How high will the Medicare Part B deductible get?

Medicare Part B Deductible 2013 As from 2013 one will be required to pay more for Medicare Part B of up to $147 which is an increase of $7 as compared to 2012. Once you pay the $147 you will be eligible for a cover of up to of 80% of the approved amount. Most people pay standard premium amounts for Medicare Part B.

What is the monthly premium for Medicare Part B?

For most people, the monthly Medicare Part B premium will increase by $5. In 2013 most Medicare beneficiaries will pay a Medicare Part B premium of $104.90 per month. 2013 Medicare Part B Deductible: The Medicare Part B 2013 deductible is $147, a $5 increase from 2012.

How to collect a part B deductible?

The Medicare Part A deductible will increase from $1,156 per benefit period to $1,184 per benefit period in 2013. 2013 Medicare Part A Copayments: The cost of spending 61-90 days in the hospital will be $296 per day, which is a $7 increase. If you are in the hospital 91-150 days, the per-day Medicare Part A copayment in 2013 is $592, a $14 ...

How does Medicare bill for Part B?

Dec 02, 2012 · The Part B Medicare deductible for 2013 is $147.00. What should you do with this information? You should avoid taking a big financial hit in the first quarter of 2013 by collecting deductibles at time of service.

What is Medicare Part B annual deductible?

The Medicare Part B deductible is $233. Once met, you pay 20 percent of the Medicare-approved amount for most doctor services, outpatient therapy and durable medical equipment.

What is the yearly Part B deductible?

Part B Annual Deductible: Before Medicare starts covering the costs of care, people with Medicare pay an amount called a deductible. In 2022, the Part B deductible is $233.

What was the Medicare Part B premium in 2010?

Medicare Part B Premiums for 2010 The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $110.50 in 2010. However, most Medicare beneficiaries will not see an increase in their monthly Part B premiums in 2010 because of a “hold-harmless” provision in current law.

How often does the Medicare Part B deductible increase?

Part B deductible by year These amounts are indexed annually, after being set by the Medicare Modernization Act in 2005: 2005: $110.

What is the new Medicare Part B deductible for 2021?

$203Medicare Part B Premium and Deductible The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What is the Medicare Part B deductible for 2021?

$203 inMedicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.Nov 6, 2020

What was Medicare premium in 2013?

Today we announced that the actual rise will be lower—$5.00—bringing 2013 Part B premiums to $104.90 a month. By law, the premium must cover a percent of Medicare's expenses; premium increases are in line with projected cost increases.Nov 16, 2012

How much did Medicare cost in 2014?

CMS said the standard Medicare Part B monthly premium will be $104.90 in 2014, the same as it was in 2013. The premium has either been less than projected or remained the same, for the past three years. The Medicare Part B deductible will also remain unchanged at $147.Oct 28, 2013

What was Medicare Part B premium in 2015?

How much will Medicare premiums cost in 2015? Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums. The Part B deductible will also remain the same for 2015, at $147.Oct 10, 2014

What is the deductible for Part B 2022?

$233The annual deductible for Medicare Part B will increase by $30 in 2022 to $233, while the standard monthly premium for Medicare Part B will increase by $21.60 to $170.10, CMS announced.Nov 15, 2021

What is the Part A deductible for 2021?

$1,484The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital for 2021 will be $1,484, which is an increase of $76 from $1,408 in 2020.Nov 13, 2020

Does Medicare Part B premium change every year based on income?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

Medicare Part A in 2013

As you probably know, premiums and deductibles for both Medicare Part A and Medicare Part B fluctuate from year to year. The latest round of changes to Medicare premiums, deductibles, and copayments for hospitalization (Part A) and medical care (Part B) takes effect January 1st, 2013.

How do the 2013 changes in Medicare affect you?

2013 Medicare Part A Premium:#N#The decrease in the 2013 Medicare Part A premium will not affect the vast majority of Medicare beneficiaries. Ninety-nine percent of beneficiaries are exempt from paying the Medicare Part A premium because they paid into this amount during their working years.

What is Part B insurance?

Part B includes coverage for: Services from doctors and other health care providers.

How long is the Medigap open enrollment period?

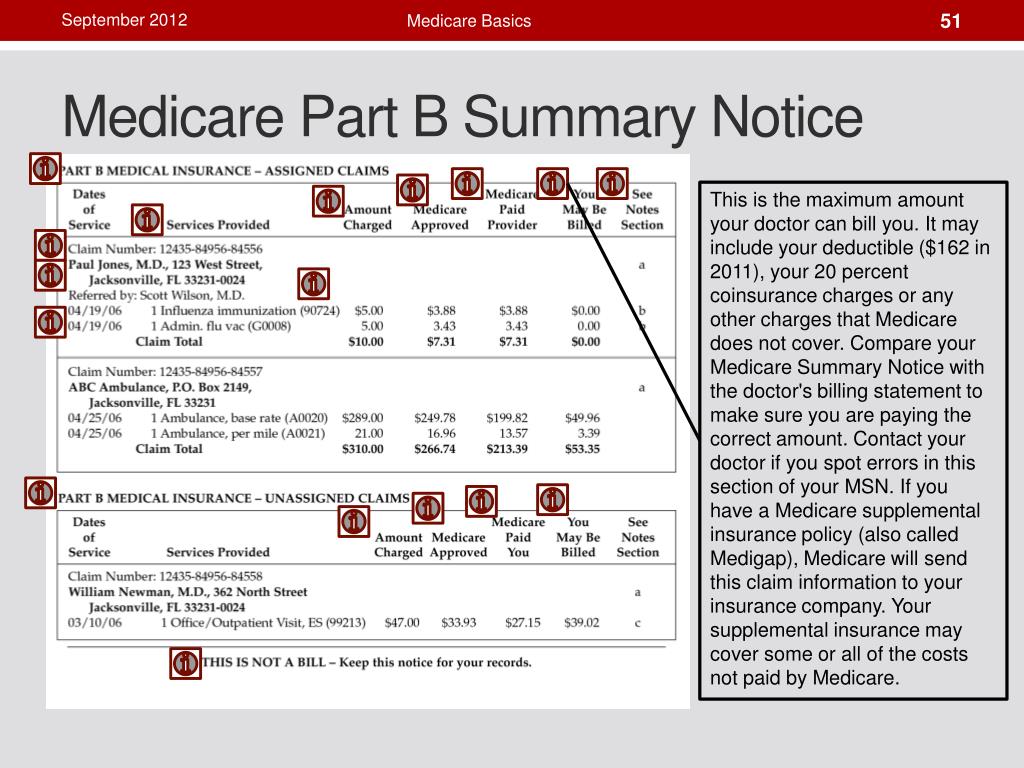

Patients have a one-time 6-month Medigap Open Enrollment Period which starts the first month they are 65 and enrolled in Part B. This period gives patients a guaranteed right to buy any Medigap policy sold in their state regardless of their health status.

2013 Part A (Hospital) Monthly Premium & Deductible

You usually don’t pay a monthly Premium for Part A coverage if you or your spouse paid Medicare taxes while working. If you aren’t eligible for premium-free Part A, you may be able to buy Part A if you meet one of the following conditions:

2013 Part B (Medical) Monthly Premium & Deductible

How Much Does Part B Coverage Cost? You pay the Part B premium each month. Most people will pay up to the standard premium amount.

2013 Part C (Medicare Advantage) Monthly Premium

Medicare Advantage plan premiums*, deductibles, and benefits will depend on the Medicare Advantage plans available in your service area (county or ZIP code). Along with your Medicare Advantage plan premium, you must continue to pay your Part B premium (and Part A premium if you do not receive your Medicare Part A coverage premium-free).

2013 Part D (Medicare Prescription Drug Plan) Monthly Premium & Deductible

Medicare Prescription Drug Plan (Part D) premiums*, deductibles, and benefits vary by plan and state. Remember that you can receive Part D prescription drug coverage from a stand-alone Medicare Part D plan (PDP) or a Medicare Advantage plan that includes drug coverage (MAPD).

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

What is 20% coinsurance?

In this instance, you’d be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%. The coinsurance amount you pay is 20% of the amount Medicare approved. This approved amount is the maximum amount your healthcare provider is allowed to charge you for an item or service. If you refer back to your broken arm example.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What is Medicare Supplement?

Medicare Supplement, or Medigap, insurance plans are sold by private insurance companies to help pay some of the costs that Original Medicare does not. They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. Medicare Advantage. An alternative to Original Medicare, a Medicare ...

What is Medicare Advantage?

Medicare Advantage. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage. Most MA plans will have an annual out-of-pocket maximum limit. Extra Help Program. Finally, the Extra Help program is something low-income Medicare ...

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $148.50 per month. The maximum cost of Medicare Part B coverage is $504.90 per month in 2021, and that's for individuals reporting half a million dollars or more in income in 2019.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,370 in 2021.