2013 FICA and Medicare Tax Rates The rate is 7.65% in total: 6.2% for the Social Security portion and 1.45% for Medicare. FYI, this had been reduced by 2% to 4.2% over the past few years as part of payroll tax holiday to help with the economic recovery.

What are the current Medicare tax rates?

Jan 08, 2013 · 2013 FICA and Medicare Tax Rates The rate is 7.65% in total: 6.2% for the Social Security portion and 1.45% for Medicare. FYI, this had been reduced by 2% to 4.2% over the past few years as part of payroll tax holiday to help with the economic recovery.

How much is FICA tax on social security?

Mar 15, 2022 · Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes. Social Security and Medicare Withholding Rates. The current tax rate for social security is 6.2% for …

What are the maximum annual earnings subject to FICA and Medicare?

Apr 17, 2022 · There are six kinds of taxes in the FICA system: C&E, payroll, corporate tax, personal tax, and income tax. Tax on social security contributions is 2.2 percent; contributions are taxable up to 1.0 percent. A Medicare tax of 45 percent is imposed (as well as, a zero tax starting in 2013). Workers earning over $200,000 pay 9 percent Medicare surtax.

What is the FICA tax rate for 2021?

Feb 16, 2022 · If you work for yourself, you’ll be responsible for the employee and employer portions of FICA and Medicare taxes. The tax rates will technically stay the same at 6.2% and 1.45% for the taxes. However, because you pay the employer portion, you will owe 12.4% of your income in FICA taxes. Medicare taxes for self-employed people come out to 2.9 ...

What is the tax rate for FICA and Medicare?

FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings.Jan 13, 2022

When did FICA rate change?

Historical FICA Tax InformationYearSocial Security20176.2% on first $127,2002015-20166.2% on first $118,50020146.2% on first $117,00020136.2% on first $113,70021 more rows

What was the Social Security tax rate in 2012?

For 2012, the maximum limit on earnings for withholding of Social Security (Old-Age, Survivors and Disability Insurance) Tax is $110,100.00. The maximum limit is changed from last year. The Social Security Tax Rate is 6.2 percent.

When was the last time the FICA rate changed?

There is no specific “frequency” for how often the Social Security rate increases. Since 1990, the rate has (for the most part) remained at 6.2% for employees and employers (12.4% total). However in 2011 and 2012, the employee portion decreased from 6.2% to 4.2% due to the 2010 Tax Relief Act.Nov 8, 2021

What are the FICA and Medicare rates for 2022?

For 2022, the FICA tax rate for employers is 7.65% — 6.2% for Social Security and 1.45% for Medicare (the same as in 2021). For 2022, an employee will pay: 6.2% Social Security tax on the first $147,000 of wages (6.2% of $147,000 makes the maximum tax $9,114), plus.Jan 12, 2022

What is Medicare rate?

The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.Mar 15, 2022

What was the Social Security rate in 2011?

General Information, 2011 a. Recent legislation reduced the 2011 OASDI tax rates by two percentage points for employees (from 6.2 percent to 4.2 percent) and for the selfemployed (from 12.4 percent to 10.4 percent).

What was the maximum Social Security benefit in 2013?

In 2013, with the higher income ceiling and the return to the 6.2 percent withholding rate, the maximum yearly Social Security tax withholding rises from $4,624.20 (4.2 percent on income up to $110,100) to $7,049.40 (6.2 percent on income up to $113,700).

What was the Social Security tax rate in 1984?

5.4 percentIn 1984 only, an immediate credit of 0.3 percent of taxable wages was allowed against the OASDI taxes paid by employees, resulting in an effective employee tax rate of 5.4 percent.

What is FICA old age?

The Old-Age, Survivors, and Disability Insurance ( OASDI ) program provides monthly benefits to qualified retired and disabled workers and their dependents and to survivors of insured workers. Eligibility and benefit amounts are determined by the worker's contributions to Social Security.

Will tax brackets change in 2022?

The tax rates themselves are the same for both the 2021 and 2022 tax years....2022 Tax Brackets for Single Filers and Married Couples Filing Jointly.Tax RateTaxable Income (Single)Taxable Income (Married Filing Jointly)35%$215,951 to $539,900$431,901 to $647,85037%Over $539,900Over $647,8505 more rows

What is the Social Security Max for 2022?

$147,000Social Security tax is paid as a percentage of net earnings and has an annual limit. In 2022, the Social Security tax limit increased significantly, to $147,000. This could result in a higher tax bill for some taxpayers. The amount of the benefits received by individuals and couples rose to 5.9%.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

How to calculate FICA tax burden?

To calculate your FICA tax burden, you can multiply your gross pay by 7.65%. Self-employed workers get stuck paying the entire FICA tax on their own. For these individuals, there’s a 12.4% Social Security tax, plus a 2.9% Medicare tax. You can pay this tax when you pay estimated taxes on a quarterly basis.

How much does each party pay for FICA?

Employers and employees split the tax. For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.

How much is FICA tax?

If you earn a wage or a salary, you’re likely subject to FICA taxes. (FICA stands for Federal Insurance Contributions Act.) Not to be confused with the federal income tax, FICA taxes fund the Social Security and Medicare programs and add up to 7.65% of your pay (in 2020). The breakdown for the two taxes is 6.2% for Social Security (on wages up to $137,700) and 1.45% for Medicare (plus an additional 0.90% for wages in excess of $200,000). Also known as payroll taxes, FICA taxes are automatically deducted from your paycheck. Your company sends the money, along with its match (an additional 7.65% of your pay), to the government. In this article we’ll discuss what FICA taxes are, how they’re applied and who’s responsible for paying them.

What are the different types of payroll taxes?

There are several different types of payroll taxes, including unemployment taxes, income taxes and FICA taxes. Two types of taxes fall under the category of FICA taxes: Medicare taxes and Social Security taxes. Paying FICA taxes is mandatory for most employees and employers under the Federal Insurance Contributions Act of 1935.

What happens if you overpay Social Security?

If you overpaid Social Security and you only have one job, you’ll need to ask your employer for a refund. Excess Medicare tax repayments are nonrefundable since there’s no wage base limit. If you have more than one job, you may underpay the amount of FICA taxes you owe.

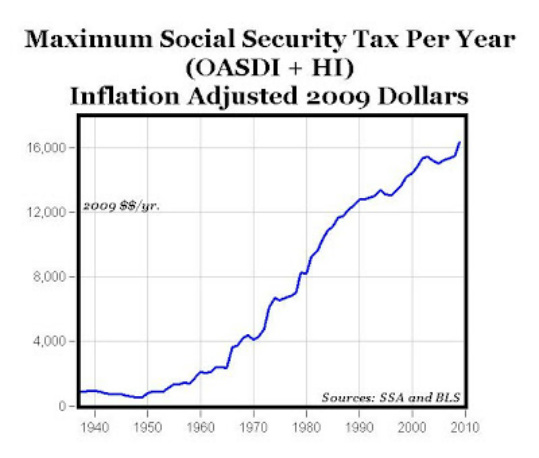

What was the Social Security tax rate in the 1960s?

Social Security tax rates remained under 3% for employees and employers until the end of 1959. Medicare tax rates rose from 0.35% in 1966 (when they were first implemented) to 1.35% in 1985. For the past couple of decades, however, FICA tax rates have remained consistent. Employers and employees split the tax.

What is the Medicare tax rate?

The Additional Medicare Tax rate is 0.90% and it applies to employees’ (and self-employed workers’) wages, salaries and tips. So any part of your income that exceeds a certain amount gets taxed for Medicare at a total rate of 2.35% (1.45% + 0.90%).

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is the FICA tax rate for 2021?

FICA Tax Rates 2021. FICA tax is a combination of social security tax and Medicare tax. The taxes imposed on social security tax will be 6.2% and 1.45% for Medicare tax for each employee with matching contributions from their employer. FICA Tax Rates. Employee Contribution.

What is FICA tax?

What are FICA Taxes? Federal Insurance Contributions Act (FICA) is an act that mandates withholding of taxes from employees’ paycheck and matching that with an equal contribution from the employer to fund the Social Security and Medicare Program .

What is the wage base limit for Social Security?

The Wage Base Limit helps determine the maximum amount to social security tax to be withheld. That's because the employee wages are taxed only to a certain limit. Note: For 2021, social security and Medicare taxes also apply to wages paid to household employees if the wages are $2,300 or more in cash.

What is the federal unemployment tax?

The Federal Unemployment Tax Act (FUTA) is used to fund the federal unemployment program that benefits people who lose their job. No taxes are withheld from the employee paycheck towards FUTA tax. Only the employer contributes to this program.

How does Medicare work?

The program is funded by payroll taxes paid by the employees with matching contributions from their employer, and also self-employed individuals.

What is the wage base limit?

The Wage Base Limit is the annual limit on the wages earned for which the social security tax is paid. It is set on a yearly basis and adjusted based on the change in wage growth. This wage base limit will change every year.

How much does a self employed person pay in taxes?

Self-employed individuals pay a combined employer and employee amount towards social security taxes, which is at 12.4% up to $142,800 on their net earnings. They also pay a 2.9% Medicare tax on their entire net earnings. An additional Medicare tax rate of 0.9% is applicable to the threshold amount mentioned.