How much will your Social Security tax be in 2018?

| Salary | Social Security Taxes | Medicare Taxes | Total Taxes |

| $20,000 | $1,240 | $290 | $1,530 |

| $30,000 | $1,860 | $435 | $2,295 |

| $40,000 | $2,480 | $580 | $3,060 |

| $50,000 | $3,100 | $725 | $3,825 |

What is the Medicare tax rate for 2018?

5 rows · Dec 18, 2017 · (Maximum Social Security tax withheld from wages is $7,960.80 in 2018). For Medicare, the ...

What is the maximum Social Security tax for 2018?

Nov 27, 2017 · The tax rates shown above do not include the 0.9 percent. 2017 2018 Maximum Taxable Earnings Social Security (OASDI only) $127,200 $128,400 1 Medicare (HI only) No Limit Quarter of Coverage $1,300 $1,320 Retirement Earnings Test Exempt Amounts Under full retirement age $16,920/yr. ($1,410/mo.) $17,040/yr. ($1,420/mo.)

What is the cap for federal income tax in 2018?

Jun 06, 2018 · While the 2018 social security tax is charged at the rate of 12.4% on the maximum of actual employment income or $128,400, the Medicare tax is charged at 2.9% with no cap. Half of the Medicare tax i.e. 1.45% is automatically deducted by the employer from its employee’s gross employment income i.e. salaries plus bonuses and the other half i.e. 1.45% is matched …

What is the tax rate for Social Security and Medicare?

Oct 12, 2018 · Your monthly Part B premiums will range from $187.50 per person to $428.60 per person, depending on your income. What You'll Pay for Medicare in 2018 You may be able to contest the extra charge if...

What is the Medicare tax cap for 2019?

2019 Payroll Taxes Will Hit Higher IncomesPayroll Taxes: Cap on Maximum EarningsType of Payroll Tax2019 Maximum Earnings2018 Maximum EarningsSocial Security$132,900$128,400MedicareNo limitNo limitSource: Social Security Administration.

What income is subject to the 3.8 Medicare tax?

Income Tax Calculator: Estimate Your Taxes There is a flat Medicare surtax of 3.8% on net investment income for married couples who earn more than $250,000 of adjusted gross income (AGI). For single filers, the threshold is just $200,000 of AGI.Nov 9, 2021

Is there a cap on taxable Medicare wages?

There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax. The Medicare tax rate applies to all taxable wages and remains at 1.45 percent with the exception of an “additional Medicare tax” assessed against all taxable wages paid in excess of the applicable threshold (see Note).

What was the Social Security cap in 2018?

$128,400Maximum Taxable Earnings Each YearYearAmount2016$118,5002017$127,2002018$128,4002019$132,9004 more rows

Who pays the 3.8 investment tax?

individual taxpayersEffective Jan. 1, 2013, individual taxpayers are liable for a 3.8 percent Net Investment Income Tax on the lesser of their net investment income, or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status.

What income is not subject to Medicare tax?

Also, qualified retirement contributions, transportation expenses and educational assistance may be pretax deductions. Most of these benefits are exempt from Medicare tax, except for adoption assistance, retirement contributions, and life insurance premiums on coverage that exceeds $50,000.Oct 31, 2018

What is the cap on Medicare?

Note: For employed wage earners, their Social Security portion is 6.2% on earnings up to the taxable maximum. Their Medicare portion is 1.45% on all earnings....2022 Wage Cap Jumps to $147,000 for Social Security Payroll Taxes.Payroll Taxes: Cap on Maximum EarningsType of Payroll Tax2022 Maximum Earnings2021 Maximum EarningsMedicareNo limitNo limit2 more rows•Oct 13, 2021

Is there a cap on Medicare tax 2021?

For 2021, an employee will pay: 6.2% Social Security tax on the first $142,800 of wages (maximum tax is $8,853.60 [6.2% of $142,800]), plus. 1.45% Medicare tax on the first $200,000 of wages ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return), plus.Oct 15, 2020

How is Medicare tax calculated?

For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party – employee and employer – pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.Jan 12, 2022

How much of my Social Security is taxable for 2018?

between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

Is there a max Social Security tax per year?

The amount liable to Social Security tax is capped at $142,800 in 2021 but will rise to $147,000 in 2022. The change to the taxable maximum, called the contribution and benefit base, is based on the National Average Wage Index. The increase for 2022, at 2.9 percent, is less than the 3.7 percent increase for 2021.Nov 4, 2021

What is the max for Social Security tax?

$142,800The Social Security tax limit is the maximum amount of earnings subject to Social Security tax. The Social Security taxable maximum is $142,800 in 2021. Workers pay a 6.2% Social Security tax on their earnings until they reach $142,800 in earnings for the year.Oct 4, 2021

What Is The Maximum 2018 Social Security Tax?

For 2018, the maximum amount of Social Security taxes you'll have to pay as an employee is $7,960.80. To understand where this number comes from, i...

How Much Will Your Social Security Tax Be in 2018?

While the maximum Social Security tax for 2018 is $7,960, only a small percentage of taxpayers have incomes high enough to pay the maximum. In 2015...

Employers Also Pay Social Security Taxes on Your Behalf

While employees pay a tax equal to 6.2% of their wages for Social Security and 1.45% of their wages for Medicare, this is not the total amount of S...

Where Exactly Is Your Social Security Tax Money Going?

Many taxpayers are rightfully concerned about what's happening to the thousands of dollars they -- and their employers -- pay into Social Security...

Don't Rely on Social Security For Your Retirement Income

If you're looking ahead toward retirement and worried that Social Security benefits will be cut, you have reason for concern. But regardless of whe...

Additional Medicare Tax

Additional Medicare Tax is a Medicare tax charged on the employees only at the rate of 0.9% of the income exceeding a certain threshold (i.e. $200,000 for a single filer, $250,000 for a couple filing jointly and $150,000 for a married person filing separately).

Formula

The following formulas can be used to work out the total Medicare tax, employee deduction and employer contribution:

What is the Medicare premium for 2018?

What are Medicare premiums in 2018? The standard premium of $134 for Medicare Part B won't change, but some recipients will still end up paying more. by: Kimberly Lankford. October 12, 2018.

How much will hold harmless pay for Medicare?

Another 28% of Part B enrollees who are covered by the hold-harmless provision will pay less than $134 because the 2% increase in their Social Security benefits will not be large enough to cover the full Part B premium increase. Most people who sign up for Medicare in 2018 or who do not have their premiums deducted from their Social Security ...

Why is Medicare holding harmless?

The reason is rooted in the "hold harmless" provision, which prevents enrollees' annual increase in Medicare premiums from exceeding their cost-of-living increase in Social Security benefits —if their premiums are automatically deducted from their Social Security checks. This applies to about 70% of Medicare enrollees.

How much is Medicare Part B?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018. However, even though the standard premium remains the same, many people will have to pay much more for Part B in 2018 than they did in 2017.

How much is the Part B premium?

Some 42% of Part B enrollees who are subject to the hold-harmless provision for 2018 will pay the full monthly premium of $134 because the increase in their Social Security benefit will cover the additional Part B premiums.

How much did people pay for hold harmless in 2017?

The cost-of-living adjustment for Social Security benefits for this year was so low (just 0.3%) that people covered by the hold-harmless provision paid about $109 per month, on average, for Medicare premiums in 2017. But Social Security benefits will be increasing by 2% in 2018, which will cover more of the increase for people protected by ...

What is the maximum Social Security tax?

While the maximum Social Security tax for 2018 is $7,960, only a small percentage of taxpayers have incomes high enough to pay the maximum. In 2015, for example, just 6% of workers earned more than the capped amount, according to the National Academy of Social Insurance.

How much is Medicare tax?

In addition to Social Security taxes, workers also pay a Medicare tax of 1.45%. The earnings subject to the Medicare tax are not capped, so employees pay this 1.45% on their entire incomes.

Why do employees pay only a portion of their Social Security and Medicare taxes?

Employees pay only a portion of their Social Security and Medicare taxes because employers pick up the other half of the tab. For example, for a worker who earns that maximum $128,400, the actual amount paid into Social Security on their behalf is $15,921.60.

How much does an employer pay for Social Security?

Employers also pay Social Security taxes on your behalf. While employees pay a tax equal to 6.2% of their wages for Social Security and 1.45% of their wages for Medicare, this is not the total amount of Social Security tax collected for each worker.

How much money did Social Security give in 2017?

Close to 62 million Americans received an estimated $955 billion in Social Security benefits in 2017. Money for Social Security retirement benefits comes from the Social Security trust fund, which is funded by tax dollars and invested in special-issue securities issued by the U.S. Treasury.

Is there a wage cap on Social Security?

There's a wage cap on Social Security benefits, which means there' s a maximum amount of taxes you'll have to pay into Social Security each year. This amount is adjusted upward periodically to keep pace with the increase in average wages. Image source: Getty Images.

How much is the penalty for Medicare Part B?

For Part B, the penalty is 10 percent of your premium (charged on top of the premium rate) for each 12-month period that you didn’t have Part B coverage when you could have. The penalty lasts for as long as you have Part B. Medicare Part B has other costs as well.

How much is Medicare premium in 2017?

The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

How much does Medicare Part B cost?

Medicare Part B covers medical care, including regular trips to the doctor and anything considered “medically necessary” for you. How much you pay for Part B coverage depends on different factors, such as when you enroll and your yearly income. The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

What is Medicare Part A?

Medicare Part A is the hospital portion, covering services related to hospital stays, skilled nursing facilities, nursing home care, hospice and home healthcare. Under the Affordable Care Act, Part A alone counts as minimum essential coverage, so if this is all you sign up for, you’ll meet the law’s requirements. Most people don’t pay a premium for Part A because it’s paid for via work-based taxes. If, over the course of your working life, you’ve accumulated 40 quarter credits, then you won’t pay a premium for Part A. This applies to nearly all enrollees, but some do pay a premium as follows:

What is catastrophic limit?

This will effectively close the coverage gap. As it stands, the catastrophic limit prevents you from paying higher prescription drug costs forever. Once you hit the catastrophic limit ($5,000 in 2018), you’ll only be responsible for about 5 percent of the cost of your medications for the rest of your plan year.

How much is Part D deductible for 2017?

In 2017, you can expect the following costs: The Part D deductible is $1,316 per benefit period. Once you meet the deductible, you’ll pay nothing out of pocket for the first 60 days of your stay. For days 61 to 90, you’ll pay $329 per day. For days 91 and beyond, you’ll pay $658 per day.

Does Medicare Advantage cover Part B?

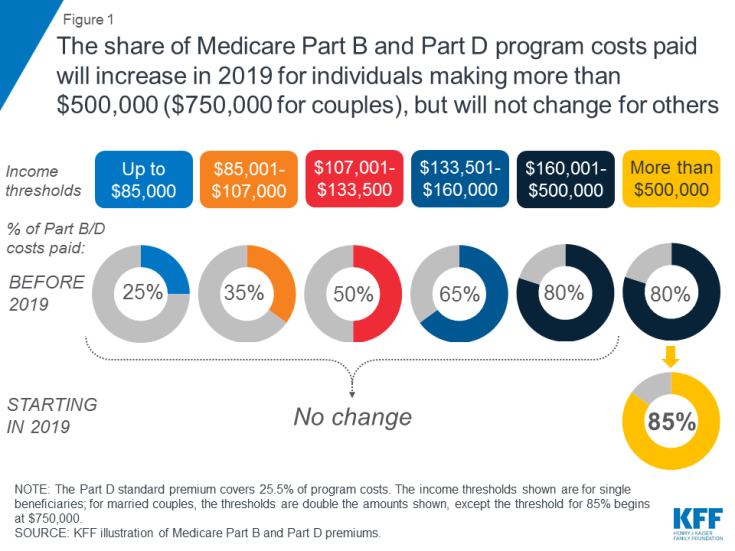

If you have Medicare Advantage, then you will pay the Part B premium as well as any premiums that your plan charges. Medicare Advantage must cover Part B services. Income thresholds will change in 2018.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

Get the latest on how much the government will take away from you in the coming year

Dan Caplinger has been a contract writer for the Motley Fool since 2006. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool.com.

How much money will go to FICA in 2018?

You won't necessarily see any reference to FICA when you get paid. Some companies break out the amount that gets withheld for Social Security separately from Medicare withholding, making the breakdown between the two programs much clearer.

Could tax reform change FICA taxes?

There's a lot of uncertainty right now about the tax system, because Congress is considering reforms that could dramatically change key tax provisions. However, most of the focus among lawmakers right now is on the income tax system, and payroll tax provisions haven't really made it into discussions of immediate reform efforts.

Watch your FICA taxes carefully

The vast majority of taxpayers will see no change to the FICA taxes they pay, with only high-income earners seeing a slight increase in the maximum amount of Social Security-related taxes taken out of their pay.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

Does Medicare change if you make a higher income?

If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.