What does HCPCS code g8752 mean?

HCPCS Code Details - G8752 HCPCS Code G8752 Type of service 1 - Medical care Effective date Effective Jan 01, 2012 Date added Added Jan 01, 2012 8 more rows ...

What is the HCPCS code for physician fee schedule?

HCPCS Code Details - G8752 HCPCS Code G8752 Description Long description: Most recent systolic b ... HCPCS Modifier 1 HCPCS Pricing indicator 00 - Physician Fee Schedule And Non-Phys ... Multiple pricing indicator 9 - Not applicable as HCPCS not priced s ... 7 more rows ...

What is the CY 2018 Medicare physician fee schedule final rule?

The CY 2018 Medicare Physician Fee Schedule Final Rule was placed on display at the Federal Register on November 2, 2017. This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2018.

What is a Medicare reimbursement rate for CPT codes?

A Medicare reimbursement rate is the amount of money that Medicare pays doctors and other health care providers for the services and items they administer to Medicare beneficiaries. CPT codes are the numeric codes used to identify different medical services, procedures and items for billing purposes.

How do I find my Medicare fee schedule?

To start your search, go to the Medicare Physician Fee Schedule Look-up Tool. To read more about the MPFS search tool, go to the MLN® booklet, How to Use The Searchable Medicare Physician Fee Schedule Booklet (PDF) .

How do I calculate Medicare reimbursement for CPT codes?

You can search the MPFS on the federal Medicare website to find out the Medicare reimbursement rate for specific services, treatments or devices. Simply enter the HCPCS code and click “Search fees” to view Medicare's reimbursement rate for the given service or item.

What is the Medicare physician fee schedule conversion factor?

On Dec. 16, the Centers for Medicare and Medicaid Services (CMS) announced an updated 2022 physician fee schedule conversion factor of $34.6062, according to McDermott+Consulting. This represents a 0.82% cut from the 2021 conversion factor of $34.8931.

What is the CPT code for facility fee?

To collect the facility fee, the following specifications must be met, however: Use this CPT code: Q3014.

How are fee schedules determined?

Most payers determine fee schedules first by establishing relative weights (also referred to as relative value units) for the list of service codes and then by using a dollar conversion factor to establish the fee schedule.

What's a fee schedule?

fee schedule (plural fee schedules) A list or table, whether ordered or not, showing fixed fees for goods or services. The actual set of fees to be charged.

Has Medicare released the 2021 fee schedule?

On December 27, the Consolidated Appropriations Act, 2021 modified the Calendar Year (CY) 2021 Medicare Physician Fee Schedule (MPFS): Provided a 3.75% increase in MPFS payments for CY 2021.

Has Medicare released the 2022 fee schedule?

In addition, the Centers for Medicare and Medicaid Services (CMS) has released the new 2022 physician fee schedule conversion factor of $34.6062 and Anesthesia conversion factor of $21.5623.

What is the Medicare conversion factor for 2020?

$36.09The CY 2020 Medicare Physician Fee Schedule (PFS) conversion factor is $36.09 (CY 2019 conversion factor was $36.04). The conversion factor update of +0.14 percent reflects a budget neutrality adjustment for reductions in relative values for individual services in 2020.

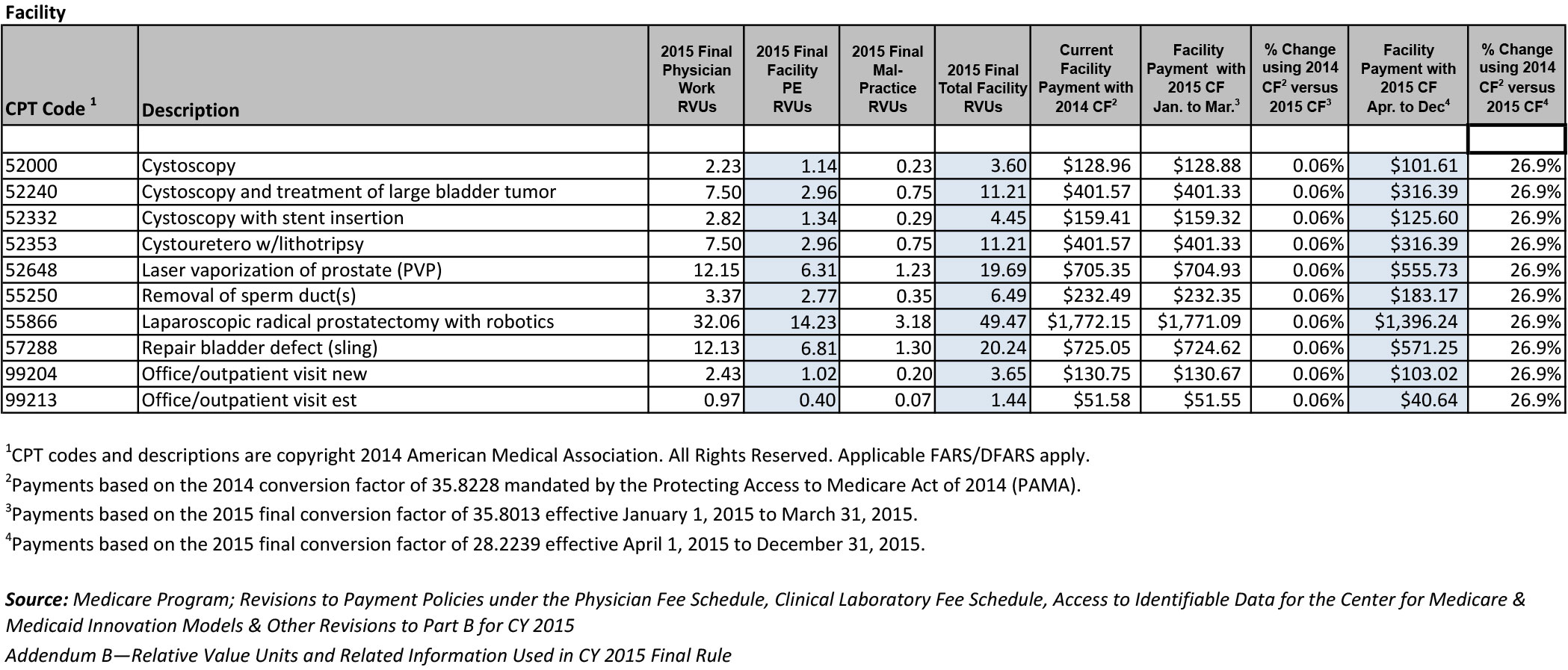

What is the difference between facility and non facility fees?

In a Facility setting, such as a hospital, the costs of supplies and personnel that assist with services - such as surgical procedures - are borne by the hospital whereas those same costs are borne by the provider of services in a Non Facility setting.

Is place of service 10 facility or non facility?

Database (updated September 2021)Place of Service Code(s)Place of Service Name07Tribal 638 Free-standing Facility08Tribal 638 Provider-based Facility09Prison/ Correctional Facility10Telehealth Provided in Patient's Home54 more rows

Is place of service 24 facility or non facility?

By definition, a “facility” place-of-service is thought of as a hospital or skilled nursing facility (SNF) or even an ambulatory surgery center (ASC) (POS codes 21, POS 31 and POS 24, respectively), while “non-facility” is most often associated with the physician's office (POS code 11).

When will Medicare start charging for PFS 2022?

The CY 2022 Medicare Physician Fee Schedule Proposed Rule with comment period was placed on display at the Federal Register on July 13, 2021. This proposed rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after January 1, 2022.

When will Medicare change to MPFS?

On December 27, the Consolidated Appropriations Act, 2021 modified the Calendar Year (CY) 2021 Medicare Physician Fee Schedule (MPFS):

What is the MPFS conversion factor for 2021?

CMS has recalculated the MPFS payment rates and conversion factor to reflect these changes. The revised MPFS conversion factor for CY 2021 is 34.8931. The revised payment rates are available in the Downloads section of the CY 2021 Physician Fee Schedule final rule (CMS-1734-F) webpage.

When will CMS issue a correction notice for 2021?

On January 19, 2021, CMS issued a correction notice to the Calendar Year 2021 PFS Final Rule published on December 28, 2020, and a subsequent correcting amendment on February 16, 2021. On March 18, 2021, CMS issued an additional correction notice to the Calendar Year 2021 PFS Final Rule. These notices can be viewed at the following link:

What is the 2020 PFS rule?

The calendar year (CY) 2020 PFS final rule is one of several rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

When is the CY 2020 PFS final rule?

This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2020.

When is the Medicare Physician Fee Schedule 2020?

This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2020.

What is a CPT code?

CPT codes are the numeric codes used to identify different medical services, procedures and items for billing purposes. When a health care provider bills Medicare to seek reimbursement, they will use CPT codes to list the various treatments they delivered. The CPT codes used to bill for medical services and items are part ...

How many digits are in a CPT code?

CPT codes consist of 5 numeric digits, while HCPCS codes are an alphabetical number followed by 4 numeric digits.

What Is the Average Medicare Reimbursement Rate?

The Medicare reimbursement rate varies according to the service or item being provided as well as the type of health care provider that is delivering the care and other factors.

What is the coinsurance rate for Medicare Part B?

Looking up the reimbursement rates can also help you calculate how much you can expect to be billed for using the standard 20% coinsurance rate that applies to most services and items covered by Medicare Part B .

How many Medicare codes can you enter at once?

You may enter up to five codes at a time or a range of codes. You may also select either the national payment amount or a specific Medicare Administrative Contractor (MAC), as reimbursement rates can vary within specific localities.

How much does Medicare pay for coinsurance?

In fact, Medicare’s reimbursement rate is generally around only 80% of the total bill as the beneficiary is typically responsible for paying the remaining 20% as coinsurance. Medicare predetermines what it will pay health care providers for each service or item. This cost is sometimes called the allowed amount but is more commonly referred ...

How to contact Medicare for claims?

For questions about your Medicare claims, bills or costs, call 1-800-MEDICARE (1-800-633-4227).