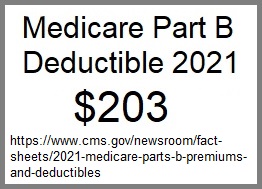

How much is the Medicare Part B deductible?

In 2020, you pay $198 ($203 in 2021) for your Part B Deductible. After you meet your deductible for the year, you typically pay 20% of the Medicare-approved amount for these: Clinical laboratory services: You pay $0 for Medicare-approved services. $0 for home health care services.

How many times can you pay the inpatient hospital deductible?

You must pay the inpatient hospital deductible for each benefit period. There's no limit to the number of benefit periods. . An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%). for each benefit period.

What does Medicare Part a cover for inpatient care?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. You’re admitted to the hospital as an inpatient after an official doctor’s order, which says you need inpatient hospital care to treat your illness or injury.

How much is the monthly premium for Medicare Part A?

Monthly Premium. : Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $422 each month in 2018 ($437 in 2019). If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $422 ($437 in 2019).

What is the Medicare deductible for 2015?

The 2015 Medicare Part A premium for those who are not eligible for premium free Medicare Part A is $407. The Medicare Part A deductible for all Medicare beneficiaries is $1,260.

What is the hospital deductible for Medicare?

$1,556About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible that beneficiaries pay if admitted to the hospital will be $1,556 in 2022, an increase of $72 from $1,484 in 2021.

What was the Medicare Part B premium for 2015?

Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums. The Part B deductible will also remain the same for 2015, at $147.

What was the Medicare deductible in 2014?

$1,216The Medicare Part A deductible that beneficiaries pay when admitted to the hospital will be $1,216 in 2014, an increase of $32 from this year's $1,184 deductible.

What is the Medicare hospital deductible for 2021?

$1,484 inThe Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.

Does Medicare have a deductible every year?

Medicare deductibles are reset each year and the dollar amount may be subject to change. Both Medicare Parts A and B have deductibles that must be met before Medicare starts paying. Medicare Advantage, Medigap and Part D plans are all sold by private insurance companies that set their own deductibles.

What was the Medicare deductible for 2016?

The 2016 Medicare Part A premium for those who are not eligible for premium free Medicare Part A is $411. The Medicare Part A deductible for all Medicare beneficiaries is $1,288.

What were Medicare premiums in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

What is the Medicare Part B deductible for 2017?

$183 in 2017CMS also announced that the annual deductible for all Medicare Part B beneficiaries will be $183 in 2017 (compared to $166 in 2016).

What is the Medicare Part B deductible 2012?

$140In 2012, the Part B deductible will be $140, a decrease of $22 from 2011.

How much did Medicare cost in 2013?

Most people will pay more for this government health care plan for seniors.2011 ADJUSTED GROSS INCOME$85,000 or less (single), $170,000 or less (joint)More than $214,000 (single), more than $428,000 (joint)2013 Medicare Part B monthly premium$104.90$335.702013 Medicare Part D monthly premiumpremium only$66.40 surcharge

What were Medicare premiums in 2017?

Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

How much is Medicare Part B in 2015?

Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums. The Part B deductible will also remain the same for 2015, at $147. The Medicare Part A deductible, which covers the first 60 days of Medicare-covered inpatient hospital care, will rise to $1,260 in 2015, a $44 increase from 2014.

How much is Medicare Advantage going up?

The average premium for a Medicare Advantage plan is going up by about 9.5%, to $33.90 per month (you’re still on the hook for Part B premiums). However, premiums will remain the same for about 61% of people if they elect to stay with the same Medicare Advantage plan.

How long can you open enrollment for Medicare Supplement?

Medicare supplement policies don’t have an annual open-enrollment period; you can buy them anytime. But you usually can be rejected or charged more because of your health if you get the policy more than six months after signing up for Medicare Part B.

What does Medicare Part B cover?

If you also have Part B, it generally covers 80% of the Medicare-approved amount for doctor’s services you get while you’re in a hospital. This doesn't include: Private-duty nursing. Private room (unless Medically necessary ) Television and phone in your room (if there's a separate charge for these items)

What are Medicare covered services?

Medicare-covered hospital services include: Semi-private rooms. Meals. General nursing. Drugs as part of your inpatient treatment (including methadone to treat an opioid use disorder) Other hospital services and supplies as part of your inpatient treatment.

What is an inpatient hospital?

Inpatient hospital care. You’re admitted to the hospital as an inpatient after an official doctor’s order, which says you need inpatient hospital care to treat your illness or injury. The hospital accepts Medicare.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $170.10 per month. The maximum cost of Medicare Part B premiums is $578.30 per month in 2022, and that's for individuals reporting half a million dollars or more in income in 2020.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022.

What is the Medicare deductible for a hospital in 2016?

The Medicare statute specifies the formulae used to determine these amounts. For CY 2016, the inpatient hospital deductible will be $1,288. The daily coinsurance amounts for CY 2016 will be: (1) $322 for the 61st through 90th day of hospitalization in a benefit period; (2) $644 for lifetime reserve days; and (3) $161.00 for the 21st through 100th day of extended care services in a skilled nursing facility in a benefit period.

Does the Office of Management and Budget have to review the Paperwork Reduction Act?

This document does not impose information collection requirements, that is, reporting, recordkeeping or third-party disclosure requirements. Consequently, there is no need for review by the Office of Management and Budget under the authority of the Paperwork Reduction Act of 1995 ( 44 U.S.C. 3501 et seq. ).

I. Background

II. Computing The Inpatient Hospital Deductible For Cy 2015

- Section 1813(b) of the Act prescribes the method for computing the amount of the inpatient hospital deductible. The inpatient hospital deductible is an amount equal to the inpatient hospital deductible for the preceding CY, adjusted by our best estimate of the payment-weighted average of the applicable percentage increases (as defined in section 18...

IV. Cost to Medicare Beneficiaries

- Table 1 below summarizes the deductible and coinsurance amounts for CYs 2014 and 2015, as well as the number of each that is estimated to be paid. The estimated total increase in costs to beneficiaries is about $1,120 million (rounded to the nearest $10 million) due to: (1) The increase in the deductible and coinsurance amounts, and (2) the increase in the number of deductibles a…

v. Waiver of Proposed Notice and Comment Period

- Section 1813(b)(2) of the Act requires publication of the inpatient hospital deductible and all coinsurance amounts—the hospital and extended care services coinsurance amounts—between September 1 and September 15 of the year preceding the year to which they will apply. These amounts are determined according to the statute as discussed above. As has been our custom, …

VI. Collection of Information Requirements

- This document does not impose information collection requirements, that is, reporting, recordkeeping or third-party disclosure requirements. Consequently, there is no need for review by the Office of Management and Budget under the authority of the Paperwork Reduction Act of 1995.

VII. Regulatory Impact Analysis

- A. Statement of Need

Section 1813(b)(2) of the Act requires the Secretary to publish, between September 1 and September 15 of each year, the amounts of the inpatient hospital deductible and hospital and extended care services coinsurance applicable for services furnished in the following calendar y… - B. Overall Impact

We have examined the impacts of this rule as required by Executive Order 12866 on Regulatory Planning and Review (September 30, 1993), Executive Order 13563 on Improving Regulation and Regulatory Review (January 18, 2011), the Regulatory Flexibility Act (RFA) (September 19, 1980, …