When are Medicare premiums deducted from Social Security?

· Statement SSA-1099 and Medicare. You do have to report your spouses's SSA benefits before deduction of the Medicare Part B premiums. If you did not recive his form SSA-1099, you could go to his account on ssa.gov to print it out. If he does not have an account on ssa.gov, he can create one.

Are Medicare premiums deducted from Social Security payments?

· No, Medicare B premiums don’t count as income, per se. However, the amount in Box 5 of your Form SSA-1099 – including Medicare B premiums, if present – is used in the computation of the taxable Social Security amount included on your return. Please see the Social Security Benefits Worksheet—Lines 6a and 6b on page 31 of the 2021 ...

Does social security issue 1099's?

1099-R, RRB-1099, RRB-1099-R, SSA-1099 - Distributions from pensions, annuities, retirement, IRA's, Social Security, etc. Social Security Benefits/RRB-1099. Box 5 shows the net amount of benefits paid for the year. Box 6 shows the amount of your federal tax withholdings. It is uncommon to have withholdings from social security benefits.

How does income affect monthly Medicare premiums?

· Since 2007, higher-income beneficiaries have paid a larger percentage of their Medicare Part B premium than most. Depending on their income, these higher-income beneficiaries will pay premiums that amount to 35, 50, 65, or 80 percent of the total cost of coverage. You can get details at Medicare.gov or by calling 1-800-MEDICARE ( 1-800-633-4227 ...

Does SSA 1099 include Medicare premiums?

The SSA-1099 will show the premiums you paid for Part B, and you can use this information to itemize your premiums when you file your taxes. You'll also receive a form from Medicare called a Medicare summary notice.

Is the Medicare portion of Social Security taxable?

NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

What is Medicare tax?

The current Medicare tax rate is 1.45 percent of your wages and is withheld from your paycheck. Your employer matches your contribution by paying another 1.45 percent. If you are self-employed, you have to pay the full 2.9 percent of your net income as the Medicare portion of your FICA taxes.

What taxes include Medicare and SSI?

FICA Tax Rates Both employees and employers pay FICA taxes at the same rate. FICA taxes are divided into two parts: Social Security tax and Medicare tax. The Social Security tax rate is 6.2% of wages for 2022, and the Medicare tax rate is 1.45% of wages. Together, these make up a tax rate of 7.65% for FICA taxes.

How is Medicare tax calculated?

For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party – employee and employer – pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.

What is the Medicare tax rate for 2021?

1.45%FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings. In 2021, only the first $142,800 of earnings are subject to the Social Security tax ($147,000 in 2022). A 0.9% Medicare tax may apply to earnings over $200,000 for single filers/$250,000 for joint filers.

Do I get Medicare tax back?

No, you can not get the Social Security and Medicare taxes refunded.

Why am I paying for Medicare?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act - which go toward Medicare.

Why do they take Medicare out of my paycheck?

Medicare provides health insurance for people aged 65 and over, as well as some people with disabilities. Generally, employers are required to withhold Social Security and Medicare taxes from your paycheck in order to pay for these social programs.

How much is deducted from Social Security for Medicare?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

How much income is taxed on SSA 1099?

For singles with combined income between $25,000 and $34,000, as much as one-half of your benefits can be subject to income tax, although many will pay lesser amounts. Above $34,000, the maximum amount rises to 85% of the benefits reported on Form SSA-1099.

Why is SSA-1099 important?

Making sure you have the form available when you prepare your tax return is essential in order to avoid mistakes that could lead to an audit.

How much Social Security is taxed?

If you're single and the number is less than $25,000, then none of your Social Security will get taxed. For joint filers, the threshold number is $32,000. Above those amounts, however, some of your benefits will be added to taxable income. For singles with combined income between $25,000 and $34,000, as much as one-half ...

Does SSA 1099 include Medicare?

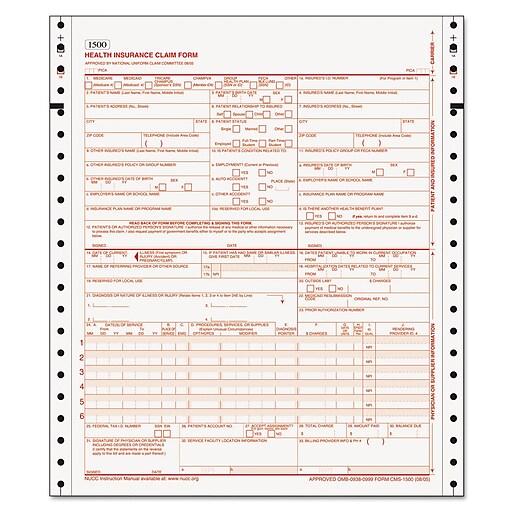

Image: IRS. Form SSA-1099 can also include supplemental information. For instance, if you're on Medicare, then your monthly Part B premiums will typically get deducted directly from your benefits. A description of that withholding will appear in the box marked Description of Amount in Box 3.

Do retirees have to worry about taxes?

Retirees often think that they don't need to worry too much about their taxes, largely because their lack of wage income means they don't have to pay Uncle Sam very much every April. But every year during tax season, the Social Security Administration sends out information on Form SSA-1099 to anyone who receives Social Security benefits, and it's important to know what you're supposed to do with this tax form and how it can affect what you owe the IRS. Let's take a closer look at Form SSA-1099 and the key facts you need to know.

Is it too late to pay taxes on Social Security?

Planning to reduce taxable Social Security income. By the time you get Form SSA-1099, it's usually too late to do anything to reduce the amount of Social Security income that you'll pay tax on.

Why do you need to look at SSA 1099?

The reason why Social Security recipients need to look closely at Form SSA-1099 is that it plays a key role in letting the IRS know whether your benefits will be subject to tax. In particular, the IRS calculates a figure it calls "combined income," which adds up any wage or salary income you have, as well as investment income, business income, ...

What is a 1099 form?

A Social Security 1099 or 1042S Benefit Statement, also called an SSA-1099 or SSA-1042S, is a tax form that shows the total amount of benefits you received from Social Security in the previous year. It is mailed out each January to people who receive benefits and tells you how much Social Security income to report to the IRS on your tax return.

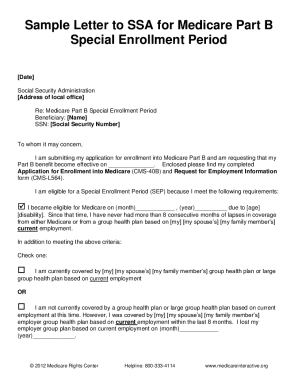

How to get a replacement 1099?

Need a replacement copy of your SSA-1099 or SSA-1042S, also known as a Benefit Statement? You can instantly download a printable copy of the tax form by logging in to or creating a free my Social Security account.

How long does it take to create a Social Security account?

Creating a free my Social Security account takes less than 10 minutes, lets you download your SSA-1099 or SSA-1042S and gives you access to many other online services.

Can non-citizens receive SSA 1099?

Noncitizens who live outside of the United States receive the SSA-1042S instead of the SSA-1099. The forms SSA-1099 and SSA-1042S are not available for people who receive Supplemental Security Income (SSI).

What is SSA 1099?

Form SSA-1099 is used to report any Social Security benefits that you may have collected during the year.

What is Box 6 on Social Security?

Box 6 shows the amount of your federal tax withholdings. It is uncommon to have withholdings from social security benefits.

What is SSA 1099?

A form SSA-1099, Social Security Administration, is used to report Social Security benefits issued to you during the year. If you received benefits for more than one Social Security record, such as, for example, survivor's benefits, you may get more than one form SSA-1099. You'll need all of your forms SSA-1099 to determine whether you need ...

What box do you find the total amount of benefits you repaid to SSA in 2015?

In box 4 , you'll see the total amount of benefits, of any, you repaid to SSA in 2015.

What is offset on Social Security?

Treasury benefit payment offset, garnishment, and/or tax levy. Social Security benefits may be withheld to recover debts you owe to other federal agencies such as for student loans and taxes. For more about offsets and Social Security, click here.

What box is the total benefits paid in 2015?

In box 3, you'll find the total benefits paid in 2015 to the person named in box 1. This figure may not agree with the amounts actually received for two reasons:

Is Social Security taxable?

If your only source of income is Social Security benefits, your benefits are generally not taxable. If your only source of income is Social Security benefits, your benefits are generally not taxable. By now, you probably have a stack of tax forms from employers, banks, stockbrokers, lenders and more on your desk - or more likely, ...

What is the Medicare premium for 2021?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Will Social Security send out a letter to all people who collect Social Security benefits?

Social Security will send a letter to all people who collect Social Security benefits ( and those who pay higher premiums because of their income) that states each person’s exact Part B premium amount for 2021. Since 2007, higher-income beneficiaries have paid a larger percentage of their Medicare Part B premium than most.

How many credits do you need to work to get Medicare?

You’re eligible to enroll in Medicare Part A and pay nothing for your premium if you’re age 65 or older and one of these situations applies: You’ve earned at least 40 Social Security work credits. You earn 4 work credits each year you work and pay taxes.

How long do you have to be married to get Social Security?

You were married for at least 9 months but are now widowed and haven’t remarried.

How much can you deduct out of pocket medical expenses?

The IRS allows you to deduct any out-of-pocket healthcare expenses, including premiums, that are more than 7.5 percent of your AGI.

Is Medicare premium tax deductible?

Medicare premiums are tax deductible. However, you can deduct premiums only once your out-of-pocket medical expenses reach a certain limit.

Does Medicare cover prescription drugs?

Medicare Part D plans cover prescription drugs. Part C and Part D plans are optional. If you do want either part, you’ll also have multiple options at various price points. You can shop for Part C and Part D plans in your area on the Medicare website.

What is Medicare Part C and Part D?

Medicare Part C and Part D. Medicare Part C (Medicare Advantage) and Medicare Part D (prescription drug coverage) plans are sold by private companies that contract with Medicare. Medicare Advantage plans cover everything that Medicare parts A and B do and often include coverage for extra services.

How much is Medicare Part B in 2021?

Your Part B premiums will be automatically deducted from your total benefit check in this case. You’ll typically pay the standard Part B premium, which is $148.50 in 2021. However, you might have a higher or lower premium amount ...

Not everyone pays for Medicare with their Social Security check

Lorraine Roberte is an insurance writer for The Balance. As a personal finance writer, her expertise includes money management and insurance-related topics. She has written hundreds of reviews of insurance products.

Who Is Eligible for Medicare?

Medicare is a social insurance program available to U.S. citizens and permanent residents 65 years of age or older. It’s also available to some younger Americans who are disabled or diagnosed with End-Stage Renal Disease (ESRD).

When Do You Have To Pay for Medicare?

If you don’t qualify for premium-free Part A coverage, you’ll need to pay a monthly premium. You’ll also have to pay a premium if you sign up for Part B, which is optional.

Medicare Costs You Can Deduct From Social Security

Most people who receive Social Security benefits will have their Medicare premiums automatically deducted. Here’s a closer look at what costs you can expect to see taken out of your checks.

Can You Change How You Pay for Medicare?

If you have Social Security benefits, your Part B premiums will be automatically deducted from them. If you don’t qualify for Social Security benefits, you’ll get a bill from Medicare that you’ll need to pay via:

What does Medicare pay for?

Medicare pays for many different types of medical expenses. Part A covers inpatient hospital care, surgery, and home health care, among other items. Part B covers things such as preventive care, doctors’ visits, and durable medical equipment. Part D covers prescription drugs.

How much will I pay for Medicare?

The amount you’ll pay for Medicare depends on several factors, including your sign-up date, income, work history, prescription drug coverage, and whether you sign up for extra coverage with an Advantage or Medigap plan. The Medicare Plan Finder can help you compare costs between different plans.