What is the base Part D monthly premium for 2021?

As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2021 is $33.06, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.Nov 6, 2020

What is the standard Medicare Part B premium for 2021?

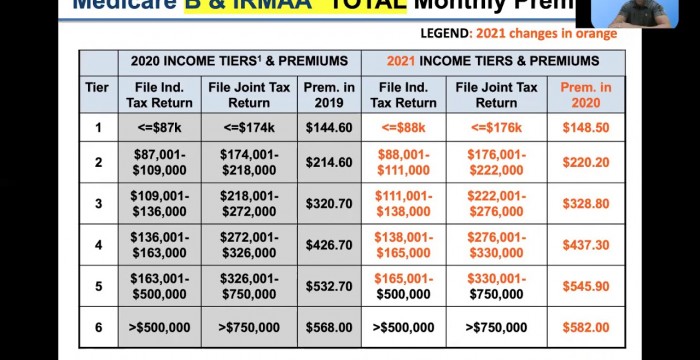

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

How much is the Medicare Part D deductible for 2021?

$445Medicare Part D, also known as prescription drug coverage, is the part of Medicare that helps you pay for prescription drugs. When you enroll in a Part D plan, you are responsible for paying your deductible, premium, copayment, and coinsurance amounts. The maximum Medicare Part D deductible for 2021 is $445.

What is the cost of Part D for 2022?

Highlights for 2022 The estimated average monthly premium for Medicare Part D stand-alone drug plans is projected to be $43 in 2022, based on current enrollment, while average monthly premiums for the 16 national PDPs are projected to range from $7 to $99 in 2022.Nov 2, 2021

What changes are coming to Medicare in 2021?

What are the 2021 proposed changes to Medicare?Increased eligibility. One of President Biden's campaign goals was to lower the age of Medicare eligibility from 65 to 60. ... Expanded income brackets. ... More Special Enrollment Periods (SEPs) ... Additional coverage.Nov 22, 2021

How much did Medicare increase for 2021?

The increase in the standard monthly premium—from $148.50 in 2021 to $170.10 in 2022—is based in part on the statutory requirement to prepare for expenses, such as spending trends driven by COVID-19, and prior Congressional action in the Continuing Appropriations Act, 2021 that limited the 2021 Medicare Part B monthly ...Nov 12, 2021

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.Dec 1, 2021

What is the max out-of-pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000, while under H.R. 19 and the Senate Finance bill, the cap would be set at $3,100 (both amounts exclude the value of the manufacturer price discount).Jul 23, 2021

What is the Best Medicare Plan D for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

What is Medicare Part D 2022 premium?

Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.Dec 31, 2021

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is Medicare Part D 2021?

Medicare Part D costs include the initial deductible, initial coverage limit, out-of-pocket threshold, and the coverage gap, also known as the donut hole.

How much is the deductible for Part D in 2021?

The initial deductible for Part D is $445 in 2021. In 2022, the initial deductible will be $480.

How much does Medicare Part D cost?

The average premium for Medicare Part D is around $40 a month. The premiums do vary by location and plan. Medications that fall on the higher tiers attract higher coinsurance costs and co-payments compared to those on the lower tiers.

What is the Medicare donut hole?

The coverage gap is known as the donut hole. It begins once you reach your Medicare Part D costs plan’s initial coverage limit and ends when you spend a total of $6,550. Part D enrollees will receive a 75% discount on the total cost of their brand-name drugs purchased while in the donut hole. The 75% discount paid by the brand-name drug ...

How much discount do you get for a brand name drug?

The 75% discount paid by the brand-name drug manufacturer will apply to get out of the donut hole. For example: if you reach the donut hole and purchase a brand-name medication with a retail cost of $100, you will pay $25 for the medication, and receive $95 credit toward meeting your total out-of-pocket spending limit.

Do you have to pay a coinsurance for Medicare Part D?

If you receive extra help paying your Part D Medicare costs. One major cost that you should consider is the monthly premium. Stand-alone Part D policies and Medicare Advantage policies have a monthly premium. Other than the monthly premiums, you may have to pay an annual deductible and a co-payment/coinsurance.

Can you still receive Medicare Part D coverage?

These are Medicare’s rules for late payments of Part D premiums: You can still receive coverage without penalties. You’re granted a grace period and warning. You receive a letter informing you to contact your plan for resolution. You must receive notification before a plan can drop you from your coverage.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

Does Social Security pay Part D?

Social Security will contact you if you have to pay Part D IRMAA, based on your income . The amount you pay can change each year. If you have to pay a higher amount for your Part D premium and you disagree (for example, if your income goes down), use this form to contact Social Security [PDF, 125 KB].

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or. Medicare Cost Plan. A type of Medicare health plan available in some areas. In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for ...

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Do you have to pay extra for Part B?

This doesn’t affect everyone, so most people won’t have to pay an extra amount. If you have Part B and you have a higher income, you may also have to pay an extra amount for your Part B premium, even if you don’t have drug coverage. The chart below lists the extra amount costs by income.

Do you pay extra for Medicare?

If you have questions about your Medicare drug coverage, contact your plan. The extra amount you have to pay isn’t part of your plan premium. You don’t pay the extra amount to your plan. Most people have the extra amount taken from their Social Security check.

How much is the Part D premium in 2021?

The figures below apply to whatever your income was two years before now, or 2019 for premiums paid in 2021: For individuals with this income: Or joint filers with this income: The Part D premium surcharge in 2021 is: $88,000 to $111,000.

How much is the deductible for Part D in 2021?

Some Part D plans charge deductibles, and the annual limit on that amount in 2021 will go up by $10 to $445. However, a plan can charge a smaller deductible, or no deductible at all. There are limits on how much you'll have to pay for drugs.

What is Part D insurance?

Part D comes with highly variable costs. Less expensive plans often omit certain drugs from their coverage, while more expensive plans typically offer more comprehensive selections of prescriptions. Plans are also allowed to have different copayments and to treat various types of drugs differently, such as charging less for generic versions of drugs than for name-brand pharmaceuticals.

What is Medicare Part D?

One of the newer elements of the Medicare program is prescription drug coverage, added under what's known as Medicare Part D. Part D coverage is an optional add-on that participants can use regardless of whether they have traditional Medicare coverage under Parts A ...

Do Part D plans charge a monthly premium?

With those coverage differences in mind, some Part D plans don't charge a monthly premium at all. Others can be quite expensive.

Does private insurance have Part D?

Instead, private insurance companies come out with Part D prescription drug plans of their own, and it's up to participants to choose the plan that fits best with their individual needs. Image source: Getty Images. There is some uniformity across all Part D plans.

Is Medicare Part D good for retirement?

Prescription drugs play a vital role in keeping people healthy, but paying for them in your retirement years can be challenging. Medicare Part D offers a valuable way to control healthcare costs, but it's important to know the ins and outs of the program to make sure that you get everything you can out of it.

What is Medicare Part D 2021?

Published: Jun 08, 2021. The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans (PDPs) to supplement traditional Medicare and Medicare Advantage prescription drug plans (MA-PDs) ...

How much is Part D 2021?

For PDPs, the average Part D deductible in 2021 is $350, 3.5 times larger than the average drug deductible in MA-PDs ($102) (Figure 5). The increase in the weighted average Part D deductible for PDPs was particularly steep between 2019 and 2020, when two national PDPs modified their plan design from charging no deductible to charging a partial ...

How much does a PDP payer pay in 2021?

For drugs on the non-preferred tier (which can be all brands or a mix of brands and generics), virtually all PDP enrollees pay coinsurance between 25% and 50% in 2021, while most MA-PD enrollees (83%) pay copayments between $90 and $100. The maximum cost-sharing amount permitted by CMS is $47 or 25% for preferred brands ...

How many Medicare beneficiaries will receive low income subsidies in 2021?

An increasing share of beneficiaries receiving low-income subsidies are enrolled in Medicare Advantage drug plans, with just over half now enrolled in MA-PDs. In 2021, nearly 13 million Part D enrollees, or just over 1 in 4, receive premium and cost-sharing assistance through the Part D Low-Income Subsidy (LIS) program.

How much is MA PD insurance in 2021?

For MA-PDs, the monthly premium for the Part D portion of covered benefits averages $12 in 2021 (and $21 for Part C and Part D benefits combined). The average premium for drug coverage in MA-PDs is lower than the average premium for PDPs due in part to the ability of MA-PD sponsors to use rebate dollars (which may include bonuses) ...

How many people are in Medicare Part D?

A total of 48 million people with Medicare are currently enrolled in plans that provide the Medicare Part D drug benefit, representing more than three-quarters (77%) ...

What is a SNP in Medicare?

SNPs limit enrollment to beneficiaries with certain characteristics, including those with certain chronic conditions (C-SNPs), those who require an institutional level of care (I-SNPs), and those who are dually enrolled in Medicare and Medicaid ( D-SNPs), which account for the majority of SNP enrollees.