CMS Part D 2013 Standard Benefit Model Plan Details

| Part D Standard Benefit Design Parameter ... | 2013 | 2012 | 2011 | 2010 |

| Deductible - (after the Deductible is me ... | $325 | $320 | $310 | $310 |

| Initial Coverage Limit - Coverage Gap (D ... | $2,970 | $2,930 | $2,840 | $2,830 |

| Total Covered Part D Drug Out-of-Pocket ... | $6,733.75 (1) plus a 52.50% brand discou ... | $6,657.50 (1) plus a 50% brand discount | $6,447.50 (1) plus a 50% brand discount | $6,440.00 plus a $250 rebate |

What is a Medicare Part D deductible?

The Medicare Part A deductible will increase from $1,156 per benefit period to $1,184 per benefit period in 2013. 2013 Medicare Part A Copayments: The cost of spending 61-90 days in the hospital will be $296 per day, which is a $7 increase. If you are in the hospital 91-150 days, the per-day Medicare Part A copayment in 2013 is $592, a $14 increase from 2012. After 150 days, …

What is the Medicare Part D deductible in 2021?

9 rows · begins once you reach your Medicare Part D plan’s initial coverage limit ($2,970 in 2013) ...

What is the annual deductible for Medicare drug plans?

Apr 16, 2020 · According to research by the Kaiser Family Foundation, 86% of stand-alone Part D prescription drug plans have an annual deductible. Of those, 69% use the $435 maximum established by CMS. If you get your Medicare Part D coverage through a Medicare Advantage plan, you may not pay a deductible.

Is there a dollar limit for Medicare Part D?

Part D standard benefit model Initial Part D deductible – can be as high as $325 which is up from $320 for 2012 plans. Initial coverage limit – will be set at $2970 up from $2930 for 2012 plans. Out-of-pocket threshold amount – increases to $4750 from $4700 in 2012.

What was the Medicare deductible for 2013?

This will increase to $1,184 in 2013, up from $1156 this year (an increase of 2.4%). Medicare Part B Deductible: The deductible will increase to $147 in 2013, from $140.Nov 16, 2012

What was the Medicare deductible for 2014?

$1,216The Medicare Part A deductible that beneficiaries pay when admitted to the hospital will be $1,216 in 2014, an increase of $32 from this year's $1,184 deductible. The deductible covers beneficiaries' costs for up to 60 days of Medicare-covered inpatient hospital care in a benefit period.Oct 28, 2013

What is the Medicare Part D deductible?

The Medicare Part D deductible is the amount you most pay for your prescription drugs before your plan begins to pay. The amount of the Medicare Part D deductible can vary from plan, but Medicare dictates that it can be no greater than $445 a year in 2021. Some plans don't have a deductible.

What is the 2022 Medicare Part D deductible?

$480 inWhat is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.Mar 23, 2022

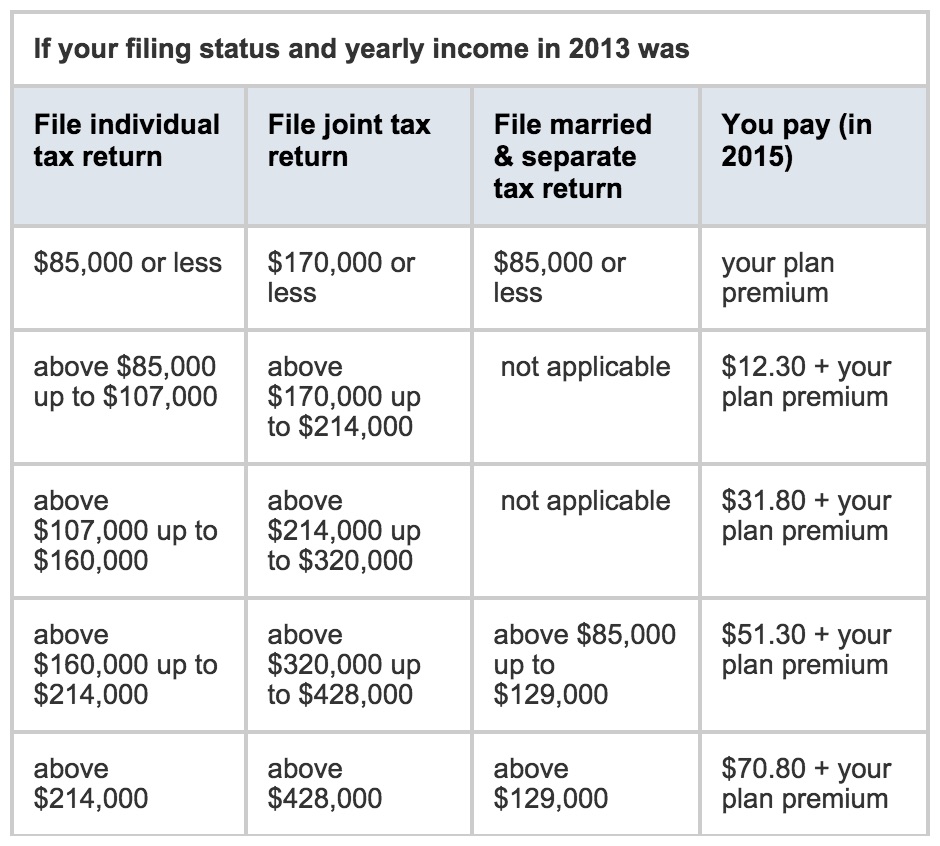

What were Medicare premiums in 2015?

2015 Part B (Medical) Monthly Premium & DeductibleIf Your Yearly Income is$85,000 or below$170,000 or below$104.90*$85,001 - $107,000$170,001 - $214,000$146.90*$107,001 - $160,000$214,001 - $320,000$209.80*$160,001 - $214,000$320,001 - $428,000$272.70*3 more rows

What was Medicare Part B premium in 2015?

How much will Medicare premiums cost in 2015? Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums. The Part B deductible will also remain the same for 2015, at $147.Oct 10, 2014

What is the 2021 Medicare Part D deductible?

$445Share on Pinterest In 2021, the maximum deductible for Medicare Plan D is $445. Medicare Part D helps pay for brand name and generic drugs that have been prescribed by a doctor. A person must have original Medicare, parts A and B, to be eligible for a PDP.Jul 14, 2020

Do all Medicare Part D plans have the same deductible?

Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $480 in 2022. Some Medicare drug plans don't have a deductible.

How do plan D deductibles work?

The deductible is the amount a beneficiary must pay for covered drugs before the plan starts to pay. The full cost of the drug determines how much a beneficiary must pay when the plan has a deductible. In other words, one pays the full cost for drugs subject to a deductible until the designated amount is met.Mar 9, 2021

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the Best Medicare Plan D for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

What is the max out-of-pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000, while under H.R. 19 and the Senate Finance bill, the cap would be set at $3,100 (both amounts exclude the value of the manufacturer price discount).Jul 23, 2021

Do I Need A Medicare Part D Plan?

If you have Original Medicare (Part A and Part B) and want prescription drug coverage for prescription drugs you take at home, you will likely have...

What Is The Medicare Deductible For A Medicare Part D Plan?

A Medicare deductible is the amount you must pay each year for your prescription drugs before your Medicare Part D Prescription Drug Plan begins to...

How Else Do Stand-Alone Medicare Part D Plans differ?

Unlike Medicare Part D deductibles, Medicare doesn’t set a dollar limit for Medicare Part D premiums. Your plan sets the amount for your monthly pr...

Medicare Part A in 2013

As you probably know, premiums and deductibles for both Medicare Part A and Medicare Part B fluctuate from year to year. The latest round of changes to Medicare premiums, deductibles, and copayments for hospitalization (Part A) and medical care (Part B) takes effect January 1st, 2013.

How do the 2013 changes in Medicare affect you?

2013 Medicare Part A Premium:#N#The decrease in the 2013 Medicare Part A premium will not affect the vast majority of Medicare beneficiaries. Ninety-nine percent of beneficiaries are exempt from paying the Medicare Part A premium because they paid into this amount during their working years.

Increasing Medicare premiums and deductibles to impact some more than others

If you have been enrolled in Medicare for sometime you know that premiums and deductibles increase annually and 2013 is no different.

Medicare Premiums for 2013

Most people will be subject to the standard Part B premium and will have a $5 increase or $60 per year. People with higher taxable income will see rates increasing proportionally.

Progressive Part B premiums bring mixed opinions

Some people would say that it’s fair for people with higher incomes to pay higher Part B premiums while others say it’s a government money grab.

CMS Part D 2013 Standard Benefit Model Plan Details

Here are the highlights for the CMS defined Standard Benefit Plan changes from 2012 to 2013. The chart below shows the Standard Benefit design changes for plan years 2009, 2010, 2011, 2012 and 2013. This "Standard Benefit Plan" is the minimum allowable plan to be offered.

Annual Notice of Change (ANOC) and Other Important Notices to be Sent out Earlier

The 2013 plan year standardized, combined Annual Notice of Change (ANOC) and Evidence of Coverage (EOC) document will be mailed to current members of all Medicare Advantage (MA) plans, Medicare Advantage with Prescription Drug Coverage (MA-PD) plans, Prescription Drug Only (PDP) plans and cost-based plans offering Part D.

2013 Annual Election Period (AEP) and Open Enrollment Period (OEP)

he Annual Election Period (AEP) and Open Enrollment Period (OEP) will begin on October 15, 2012 and end on December 7, 2012. Marketing of Medicare Part D plans will begin on October 1, 2012. Your new Medicare Part D plan will still take effect on January 1, 2013.

Closing the Coverage Gap: 2013 Donut Hole Discounts

In plan year 2013, Medicare beneficiaries who reach the Coverage Gap (Donut Hole) will receive a 21% discount on generic drugs purchased and a 52.5% (50% paid by the drug manufacturer and 2.5% paid by the Medicare Part D plan) discount on brand name drugs.

New 2013 Special Enrollment Period (SEP) to Leave a Consistently Low Rated Medicare Drug or Health Plan

To promote high Medicare Part D and MA plan quality, in 2013, The Centers for Medicare and Medicaid Services (CMS) will alert plan members if their Medicare Part D drug plan or Medicare Advantage health plan has failed for three straight years to achieve at least a 3-star quality rating and offer a Special Enrollment Period (SEP), if desired, that will allow the member to move to a higher quality plan..

2013 Special Enrollment Period (SEP) to Switch to 5-star Medicare Advantage AND Prescription Drug Plans

Beginning in 2012, CMS established a Special Enrollment Period (SEP) to allow Medicare beneficiaries eligible for Medicare Prescription Drug (PDP) Plans or Medicare Advantage (MA & MAPD) plans to switch to a 5-star plan at any point during the year.

2012 Federal Poverty Level Guidelines: LIS Qualification

The 2012 Federal Poverty Level (FPL) Guidelines determine the income level requirements for people applying for the Low Income Subsidy (LIS) program.

What is Medicare Part D?

Medicare Part D plans are private insurance plans. Insurance companies are free to design plan benefits and cost-sharing structures to meet the needs of their members, as long as they follow Medicare’s rules for minimum coverage requirements. Your costs and benefits may be different with each plan available in your area.

What is the maximum deductible for 2020?

The 2020 maximum deductible set by CMS is $435, however, insurers can set their deductible below the limit. According to research by the Kaiser Family Foundation, 86% of stand-alone Part D prescription drug plans have an annual deductible.

When do you enter the coverage gap?

In 2020, you enter the coverage gap once you and your insurance company spend ...

Does Medicare Supplement Insurance cover Part D?

Also remember a Medicare Supplement Insurance Plan doesn’t cover any costs associated with Medicare Part D coverage. Finally, compare pharmacy networks and benefits such as mail-order pharmacies. If you have a preferred pharmacy and it’s not in a plan’s network, you may be happier with a different plan.

Does Medicare cover prescription drugs?

Medicare Part D coverage for prescription drugs is technically optional , but if you enroll in Original Medicare (Part A and Part B), there is very little coverage for prescription medications you take at home. For that reason, most Medicare enrollees choose to buy a Medicare Part D plan to help pay for prescription drugs.

Part D 2013 standard benefit model changes mean greater out-of pocket costs

In today’s economy counting pennies has become important for some people to meet their monthly budgets. With health care costs rising and Social Security cost of living raises non-existent you need to have an affordable Part D drug plan.

Part D standard benefit model

Initial Part D deductible – can be as high as $325 which is up from $320 for 2012 plans.

Help within the Part D donut hole

Thanks to health care reform you will still receive help when you are in the coverage gap. You will pay only 47.5% for brand name drugs and a maximum of 79% for generic drugs.

2013 Part A (Hospital) Monthly Premium & Deductible

You usually don’t pay a monthly Premium for Part A coverage if you or your spouse paid Medicare taxes while working. If you aren’t eligible for premium-free Part A, you may be able to buy Part A if you meet one of the following conditions:

2013 Part B (Medical) Monthly Premium & Deductible

How Much Does Part B Coverage Cost? You pay the Part B premium each month. Most people will pay up to the standard premium amount.

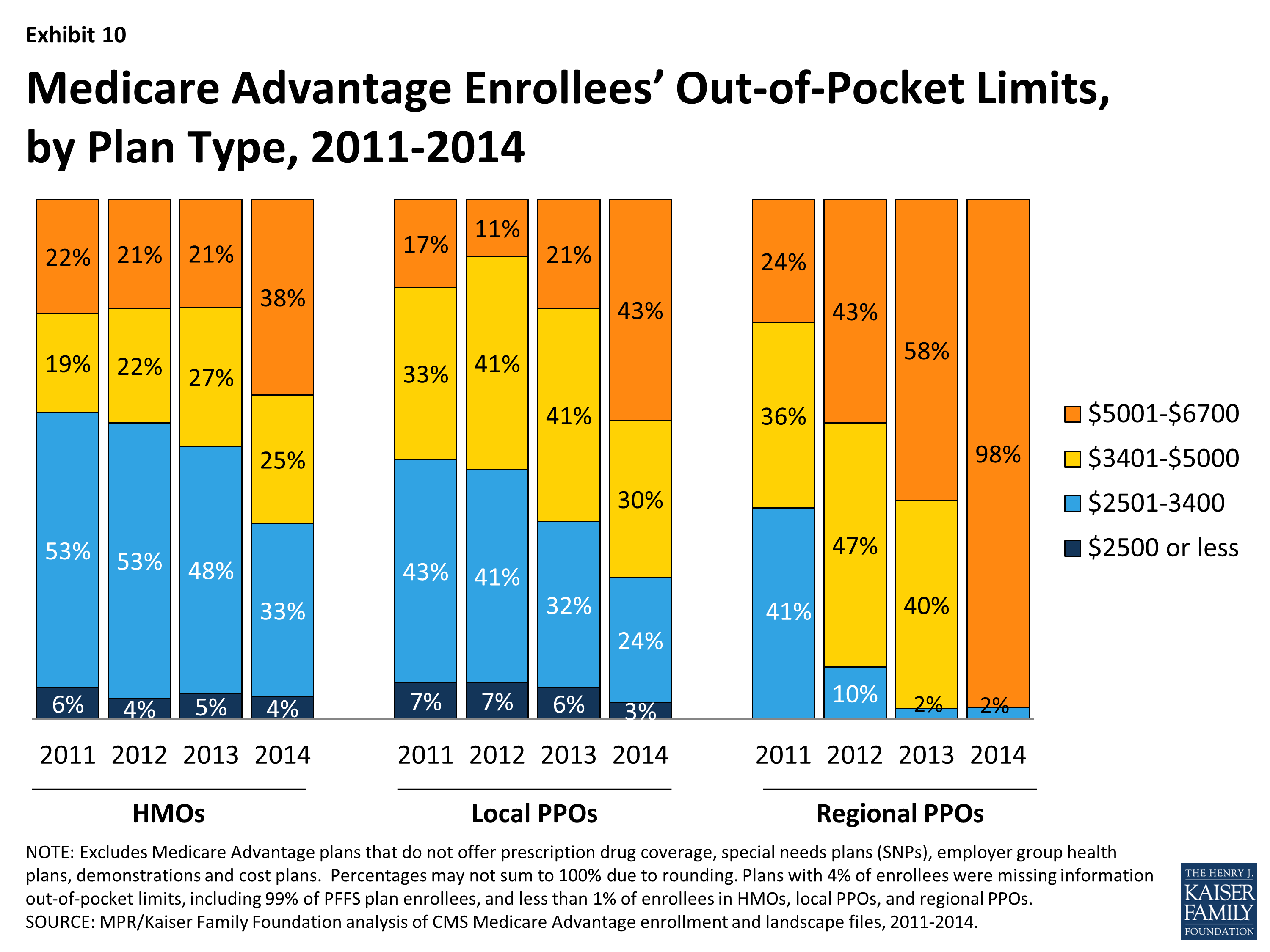

2013 Part C (Medicare Advantage) Monthly Premium

Medicare Advantage plan premiums*, deductibles, and benefits will depend on the Medicare Advantage plans available in your service area (county or ZIP code). Along with your Medicare Advantage plan premium, you must continue to pay your Part B premium (and Part A premium if you do not receive your Medicare Part A coverage premium-free).

2013 Part D (Medicare Prescription Drug Plan) Monthly Premium & Deductible

Medicare Prescription Drug Plan (Part D) premiums*, deductibles, and benefits vary by plan and state. Remember that you can receive Part D prescription drug coverage from a stand-alone Medicare Part D plan (PDP) or a Medicare Advantage plan that includes drug coverage (MAPD).

What are the tiers of Medicare Part D?

Medicare Part D plan prescription drug tiers are usually set such that the lower the tier number , the less expensive the drug, as in the following example:: Tier 1: preferred generic, generally the lowest cost tier. Tier 2: generic, generally cost more than tier 1. Tier 3: preferred brand, generally cost more than tier 2.

What is deductible in Medicare?

You may have various out of pocket costs with Medicare insurance, including copayments, coinsurance, and deductibles. “Deductible” is a common term in insurance. Generally the lower the deductible, the less you are responsible for paying out-of-pocket before your insurance coverage kicks in.

How much is Medicare Part D 2020?

According to 2020 eHealth research, the average deductibles for stand-alone Medicare Part D plans in the study increased from $335 in 2019 to $405 in 2020.*. Some Medicare Part D plans have $0 deductibles, which means you are only responsible for a set copayment or coinsurance amount when you pick up your prescription drugs.

What is tier 5?

Tier 5: specialty tier, generally cost more than tier 4. Tier 6: select care drugs. If you only take generic prescription drugs, for example, you may not be subjected to the deductible in certain plans.