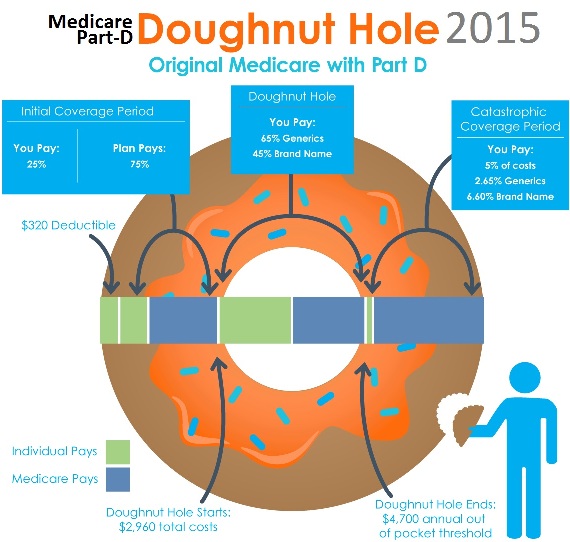

Medicare Part-D Initial Donut Hole (Coverage Gap) 2015: begins once you reach your Medicare Part D

Medicare Part D

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs through prescription drug insurance premiums. Part D was originally propo…

How to avoid the Medicare Part D Donut Hole?

- Your prescription drug plan’s yearly deductible

- The amount you pay for your prescription medications

- The 70% manufacturer discount for brand-name drugs while you’re in the coverage gap

When does the Medicare Donut Hole End?

When does the Medicare Donut Hole End? The donut hole ends when you reach the catastrophic coverage limit for the year. In 2022, the donut hole will end when you and your plan reach $7,050 out-of-pocket in one calendar year. That limit is not just what you have spent but also includes the amount of any discounts you received in the donut hole.

What is the exact Medicare Part D Donut Hole amount?

The Donut Hole remains the third phase or part of your Medicare Part D prescription drug coverage and you only enter the Donut Hole when (if) the total retail value of your purchased medications exceeds your plan's 2022 Initial Coverage Limit (ICL) of $4,430.

Do all Medicare Part D plans have a donut hole?

The reason they call it the Medicare donut hole is because it used to be a hole in the middle of your drug coverage during a calendar year. All Medicare Part D plans have four stages, and the third stage is the donut hole. However, you may have heard about the Medicare donut hole ending.

Does the Medicare donut hole reset each year?

Your Medicare Part D prescription drug plan coverage starts again each year — and along with your new coverage, your Donut Hole or Coverage Gap begins again each plan year. For example, your 2021 Donut Hole or Coverage Gap ends on December 31, 2021 (at midnight) along with your 2021 Medicare Part D plan coverage.

Does the Medicare Part D donut hole still exist?

The Part D coverage gap (or "donut hole") officially closed in 2020, but that doesn't mean people won't pay anything once they pass the Initial Coverage Period spending threshold. See what your clients, the drug plans, and government will pay in each spending phase of Part D.

How long does the Medicare Part D donut hole last?

When does the Medicare Donut Hole End? The donut hole ends when you reach the catastrophic coverage limit for the year. In 2022, the donut hole will end when you and your plan reach $7,050 out-of-pocket in one calendar year.

How do I avoid the Medicare donut hole?

Five Ways to Avoid the Medicare Part D Coverage Gap (“Donut Hole”...Buy generic prescriptions. Jump to.Order your medications by mail and in advance. Jump to.Ask for drug manufacturer's discounts. Jump to.Consider Extra Help or state assistance programs. Jump to.Shop around for a new prescription drug plan. Jump to.

Will there be a Medicare donut hole in 2022?

In 2022, you'll enter the donut hole when your spending + your plan's spending reaches $4,430. And you leave the donut hole — and enter the catastrophic coverage level — when your spending + manufacturer discounts reach $7,050. Both of these amounts are higher than they were in 2021, and generally increase each year.

How much is the donut hole for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

How much is the donut hole for 2022?

$4,430In 2022, that limit is $4,430. While in the coverage gap, you are responsible for a percentage of the cost of your drugs. How does the donut hole work? The donut hole closed for all drugs in 2020, meaning that when you enter the coverage gap you will be responsible for 25% of the cost of your drugs.

What will the donut hole be in 2022?

In 2022, the coverage gap ends once you have spent $7,050 in total out-of-pocket drug costs. Once you've reached that amount, you'll pay the greater of $3.95 or 5% coinsurance for generic drugs, and the greater of $9.85 or 5% coinsurance for all other drugs. There is no upper limit in this stage.

Is donut hole going away?

Then, in 2012, the ACA implemented discounts for the Coverage Gap. In 2019, discounts meant that beneficiaries paid 25% of the cost for any brand-name medication, officially closing the donut hole, and 37% for generics. Then, in 2020, the donut hole for generic drugs is also closed.

Can you use GoodRx If you are on Medicare?

While you can't use GoodRx in conjunction with any federal or state-funded programs like Medicare or Medicaid, you can use GoodRx as an alternative to your insurance, especially in situations when our prices are better than what Medicare may charge. Here's how it works.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Do Medicare Advantage plans cover the donut hole?

Some people ask: Do Medicare Advantage plans cover the donut hole? If you choose to include Medicare prescription drug coverage in your Medicare Advantage plan, it will still have a donut hole just like a regular Part D plan. Medicare Advantage does not cover any additional Part D costs during the coverage gap.

What Is The Coverage Gap (“Donut Hole”), and When Does It Start?

For those who are new to the coverage gap, or “donut hole,” learning about the different Medicare Part D coverage phases is a good place to start....

What Costs Count Towards Getting Out of The Coverage Gap (“Donut Hole”)?

Once you’ve entered the coverage gap (“donut hole”), it’s important to understand which out-of-pocket costs count towards helping you reach the cat...

What Costs Don’T Count Towards Getting Out of The Coverage Gap (“Donut Hole”)?

Not all out-of-pocket costs count towards reaching catastrophic coverage. The following costs don’t count towards getting you out of the coverage g...

How Do I Avoid The Medicare Part D Coverage Gap (“Donut Hole”)?

Now that you know about the coverage gap (“donut hole”), here is some good news: 1. Many Medicare beneficiaries won’t have to pay the increased pri...

What If I Have Questions About The Coverage Gap (“Donut Hole”)?

If you have questions about how the coverage gap works and how to avoid it, I can help. A licensed insurance agent such as myself can help you comp...

What is the donut hole?

The donut hole is a gap in prescription drug coverage during which you may pay more for prescription drugs. You enter the donut hole once Medicare has paid a certain amount toward your prescription drugs in one coverage year. Once you fall into the donut hole, you’ll pay more out of pocket (OOP) for the cost of your prescriptions ...

What happens if you fall into a donut hole?

Once you fall into the donut hole, you’ll pay more out of pocket (OOP) for the cost of your prescriptions until you reach the yearly limit. Depending on the type of coverage you choose, when you hit this limit, your plan may help pay for your prescriptions again. Continue reading as we discuss more about the donut hole and how may it affect how ...

How much is the OOP in 2021?

For 2021, the OOP threshold has increased to $6,550. This is up from $6,350 in 2020, meaning that you’ll have to pay more OOP than before in order to get out of the donut hole. When you’re in the donut hole, certain things count toward your total OOP cost to exit it. These include:

What is Medicare Part D?

Understanding Medicare Part D. Medicare Part D is an optional plan under Medicare for coverage of prescription drugs. Insurance providers approved by Medicare provide this coverage. Prior to Part D, many people received prescription drug coverage through their employer or a private plan. Some had no coverage.

What is the 2022 Medicare coverage limit?

For 2022, the initial coverage limit has increased to $4,430. This is up from $4,130 in 2021. Generally speaking, this means that you’ll be able to get more medications before you fall into the donut hole.

What is extra help for Medicare?

Individuals that have Medicare drug coverage and have limited income and resources may qualify for Extra Help. This helps to pay for premiums, deductibles, and copayments associated with a Medicare drug plan.

What is the initial coverage limit?

The initial coverage limit includes the total (retail) cost of drugs — what both you and your plan pay for your prescriptions.

What is the Medicare Part D coverage gap?

The Medicare Part D Coverage Gap (“Donut Hole ”) Made Simple. Summary: When it comes to Medicare prescription drug coverage, you might have questions surrounding the Medicare Part D coverage gap, also known as the “donut hole.”. The coverage gap is a temporary limit on what most Medicare Part D Prescription Drug Plans or Medicare Advantage ...

Why won't Medicare pay the $4,020 coverage gap?

Now that you know about the coverage gap (“donut hole”), here is some good news: Many Medicare beneficiaries won’t have to pay the increased prices during the coverage gap because their prescription drug costs won’t reach the initial coverage limit of $4,020 in 2020.

What is the deductible phase of Medicare?

Deductible phase: For most stand-alone Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans, you’ll pay 100% for medication costs until you reach the yearly deductible amount (if your plan has one). After you reach the deductible, the Medicare plan begins to cover its share of prescription drug costs. The deductible amount may vary by plan, and some plans may not have a deductible. If your Medicare plan doesn’t have a deductible, then you’ll start your coverage in the initial coverage phase (see below).

How to avoid coverage gap?

Managing your out-of-pocket prescription drug costs is a big part of avoiding the coverage gap. Here are some tips for how you can lower the amount you spend on medications: Many expensive prescription drugs have a generic or lower-cost alternative. Switching to lower-cost drugs may help you avoid entering the coverage gap.

What is the coverage gap in Medicare?

Typically, each new coverage phase begins once your spending has reached a certain amount. The coverage gap is one of the coverage phases under Medicare Part D.

How much is the coverage gap for 2020?

While in the coverage gap, you’ll typically pay up to 25% of the plan’s cost for both covered brand-name drugs and generic drugs in 2020. You’re out of the coverage gap once your yearly out-of-pocket drug costs reach $ 6,350 in 2020. Once you have spent this amount, you’ve entered the catastrophic coverage phase.

What is the cost of prescription drugs in 2020?

Remember, if your prescription drug spending reaches $6,350 in 2020, you’ll have catastrophic coverage for the rest of the year. The following costs count towards your out-of-pocket spending and getting you out of the coverage gap: The 70% manufacturer discount for brand-name drugs while you’re in the coverage gap.

Medicare Part-D 2015: Donut Hole, Costs, Drug Plans, Deductible

The Centers for Medicare & Medicaid Services (CMS) recently released information about the Medicare Part D stand-alone prescription drug plans (PDPs) that will be available in 2015.

Medicare Part D Benefit Parameters Comparison 2015

Medicare & Medicaid Services (CMS) on April 7, 2014, has announced the Medicare Part-D 2015 rates, deductible and out-of-pocket limit. Here are the Medicare Part-D Benefit Plan changes from 2014 to 2015. These are the Standard Benefit plan changes. This "Standard Benefit Plan" is the minimum allowable plan to be offered.

Maximum Copay for Non-Institutionalized Beneficiaries

Total Covered Part D Spending at Out-of-Pocket Threshold for Non-Applicable Beneficiaries - Beneficiaries who ARE entitled to an income-related subsidy under section 1860D-14 (a) (LIS)

What is the donut hole in Medicare?

Did you know some Medicare prescription drug plans (PDPs) or Medicare Advantage plans with prescription drug coverage (MA-PDs) have annual coverage limits? If you reach the annual coverage limit, you enter a temporary coverage gap, called “the donut hole.”.

How much is deductible for prescription drugs?

Deductibles vary between Medicare drug plans, and not all plans have one, but if your drug plan has a deductible, it cannot be greater than $405 in 2018.

What is the gap limit for Stage 4?

Stage 4 – Catastrophic Coverage. Once you have reached the coverage gap limit – $5,000 in 2018 – your catastrophic coverage automatically begins. Your plan will begin to contribute more, and you will only pay a small coinsurance or copayment amount for covered drugs for the rest of the year.

What happens when you pay for prescriptions out of pocket?

When you’ve paid that amount, you’ll automatically leave the donut hole and your catastrophic drug coverage will kick in, leaving you with significantly lower copays or coinsurance for the rest of the year.

How much does Medicare pay out in 2020?

On average, your Medicare Part D plan pays out around $4,020 as of 2020 before the gap begins. That being said, the type of plan you have, your income, your medication needs, and yearly adjustments may affect this number at any given time, so it’s important to familiarize yourself with your own plan. Also, if you’re part of the Extra Help program, this gap will not apply to you at all.

How much does Medicare pay for generic drugs?

Medicare will pay for 75% of the overall cost of generic drugs, with the remaining 25% paid by you. For these, only the amount you pay will go towards reaching your gap limit. Let’s use the example from before, with a prescription that costs $100, plus a $10 dispensing fee. Broken down:

Does coinsurance count towards gap limit?

Your yearly deductible, coinsurance, and copayments also count towards your coverage gap limit.

Does Medicare cover gap drugs?

As with brand name drugs, if you have a Medicare drug plan which includes coverage in the gap, you may get a discount for the amount your plan covers. This discount on brand-name drugs applies to the remaining amount you owe.

What is Medicare Donut Hole?

Summary. The Medicare donut hole is a colloquial term that describes a gap in coverage for prescription drugs in Medicare Part D. For 2020, Medicare are making some changes that help to close the donut hole more than ever before. Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs.

How much does the insurance company add up to the donut hole?

The insurance company will add up what a person has paid out-of-pocket for medications in the donut hole. Once this total reaches $6,350, a person has crossed the donut hole. A person is now in the catastrophic coverage stage of their medication coverage.

What was the Affordable Care Act in 2011?

2011: The Affordable Care Act required pharmaceutical manufacturers to introduce discounts of up to 50% for brand name drugs and up to 14% for generic drugs, making it easier for people to buy medications once in the donut hole. 2012‑2018: The discounts continued to increase. 2018: The Bipartisan Budget Act sped up changes to prescription drug ...

Why did the Donut Hole change?

The aim of these changes was to make drugs more affordable once a person reached the donut hole, which would encourage people to continue taking their medications and reduce the risk of a break in treatment . A person pays their co-payment for their prescription drugs, depending upon their drug plan.

What is Medicare Part D?

Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs. A person enrolled in Medicare does not have to choose Medicare Part D. However, they must have some other prescription drug coverage, usually through private- or employer-based insurance. In this article, we define the donut hole and how it applies ...

Why do people stop taking drugs after reaching the donut hole?

The issue with the donut hole is that many people in the United States stop taking their medications upon reaching the donut hole because they cannot afford to pay the high costs for the drugs. They often have to pay thousands of dollars for prescription drugs until they cross this coverage gap.

What happens when you pay a prescription drug deductible?

A person pays a specified amount for their prescription drugs, and once they meet this deductible, their plan takes over the funding . However, when the plan has paid up to a specified limit, the person has reached the donut hole.

When will the donut hole close?

The donut hole gradually lessened until it closed in 2020, leaving users responsible for 25% of costs for both brand-name and generic prescription drugs, versus the 100% they had to pay previously. 8.

How much is the deductible for Medicare 2021?

Deductibles vary, depending on the Medicare drug plan you have, but no plan can have a deductible of more than $445 in 2021. Some plans have no deductible at all. Initial coverage: Once you’ve met your deductible, your plan will pay for some of the costs of your covered prescription drugs. You will owe a copayment or coinsurance for each covered ...

What is catastrophic coverage?

Catastrophic coverage: Once you hit $6,550 in out-of-pocket costs for covered prescription drugs, your catastrophic coverage kicks in . Within this coverage, you’re responsible for lower copays and coinsurance for covered drugs for the rest of your plan year.

What happens if you don't sign up for Medicare?

If you don’t sign up for Medicare Part D when you’re first eligible, you may have to pay a late enrollment penalty. The amount of the penalty depends on how long you went without Part D or creditable prescription drug coverage. You’ll generally pay this penalty for as long as you have a Medicare drug plan. 10.

What is Medicare coverage gap?

Medicare coverage gap or donut hole: Although consumers used to be responsible for all or most drug costs within the donut hole, now you’ll be responsible for 25% of the cost of your drugs. This may or may not be significantly different from what you pay under your initial coverage. Catastrophic coverage: Once you hit $6,550 in out-of-pocket costs ...

How many stages of Medicare Part D?

There are four payment stages of Medicare Part D prescription drug coverage, which starts over January 1 of each year. 3. Annual deductible: Each year, you must pay a certain amount for your prescriptions before your Medicare drug plan starts covering some costs.

What happens if you wait to enroll in Medicare Part D?

If you wait on enrolling in Medicare Part D when first eligible, you could pay a late enrollment penalty. Unfortunately, it doesn’t refer to a sugary treat – the Medicare “donut hole” is a coverage gap in Medicare Part D ...

What is a Medicare donut hole?

The Medicare donut hole is a gap in coverage that some Medicare beneficiaries may experience at some point during their plan year. The good news? You can save money by knowing how to avoid it and what do to once you’re in it.

How much is the Medicare donut hole for 2021?

The Medicare donut hole for 2021 starts once you hit $4,130 in out-of-pocket prescription drug costs, and it extends to $6,550. If your prescription drug spending reaches $6,550 in 2021, you’ll have catastrophic coverage for the rest of the year.

What is the Medicare coverage gap in 2021?

After you and your drug plan have combined to spend a set amount for the prescription drugs covered by your plan ($4,130 in 2021), you move into the center of the donut (i.e., the hole) which is your Medicare coverage gap. While you’re in the donut hole coverage gap, you’re responsible for 25% of your prescription drug costs for both brand name ...

How many stages of Medicare Part D coverage?

Basically, there are four Medicare Part D coverage stages you need to understand. Your first Medicare Part D coverage phase can be represented by the left side of the donut ring. On this side of the donut, you pay the entire amount for your prescription drugs until you meet your deductible (assuming your plan has one, but not all Part D plans do). ...

How much is a 2021 deductible?

The good news is that once you meet your deductible ( which can be no higher than $445 in 2021 though some plans may offer $0 deductibles) you move to your initial coverage period. If your plan features a $0 deductible, then your coverage starts in this phase.

When does the catastrophic coverage period end for 2021?

Finally, your policy period ends on December 31, ...

How to avoid coverage gap?

One way is to switch from a brand name drug to a generic drug or from a brand name to a less expensive brand name drug, if possible. Ask your physician whether this is possible based on your specific medical condition and health history.