How much does Medicare Part B costs?

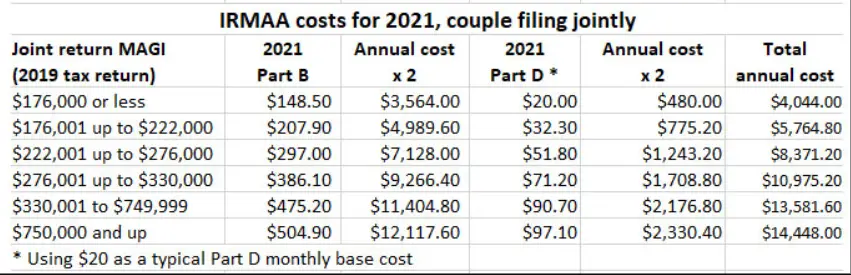

2021 IRMAA For Medicare Part B and Part D *based on 2019 income File an individual tax return File a joint tax return Part B Premium $88,000 or less $176,000 or less $148.50 $88,001 to $111,000 $176,001 to $222,000 $207.90 $111,001 to $138,000 $222,001 to $276,000 $297.00 $138,001 to $165,000 $276,001 to $330,000 $386.10

What is the monthly premium for Medicare Part B?

Nov 06, 2020 · As background, Medicare Part D IRMAA payments can change every year and are calculated using the annually-released standard base Medicare Part D premium. The 2021 standard base premium is $33.06, an increase of $0.32 (.98%) or roughly 1% higher than the 2020 standard base premium.

Does Medicare Part B cost money?

Nov 13, 2021 · Table 2. Part D – 2021 IRMAA; Individual Joint Monthly Premium; $91,000 or less: $182,000 or less: Your Premium > $91,000 – $114,000 > $182,000 – $228,000: $12.40 + Plan Premium > $114,000 – $142,000 > $228,000 -$284,000: $32.10 + Plan Premium > $142,000 – $170,000 > $284,000 – $340,000: $51.70 + Plan Premium > $170,000 – $500,000 > $340,000 – …

How high will the Medicare Part B deductible get?

May 20, 2021 · 05/20/2021 Medicare with Melissa Income-Related Monthly Adjustment Amount or IRMAA is a surcharge that high-income people will pay in addition to their monthly premium. Social Security sets income brackets that determine your (or you and your spouse) IRMAA. Determination is based on the income you reported on your IRS tax returns two years prior.

What are the Part D Irmaa brackets for 2021?

How much are Part D IRMAA surcharges?Table 2. Part D – 2021 IRMAAIndividualJointMonthly Premium$91,000 or less$182,000 or lessYour Premium> $91,000 – $114,000> $182,000 – $228,000$12.40 + Plan Premium> $114,000 – $142,000> $228,000 -$284,000$32.10 + Plan Premium3 more rows

What is Medicare D Irmaa?

An IRMAA is a surcharge added to your monthly Medicare Part B and Part D premiums, based on your yearly income. The Social Security Administration (SSA) uses your income tax information from 2 years ago to determine if you owe an IRMAA in addition to your monthly premium.

What is the Part D premium for 2021?

As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2021 is $33.06, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.Nov 6, 2020

Is there an Irmaa for Medicare Part D?

You pay your Part D IRMAA directly to Medicare, not to your plan or employer. You're required to pay the Part D IRMAA, even if your employer or a third party (like a teacher's union or a retirement system) pays for your Part D plan premiums.

What is the income limit for Part D Irmaa?

What are the income brackets for IRMAA Part D and Part B?SingleMarried Filing JointlyPart D IRMAA$88,000 or less$176,000 or less$0 + your plan premium$165,001 and under $500,000$330,001 and under $750,000$70.70 + your plan premium$500,000 or above$750,000 and above$77.10 + your plan premium3 more rows

What is the Part D Irmaa for 2022?

What is an IRMAA for Medicare?2020 Individual tax return2020 Joint tax return2022 Part D premiumMore than $170,000 up to $500,000More than $340,000 up to $750,000Your plan premium + $71.30More than $500,000More than $750,000Your plan premium + $77.904 more rows•Feb 15, 2022

How is Irmaa calculated Part D?

SSA determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior, meaning two years before the year in which you are paying IRMAA. The income that counts is the adjusted gross income you reported plus other forms of tax-exempt income.

What is the 2022 Part D initial coverage limit?

$4,430The Initial Coverage Limit (ICL) will go up from $4,130 in 2021 to $4,430 in 2022. This means you can purchase prescriptions worth up to $4,430 before entering what's known as the Medicare Part D Donut Hole, which has historically been a gap in coverage.

How do you pay Part D Irmaa?

Part D IRMAA must be paid directly to Medicare—not your plan or employer. It's your responsibility to pay it even if your employer or a third party (e.g., retirement system) pays your Part D plan premiums.Oct 4, 2021

How is Irmaa calculated 2021?

The income used to determine IRMAA is your AGI plus muni bond interest from two years ago. Your 2020 income determines your IRMAA in 2022. Your 2021 income determines your IRMAA in 2023. The untaxed Social Security benefits aren't included in the income for determining IRMAA.Mar 10, 2022

What is IRMAA?

For Medicare beneficiaries who earn over $91,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to unders...

How is my income used in my IRMAA determination?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax r...

Can I appeal the IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have...

What is IRMAA in Medicare?

IRMAA is an acronym for, “the Income Related monthly Adjustment Amount.” What IRMAA does is increase the amount you are required to pay for Medicare part B and D based upon how much income you receive in retirement. These increased payments present themselves in the form of surcharges tacked onto the standard Medicare part B and D premiums. In other words, IRMAA requires Individuals who make more money to pay more for Medicare to help foot the Medicare bills for individuals who make less money. Whether or not you will be subject to IRMAA is entirely dependent upon your income in retirement.

How much will Medicare cost in 2021?

In 2021, the average expenditure for part B is set at $594.00 a month. In other words, the government expects that the overall national expense for Medicare Part B divided by the number of individuals enrolled in Medicare part B will result in an average cost of $594.00 per person per month. Of course, $594.00 is not what retirees pay ...

What is the IRMAA?

The Income Related monthly Adjustment Amount (IRMAA) is an additional surcharge that raises the amount higher income individuals will pay for Medicare. IRMAA applies to Medicare parts B and D.

What is the Medicare IRMAA?

Medicare IRMAA (Income-Related Monthly Adjustment Amount) stipulates that higher income earners must pay more for Medicare Part B and Part D premiums. Here’s how it works. The standard premium for Medicare Part B is $148.50 in 2021. However, some people may receive a bill for more than that amount along with an IRMAA ...

How much is the MAGI for 2021?

If your MAGI is $88,000 or less when filed individually (or married and filing separately), or $176,000 or less when filed jointly, you will pay the standard Part B premium of $148.50 per month in 2021, and you won’t pay a Part B IRMAA.

What is Medicare Part B based on?

Your Medicare Part B and Part D premiums are based on your modified adjusted gross income ( MAGI) that is reported on your IRS tax return from two years prior. For example, your 2021 Medicare Part B premiums will be based on your reported income from 2019. If your MAGI is $88,000 or less when filed individually (or married and filing separately), ...

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Does Medicare cover emergency services?

In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for under Original Medicare (your Cost Plan pays for emergency services or urgently needed services ). with drug coverage, the monthly premium may include an amount for drug coverage.