Full Answer

What is Medicare coinsurance and how does it work?

Medicare coinsurance is typically 20 percent of the Medicare-approved amount for goods or services covered by Medicare Part B. So once you have met your Part B deductible for the year, you will then typically be responsible for 20 percent of the remaining cost for covered services and items.

What is a group code for Medicare?

A group code is defined as a code used to identify a general category of the payment adjustment. Thus, it must be always used along with a claim adjustment reason code for showing liability for the amounts that are not covered under Medicare for a service or claim.

When to use a Medicare denial reason code?

Thus, it must be always used along with a claim adjustment reason code for showing liability for the amounts that are not covered under Medicare for a service or claim. Medicare denial codes are standard messages used to provide or describe information to a medical patient or provider by insurances about why a claim was denied.

What is the co-coinsurance amount for Medicare?

Coinsurance amounts are generally 20% of the Medicare fee schedule. Physicians must collect the unmet coinsurance from the beneficiary. Consistently waiving the coinsurance may be interpreted as program abuse.

What is reason code 129?

129. Prior processing information appears incorrect. At least one Remark Code must be provided (may be comprised of either the NCPDP Reject Reason Code, or Remittance Advice Remark Code that is not an ALERT.)

What is Medicare Reason code 96?

Transportation to/from this destination is not covered. Ambulance services to or from a doctor's office are not covered.

What is Medicare Reason code 50?

CO 50 means that the payer refused to pay the claim because they did not deem the service or procedure as medically necessary. It's essential to not only understand how to solve this problem when this type of denial occurs, but also how to prevent it in the first place.

What does Adjustment Reason code 45 mean?

45. Charge exceeds fee schedule/maximum allowable or contracted/legislated fee arrangement.

What is Reason code 97?

Code. Description. Reason Code: 97. The benefit for this service is included in the payment/allowance for another service/procedure that has already been adjudicated.

What is Medicare denial code CO 109?

Reason Code: 109. Claim/service not covered by this payer/contractor. You must send the claim/service to the correct payer/contractor.

What is denial code CO 236?

CO-236: This procedure or procedure/modifier combination is not compatible with another procedure or procedure/modifier combination that was provided on the same day according to the National Correct Coding Initiative (NCCI) or workers compensation state regulations/fee schedule requirements.

What does Medicare denial code Co 97 mean?

Denial Code CO 97 – Procedure or Service Isn't Paid for Separately. Denial Code CO 97 occurs because the benefit for the service or procedure is included in the allowance or payment for another procedure or service that has already been adjudicated. Basically, the procedure or service is not paid for separately.

What does denial code Co 234 mean?

This procedure is not paid separately234. This procedure is not paid separately. At least one Remark Code must be provided (may be comprised of either the NCPDP Reject Reason Code, or Remittance Advice Remark Code that is not an ALERT.) 1/24/2010. New Codes - RARC.

What is denial Reason code 23?

OA-23: Indicates the impact of prior payers(s) adjudication, including payments and/or adjustments. No action required since the amount listed as OA-23 is the allowed amount by the primary payer. OA-109: Claim not covered by this payer/contractor. You must send the claim to the correct payer/contractor.

What is reason code 015?

Reason Code 15: Duplicate claim/service. This change effective 1/1/2013: Exact duplicate claim/service. Reason Code 16: This is a work-related injury/illness and thus the liability of the Worker's Compensation Carrier. Reason Code 17: This injury/illness is covered by the liability carrier.

What is adjustment code 72?

72. Provider refund amount. This adjustment acknowledges a refund received from a provider for previous overpayment.

What is coinsurance in Medicare?

A provision in a member's coverage that limits the amount of coverage by the plan to a certain percentage, commonly 80 percent. Any additional costs are paid by the member out of pocket. Coinsurance amounts are generally 20% of the Medicare fee schedule.

What to do if a beneficiary is unable to pay coinsurance?

If a beneficiary is unable to pay the coinsurance, the physician should ask him or herto sign a waiver that explains the financial hardship. If no waiver is signed, the beneficiary ’ s medical record should reflect normal and reasonable attempts to collect, before the charge is written off. 1.

What happens if there is no secondary insurance?

If there is no secondary insurance we can bill the patient. A flat amount the member must pay before the insurer will make any benefit payments. The deductible is usually a set amount or percentage determined by the member’s contract and is set for a given period of time.

What percentage of Medicare coinsurance is covered by Part B?

Medicare coinsurance is typically 20 percent of the Medicare-approved amount for goods or services covered by Medicare Part B. So once you have met your Part B deductible for the year, you will then typically be responsible for 20 percent of the remaining cost for covered services and items. The Medicare-approved amount is a predetermined amount ...

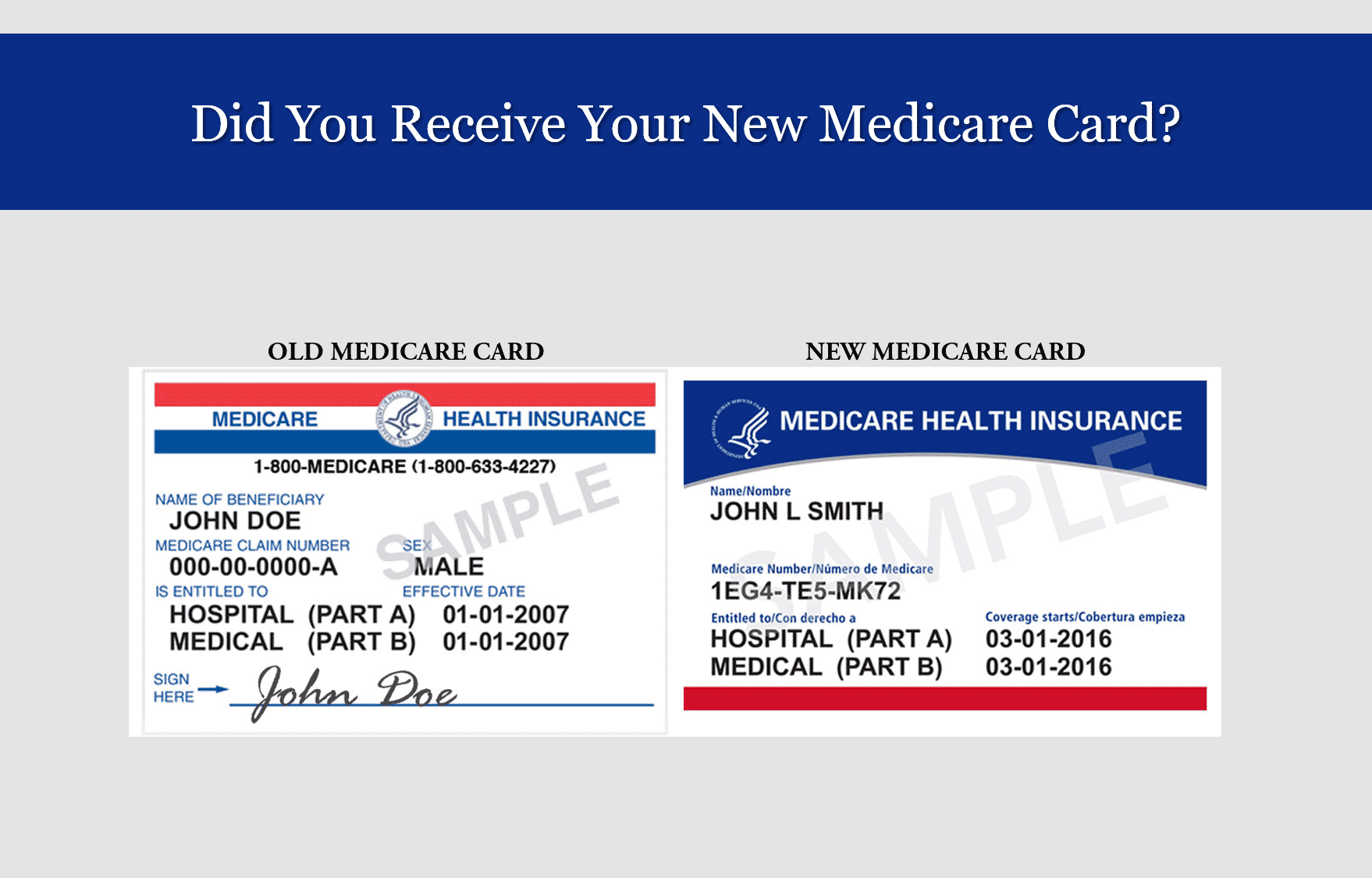

What is Medicare Supplement Insurance?

Medicare Supplement Insurance plans (also called Medigap) are optional plans sold by private insurers that offer some coverage for certain out-of-pocket Medicare costs , such as coinsurance, copayments and deductibles.

What is a copayment in Medicare?

Copayment, or copay, is another term you’ll see used in relation to Medicare cost-sharing . A copay is like coinsurance, except for one difference: While coinsurance typically involves a percentage of the total medical bill, a copayment is generally a flat fee. For example, Part B of Medicare uses coinsurance, which is 20 percent in most cases.

How much is Medicare Part B 2021?

Part B carries an annual deductible of $203 (in 2021), so John is responsible for the first $203 worth of Part B-covered services for the year. After reaching his Part B deductible, the remaining $97 of his bill is covered in part by Medicare, though John will be required to pay a coinsurance cost. Medicare Part B requires beneficiaries ...

What is the deductible for John's doctor appointment?

John’s doctor appointment is covered by Medicare Part B, and his doctor bills Medicare for $300. Part B carries an annual deductible of $203 (in 2021), so John is responsible for the first $203 worth ...

What is the most important thing to know about Medicare?

There are a number of words and terms related to the way Medicare works, and one of the most important ones to know is coinsurance.

Does Medicare Advantage include coinsurance?

Medicare Advantage plans typically include coinsurance. Many Medicare beneficiaries choose to get their benefits through a privately-sold Medicare Advantage plan (Medicare Part C), which provides the benefits of Original Medicare combined into one plan.

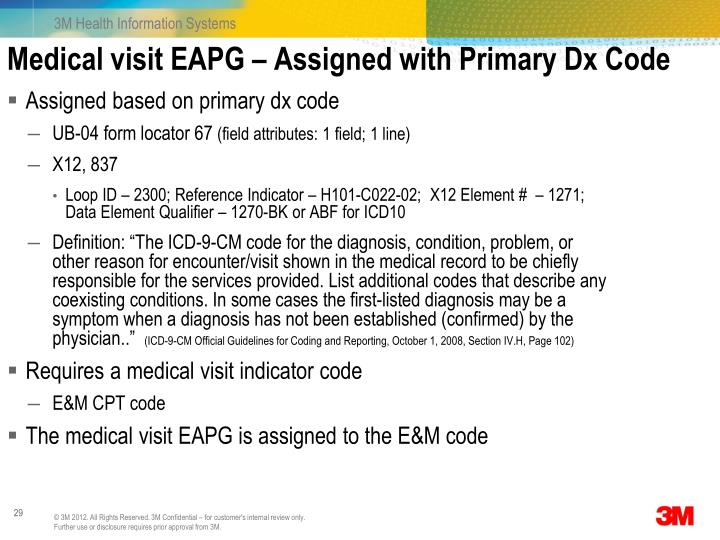

What is a Medicare denial code?

Medicare denial code - Full list - Description. Medicare denial code and Description. A group code is a code identifying the general category of payment adjustment. A group code must always be used in conjunction with a claim adjustment reason code to show liability for amounts not covered by Medicare for a claim or service.

What is a CO code?

CO or contractual obligations is the group code that is used whenever the contractual agreement existing between the payee and payer or the regulatory requirement has resulted in a proper adjustment.

What are the remittance advice codes?

The following Remittance Advice Remark Codes under Inpatient Adjudication Information (MIA) or Outpatient Adjudication Information (MOA):#N#N781 - Alert: No deductible may be collected as patient is a Medicaid/Qualified Medicare Beneficiary. Review your records for any wrongfully collected deductible.#N#N782 -Alert: No coinsurance may be collected as patient is a Medicaid/Qualified Medicare Beneficiary. Review your records for any wrongfully collected coinsurance. 1 N781 - Alert: No deductible may be collected as patient is a Medicaid/Qualified Medicare Beneficiary. Review your records for any wrongfully collected deductible. 2 N782 -Alert: No coinsurance may be collected as patient is a Medicaid/Qualified Medicare Beneficiary. Review your records for any wrongfully collected coinsurance.

When will CMS revert back to QMB?

On December 8, 2017 , CMS systems will revert back to the previous display of patient responsibility for QMBs on the Medicare RA. Providers may want to hold QMB related claims and submit them after December 8.

Does Medicaid cover Medicare?

For these beneficiaries, Medicaid is responsible for covering Medicare cost-sharing, though the beneficiary may also have other secondary payers (e.g. , VA, tribes, Medigap).