IRMAA is the Income Related Monthly Adjustment Amount added to your Medicare Part B and Medicare Part D premiums. You will only need to pay an IRMAA if your annual modified adjusted gross income (MAGI) exceeds a predetermined amount. In 2003, IRMAA was added as a provision to the Medicare Modernization Act

Medicare Prescription Drug, Improvement, and Modernization Act

The Medicare Prescription Drug, Improvement, and Modernization Act, also called the Medicare Modernization Act or MMA, is a federal law of the United States, enacted in 2003. It produced the largest overhaul of Medicare in the public health program's 38-year history.

What does irmaa stand for in Medicare?

- Medicare. You can contact Medicare directly at 800-Medicare to get information on benefits, costs, and assistance programs like Medicare Savings Programs and Extra Help.

- SSA. To get information about IRMAA and the appeals process, the SSA can be contacted directly at 800-772-1213.

- SHIP. ...

- Medicaid. ...

Does Medicare Part A have a premium?

They differ not only in the Medicare benefits covered but also in how the premiums are determined. Most people eligible for Part A have premium-free coverage. The premium is based on credits earned by working and paying taxes. When you work in the U.S., a portion of the taxes automatically deducted are earmarked for the Medicare program.

What determines your Medicare Part B premium?

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employer’s pension plan.

What does Irma stand for in Medicare?

- You married,

- You divorced, or your marriage was annulled,

- You became a widow or widower,

- You or your spouse stopped working or reduced work hours,

- You or your spouse lost income-producing property due to a disaster or other event beyond your control,

What are the Irmaa brackets for 2021 Part D?

D. IRMAA tables of Part D Prescription Drug coverage premium year for three previous premium yearsIRMAA Table2021More than $165,000 but less than $500,000$70.70 + Plan premiumMore than or equal to $500,000$77.10 +Plan premiumMarried filing jointlyMore than $176,000 but less than or equal to $222,000$12.30 + Plan premium12 more rows•Dec 6, 2021

Is there an Irmaa for Medicare Part D?

IRMAA stands for the Income-Related Monthly Adjustment Amounts. IRMAA can apply to Medicare Part B (medical insurance) and Medicare Part D (prescription drug coverage).

What are the Irmaa brackets for 2020?

IRMAA income brackets generally increased from $1,000 to $3,000 for individual tax filers, and between $2,000 and $6,000 for married couples filing jointly.

What is the Part D Irmaa for 2022?

What is an IRMAA for Medicare?2020 Individual tax return2020 Joint tax return2022 Part D premiumMore than $170,000 up to $500,000More than $340,000 up to $750,000Your plan premium + $71.30More than $500,000More than $750,000Your plan premium + $77.904 more rows•Feb 15, 2022

What are the income brackets for Irmaa Part D and Part B?

How much are Part B IRMAA premiums?Table 1. Part B – 2022 IRMAAIndividualJointMonthly Premium$91,000 or less$182,000 or less$170.10> $91,000 – $114,000> $182,000 – $228,000$238.10> $114,000 – $142,000> $228,000 -$284,000$340.203 more rows

How is the Irmaa calculated?

How Is IRMAA Calculated? The government determines whether you qualify for IRMAA by finding your modified adjusted gross income (MAGI). Your monthly IRMAA payment for each year is determined by your MAGI from two years prior. Your MAGI is your adjusted gross income (AGI) with certain costs added back to it.

Does Social Security income count towards Irmaa?

Some examples of what counts as income towards IRMAA are: Wages, Social Security benefits, Pension/Rental income, Interest, Dividends, distributions from any tax-deferred investment like a Traditional 401(k) or IRA and, again, Capital Gains.

How do you calculate modified adjusted gross income for Irmaa?

That means your 2021 premiums and IRMAA determinations are calculated based on MAGI from your 2019 federal tax return. MAGI is calculated as Adjusted Gross Income (line 11 of IRS Form 1040) plus tax-exempt interest income (line 2a of IRS Form 1040).

How do I avoid Medicare Irmaa?

To avoid getting issued an IRMAA, you can proactively tell the SSA of any changes your income has seen in the past two years using a “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” form or by scheduling an interview with your local Social Security office (1-800-772-1213).

Are Part D premiums based on income?

The income that counts is the adjusted gross income you reported plus other forms of tax-exempt income. Your additional premium is a percentage of the national base beneficiary premium $33.37 in 2022. If you are expected to pay IRMAA, SSA will notify you that you have a higher Part D premium.

What is the Part D deductible for 2022?

$480 inWhat is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.

What is the Part D premium for 2022?

$33Medicare Part D Premium Will Increase in 2022. The Centers for Medicare and Medicaid Services (CMS) recently announced that the projected 2022 Medicare Part D monthly premium will average at $33. This is an increase from $31.47 in 2021.

What is IRMAA?

For Medicare beneficiaries who earn over $91,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to unders...

How is my income used in my IRMAA determination?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax r...

Can I appeal the IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have...

Who does IRMAA apply to?

IRMAA applies to Medicare beneficiaries who have higher incomes. Keep reading to learn more about IRMAA, how it works, and the parts of Medicare that it applies to.

What is an IRMAA?

Takeaway. An IRMAA is a surcharge added to your monthly Medicare Part B and Part D premiums, based on your yearly income. The Social Security Administration (SSA) uses your income tax information from 2 years ago to determine if you owe an IRMAA in addition to your monthly premium. The surcharge amount you’ll pay depends on factors like your income ...

How much is the IRMAA premium for 2021?

In 2021, the standard monthly premium for Part B is $148.50. Depending on your yearly income, you may have an additional IRMAA surcharge. This amount is calculated using your income tax information from 2 years ago. So, for 2021, your tax information from 2019 will be assessed.

How to contact Medicare directly?

SSA. To get information about IRMAA and the appeals process, the SSA can be contacted directly at 800-772-1213.

How many people will be covered by Medicare in 2027?

It’s made up of several parts. In 2019, Medicare covered about 61.5 million Americans and is predicted to increase to 75 million by 2027. Many parts of Medicare involve paying a monthly premium. In some cases, your monthly premium may be adjusted based on your income.

What is Medicare Part C?

Medicare Part C. Part C is also referred to as Medicare Advantage. These plans often cover services that original Medicare (parts A and B) don’t cover, such as dental, vision, and hearing. Part C is not affected by IRMAA.

What is a Part D insurance plan?

Part D is prescription drug coverage. Like Part C plans, Part D plans are sold by private companies. Part D is affected by IRMAA. As with Part B, a surcharge can be added to your monthly premium, based on your yearly income. This is separate from the surcharge that can be added to Part B premiums.

What is IRMAA Part D?

For Part D, the IRMAA amounts are added to the regular premium for the enrollee’s plan (Part D plans have varying prices, so the full amount, after the IRMAA surcharge, will depend on the plan).

What is IRMAA Medicare?

What is IRMAA? For Medicare beneficiaries who earn over $88,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to understand the income-related monthly adjusted amount (IRMAA), which is a surcharge added to the Part B and Part D premiums.

What is the Medicare surcharge for 2021?

This means that for your 2021 Medicare premiums, your 2019 income tax return is used. This amount is recalculated annually. The IRMAA surcharge will be added to your 2021 premiums if your 2019 income was over $88,000 (or $176,000 if you’re married), but as discussed below, there’s an appeals process if your financial situation has changed.

How is IRMAA determined?

IRMAA is determined by income from your income tax returns two years prior. How IRMAA affects Part B premiums depends on your household income. IRMAA surcharges are added to you Part D premiums. You can appeal your IRMAA determination if you believe the calculation was erroneous. The SECURE Act of 2019 could further affect your premiums.

What is IRMAA in Social Security?

The income used to determine IRMAA is a form of Modified Adjusted Gross Income (MAGI), but it’s specific to Medicare.

What age can you contribute to an IRA?

The SECURE Act has a number of different features – such as allowing IRA contributions after age 70½ if you’re still earning an income – and it extends the minimum age that one must receive RMDs (Required Minimum Distributions) from 70½ to 72. Note that those who are already at least 70½ must continue to receive RMDs.

Can I appeal an IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have had a life-changing event such as a loss of income or divorce, then you can refile or you can file for a redetermination using Form SSA-44.

How to appeal an IRMAA?

If you want to appeal your IRMAA, you should visit the Social Security website for the form called Request for Reconsideration. The form will give you three options on how to appeal, with the easiest and most common way being a case review. Documentation is an essential thing in any appeal.

How does Social Security determine if you owe an IRMAA?

The Social Security Administration determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior. If you feel you’re higher Part B premium is incorrect, there are steps you can take to appeal IRMAA.

How to request a new initial determination for Medicare?

You can request a new initial determination by submitting a Medicare IRMAA Life-Changing Event form. You can also schedule an appointment with Social Security. Documentation will be required with either your correct income or of the life-changing event that caused your income to go down.

What is modified adjusted gross income?

Your Modified Adjusted Gross Income amount is made up of your total adjusted gross income in addition to any tax-exempt interest income. On your IRS Form 1040, these are line items 37 and 8b; if you are unsure of your MAGI, you can quickly figure it out by looking at your tax return records. Income examples that you may have reported on your tax return would include wages, dividends, alimony received, rental income, investment income, capital gains, farm income, and SSA benefits.

Can you appeal Medicare Part B?

You can appeal your Medicare Part B premium increase for outdated or incorrect information when you: Filed an amended tax return with the IRS. Have a more recent tax return that shows you are receiving a lower income than previously reported.

Easy Article Navigation

To be clear, IRMAA represents the amount of money you may have to pay for Medicare Part B and Part D (if purchased). It stands for Income Related Monthly Adjustment Amount. Typically, IRMAA only impacts individuals with high incomes.

First, the Basics for Medicare Part B, Part C, and Part D

Medicare Part B is part of Original Medicare works like typical medical insurance (for doctor visits and other services) and Part A is hospital insurance. You can check your red, white, and blue Medicare card to confirm that you have Medicare Part A and Part B.

What is the IRMAA Part D for 2022?

For Medicare Part D in 2022, the IRMAA amounts (surcharge) will be added to the normal premium for the individual’s Part D plan.

What is the IRMAA for Medicare Part B in 2022?

The Part B premium you pay will also depend on your taxable income from 2 prior years. This means that your 2022 Medicare Part B premium will be calculated from your 2020 tax return.

Can I Appeal the IRMAA?

Yes, you can appeal your IRMAA determination if you believe there is an error in the calculations by filing for a redetermination through the Social Security Administration. You can write to SSA or call them at 800-772-1213.

Is Part D IRMAA Separate from Part D Late Enrollment Penalties?

IRMAA Part D and IRMAA Part B surcharges are different from a late enrollment penalty. Both can be added to your monthly premiums and it’s completely possible that high-income individuals who are late enrollees in Part B or Part D will have to pay both the IRMAA surcharge and the late enrollment penalty. Here are the differences:

How Will I Know about the Penalty and How do I Pay I t?

The Social Security Administration will notify you of an IRMAA surcharge for Part B and/or Part D. You will receive an Initial IRMAA Determination in the mail that will explain how much your surcharge amounts to and your right to appeal SSA’s determination.

What is the Medicare IRMAA?

Medicare IRMAA (Income-Related Monthly Adjustment Amount) stipulates that higher income earners must pay more for Medicare Part B and Part D premiums. Here’s how it works. The standard premium for Medicare Part B is $148.50 in 2021. However, some people may receive a bill for more than that amount along with an IRMAA ...

When was IRMAA enacted?

IRMAA was enacted for Medicare Part B premiums in 2003 as a provision of the Medicare Modernization Act. It was then expanded to Part D coverage in 2011 as part of the Affordable Care Act (ACA, also called Obamacare). IRMAA was developed by the federal government as a means of strengthening the financial stability of the Medicare program.

What is Medicare Part B based on?

Your Medicare Part B and Part D premiums are based on your modified adjusted gross income ( MAGI) that is reported on your IRS tax return from two years prior. For example, your 2021 Medicare Part B premiums will be based on your reported income from 2019. If your MAGI is $88,000 or less when filed individually (or married and filing separately), ...

Will Medicare Part B and Part D be paid in 2021?

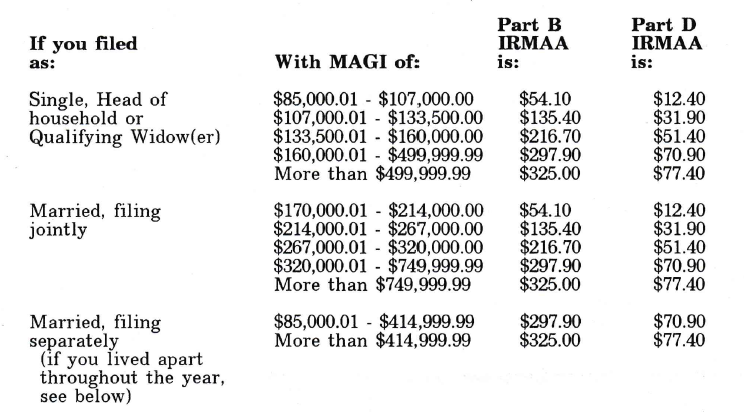

But if your modified adjusted gross income from 2019 is more than those amounts, you will pay more than the standard Part B and Part D premiums in 2021, because you will pay an IRMAA. The full breakdown is as follows: Medicare Part B & Part D IRMAA. 2019 Individual tax return. 2019 Joint tax return. 2019 Married and separate tax return.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

Does Social Security pay Part D?

Social Security will contact you if you have to pay Part D IRMAA, based on your income . The amount you pay can change each year. If you have to pay a higher amount for your Part D premium and you disagree (for example, if your income goes down), use this form to contact Social Security [PDF, 125 KB].

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or. Medicare Cost Plan. A type of Medicare health plan available in some areas. In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for ...

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Do you have to pay extra for Part B?

This doesn’t affect everyone, so most people won’t have to pay an extra amount. If you have Part B and you have a higher income, you may also have to pay an extra amount for your Part B premium, even if you don’t have drug coverage. The chart below lists the extra amount costs by income.

Do you pay extra for Medicare?

If you have questions about your Medicare drug coverage, contact your plan. The extra amount you have to pay isn’t part of your plan premium. You don’t pay the extra amount to your plan. Most people have the extra amount taken from their Social Security check.