How high will the Medicare Part B deductible get?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the monthly premium for Medicare Part B?

The standard monthly premium for Medicare Part B is $148.50 per month in 2021. Some Medicare beneficiaries may pay more or less per month for their Part B coverage. The Part B premium is based on your reported income from two years ago (2019).

Is it mandatory to have Medicare Part B?

Medicare Part B is optional, but in some ways, it can feel mandatory, because there are penalties associated with delayed enrollment. As discussed later, you don’t have to enroll in Part B, particularly if you’re still working when you reach age 65.

Does Medicare Part B cost money?

• Part B Medicare Part B has a monthly premium. The amount you pay depends on your yearly income. Most people pay the standard premium amount of $144.60 (as of 2020) because their individual income is less than $87,000.00, or their joint income is less than $174,000.00 per year.

What is the Medicare deductible for office visits?

Your annual deductible will need to be met before Medicare covers the full 80 percent of medically necessary doctor's visits. In 2020, the deductible for Part B is $198. This represents an increase of $13 from the annual deductible of $185 in 2019.

Does Medicare Part B cover physician expenses?

Medical and other services. Medicare Part B pays 80% of most doctor's services, outpatient treatments, and durable medical equipment (like oxygen or wheelchairs).

What is the Medicare Part B deductible for 2021?

$203 inThe annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

Does Medicare Part B pay 80% of covered expenses?

For most services, Part B medical insurance pays only 80% of what Medicare decides is the approved charge for a particular service or treatment. You are responsible for paying the other 20% of the approved charge, called your coinsurance amount.

What services does Medicare Part B not cover?

But there are still some services that Part B does not pay for. If you're enrolled in the original Medicare program, these gaps in coverage include: Routine services for vision, hearing and dental care — for example, checkups, eyeglasses, hearing aids, dental extractions and dentures.

How much does Medicare Part B pay for physician fees quizlet?

Part B of Medicare pays 80% of physician's fees (based upon Medicare's physician fee schedule) for surgery, consultation, office visits and institutional visits after the enrollee meets a $185 deductible/yr. (2019). Then the patient pays 20% coinsurance of the Medicare approved amount for services.

What will the Medicare Part B deductible be in 2022?

$233The 2022 Medicare deductible for Part B is $233. This reflects an increase of $30 from the deductible of $203 in 2021.

How much will be deducted from my Social Security check for Medicare in 2021?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

What is the Part D deductible for 2022?

$480 inWhat is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.

What is the 2020 Part B deductible?

The Part B deductible increased again for 2017, to $183, and remained unchanged for 2018. For 2019, it increased slightly, to $185. And for 2020, it increased by another $13, to $198. The $5 increase in 2021 pushed it over $200 for the first time, with the 2021 Part B deductible reaching $203.

What percentage does Medicare B pay?

Medicare Part B pays 80% of the cost for most outpatient care and services, and you pay 20%. For 2022, the standard monthly Part B premium is $170.10.

Who pays the 20% of a Medicare B claim?

When an item or service is determined to be coverable under Medicare Part B, it is reimbursed at 80% of a payment rate approved by Medicare, known as the “approved charge.” The patient is responsible for the remaining 20%.

Medicare Part B Deductible – What It Is

Medicare Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. Some people automatically get Medicare Part B (Medical Insurance), and some people need to sign up for Part B

Find Best Medicare Insurance Plan Coverage

There are countless companies looking to sell you Medicare coverage. Only one resource exclusively lets you find local Medicare insurance agents.

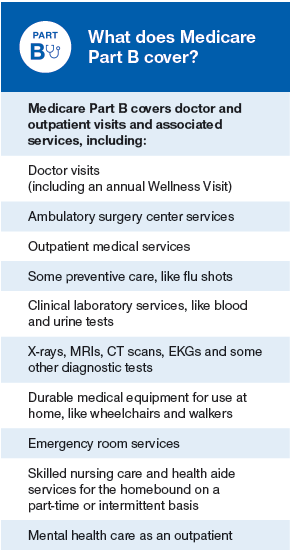

What Does Part B Cover?

Medically necessary services: This includes services or supplies that are needed to diagnose or treat your medical condition. And, they meet accepted standards of medical practice.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

How to know if Medicare will cover you?

Talk to your doctor or other health care provider about why you need certain services or supplies. Ask if Medicare will cover them. You may need something that's usually covered but your provider thinks that Medicare won't cover it in your situation. If so, you'll have to read and sign a notice. The notice says that you may have to pay for the item, service, or supply.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is Medicare Part B?

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is Part B for 2021?

The 2021 Part B total premiums for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, ...

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

Is Medicare Advantage the lowest in 14 years?

The Medicare Advantage average monthly premium will be the lowest in fourteen years (since 2007). Premiums and deductibles for Medicare Advantage and Medicare Part D Prescription Drug plans are already finalized and are unaffected by this announcement.

What Is the 2022 Medicare Part B Deductible?

As mentioned above, the annual Medicare Part B deductible for 2022 is $233. So what exactly does that mean?

How much is Part B medical insurance?

This is the first medical care covered by Part B you have received in 2019. You will be responsible for the full $120 for your appointment since you have not yet satisfied your 2019 Part B deductible. In July, you injure your knee and schedule another appointment with your doctor.

What Are Other Part B Costs in 2022?

There are several types of Part B costs you may face in 2022, such as:

How much coinsurance do you pay for Medicare Part B?

After you reach your Medicare Part B deductible, you will typically pay a 20% coinsurance for all services and items that are covered by Part B for the remainder of 2019.

How much is the $65 out of pocket for Part B?

After the $65 is paid, you have reached $185 in out-of-pocket spending for covered Part B services in 2019. You have reached your deductible and you will now be responsible for any Part B coinsurance charges. There is still $85 remaining for your doctor's visit ($150 total charge minus the $65 you paid out of pocket).

How much is Medicare Part B premium?

2019 Medicare Part B Premium. The standard premium for Medicare Part B in 2019 is $135.50 per month , although some people might pay more than that amount. The Part B premium is based on your reported income from two years prior. So that means your 2019 premiums are based off of your reported income from 2017.

What is the 2019 Medicare premium based on?

So that means your 2019 premiums are based off of your reported income from 2017. Most people pay the standard Part B premium amount, but higher income earners may pay a higher amount called the Income-Related Monthly Adjusted Amount, or IRMAA.

Medicare Deductible: Part A

Medicare Part A benefits include inpatient hospital care, skilled nursing facility care, home health services, and hospice.

How Much Does Original Medicare Cost

You usually do not pay a monthly premium for Part A coverage if you or your spouse paid Medicare taxes while working. For Part B, most people pay a standard monthly premium, but some people may pay a higher Part B premium based on their income.

The Information We Collect And How We Collect It

Personally Identifiable Information. The HealthPlanOne.com website collects two kinds of information that relates to you. The first, and most important to you, is information that is personally identifiable to you. This is information like your name, telephone number, email address, home address and social security number.

What Does Medicare Plan F Cover

Youll need to investigate the different Medigap plans to determine the right one for you. The comparison chart below will help.

An Overview Of Aarp Medicare Supplement Plans

AARP Medicare supplement plans are offered through UnitedHealthcare Insurance. Eligible people use these plans to supplement their Medicare plan if they think that their plan may not provide all the health coverage they need. AARP has offered health plans for its group members for more than 50 years.

Deductibles For Drug Coverage And Medicare Advantage

Deductibles for Medicare Part C, also known as Medicare Advantage plans, and Medicare Part D prescription drug coverage varies based on the plan you purchase. Both Medicare Advantage and Part D plans are sold by private insurers that have contracts with the Medicare program.

What Is Medicare Part B Medical Insurance

Medicare Part B provides outpatient/medical coverage. The list below provides a summary of Part B-covered services and coverage rules:

What percentage of Medicare deductible is paid?

After your Part B deductible is met, you typically pay 20 percent of the Medicare-approved amount for most doctor services. This 20 percent is known as your Medicare Part B coinsurance (mentioned in the section above).

How much is Medicare Part B deductible for 2021?

The Medicare Part B deductible in 2021 is $203 per year. You must meet this deductible before Medicare pays for any Part B services. Unlike the Part A deductible, Part B only requires you to pay one deductible per year, no matter how often you see the doctor. After your Part B deductible is met, you typically pay 20 percent ...

What is a copay in Medicare?

A copay is your share of a medical bill after the insurance provider has contributed its financial portion. Medicare copays (also called copayments) most often come in the form of a flat-fee and typically kick in after a deductible is met. A deductible is the amount you must pay out of pocket before the benefits of the health insurance policy begin ...

How much is Medicare coinsurance for days 91?

For hospital and mental health facility stays, the first 60 days require no Medicare coinsurance. Days 91 and beyond come with a $742 per day coinsurance for a total of 60 “lifetime reserve" days.

What is deductible insurance?

A deductible is the amount you must pay out of pocket before the benefits of the health insurance policy begin to pay.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

What is Medicare approved amount?

The Medicare-approved amount is the maximum amount that a doctor or other health care provider can be paid by Medicare. Some screenings and other preventive services covered by Part B do not require any Medicare copays or coinsurance.

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

How much does Medicare cover if you have met your deductible?

If you already met your deductible, you’d only have to pay for 20% of the $80. This works out to $16. Medicare would then cover the final $64 for the care.

Does Medicare Advantage have coinsurance?

They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage.