What wages are subject to Medicare tax?

What wages are taxable for Medicare?

- Medicare is funded by a payroll tax of 1.45% on the first $200,000 of an employee’s wages.

- Employers also pay 1.45%.

- The Medicare tax for self-employed individuals is 2.9% to cover both the employee’s and employer’s portions.

Why are Medicare wages higher than wages?

The most common reason why medicare wages are higher is due to 401(k) contributions (W2, Box 12, Code D) or other pre-tax retirement plan contributions. They are subject to medicare tax but not to federal or state income tax.

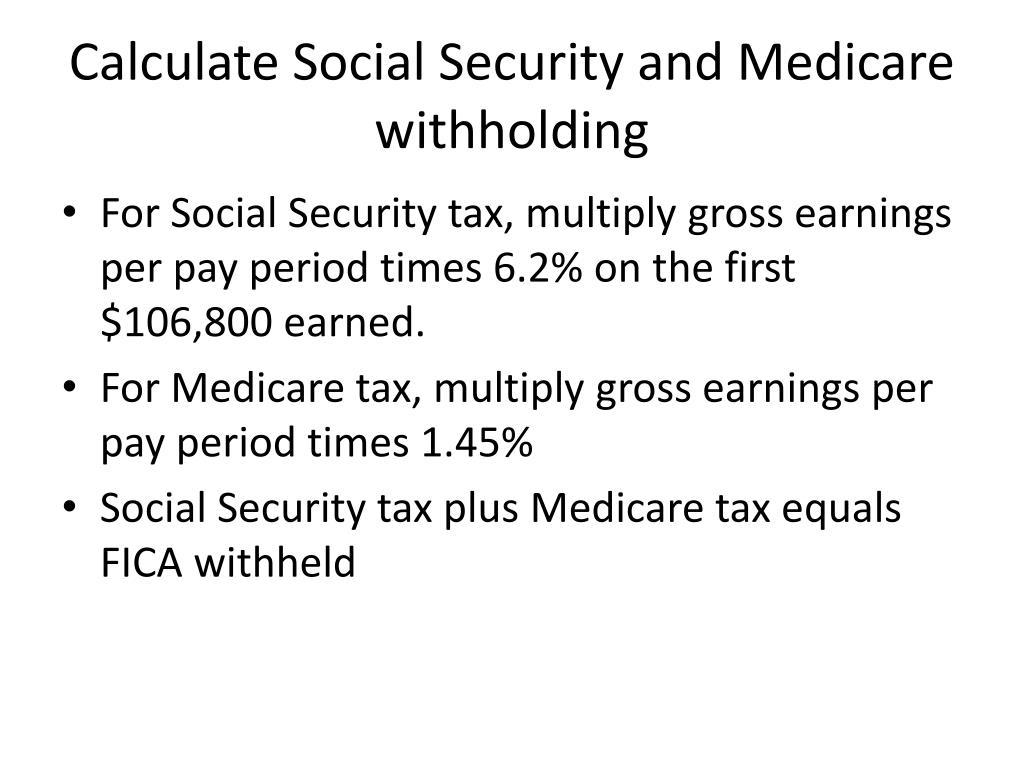

How do you calculate Medicare wages?

Medicare taxable wage refers to the employee wages on which Medicare tax is paid. It is calculated as the employee’s gross earnings less the non-taxable items, without any maximum on gross wages. Employers are required to withhold 1.45% of employee’s Medicare wages as Medicare tax and submit a matching amount to cover the costs of the ...

What reduces Medicare taxable wages?

What Pretax Deductions Lower FICA?

- Deductions Exempt From FICA. Qualified benefits offered under a cafeteria or Section 125 plan are exempt from FICA. ...

- Pretax Versus After-Tax Deductions. ...

- Benefits That Do not Lower FICA Earnings. ...

- Wages Excluded From FICA. ...

- FICA Wages on a W-2. ...

What is the maximum Medicare wages for 2020?

Social Security and Medicare Wage Bases and Rates for 2020 The Medicare wage base will not have a dollar limit for 2020. The employer and employee tax rates will remain the same in 2020. The Social Security (full FICA) rate remains at 7.65% (6.20% Social Security plus 1.45% Medicare) for wages up to $137,700.

Do Medicare wages have a limit?

There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax. The Medicare tax rate applies to all taxable wages and remains at 1.45 percent with the exception of an “additional Medicare tax” assessed against all taxable wages paid in excess of the applicable threshold (see Note).

What is the Medicare wage base limit?

no wageThere is no wage base limit for Medicare tax. Social security and Medicare taxes apply to the wages of household workers you pay $2,400 or more in cash wages in 2022. Social security and Medicare taxes apply to election workers who are paid $2,000 or more in cash or an equivalent form of compensation in 2022.

What is the income limit on which Medicare tax is paid?

A 0.9% Additional Medicare Tax applies to Medicare wages, self-employment income, and railroad retirement (RRTA) compensation that exceed the following threshold amounts based on filing status: $250,000 for married filing jointly; $125,000 for married filing separately; and. $200,000 for all other taxpayers.

What is the Medicare limit for 2021?

2021 updates. For 2021, an employee will pay: 6.2% Social Security tax on the first $142,800 of wages (maximum tax is $8,853.60 [6.2% of $142,800]), plus. 1.45% Medicare tax on the first $200,000 of wages ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return), plus.

What is a Medicare wage?

Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the Medicare tax.

Why is Medicare wages more than wages?

How is that possible? Certain amounts that are taken out of your pay are not subject to federal income tax, so they are not included in box 1, but they are subject to Social Security and Medicare taxes, so they are included in boxes 3 and 5.

How are Medicare wages calculated?

These wages are taxed at 1.45% and there is no limit on the taxable amount of wages. The amount of taxable Medicare wages is determined by subtracting the following from the year-to-date (YTD) gross wages on your last pay statement. Health – subtract the YTD employee health insurance deduction.

What is Medicare wage exemption?

Also, qualified retirement contributions, transportation expenses and educational assistance may be pretax deductions. Most of these benefits are exempt from Medicare tax, except for adoption assistance, retirement contributions, and life insurance premiums on coverage that exceeds $50,000.

What is the 3.8 Medicare surtax?

The Medicare tax is a 3.8% tax, but it is imposed only on a portion of a taxpayer's income. The tax is paid on the lesser of (1) the taxpayer's net investment income, or (2) the amount the taxpayer's AGI exceeds the applicable AGI threshold ($200,000 or $250,000).

How can I avoid paying Medicare taxes?

To do that, you'll use IRS Form 4029, Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits.

What are Medicare income limits?

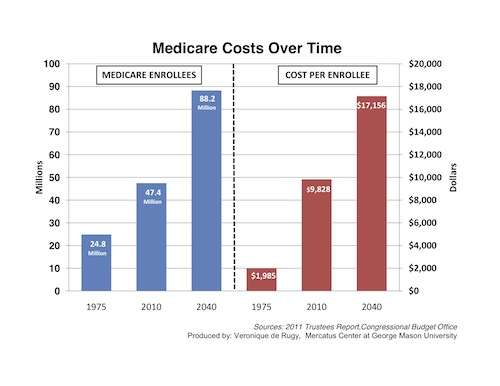

Medicare beneficiaries with incomes above a certain threshold are charged higher premiums for Medicare Part B and Part D. The premium surcharge is...

Why does Medicare impose income limits?

The higher premiums for Part B took effect in 2007, under the Medicare Modernization Act. And for Part D, they took effect in 2011, under the Affor...

Who is affected by the IRMAA surcharges and how does this change over time?

There have been a few recent changes that affect high-income Medicare beneficiaries: In 2019, a new income bracket was added at the high end of the...

Will there be a rate increase in 2022?

We don’t yet have concrete details from CMS. But the Medicare Trustees Report, which was published in late August, projects that the standard Part...

What is the Medicare Advantage spending limit?

Medicare Advantage (Medicare Part C) plans, however, do feature an annual out-of-pocket spending limit for covered Medicare expenses. While each Medicare Advantage plan carrier is free to set their own out-of-pocket spending limit, by law it must be no greater than $7,550 in 2021. Some plans may set lower maximum out-of-pocket (MOOP) limits.

How many reserve days do you get with Medicare?

Medicare limits you to only 60 of these days to use over the course of your lifetime, and they require a coinsurance payment of $742 per day in 2021. You only get 60 lifetime reserve days, and they do not reset after a benefit period or a calendar year.

What is the Medicare donut hole?

Medicare Part D prescription drug plans feature a temporary coverage gap, or “ donut hole .”. During the Part D donut hole, your drug plan limits how much it will pay for your prescription drug costs. Once you and your plan combine to spend $4,130 on covered drugs in 2021, you will enter the donut hole. Once you enter the donut hole in 2021, you ...

How much is Medicare Part A deductible in 2021?

You are responsible for paying your Part A deductible, however. In 2021, the Medicare Part A deductible is $1,484 per benefit period. During days 61-90, you must pay a $371 per day coinsurance cost (in 2021) after you meet your Part A deductible.

What happens if you spend $6,550 out of pocket in 2021?

After you spend $6,550 out-of-pocket on covered drugs in 2021, you leave the donut hole coverage gap and enter the catastrophic coverage stage. Once you reach this stage, you only pay a small coinsurance or copayment for your covered drugs for the rest of the year.

What is Medicare Part B and Part D?

Medicare Part B (medical insurance) and Part D have income limits that can affect how much you pay for your monthly Part B and/or Part D premium. Higher income earners pay an additional amount, called an IRMAA, or the Income-Related Monthly Adjusted Amount.

What is Medicare Advantage Plan?

When you enroll in a Medicare Advantage plan, it replaces your Original Medicare coverage and offers the same benefits that you get from Medicare Part A and Part B.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the Medicare tax rate?

The Medicare tax rate applies to all taxable wages and remains at 1.45 percent with the exception of an “additional Medicare tax” assessed against all taxable wages paid in excess of the applicable threshold (see Note).

When did Medicare withholding change?

Note: The Patient Protection and Affordable Care Act signed into law March 23, 2010, created the “additional Medicare tax” that changed Medicare withholding computations effective January 1, 2013. All wages, self-employment income, and other compensation that are subject to regular Medicare tax and are paid in excess of ...

What is the maximum amount of Social Security tax withheld for 2020?

For 2020, the maximum limit on earnings for withholding of Social Security (old-age, survivors, and disability insurance) tax is $137,700.00. The Social Security tax rate remains at 6.2 percent.

What is the FICA tax rate for 2020?

The FICA tax rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2020 (or 8.55 percent for taxable wages paid in excess of the applicable threshold). The information in the following table shows the changes in Social Security withholding limits from 2019 to 2020.