it finances about one-fifth of all health spending and 39 percent of all home health spending. In 2020, Medicare …

Is Medicare funded by state or federal?

Sep 21, 2020 · Medicare is the second-largest federal program and provides subsidized medical insurance for the elderly and certain disabled people. CBO’s work on Medicare includes projections of federal spending under current law, cost estimates for legislative proposals, and analyses of specific aspects of the program and options for changing it.

What percentage of the budget is Medicare?

Sep 17, 2021 · In 2020, the share of U.S. federal budget spent on Medicare was 12 percent, a four-times increase since 1970. If current laws stand, the …

How does the federal government funds Medicaid?

to view the operations of the Medicare Program from a budget perspective. The Federal budget comprises all tax and other amounts received by the government from the public and all amounts paid to the public in the form of benefits, government purchases from the private sector, wages to Federal employees, etc. If aggregate

How much of the federal budget goes to Medicare?

12 percentMedicare accounts for a significant portion of federal spending. In fiscal year 2020, the Medicare program cost $776 billion — about 12 percent of total federal government spending. Medicare was the second largest program in the federal budget last year, after Social Security.

How much did the government spend on Medicare in 2020?

$829.5 billionMedicare spending totaled $829.5 billion in 2020, representing 20% of total health care spending. Medicare spending increased in 2020 by 3.5%, compared to 6.9% growth in 2019. Fee-for-service expenditures declined 5.3% in 2020 down from growth of 2.1% in 2019.Dec 15, 2021

What is the Medicare budget for 2021?

$683 BillionPROJECTIONS FOR MAJOR HEALTH CARE PROGRAMS FOR FY 2021MEDICARE (Net of Offsetting Receipts)$683 BillionMEDICAID$519 BillionPREMIUM TAX CREDITS AND RELATED SPENDING$68 BillionCHILDREN'S HEALTH INSURANCE PROGRAM$16 Billion

Is Medicare funded by the federal government?

As a federal program, Medicare relies on the federal government for nearly all of its funding. Medicaid is a joint state and federal program that provides health care coverage to beneficiaries with very low incomes.Mar 23, 2022

Is there a 2021 federal budget?

The United States federal budget for fiscal year 2021 ran from October 1, 2020 to September 30, 2021....2021 United States federal budget.Submitted byDonald TrumpSubmitted to116th CongressTotal revenue$4.046 trillion (actual) 18.1% of GDPTotal expenditures$6.818 trillion (actual) 30.5% of GDP3 more rows

How much does the US government spend on healthcare per person?

Total national health expenditures, US $ per capita, 1970-2020. On a per capita basis, health spending has increased sharply in the last five decades, from $353 per person in 1970 to $12,531 in 2020. In constant 2020 dollars, the increase was from $1,875 in 1970 to $12,531 in 2020.Feb 25, 2022

How much of the federal budget goes to Social Security?

Today, Social Security is the largest program in the federal budget and typically makes up almost one-quarter of total federal spending. The program provides benefits to nearly 65 million beneficiaries, or about 20 percent of the American population.

How much did the government spend in 2021?

$6.82 trillionIn 2021, the federal government spent $6.82 trillion.

Which programs get funded the most by the budget?

Nearly 60 percent of mandatory spending in 2019 was for Social Security and other income support programs (figure 3). Most of the remainder paid for the two major government health programs, Medicare and Medicaid.

Is Medicare funded by taxpayers?

Funding for Medicare is done through payroll taxes and premiums paid by recipients. Medicaid is funded by the federal government and each state. Both programs received additional funding as part of the fiscal relief package in response to the 2020 economic crisis.

How is Medicare Part A funded?

Part A, which covers inpatient hospital stays, skilled nursing facility (SNF) stays, some home health visits, and hospice care, is financed primarily through a 2.9% tax on earnings paid by employers and employees (1.45% each).Mar 16, 2021

Who pays for Medicare Part A and B?

Everyone pays for Part B of Original Medicare. In 2020, the standard premium is $144.60/month for those making no more than $87,000 per year ($174,000 per year for married couples filing jointly). For 2020, the threshold for having to pay higher premiums based on income increased.

What is the purpose of Medicare trustees report?

The primary purpose of the report is to analyze whether each of the two trust funds has sufficient income and assets to enable the payment of Medicare benefits and administrative expenses. The MedicareTrusteesReport necessarily has a trust fund perspective. In contrast, the annual budget of the United States includes estimates of projected Medicare incomeand expenditures,but reports on how all three parts of the program

Is sustainability a question of financial adequacy?

The question of sustainabilityis not easily quantified or agreed on. Financial adequacy does not imply sustainability, and sustainability does not indicate financial adequacy. The sustainability of Medicare is a policyissue,and society, through its elected representatives, makes choices according to what it desires and what it is willing to accept. The desired Medicare coverage is balanced against the reasonableness of the cost of that coverage, but this balance is not easily quantified and is not the same as financial adequacy. With an understanding of the differences surrounding the concepts of financial status, budget impact, and sustainability, the following statements are fair, in our opinion:

Is Medicare a financial or actuarial issue?

The evaluation of Medicare’s financial status is a technical, actuarial issue . Medicare’s impact on the Federal budget is a similarly narrow and straightforward calculation. In contrast, assessingthe long-range sustainability of Medicare is anything but straightforward. Sustainabilityis much more difficult to assess because it is a very broad issue and ultimately one that involves societal values. There is no agreed-upon standard by which to measure the sustain-ability of Medicare—indeed, there is considerable confusion about the differences betweentheconceptsof sustainability, financial status, and budget impact.

Why is Medicare underfunded?

Medicare is already underfunded because taxes withheld for the program don't pay for all benefits. Congress must use tax dollars to pay for a portion of it. Medicaid is 100% funded by the general fund, also known as "America's Checkbook.".

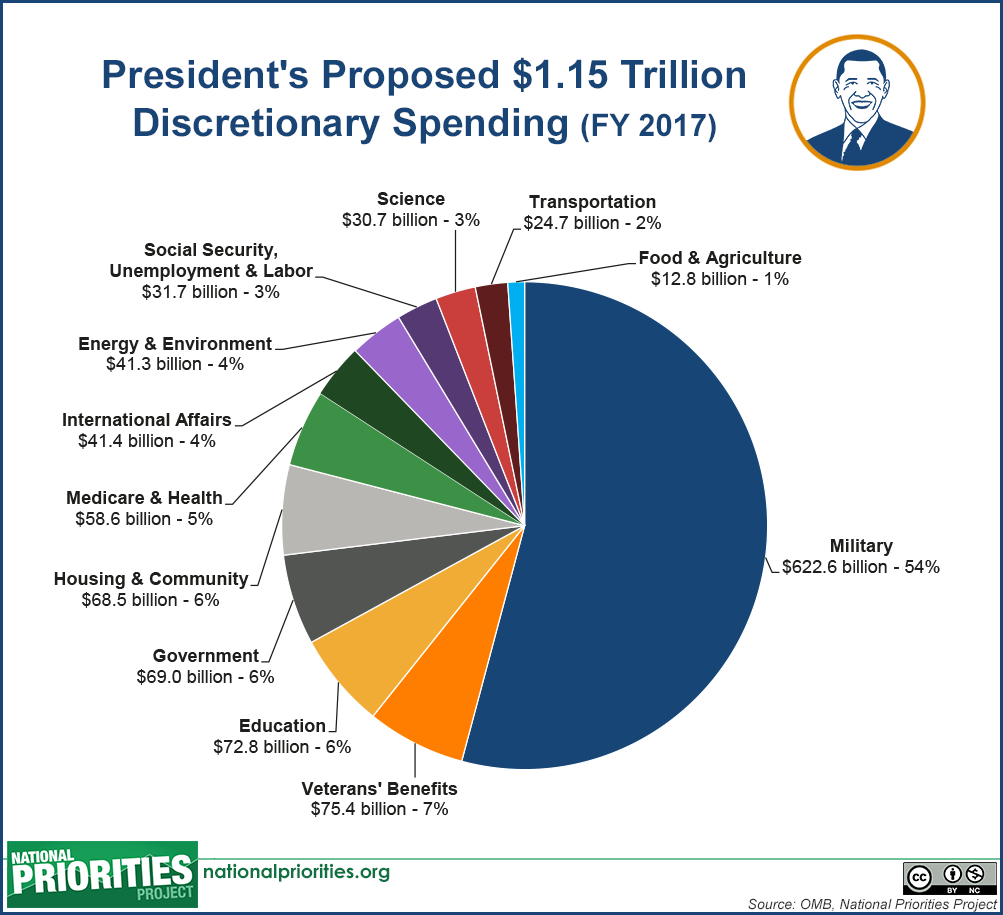

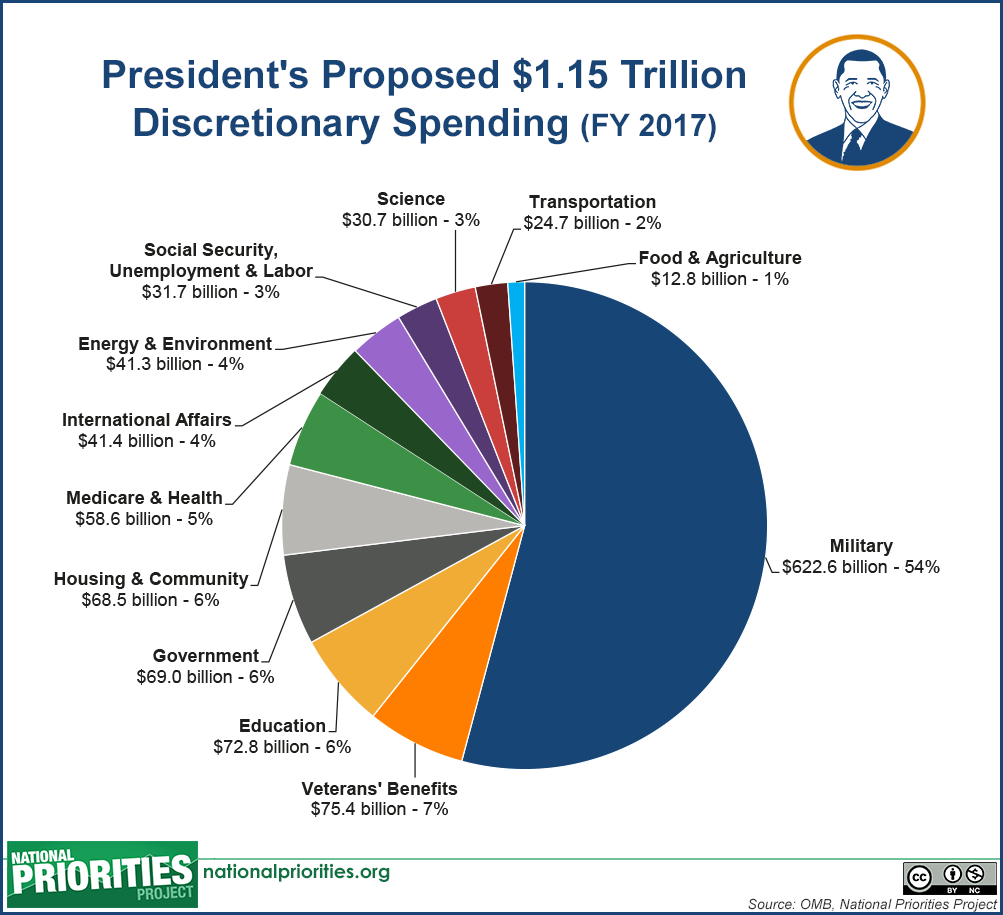

How much is discretionary spending?

Discretionary spending, which pays for everything else, will be $1.688 trillion. The U.S. Congress appropriates this amount each year, using the president's budget as a starting point. Interest on the U.S. debt is estimated to be $305 billion.

What is the budget for 2022?

The discretionary budget for 2022 is $1.688 trillion. 1 Much of it goes toward military spending, including Homeland Security, the Department of Veterans Affairs, and other defense-related departments. The rest must pay for all other domestic programs.

How much is Biden's budget for 2022?

President Biden’s budget for FY 2022 totals $6.011 trillion, eclipsing all other previous budgets. Mandatory expenditures, such as Social Security, Medicare, and the Supplemental Nutrition Assistance Program account for about 65% of the budget. For FY 2022, budget expenditures exceed federal revenues by $1.873 trillion.

Who is Kimberly Amadeo?

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch.

Who is Roger Wohlner?

Roger Wohlner is a financial advisor and writer with 20 years of experience in the industry. He specializes in financial planning, investing, and retirement. Article Reviewed on October 29, 2020. Read The Balance's Financial Review Board. Roger Wohlner.

What is the agency that administers Medicare?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare:

Does Medicare pay payroll taxes?

Additionally, Medicare recipients have seen their share of payroll taxes for Medicare deducted from their paychecks throughout their working years.

How much is Medicare spending?

Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the Medicare Hospital Insurance (Part A) trust fund is projected to be depleted in 2026, the same as the 2018 projection. In 2018, Medicare benefit payments totaled ...

How many people are covered by Medicare?

Published: Aug 20, 2019. Medicare, the federal health insurance program for more than 60 million people ages 65 and over and younger people with long-term disabilities, helps to pay for hospital and physician visits, prescription drugs, and other acute and post-acute care services. This issue brief includes the most recent historical ...

Why is Medicare spending so high?

Over the longer term (that is, beyond the next 10 years), both CBO and OACT expect Medicare spending to rise more rapidly than GDP due to a number of factors, including the aging of the population and faster growth in health care costs than growth in the economy on a per capita basis.

When will Medicare be depleted?

In the 2019 Medicare Trustees report, the actuaries projected that the Part A trust fund will be depleted in 2026, the same year as their 2018 projection and three years earlier than their 2017 projection (Figure 8).

Will Medicare spending increase in the future?

While Medicare spending is expected to continue to grow more slowly in the future compared to long-term historical trends, Medicare’s actuaries project that future spending growth will increase at a faster rate than in recent years, in part due to growing enrollment in Medicare related to the aging of the population, increased use of services and intensity of care, and rising health care prices.

Does Medicare Advantage cover Part A?

Medicare Advantage plans, such as HMOs and PPOs, cover Part A, Part B, and (typically) Part D benefits. Beneficiaries enrolled in Medicare Advantage plans pay the Part B premium, and may pay an additional premium if required by their plan; about half of Medicare Advantage enrollees pay no additional premium.

Is Medicare spending comparable to private health insurance?

Prior to 2010, per enrollee spending growth rates were comparable for Medicare and private health insurance. With the recent slowdown in the growth of Medicare spending and the recent expansion of private health insurance through the ACA, however, the difference in growth rates between Medicare and private health insurance spending per enrollee has widened.

What is Medicaid financed by?

Medicaid is a health insurance program targeted to lower-income recipients that is financed jointly by the federal government and the states . This budget explainer describes what Medicaid is, how it is funded, and who benefits from it.

What percentage of Medicaid is children?

Even though children make up about 40 percent of Medicaid beneficiaries, they account for less than 20 percent of the program’s spending. Conversely, the elderly and people with disabilities make up one-quarter of beneficiaries but account for more than half of Medicaid spending.

What is the FMAP formula?

The formula that governs a majority of government funding is called the federal medical assistance percentage (FMAP), and takes into account differences in per capita income among the states. The FMAP ranges from a minimum of 50 percent in wealthier states such as Alaska to 78 percent in Mississippi. INTERACTIVE MAP.

Does Medicaid cover dental care?

Federal rules require state Medicaid programs to cover mandatory services such as hospital care and physician care , but states may also elect to cover optional services such as physical therapy and dental care. Medicaid services are designed to take into account the needs of its population of beneficiaries.