4 Predictions About the Future of Medicare Advantage Plans

- Medicare Advantage plans may continue to offer more new benefits. ...

- Medicare Advantage plan prices should remain stable or possibly drop. ...

- Quality of care could get better. ...

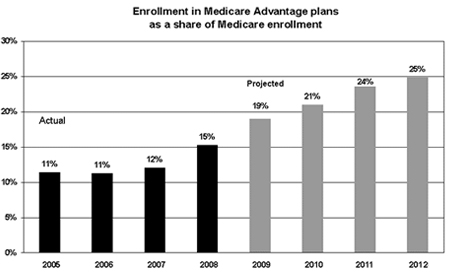

- Enrollment will continue to climb. ...

- Enrolling in a Medicare Advantage plan. ...

Full Answer

Which is better Medicare or Advantage plans?

Dec 07, 2021 · Humana, one company that provides Medicare Advantage plans, pulled out of the individual health insurance exchange in 2018 to invest more heavily in the Medicare Advantage program. 3. Steven Nelson, CEO of Medicare Advantage plan provider UnitedHealthcare, predicted that 50% of seniors will soon be enrolled in a Medicare Advantage plan. 4

Should you choose a Medicare Advantage plan?

Jun 22, 2021 · Medicare Advantage enrollment is expected to reach 26 million in 2021. The three biggest changes to MA plans in 2021 are: The expansion of telehealth services and coverage. Data indicates that in 2021, more than 94% of Medicare Advantage plans will offer additional telemedicine benefits reaching 20.7 million beneficiaries, up from about 58% of plans offering …

What could be the potential future of Medicare?

Dec 12, 2021 · Until you get older, Advantage plans “can be” less costly than Medicare. Joel Details the Future For now, you can choose traditional Medicare or Medicare Advantage. If you plan to remain where you are and like the healthcare …

What are the weaknesses of Medicare Advantage plans?

Oct 29, 2018 · Most Medicare Advantage plans offer prescription drug coverage and some may even offer dental, vision, and hearing coverage. As Medicare Advantage plan popularity continues to increase, it is likely that carriers will continue to add extra benefits to their consumers. SilverSneakers is a great example of this.

Will Medicare Advantage plans go away?

Is Medicare going away? In a word—no, Medicare isn't going away any time soon, and Medicare Advantage plans aren't being phased out. The Medicare Advantage (Part C) program is administered through Medicare-approved private insurance companies.Jun 30, 2021

Will Medicare Advantage plans increase in 2022?

Medicare Advantage premiums to decline slightly in 2022, Part D to rise by nearly 5% Average Medicare Advantage plan premiums are expected to hit $19 per month next year, a slight decline from the $21.22 in 2021.

How many Medicare Advantage plans are there 2022?

Payers are offering a total of more than 3,800 Medicare Advantage plans in 2022. Nearly nine out of ten of these health plans are Medicare Advantage-prescription drug plans.Nov 10, 2021

What is the Medicare Advantage premium for 2022?

In 2022, the average monthly premium for Medicare Advantage plans is $62.66 per month. Depending on your location, $0 premium plans may be available in your area.Feb 15, 2022

What changes are coming to Social Security in 2022?

To earn the maximum of four credits in 2022, you need to earn $6,040 or $1,510 per quarter. Maximum taxable wage base is $147,000. If you turn 62 in 2022, your full retirement age changes to 67. If you turn 62 in 2022 and claim benefits, your monthly benefit will be reduced by 30% of your full retirement age benefit.Jan 10, 2022

How much does Medicare cost in 2022 for seniors?

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

How much is deducted from Social Security for Medicare?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

What changes are coming to Medicare in 2022?

Also in 2022, Medicare will pay for mental health visits outside of the rules governing the pandemic. This means that mental health telehealth visits provided by rural health clinics and federally qualified health centers will be covered. Dena Bunis covers Medicare, health care, health policy and Congress.Jan 3, 2022

What income is used to determine Medicare premiums 2021?

modified adjusted gross incomeMedicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What are Medicare Advantage Plans?

Medicare Advantage (MA) plans are a relatively recent creation compared to the original Medicare. They are offered by independent entities and funded by the US government. Any group: public, private, for-profit or non-profit may apply and if qualified, seek approval by Centers for Medicare & Medicaid Services (CMS).

Medicare vs Medicare Advantage

The primary difference between traditional Medicare and MA can be found in the way money flows from the government to health providers (doctors, hospitals, etc.) to pay for the members’ needs. In traditional Medicare, CMS pays the health providers directly for each procedure or health services they provide to the Medicare member.

Medicare Advantage Plan Options

MA plans are similar to private health insurance plans. They are each set up slightly differently, but services such as office visits, lab work, surgery, and many others are required to be covered.

A Plan for Both Parties

MA plans are one of the few areas of healthcare that both Democrats and Republicans support. This is due to the fact that MA plans satisfy the “triple aim” of healthcare improvement. They improve quality, reduce cost and increase access.

Investing Where the Market is Headed

At Jumpstart, we expect this trend to continue. Therefore, we are investing in companies that benefit from the growth of MA plans. Given the broad opportunity of Medicare Advantage, many innovations that improve quality, reduce cost and increase access work well within these plans.

What Medicare Advantage Covers for You

These are insurance plans that are created by Medicare but sold by private insurance companies.

Advanced Coverage Is Available

If you need greater coverage than all of that, then you can get it from some of the Medicare Advantage plans.

Medicare Advantage Networks for the Future

Did you know that Medicare Advantage plans are affected by the network of the provider you buy the plan from.

Diverse member population

Medicare Advantage plans continue to serve a diverse member population, compared to traditional Medicare.

Lower senior spending

Six in ten seniors did not have a premium for their Medicare Advantage plan, one ACHP fact sheet shared. Seniors also experienced lower healthcare costs due to the Medicare Advantage out-of-pocket healthcare spending cap.

Higher quality of care

The Medicare Advantage Star Ratings system incentivizes Medicare Advantage plans to value quality over quantity, another ACHP fact sheet confirmed.

High enrollment growth

Medicare Advantage plans also experienced high enrollment growth. From 2013 to 2020, Medicare Advantage saw a 60 percent increase in its enrollment.

How many Medicare Advantage plans are there?

When you combine all of the standard Medicare Advantage plans, employer plans, and Special Needs Plans, there are literally over 70,000 plan options. It’s a truly staggering number. The good news is that all of those plans are organized across nearly 2,800 U.S. counties.

What is Medicare Advantage?

Medicare Advantage (MA), also known as Medicare Part C, are health plans from private insurance companies that are available to people eligible for Original Medicare ( Medicare Part A and Medicare Part B).... bad?

What is Medicare Part B rebate?

ALSO: Some zero-dollar premium Advantage health plans can rebate all or a portion of your Medicare Part B. Medicare Part B is medical coverage for people with Original Medicare. It covers doctor visits, specialists, lab tests and diagnostics, and durable medical equipment. Part A is for hospital inpatient care....

How many standardized plans are there for Medigap?

With Medigap, there are ten standardized plans (A, B, C, D, F, G, K, L, M, and N). Regardless of which insurance company you get a plan from, its benefits and coverage are the same. Only the monthly premium is different. With Medicare Advantage plans, your costs and coverage aren’t as clear-cut.

When does Medicare enroll?

It occurs every Fall from October 15 to December 7.

What is Medicare premium?

A premium is an amount that an insurance policyholder must pay for coverage. Premiums are typically paid on a monthly basis. In the federal Medicare program, there are four different types of premiums. ... , but pay virtually nothing when you use healthcare services once the annual Part B premium is paid.

Do all Medicare Advantage plans require prior authorization?

According to the Kaiser Family Foundation, nearly all Medicare Advantage plan enrollees are in plans that require prior authorization for some services. Health plans are in the business of making money and this is one of the primary ways they have to control costs.