| Beneficiaries who file individual tax re ... | Beneficiaries who file joint tax returns ... | Medicare Part D Income Related Monthly A ... | Medicare Part D Income Related Monthly A ... | Medicare Part D Income Related Monthly A ... |

| Beneficiaries who file individual tax re ... | Beneficiaries who file joint tax returns ... | 2017 | 2016 | 2015 |

| Less than or equal to $85,000 | Less than or equal to $170,000 | $0.00 | $0.00 | $0.00 |

| Greater than $85,000 and less than or eq ... | Greater than $170,000 and less than or e ... | $13.30 | $12.70 | $12.30 |

| Greater than $107,000 and less than or e ... | Greater than $214,000 and less than or e ... | $34.20 | $32.80 | $31.80 |

Full Answer

What is the Medicare irmaa for Part D?

Jul 31, 2017 · Part-D IRMAA is calculated by your reported gross income from your IRS tax return from two years ago. For those making above a certain amount, you will have to pay the Part D-IRMAA amount in addition to your monthly Part D Plan premium. The Part D-IRMAA is paid directly to Medicare, since it is run by the government. If you are responsible for a Part D …

What are the income brackets for irmaa for Medicare Part B?

7 rows · Jul 31, 2016 · The 2017 Medicare Part D IRMAA amounts are shown in the charts below. Beneficiaries who file ...

What is the Medicare Part B deductible for 2017?

Nov 16, 2021 · An IRMAA is a surcharge added to your monthly Medicare Part B and Part D premiums, based on your yearly income. The Social Security Administration (SSA) uses your income tax information from 2...

Does irmaa go to social security or Medicare?

Aug 08, 2017 · The threshold amounts in 2017 are as follows: $85,000 for a beneficiary filing an individual income tax return or married and filing a separate return. $170,000 for a beneficiary filing a joint tax return. The Part D IRMAA penalty amount is paid directly to the federal government, not to your Part D plan.

How much is the Part D Irmaa?

| Single | Married Filing Jointly | Part D IRMAA |

|---|---|---|

| $88,000 or less | $176,000 or less | $0 + your plan premium |

| $165,001 and under $500,000 | $330,001 and under $750,000 | $70.70 + your plan premium |

| $500,000 or above | $750,000 and above | $77.10 + your plan premium |

Is there an Irmaa for Medicare Part D?

What is Medicare D Irmaa?

What are the Irmaa brackets?

| IRMAA Table | 2021 |

|---|---|

| More than $176,000 but less than or equal to $222,000 | $207.90 |

| More than $222,000 but less than or equal to $276,000 | $297.00 |

| More than $276,000 but less than or equal to $330,000 | $386.10 |

| More than $330,000 but less than $750,000 | $475.20 |

What are the Irmaa brackets for 2022 Part D?

| 2022 Medicare Part D Income Related Adjustment Amount (IRMAA) Income Brackets | |

|---|---|

| If your filing status and yearly income in 2020 (filed in 2021) was | |

| above $142,000 up to $170,000 | above $284,000 up to $340,000 |

| above $170,000 and less than $500,000 | above $340,000 and less than $750,000 |

| $500,000 and above | $750,000 and above |

What is the Part D Irmaa for 2022?

| 2020 Individual tax return | 2020 Joint tax return | 2022 Part D premium |

|---|---|---|

| More than $170,000 up to $500,000 | More than $340,000 up to $750,000 | Your plan premium + $71.30 |

| More than $500,000 | More than $750,000 | Your plan premium + $77.90 |

What is Irma Part D?

How do you calculate Magi for Irmaa?

How do you pay Part D Irmaa?

...

How to pay your Part B and Part D IRMAA

- Online through your secure Medicare account.

- From your bank's online bill payment service.

- Signing up for Medicare Easy Pay.

- Mailing your payment to Medicare.

What will Irmaa be in 2023?

| PROJECTED 2023 IRMAA BRACKETS FOR MEDICARE PART B | ||

|---|---|---|

| Above $149,000 – $178,000 | Above $298,000 – $356,000 | Standard Premium x 2.6 |

| Above $178,000 – $500,000 | Above $356,000 – $750,000 | Standard Premium x 3.2 |

| Greater than $500,000 | Greater than $750,000 | Standard Premium x 3.4 |

Is Irmaa based on AGI or magi?

What is IRMAA in Medicare?

What is IRMAA? The income-related monthly adjustment amount, or IRMAA, is a surcharge that high-income people may pay in addition to their Medicare Part B and Part D premiums. The Medicare IRMAA for Part B went into effect in 2007, while the IRMAA for Part D was implemented as part of the Affordable Care Act in 2011.

How often is IRMAA calculated?

Unlike late enrollment penalties, which can last as long as you have Medicare coverage, the IRMAA is calculated every year. You may have to pay the adjustment one year, but not the next if your income falls below the threshold.

What is Part B IRMAA?

Your Part B IRMAA is added to your Part B premium automatically; the amount will be reflected in your monthly premium bill. Most people have their premiums automatically deducted from their Social Security or Railroad Retirement Board benefits each month. If you are not currently receiving retirement benefits each month, ...

What does SSA look at in 2021?

For example, in 2021, the SSA looks at the 2019 income data you filed with your tax return.

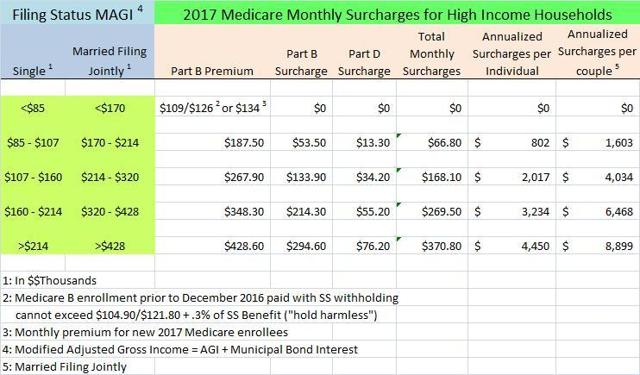

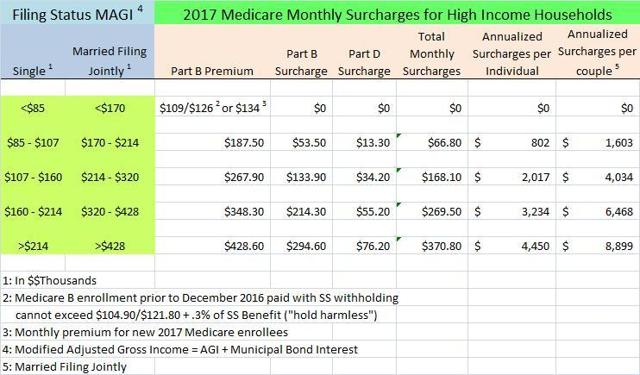

What is the Medicare premium for 2017?

For the remaining roughly 30 percent of beneficiaries, the standard monthly premium for Medicare Part B will be $134.00 for 2017, a 10 percent increase from the 2016 premium of $121.80. Because of the “hold harmless” provision covering the other 70 percent of beneficiaries, premiums for the remaining 30 percent must cover most ...

What is the average Social Security premium for 2017?

Among this group, the average 2017 premium will be about $109.00, compared to $104.90 for the past four years.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

How much is Medicare Part A deductible?

The Medicare Part A inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,316 per benefit period in 2017, an increase of $28 from $1,288 in 2016. The Part A deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

Is Medicare Part B a hold harmless?

Medicare Part B beneficiaries not subject to the “hold harmless” provision include beneficiaries who do not receive Social Security benefits, those who enroll in Part B for the first time in 2017, those who are directly billed for their Part B premium, those who are dually eligible for Medicaid and have their premium paid by state Medicaid agencies, and those who pay an income-related premium. These groups represent approximately 30 percent of total Part B beneficiaries.

Is Medicare Part B deductible finalized?

Premiums and deductibles for Medicare Advantage and prescription drug plans are already finalized and are unaffected by this announcement. Since 2007, beneficiaries with higher incomes have paid higher Medicare Part B monthly premiums. These income-related monthly premium rates affect roughly five percent of people with Medicare.