Part D Notices, or notices of “Creditable Coverage,” are simply an official document given to an employee from their employer (or union) that states whether their prescription drug coverage plan is equal to or better than the prescription drug coverage provided through Medicare.

Full Answer

What are the rules of Medicare Part D?

Notice of Creditable Coverage | Medicare Notice of Creditable Coverage What is it? You'll get this notice each year if you have drug coverage from an employer/union or other group health plan. This notice will let you know whether or not your drug coverage is “creditable.” When should I get it? September Who sends it? Employer/union plans

What are the requirements for Medicare Part D?

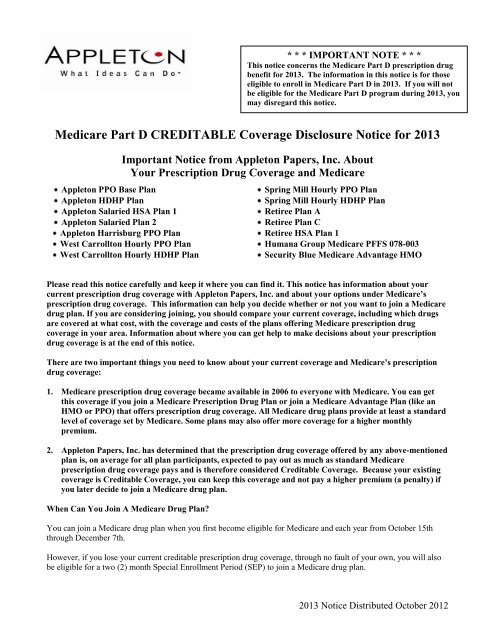

Medicare Part D: Creditable Coverage Disclosure Notices Employers with group health plans that provide prescription drug coverage to individuals who are eligible for Medicare Part D must comply with certain disclosure requirements. Group health plan sponsors must disclose to individuals who are eligible for

What you should know about Medicare Part D?

Jun 15, 2005 · The Medicare Modernization Act (MMA) requires entities (whose policies include prescription drug coverage) to notify Medicare eligible policyholders whether their prescription drug coverage is creditable coverage, which means that the coverage is expected to pay on average as much as the standard Medicare prescription drug coverage. For these entities, …

Who is eligible for Medicare Part D?

Aug 05, 2021 · What is the purpose of the notice? It lets employees know whether the employer’s plan has prescription drug coverage that is at least as good (that is “Creditable”), or is not as good (that is “Non-Creditable”), as the prescription drug coverage under a Medicare Part D plan. The purpose is to give an employee who is eligible to enroll in Medicare Part D the ability to …

Who should receive the Medicare Part D creditable coverage notice?

Employers must provide creditable or non-creditable coverage notice to all Medicare eligible individuals who are covered under, or who apply for, the entity's prescription drug plan (Part D eligibles), whether active employees or retirees, at least once a year.

What is a Notice of Creditable prescription drug coverage?

What is it? You'll get this notice each year if you have drug coverage from an employer/union or other group health plan. This notice will let you know whether or not your drug coverage is “creditable.”

What is the purpose of the Medicare Part D notice?

Medicare Part D notices must be provided to all Medicare Part D eligible individuals who are covered under or who apply for the plan's prescription drug coverage. The Medicare Part D notice is utilized to inform individuals about the plan's prescription drug coverage status for the next calendar year.Sep 1, 2020

How do I prove Medicare Part D creditable coverage?

Under §423.56(a) of the final regulation, coverage is creditable if the actuarial value of the coverage equals or exceeds the actuarial value of standard prescription drug coverage under Medicare Part D, as demonstrated through the use of generally accepted actuarial principles and in accordance with CMS actuarial ...

Can Medicare Part D notices be emailed?

CMS allows employers to send Medicare Part D notices electronically and has stated that employers who follow the general electronic disclosure rules set by the U.S. Department of Labor (DOL) for other group health plan information will be deemed to have met their Medicare Part D Notice obligations.Sep 3, 2021

Can creditable coverage notice be emailed?

Notices of creditable/non-creditable coverage may be included in annual enrollment materials, sent in separate mailings or delivered electronically.

Who provides a letter of creditable coverage?

A certificate of Creditable Coverage (COCC) is a document provided by your previous insurance carrier that proves that your insurance has ended. This includes the name of the member to whom it applies as well as the coverage effective date and cancelation date.Jul 12, 2018

How do I know if I have creditable coverage?

A group health plan's prescription drug coverage is considered creditable if its actuarial value equals or exceeds the actuarial value of standard Medicare Part D prescription drug coverage. Prescription drug coverage that does not meet this standard is called “non-creditable.”Sep 12, 2018

What is the annual creditable coverage disclosure notice?

Creditable Coverage Model Notice Letters Entities that provide prescription drug coverage to Medicare Part D eligible individuals must notify these individuals whether the drug coverage they have is creditable or non-creditable.Dec 1, 2021

Which of the following are creditable coverage?

Creditable coverage is a health insurance or health benefit plan that meets a minimum set of qualifications. Some examples include group and individual health plans, student health plans, and government-provided plans.

What is not considered creditable coverage?

If your coverage is through an employer with at least 20 employees, it is considered creditable for Medicare. If the coverage is through an employer with fewer than 20 employees or through the Marketplace, it is not creditable.

What are the 4 phases of Medicare Part D coverage?

The Four Coverage Stages of Medicare's Part D ProgramStage 1. Annual Deductible.Stage 2. Initial Coverage.Stage 3. Coverage Gap.Stage 4. Catastrophic Coverage.Oct 1, 2021

What is creditable coverage?

The Medicare Modernization Act (MMA) requires entities (whose policies include prescription drug coverage) to notify Medicare eligible policyholders whether their prescription drug coverage is creditable coverage, which means that the coverage is expected to pay on average as much as the standard Medicare prescription drug ...

How long does Medicare have to be in effect to be late?

The MMA imposes a late enrollment penalty on individuals who do not maintain creditable coverage for a period of 63 days or longer following their initial enrollment period for the Medicare prescription drug benefit.

How long does it take to complete a CMS 2nd disclosure?

The Disclosure should be completed annually no later than 60 days from the beginning of a plan year (contract year, renewal year), within 30 days after termination ...

When is Medicare Part D notice?

Medicare Part D Notices – An Overview for Employers. Employers and their group health plan sponsors will want to mark October 15, 2020 on their calendars. This is the deadline for plan sponsors to disclose to individuals who are eligible for Medicare Part D and to the Centers for Medicare and Medicaid Services ...

What is a Part D notice?

Part D Notices, or notices of “Creditable Coverage,” are simply an official document given to an employee from their employer (or union) that states whether their prescription drug coverage plan is equal to or better than the prescription drug coverage provided through Medicare. The purposes of these notices is to help beneficiaries of the plan make the best decision for their prescription health coverage moving forward.

What is a model notice of non-creditable coverage?

Fortunately, the CMS has provided two model notices that employers can use: A model notice of creditable coverage when the health plan’s prescription drug coverage IS creditable. ( click here to access this model). A model notice of non-creditable coverage when the health plan’s prescription drug coverage IS NOT creditable ...

What is CMS notice?

The Centers for Medicare and Medicaid Services (CMS) provide sample notices that employers should consider using. Employers should work with their group health plan sponsors to ensure that these notices are delivered at the right time – which might end up being more frequently than you think.

What is creditable coverage?

What Exactly Does “Creditable Coverage” Mean, and How Is It Related to Medicare Part D? “Creditable Coverage” is a term that involves two simple words, but most people have a hard time understanding what exactly it means in the world of Medicare.

Is electronic notice compliant?

Electronic notices can be compliant as well, assuming the employee has regular access to the electronic documents at their regular place of work. From an official perspective, the Department of Labor (DOL) has three requirements for electronic delivery of Part D Notices:

Can Part D be included in new enrollment materials?

Part D notices can even be included in new enrollment materials for employees. It is important for employers to understand the rules about printed notices and electronic notices. A single printed notice may be delivered to an address, even if multiple beneficiaries of the plan live at that address. However, if it is known that a beneficiary ...

How much is a deductible for integrated health insurance?

For employers that have integrated prescription drug and health coverage, the integrated health plan has no morethan a $250 deductible per year, has no annual benefit maximum or a maximum annual benefit of at least $25,000 andhas no less than a $1,000,000 lifetime combined benefit maximum.

When is Medicare Part D disclosure required?

As an employer, you are required to send the Medicare Part D Disclosure to eligible employees informing them about whether the prescription drug coverage offered is "creditable" by October 15, 2020. Read through the Frequently Asked Questions below for more information on the disclosure requirements.

When does Medicare Part D end?

Before an individual’s initial opportunity to enroll in Part D (generally satisfied by the. requirement to provide notice to all Medicare-eligible employees prior to October 15); Before the effective date of coverage for any Medicare-eligible individual who joins your plan; When, if ever, your plan’s prescription drug coverage ends ...

Do you have to report a drug plan to CMS?

A: Yes, CMS requires you to disclose the creditable coverage status of your prescription drug plan using the online portal at CMS.gov. Please note you must report to CMS within 60 days after the beginning of your plan year and within 30 days after either your prescription drug plan terminates or changes its creditable coverage status. ...

Do you have to review your prescription drug plan?

A: You must annually review your prescription drug plan using generally accepted actuarial principles and following Centers for Medicare and Medicaid Services (CMS) guidelines. Typically carriers will perform this analysis for fully insured plans.

Who must provide a creditable coverage notice to Medicare?

A: You must provide a creditable coverage notice to all Medicare eligible individuals who are covered under, or apply for, your prescription drug plan. This requirement applies to active Medicare beneficiaries and those who are retired, as well as Medicare-eligible spouses who are covered as actives or retirees.

Can I send a CMS notice to my spouse?

A: Yes, use one of the CMS notices and send to all your employees via mail or email. You can customize the sample notices with your company name/carrier/contact information. We suggest sending it to all employees, since you might not know whether a spouse is Medicare eligible and an individual’s status may change unexpectedly, e.g., due to disability.