Full Answer

What is the monthly premium for Medicare Part B?

The standard monthly premium for Medicare Part B is $148.50 per month in 2021. Some Medicare beneficiaries may pay more or less per month for their Part B coverage. The Part B premium is based on your reported income from two years ago (2019).

How is part B Medicare premium determined?

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employer’s pension plan.

Who is eligible for Medicare Part B premium reimbursement?

Who is eligible for Medicare Part B premium reimbursement? Only the member or a Qualified Surviving Spouse/Domestic Partner enrolled in Parts A and B is eligible for Medicare Part B premium reimbursement. 4. How do I get $144 back from Medicare?

Where can I buy Medicare Part B?

You can sign up for Medicare Part B three months prior to your 65th birthday by visiting the Social Security Administration (SSA) website. Or, you can call your local Social Security office or take a trip to your local SS office to fill out an in-person application. Medicare Part B enrollment options and penalties

What Is the Cost of Medicare Part B for 2022?

Have you ever asked a friend or family member: “How much does Medicare Part B cost?” If so, they probably responded with their monthly premium amou...

What is the Maximum Cost of Medicare Part B?

Typically, the cost of your Medicare Part B coverage comes down to several costs, starting with your monthly premium and annual Medicare Part B ded...

Is Medicare Part B Free for Seniors?

If you have Original Medicare (Parts A and B), you’ll likely pay for your Part B plan. Medicare beneficiaries that worked 10 or more years often re...

How is Medicare Part B premium calculated?

The Medicare Part B premium changes each year and is calculated based on data collected by the Centers for Medicare and Medicaid Services (CMS). Th...

How do I pay my Part B premium?

Your Medicare Part B premium is a monthly payment. It may be deducted automatically for you if you receive the following benefits:

What does Medicare Part B cover exactly?

Medicare Part B generally covers the medical treatments you receive. But Part B won’t cover everything — your treatments or services must either be:

How to enroll in Medicare Part B?

Are you or a loved one turning 65 and looking to enroll in Medicare? You’ll want to know when to enroll, and how. As a starting point, find your In...

How does Medicare calculate my Part B premium and Income Related Monthly Adjustment Amount (IRMAA)?

When you enroll, your IRMAA, if you pay one, will be based on your tax returns from two years prior. That year’s income will be used to determine h...

Do Part B costs remain the same after I enroll? Or do they increase each year?

Your Part B costs will change each year based on data collected by the Centers for Medicare and Medicaid Services (CMS). This generally means incre...

If I enroll in Medicare Advantage, will I still pay a Part B premium?

This depends on your plan. Some insurance companies will include the Part B premium in what you pay each month for your Medicare Advantage policy....

Can I get financial help for the cost of Medicare Part B?

Your state may be able to help you pay your Medicare Part B premium through programs such as Medicaid, the Medicare Savings Programs (MSP) and the...

Can I enroll in Part B during a Special Enrollment Period (SEP)?

You may be able to enroll in Part B during an SEP if you postponed Medicare due to having employer-sponsored coverage, whether on your own or throu...

How can I avoid Part B late enrollment penalties?

You can avoid Medicare Part B late enrollment penalties by making sure you apply for Medicare when you first become eligible, during your initial e...

What is the Maximum Cost of Medicare Part B?

This is often 20% of the Medicare-approved cost. Original Medicare does not have an out-of-pocket maximum , so there’s no limit to how much you could end up paying for Medicare Part B.

What Is the Cost of Medicare Part B for 2022?

Have you ever asked a friend or family member: “How much does Medicare Part B cost?” If so, they probably responded with their monthly premium amount. This is the monthly cost of Medicare Part B when you have Original Medicare (Parts A and B). It’s income-based and changes each year. To illustrate, here’s how the 2022 Medicare Part B premium compares to the year prior:

What is a Medicare deductible?

Your deductible is the amount you must pay out-of-pocket before Medicare begins to pay its portion. After you’ve met your deductible each year, you then pay coinsurance for each Medicare-approved service you receive. Like the premium, the Part B deductible can change each year. Here’s the most recent deductible amount compared to the year prior:

What is Medicare premium?

A premium is a fee you pay to your insurance company for a health plan coverage. This is usually a monthly cost. A deductible is the amount you pay out of pocket before your insurance company covers its ...

How does Medicare Part B work?

How it Works Premiums & Deductibles Coverage & Enrollment FAQs. Medicare Part B provides the medical portion of your Medicare coverage . Part B has costs, including a premium, deductible and coinsurance. Together, they make up the overall cost of Medicare Part B. But the costs aren’t the same for everyone.

What is premium insurance?

A premium is a fee you pay to your insurance company for a health plan coverage. This is usually a monthly cost. and annual deductible. A deductible is the amount you pay out of pocket before your insurance company covers its portion of your medical bills. For example: If your deductible is $1,000, your insurance company will not cover any costs ...

How much is the penalty for not signing up for Medicare?

Your cost may go up even more if you don’t sign up for Medicare when you’re first eligible; Medicare Part B has a 10% penalty for every 12-month period you weren’t enrolled in Medicare but were eligible. You’ll pay this enrollment penalty as long as you’re enrolled in Part B.

How much do you pay for Medicare after you pay your deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

How much will Medicare premiums be in 2021?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes.

How often do you pay premiums on a health insurance plan?

Monthly premiums vary based on which plan you join. The amount can change each year. You may also have to pay an extra amount each month based on your income.

Is there a late fee for Part B?

It’s not a one-time late fee — you’ll pay the penalty for as long as you have Part B.

Do you have to pay Part B premiums?

You must keep paying your Part B premium to keep your supplement insurance.

What are the costs of Medicare Part B?

What Are the Other 2019 Medicare Part B Costs? 1 2019 Part B deductible#N#The Medicare Part B deductible for 2019 is $185 for the year.#N#Part B beneficiaries must pay the first $185-worth of Part B covered services out of their own pocket before their Part B coverage kicks in. The deductible resets with each new year. 2 2019 Part B coinsurance or copayment#N#After you meet your Part B deductible, you are typically required to pay the Part B coinsurance or copayment for additional Part B services you receive in 2019.#N#Your Part B coinsurance for most services and items is typically 20 percent of the Medicare-approved amount. 3 2019 Part B excess charges#N#If you visit a provider who does not accept Medicare assignment, that means they still treat Medicare patients but they do not accept Medicare reimbursement as full payment.#N#These providers are allowed to charge you up to 15 percent more than the Medicare-approved amount for your care. This extra amount is called an “ excess charge ” and you will be responsible for paying it in full.

How much is Medicare Part B 2019?

There are a few other out-of-pocket Part B costs that you may be required to pay in 2019. 2019 Part B deductible. The Medicare Part B deductible for 2019 is $185 for the year. Part B beneficiaries must pay the first $185-worth of Part B covered services out of their own pocket before their Part B coverage kicks in.

What Are the Other 2022 Medicare Part B Costs?

There are a few other out-of-pocket Part B costs that you may be required to pay in 2019.

What Is the Cost of the Part B Late Enrollment Penalty?

However, if you do not sign up for Medicare Part B during your Initial Enrollment Period (IEP) and decide you want to enroll in Part B later on, you will be charged a late enrollment penalty for the rest of the time that you have Part B.

What is QMB in Medicare?

Qualified Beneficiary Medicare (QMB) Program. This program helps pay for the Medicare Part A and Part B premium, along with deductibles, copayments and coinsurance. Individuals can qualify with monthly incomes lower than $1,061 in 2019, and married couples may qualify with combined incomes of less than $1,430 in 2019.

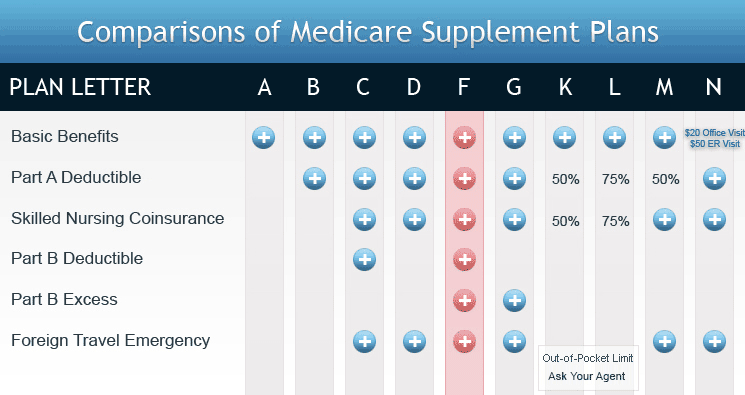

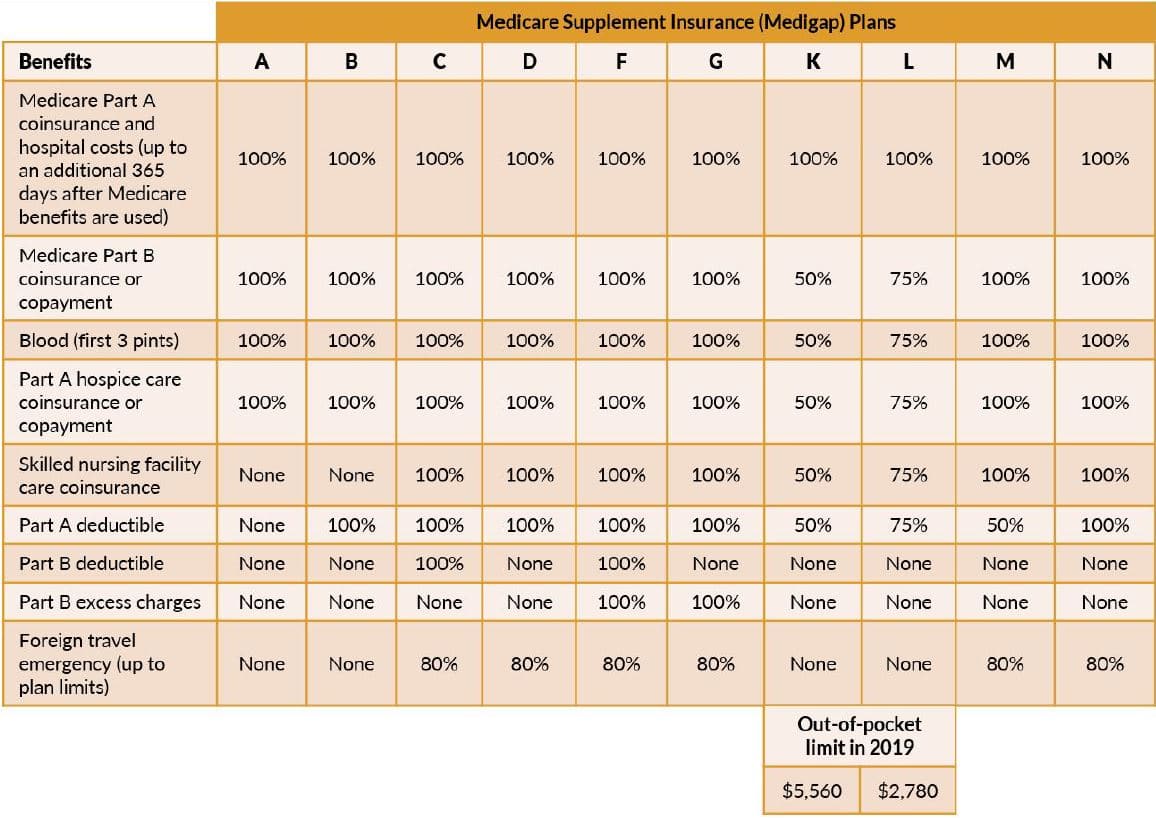

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, or Medigap, is a type of private insurance that is used along with Original Medicare (Part A and Part B) to provide coverage for some of Original Medicare's out-of-pocket costs.

What is Part B coinsurance?

Your Part B coinsurance for most services and items is typically 20 percent of the Medicare-approved amount. 2019 Part B excess charges. If you visit a provider who does not accept Medicare assignment, that means they still treat Medicare patients but they do not accept Medicare reimbursement as full payment.

How much of Medicare Part B is paid out of pocket?

Typically, after you have reached the deductible for the year, you will be required to pay 20% of Medicare Part B approved expenses out of pocket.

What is Medicare Part B and what does it cover?

Medicare Part B is a portion of Original Medicare, which is the federal health insurance program for individuals who are 65 and older or who have a qualified disability.

How is Medicare premium determined for 2021?

For Medicare purposes, your premium for 2021 will be determined by your MAGI from the 2019 tax year. Premium amounts depending on your taxable income filed on your annual taxes are outlined in the table below:

What happens if you don't sign up for Medicare Part B?

It is important to note that if you don't sign up for Medicare Part B during the initial enrollment period when you are first eligible, then you may have to pay a late enrollment fee of 10%. This will continue for every 12-month period that you are not enrolled in Medicare Part B.

How much is Medicare Part B 2021?

Medicare Part B enrollees have to pay a monthly premium in order to be covered. For 2021, the standard Medicare premium amount for Medicare Part B is $148.50.

When do you have to enroll in Medicare Part B?

Enrollment for you will begin three months before your 65th birthday and will end three months after . During this initial enrollment period, you will be able to sign up for any part of Original Medicare.

How much is Part B insurance in 2021?

In 2021, the standard monthly premium for Part B is $148.50, which is either deducted from your Social Security benefits or paid out of pocket. Part B coverage makes sense for most individuals due to its cheap monthly premiums, but you should evaluate your current health insurance coverage before enrolling in the federal plan.

How Much Does Medicare Part A Cost?

The cost of Medicare Part A premiums depends on whether you or your spouse paid income taxes, and for how long. Most individuals won’t pay a Part A premium. Here are some essential facts about Part A and what it costs.

How much is Part B premium for 2021?

Your income plays a part in your Part B premium. For 2021, individuals making $88,000 per year or less, and couples making $176,000 or less, pay the standard monthly amount of $148.50 each. If your individual or joint income is above the standard bracket, you may pay an Income-Related Monthly Adjustment (IRMAA)

What is Medicare Part A coinsurance?

You’re responsible for a daily coinsurance. Coinsurance is the percentage of your medical costs that you pay after you meet your deductible.

How much does Medicare Part A coinsurance increase?

Part A coinsurance increases when your length of stay in a facility increases: 0 to 60 days. 61 to 90 days. You have a lifetime limit of reserve days to use if your stay lasts longer than 90 days. Medicare Part A daily coinsurance rates: Days 0-60: $0. Days 61-90: $371 per day. Lifetime Reserve Days: $742 per day.

How does Medicare calculate Part A premium?

Medicare calculates Part A premium costs by how long you or your spouse have paid Medicare taxes.

What is Medicare Part A deductible?

Medicare Part A Deductible. Most Part A costs come from the inpatient. Inpatient refers to medical care that requires admission to the hospital, usually overnight. hospital deductible. Inpatient care provided at a hospital or skilled nursing facility.

What is Medicare Part A?

Medicare Part A is part of Original Medicare.

Who Pays More for Medicare Part B?

Each year the government crunches the numbers to determine total costs for providing Medicare Part B coverage. For most enrollees, the government agrees to cover 75% of the cost and charges enrollees the Medicare Part B premium to cover the other 25%.

What is Medicare Part B?

Medicare Part B covers doctor appointments, outpatient tests and exams as well as medical equipment. Unless your income is very low, you’ll be charged a monthly premium for Medicare Part B, regardless of whether you are enrolled in Original Medicare or Medicare Advantage, the two options for receiving your Medicare benefits.

How many people will pay Medicare premiums in 2029?

The annual Medicare report estimates that about 5 million beneficiaries currently pay a higher premium, and by 2029 more than 10 million enrollees will pay an IRMAA surcharge.

How much will Medicare cost in 2021?

The official estimate from the Medicare Trustees report is that the lowest possible monthly premium for Medicare Part B—$148.50 in 2021—could rise to more than $230 per person in 2029. If your income falls into a higher IRMAA tier, Medicare estimates your monthly premium in 2029 could cost you an additional $90 to $500.

What is the Medicare premium for 2021?

In 2021, a single taxpayer whose 2019 return reported MAGI of no more than $88,000 and married couples with MAGI up to $176,000 paid the lowest base Medicare Part B monthly premium of $148.50 per person.

What line is Medicare Part B based on?

Medicare Part B premiums are calculated based on a person’s modified adjusted gross income (MAGI). For purposes of Part B premiums, your MAGI is the adjusted gross income you report on line 11 of your federal tax return, plus any tax-exempt interest income, such as municipal bonds (line 2a) earnings.

What happens when you enroll in Medicare Part B?

When you enroll in Medicare Part B, the federal government picks up the tab for most of your health care costs. Most, but not all.

How much is Part B coverage?

En español | Part B coverage begins after you have paid the 2020 deductible amount of $198 for covered services. Then you usually pay coinsurance of 20 percent of the Medicare-approved amount for each service from a provider who has agreed with Medicare to accept that amount as full payment (also known as Medicare assignment).

Does Medicare cover dental care?

Original Medicare does not cover everything. Some items you will have to pay for yourself include hearing aids, most dental care, dentures, cosmetic surgery and acupuncture.

How much is the deductible for Medicare Part B?

Medicare recipients must meet an annual deductible with Medicare Part B, which is $198 for 2020. If a Medicare enrollee was eligible for a Medigap plan that pays for the Part B deductible prior to 2020, they can still receive that benefit. Medigap plans that pay the Part B deductible are no longer offered as of January 1st, 2020.

What is the minimum premium for Part B insurance?

The minimum premium for Part B coverage in 2020 is $144.60 each month, which is a $9 increase from 2019’s minimum premium of $135.50 each month. In 2020, certain income brackets that determine if high-income recipients pay more for their Part B premium each month were changed for the first time.

How much do you pay a month if you are married in 2020?

between $87,000 and $413,000, you pay $462.70 a month in 2020. more than $413,000, you pay $491.60 a month in 2020.

How much do you make a month in 2020?

between $109,000 and $136,000, you pay $289.20 a month in 2020. between $136,000 and $163,000, you pay $376.20 a month in 2020. between $163,000 and $500,000, you pay $462.70 a month in 2020. more than $500,000, you pay $491.60 a month in 2020.

Does Medicare go up in 2020?

2020’s changes to the Medicare Part B premium may also be dependent on the recipient’s tax filing status for 2018.

Can Medicare be combined with Medicaid?

Medicare benefits can be combined with Medicaid for certain low-income recipients, which also includes covering cost-sharing obligations like the deductible. Medicare Advantage plans can also offer lower deductibles as part of the benefits paid by the monthly premium they charge on top of the requisite Part B premium.

What is Medicare Part B?

Medicare Part B covers medical insurance benefits and includes monthly premiums, an annual deductible, coinsurance and other potential costs.

What is Medicare Part B excess charge?

Part B excess charges. If you receive services or items covered by Medicare Part B from a health care provider who does not accept Medicare assignment (meaning they do not accept Medicare as full payment), they reserve the right to charge you up to 15 percent more than the Medicare-approved amount.

What will Medicare Part A cost in 2021?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities.

How much does Medicare Advantage cost per month?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1

What is the average cost of Medicare Part D prescription drug plans?

In 2021, the average monthly premium for a Medicare Part D plan is $41.64 per month. 1

What is the average cost of Medicare Supplement Insurance (Medigap)?

The average premium paid for a Medicare Supplement Insurance (Medigap) plan in 2019 was $125.93 per month. 3

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.