Full Answer

Is Medicare Advantage good or bad?

Why choose Medicare Advantage over original Medicare? When relying solely on original Medicare, seniors can incur significant out-of-pocket costs after seeing a doctor or staying at the hospital. This is why many Medicare beneficiaries choose Medicare Advantage plans in order to improve their health care coverage.

Why Choose Medicare Advantage over Medicare?

- Your plan may pay less toward your care. ...

- The fees for health services may be higher. ...

- Any amount you pay might not contribute to your plan deductible, if you have one.

- You may need preauthorization for any services you receive in order for any coverage to apply.

How to find doctors who accept your Medicare Advantage plan?

Medicare Advantage plans are certainly worth the zero-dollar premium; however, it’s your choice to decide if the coverage is right. The value of an Advantage plan depends on your location, healthcare needs, budget, and preferences.

Is Medicare Advantage worth it?

Who should buy a Medicare Advantage plan?

Why Should I Choose Medicare Advantage? A Medicare Advantage plan covers some of the gaps of Original Medicare (Part A and Part B) and usually offers a $0 premium through a private company. It can be an affordable option for patients who are not currently sick or in need of intense medical care.

What is the biggest disadvantage of Medicare Advantage?

The takeaway There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling. Whether you choose original Medicare or Medicare Advantage, it's important to review healthcare needs and Medicare options before choosing your coverage.

What is the point of a Medicare Advantage plan?

A Medigap policy is private insurance that helps supplement Original Medicare. This means it helps pay some of the health care costs that Original Medicare doesn't cover (like copayments, coinsurance, and deductibles).

What percent of seniors choose Medicare Advantage?

[+] More than 28.5 million patients are now enrolled in Medicare Advantage plans, according to new federal data. That's up nearly 9% compared with the same time last year. More than 40% of the more than 63 million people enrolled in Medicare are now in an MA plan.

Can I switch from a Medicare Advantage plan back to Original Medicare?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Do Medicare Advantage plan premiums increase with age?

The way they set the price affects how much you pay now and in the future. Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

Why should I get an Advantage plan?

Advantage plans provide the benefits of Part A and B, and most also include Part D, or prescription drug coverage. Some offer extra benefits not available through Original Medicare, such as fitness classes or vision and dental care.

What is the biggest difference between Medicare and Medicare Advantage?

With Original Medicare, you can go to any doctor or facility that accepts Medicare. Medicare Advantage plans have fixed networks of doctors and hospitals. Your plan will have rules about whether or not you can get care outside your network. But with any plan, you'll pay more for care you get outside your network.

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Are Medicare Advantage plans becoming more popular?

In 2005, 13 percent of enrollees chose the MA option, and the growth has been steady ever since; enrollment in Advantage plans rose 10 percent between 2020 and 2021 alone.

Do most people choose Original Medicare or Medicare Advantage?

Most Medicare recipients still choose the original program, but in 2019, 34% of Medicare beneficiaries opted to enroll in Medicare advantage. In 2016, 29% of new Medicare beneficiaries chose an Advantage plan during the first year of enrollment.

What if I can't join Medicare Advantage?

If you can’t join a Medicare Advantage plan, you have other options for getting quality, affordable health coverage that includes more than just the basics of Original Medicare. Each of the alternatives to Medicare Advantage listed below is considered a two-payer method of health coverage (Medicare and the other form of insurance are each called a “payer”). Before you read about alternatives, you can learn the basics about how Medicare works with other forms of insurance on the CMS website.

How much does Medicare Advantage cost?

The average Medicare Advantage enrollee who gets prescription drug coverage pays just $36 for their health plan premium (s). This is a very reasonable cost, and many seniors would be willing to pay even more than that if it meant quality coverage. However, it’s important to remember that to get Medicare Advantage, seniors also need to pay their Original Medicare premiums. Most seniors will owe a Part B premium of approximately $145 and a Part A premium of $0 in 2020. However, those with high incomes and those who did not pay into the Medicare system via taxes for an extended period of time while they worked may have higher premiums for Parts A or B.

What is Medicare with Medigap?

Original Medicare with Medigap: Medigap is supplemental insurance offered by private companies that is designed to cover Medicare deductibles, copays, and coinsurance. Coverage for these items can be partial or full, depending on the plan. Seniors pay a monthly premium in exchange for the Medigap policy covering many of their out-of-pocket expenses. There are several kinds of Medigap plans which are heavily regulated by the federal and state governments. Learn more about plan types here .

What is ESRD in Medicare?

End-Stage Renal Disease (ESRD, kidney failure) is the final stage of kidney disease in which a patient becomes dependent on dialysis and needs a transplant. Kidney disease leading to ESRD can be caused by a variety of factors including uncontrolled diabetes, high blood pressure, genetic diseases, autoimmune disorders, and more. Those who are diagnosed with ESRD have special opportunities to join Original Medicare even if they otherwise would not be old enough. You can read about how ESRD affects Original Medicare eligibility if you’d like to learn more. Despite the increased likelihood of being eligible for Original Medicare, however, those who have ESRD have unusually limited opportunities to join a Medicare Advantage plan.

How many stars are Medicare Advantage plans?

Medicare has created a rating system so that patients can see how Medicare Advantage plans perform. A plan rating, which is always between one and five stars, can be clearly seen on the right-hand corner of the plan details on the plan finder. According to a recent CMS study, 81% of Medicare Advantage enrollees are in plans that have a rating of four stars or better in 2020. If you’re looking for a plan in your area, and you realize that the only plans available have ratings of three stars or lower, you’ll want to think seriously about whether or not those plans will be valuable to you.

Does Medicare cover mental health?

According to a 2012 study, about one in five seniors struggle with a mental illness and/or a substance use disorder. In many cases, poor health and problems with mobility, chronic pain, and social isolation can exacerbate underlying mental health and substance abuse issues. Original Medicare, in recognition of mental health struggles in older populations, provides many options for mental healthcare, including depression screenings, wellness visits, psychotherapy, and more. For many patients, the level of mental health care provided by Original Medicare may be enough. However, for seniors who have had serious, chronic difficulty with managing their mental health successfully, turning to a Medicare Advantage Chronic Condition Special Needs Plan (C-SNP) may offer the extra support required.

Does Medicare cover prescriptions?

Original Medicare covers very few prescription drugs. Part B of Original Medicare covers prescriptions that are typically given in the doctor’s office- things like specialized infusions, injections, antigens, and blood-clotting medication. However, it does not usually cover medications that one takes at home on a regular basis. With 45% of seniors in 2019 who were in fair to poor health saying that they found paying for their prescription drugs “difficult,” it’s clear that many seniors need help with purchasing prescriptions. Seniors in need can find relief through Medicare Advantage plans, which, unlike Original Medicare, frequently include robust drug coverage (Part D).

In a Nutshell

Medicare Advantage (also known as Medicare Part C) is offered through private insurance companies. If you’ve already enrolled in Medicare Part A and Part B, then you qualify for a Medicare Advantage plan. The main benefits of it, is that it includes medical and hospital cover, plus additional coverages and perks.

Why Sign Up for Medicare Advantage?

There are many advantages to Medicare Advantage, and these are things that you need to consider in your decision to make use of the plan. Some of these advantages are instead of having to pay for two types of coverage (as you would have to with the original Medicare), all your coverage options are in one convenient plan.

Why You Might Not Want a Medicare Advantage

However, as with most things in this world, there are a few disadvantages that you need to be aware of. For example, you may be limited to the providers that you can see (depending on the plan that you are on). The other issue with this is that you may face a higher fee if you choose to go to an out-of-network provider.

The two key factors why people select Medicare Advantage plans

Medicare advantage plans present an budget friendly substitute. One of the primary selling factors that Medicare Advantage Plans have is the fairly low premium. As the federal government subsidies these types of plans, depending on the insurer, monthly premiums for MAP policies commence at as little as $0/month.

Medicare Advantage HMO, PPO, PFFS Plans

Typically, Medicare advantage plans come as Medicare Health Maintenance Organizations ( HMO) and Medicare Preferred Provider Organizations (PPO). Each plan has a network of doctors and hospitals. The insurer has negotiated the fees with the network providers, and the plan subscribers must use these health care providers in order to be covered.

What is Medicare Advantage Plan?

A Medicare Advantage Plan is intended to be an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies that contract with Medicare to provide Part A and Part B benefits, and sometimes Part D (prescriptions). Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, ...

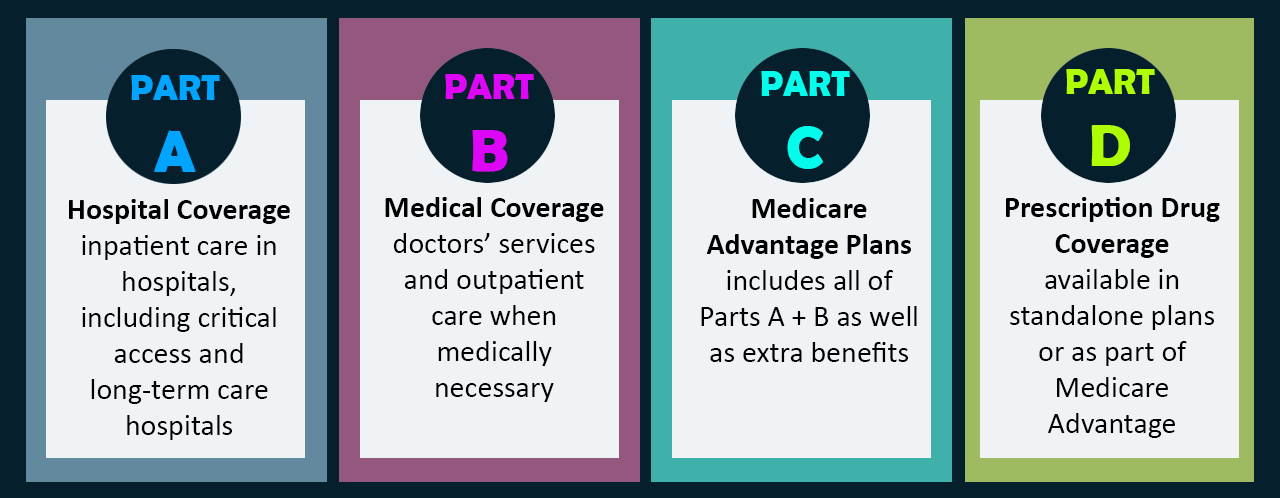

What is Medicare Part A?

Original Medicare. Original Medicare includes Part A (hospital insurance) and Part B (medical insurance). To help pay for things that aren't covered by Medicare, you can opt to buy supplemental insurance known as Medigap (or Medicare Supplement Insurance). These policies are offered by private insurers and cover things that Medicare doesn't, ...

Can you sell a Medigap plan to a new beneficiary?

But as of Jan. 2, 2020, the two plans that cover deductibles—plans C and F— cannot be sold to new Medigap beneficiaries.

Do I have to sign up for Medicare if I am 65?

Coverage Choices for Medicare. If you're older than 65 (or turning 65 in the next three months) and not already getting benefits from Social Security, you have to sign up for Medicare Part A and Part B. It doesn't happen automatically.

Does Medicare cover vision?

Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, and dental. You have to sign up for Medicare Part A and Part B before you can enroll in Medicare Advantage Plan.

Does Medicare automatically apply to Social Security?

It doesn't happen automatically. However, if you already get Social Security benefits, you'll get Medicare Part A and Part B automatically when you first become eligible (you don't need to sign up). 4. There are two main ways to get Medicare coverage: Original Medicare. A Medicare Advantage Plan.

Do I need Part D if I don't have Medicare?

Be aware that with Original Medicare and Medigap, you will still need Part D prescription drug coverage, and that if you don't buy it when you first become eligible for it—and are not covered by a drug plan through work or a spouse—you will be charged a lifetime penalty if you try to buy it later. 5.

How many people will be in Medicare Advantage in 2021?

Still, people are increasingly opting for Medicare Advantage plans. In 2021, 26.9 million beneficiaries are expected to be enrolled in Medicare Advantage. That's almost a 10 percent increase over the 24.4 million currently enrolled.

How much more likely are seniors to receive Medicare?

The study found seniors with traditional Medicare were 4.9 percent more likely to receive top care compared to those in a low-rated Medicare Advantage plan and 2.8 percent more likely to receive top care compared to those in a high-rated Medicare Advantage plan. Advertisement. Originally Published: Feb 18, 2020.

How much will Medicare cost in 2021?

Medigap premiums differ by insurer, age, location and plan selected, so retirees could pay an average of between $40 and nearly $1,000, for 2021 premiums according to Healthline. Medicare Advantage plan s, also offered by private insurers, provide all of the same benefits as Medicare ...

Does Medicare pay for dental?

But there is no coverage for drugs, dental, vision or hearing.

Does Medicare have a maximum out of pocket limit?

And while Medicare Advantage plans do set maximum out-of-pocket limits, Price says most people will never hit them. Before making any decision on coverage, though, it's always wisest to consult with a Medicare specialist who can help determine your best option.

Is Medicare Part D cheaper than Medigap?

But perhaps the biggest selling point to consumers: These plans are typically much cheaper than Medigap.

Can you choose your doctor with Medicare Advantage?

Medicare Advantage plans often involve health care networks (think HMOs or PPOs), so you may not be able to choose your physician or hospital. And if you elect to go elsewhere anyway, you may have to pay the entire bill yourself. You also generally need to make a copayment for every treatment.

Best of the Blues: Highmark

Service area: Available in Delaware, New York, Pennsylvania and West Virginia.

How to shop for Medicare Advantage plans

The right Medicare Advantage plan for you will depend on your health history, prescription medications and where you live, among other things. Here are some strategies for selecting the best plan:

How many Medicare Advantage options are there?

The average Medicare beneficiary has access to 28 Medicare Advantage options, with varying networks, coverage, deductibles, copays and co-insurance, according to the Kaiser Family Foundation. In general, though, Medicare Advantage costs less upfront and potentially more overall if you need lots of medical care.

How much is Medicare premium in 2020?

Monthly premiums vary as well but average $32.74 in 2020. Traditional Medicare has deductibles, copays and coinsurance that can quickly add up. To cover these gaps, private insurers also offer supplemental plans known as Medigap.

What is the alphabet soup of Medicare?

Medicare’s alphabet soup. The first hurdle many people face when deciding about Medicare coverage is simply understanding how the various parts fit together. Traditional Medicare, also known as original Medicare, has two parts: Part A covers hospitalization and is typically premium-free.

Does Medicare Advantage cover dental?

In addition, the plans typically cover certain expenses that Medicare doesn’t, such as hearing, vision and dental care. Most Medicare Advantage enrollees in 2020 paid no additional premiums ...

Is Medicare Advantage a poor choice?

That means the insurer may charge you more, exclude preexisting conditions for a time or not issue you a policy at all. That doesn’t mean Medicare Advantage plans are a poor choice — just a complicated one, says Tatiana Fassieux, a training specialist with California Health Advocates, a Medicare advocacy nonprofit.

Does Medicare Advantage pay additional premiums?

Most Medicare Advantage enrollees in 2020 paid no additional premiums for their coverage, other than their regular Part B premiums, according to the Kaiser Family Foundation, a health research group.

Can you choose a doctor who accepts Medicare?

The plans are known by letters A through N. As with traditional Medicare, you can choose any doctor who accepts Medicare. If you apply for a Medigap policy when you’re first eligible for Medicare, the insurer has to accept you and can’t charge more for preexisting conditions.