What is the most popular Medigap plan for 2021?

Medigap Plans F and G are the most popular Medicare Supplement plans in 2021.Oct 6, 2021

Who is the best Medicare Supplement provider?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Pricing: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

Is Plan G the best?

Medicare Plan G is currently the most comprehensive Medicare Supplement plan in terms of the coverage it offers. If you desire stability and knowing what to expect from your health care costs (and if you can afford the premium), Medicare Plan G may be the best option for you.

Why is Plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.Jul 9, 2020

What is the most expensive Medicare Supplement plan?

Because Medigap Plan F offers the most benefits, it is usually the most expensive of the Medicare Supplement insurance plans.

What is the most comprehensive Medigap plan?

Plan F is the most comprehensive plan. It covers one more benefit than Plan G. Plan G typically has higher premiums than Plan N because it includes more coverage. You could save money with Plan N because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G.

Should I switch from F to G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

What is the monthly premium for Plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

Does AARP Offer Plan G?

Medicare Supplement Insurance benefits are standardized by the federal government. That means Medigap Plan G purchased through AARP will feature the same basic benefits as a Plan G purchased through a different carrier.Sep 21, 2021

What's the difference between plan F and plan G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.Feb 18, 2021

What Medigap plans are no longer available?

The federal government standardizes all Medigap plans. Plans H, I, and J are no longer available due to the addition of a prescription drug benefit, Part D, to Medicare after a 2003 act became a law.

Is Medicare Plan G good?

Is Medicare Plan G worth it? Absolutely, Plan G is worth the cost because it covers the expenses you'd otherwise pay. The policy is especially beneficial when your health starts to decline or when you need routine care.

What do the most popular Medigap plans cover?

Medicare Supplement Insurance provides coverage in areas where Original Medicare (Part A and Part B) requires some out-of-pocket spending in the form of deductibles, copayments and coinsurance. There are nine such out-of-pocket costs that a Medigap plan can cover in part or in full, if at all.

Plan F: Traditionally the most popular Medigap plan

Plan F has been the most popular Medicare Supplement Insurance plan over recent years. Plan F offers the most comprehensive coverage, for which its popularity may be attributed. Plan F beneficiaries typically face little to no out-of-pocket costs when seeking Medicare-covered services or items.

Plan G: Becoming the new most popular plan

There’s no doubt that Plan F has been the most popular Medicare Supplement Insurance plan for years. Even going back to 2012, Plan F accounted for 53% of the Medigap market share with no other plan garnering more than 13%.

Plan N and other popular Medicare Supplement plans

Any discussion of the most popular Medigap plans deserves a mention of Plan N. Plan N has maintained about a 10% share of the Medigap market over the years, making it the clear-cut favorite after Plan F and Plan G.

Enrolling in the Most Popular Plan

The most popular Medigap plan may not always be the best plan for you. Each plan is designed with different health care needs and budgets in mind, so it’s important to examine each plan carefully to determine how it may fit your own needs.

Popular Medigap Plans: Plan F vs. Plan G vs. Plan N vs. Plan C

While Plan F is the most popular plan, Medigap Plan C, Plan G and Plan N are the next most popular Medicare Supplement Insurance plans.

Is Medigap Plan F the Best?

There are several reasons why consumers choose certain Medigap plan options over others.

Plan G and Plan N Likely to be the Most Popular Plan Going Forward

Because Plan F and Plan C are no longer available to new Medicare beneficiaries who became eligible for Medicare after January 2020, Plan G is now the Medigap plan option that covers more Medicare costs than any other Medigap plan available to new Medicare beneficiaries.

What Do the Most Medicare Supplement Plans Cover?

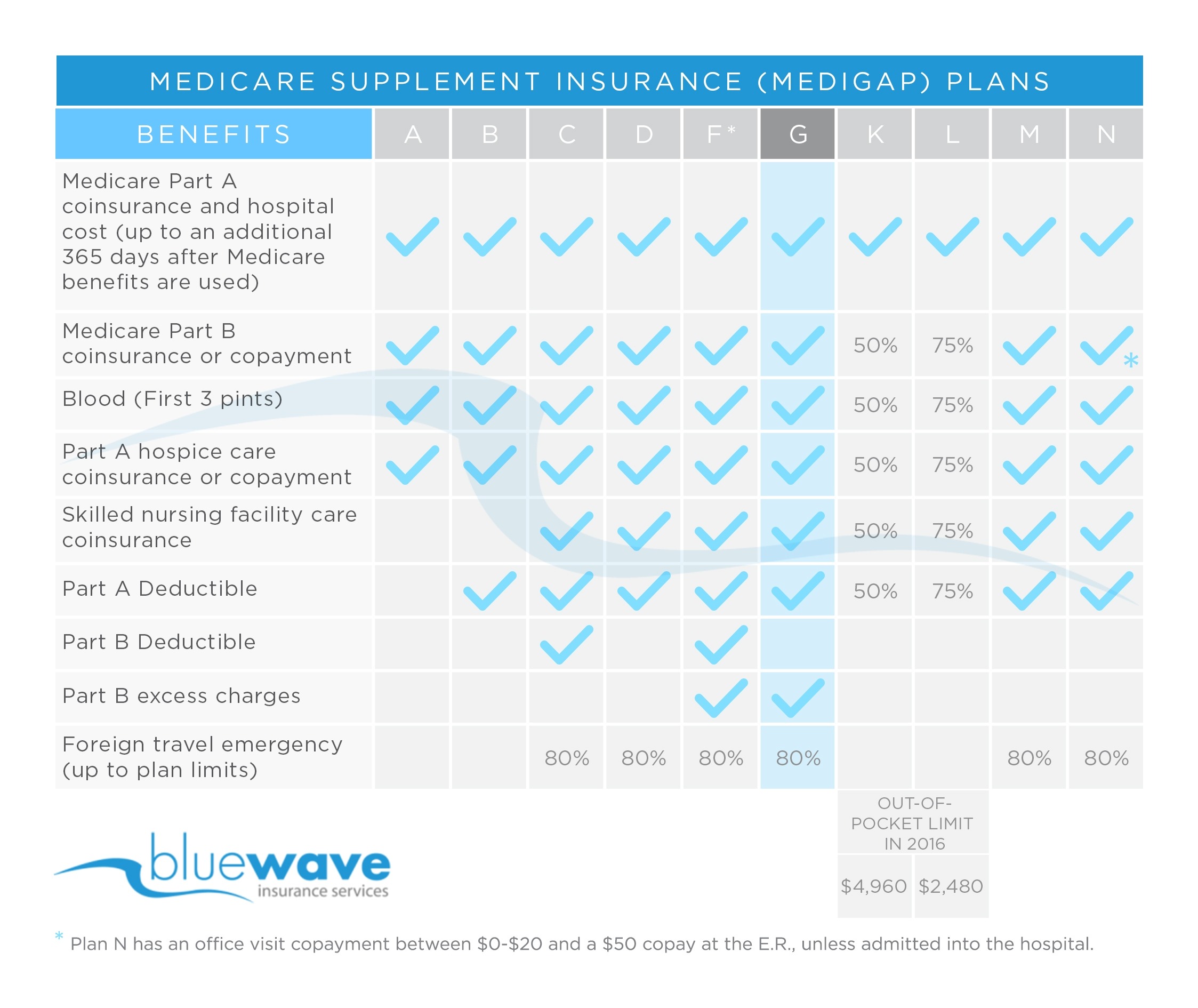

The chart below shows which benefits are covered by each of the 10 standardized Medicare Supplement Insurance plans available in most states. Take note of how Plan F and Plan G coverage compares to other plans, particularly plans like Plan A and Plan B.

What Do the Most Popular Medicare Supplement Plans Cost?

Although first-dollar coverage Medigap plans are the most popular, some beneficiaries may choose other plans based on their premiums and costs that they cover.

How Do Medicare Supplement Companies Determine Plan Costs?

Medicare Supplement Insurance companies can charge different premiums for policies depending on a number of factors, including age and location.

Why Should I Compare Medicare Supplement Plans?

Comparison shopping is important because two different insurance companies could charge you a different price for a plan with the same benefits.

What are the different Medicare Supplement plans?

Medicare Supplement plans offer different coverage to close the Medicare gaps. They are Plans A, B, C, D, F, G, K, L, M and N.

Why is Medicare Supplement Plan important?

That is why a Medicare supplement plan is so important because it provides you generally speaking with an out of pocket max. Yes, if you were in the hospital for more than 365 consecutive days you would then have exceeded both your Medicare and supplement insurance coverage and you would have to pay all the costs.

How much is Medicare Part B deductible in 2021?

That aside, you would have a out of pocket max. The Medicare Part B annual deductible is $203 in 2021. This may seem small compared to the Part A deductible. It is, but the real cost under B is the coinsurance which is where coverage matters. Part B coinsurance is different than the deductible.

How much is Medicare Part A 2021?

The annual deductible for Medicare Part A in 2021 is $1,484. This your out of pocket expense for the first 60 days of hospitalization.

What is the most comprehensive plan?

Plan F. Plan F provides the most comprehensive coverage. Policyholders get the following benefits under Plan F: Part A benefits. Part A Deductible. Part A hospital and co-insurance costs up to an additional 365 days after Medicare benefits are exhausted. Part A hospice care co-payment or co-insurance. Part B benefits.

How much is coinsurance in Medicare?

There is a 20% coinsurance under Medicare Part B. For example, if you are sent to a specialist for care, you would pay the first 20% of the charges, and Medicare would pick up the other 80%. This is different than a co-payment, where you would pay a fixed amount for service.

Which Medicare plan provides the most coverage for 2021?

Customers who purchase Plan G will usually more than save the deductible costs in their premiums. Plan G currently provides the most coverage to new 2021 Medicare recipients. This plan is still great, offering almost the same amount of coverage that Plan F provides except for the Part B deductible.

Plan F

Plan F is the most comprehensive Medicare supplement plan. It covers the Part B deductible and everything covered by Plan G. After Medicare pays its share, Medicare supplement Plan F pays the rest.

Plan G

Plan G is like Plan F. However, with Plan G, beneficiaries are responsible for the Part B deductible.

Plan N

Plan N is one of the most popular Medicare Supplement plans for all beneficiaries.

Don't Leave Your Health to Chance

You've worked hard your whole life by thinking ahead. Now do the same for your health. Get FREE Medicare help to plan your future.

Which Medicare supplement is best for seniors?

Best overall Medicare supplement for new enrollees: Plan G. Due to the inability of new applicants to purchase Plan C and Plan F, Medicare supplement Plan G is the best overall plan that provides the most coverage for seniors. Plan G is very similar to Plan F in that it will cover almost everything except the Part B deductible.

Which Medicare plan has the highest premiums?

Best overall Medicare supplement pre-2020: Plan F. Plan F has the highest Medicare supplement premiums compared to C, G and N. On the other hand, it will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

What is the deductible for Medicare Supplement 2021?

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible.

How much is Medicare Part B deductible in 2021?

This means that you would be responsible for paying the entire Medicare Part B deductible — $203 a year for 2021 — before insurance benefits will begin to pay out. However, Plan G will have one of the highest monthly premiums among all the Medicare supplement policies: $473.

What is the best alternative to Plan G?

Best alternative to Plan G Medicare supplement: Plan N. Plan N is a good option for individuals who do not want to purchase Plan G but still want comprehensive Medicare insurance coverage at a cheaper price.

Is Medicare Supplement Plan G the same as Aetna?

This means that Medicare supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna. However, rates will change from company to company since each provider will choose a different pricing structure for their Medicare supplement plans.

Does Cigna offer a discount on Medicare?

Cigna Medicare supplement has some added benefits when compared to other companies, such as a household premium discount. The discount is available in most states when multiple family members in the same household enroll in the same Cigna Medigap plan.

Medicare Supplement Plan G

The most popular Medicare supplement plan available now is Medicare supplement Plan G. Plan G offers great coverage with only one small deductible you have to pay each year.

Medicare Supplement Plan N

Now, coming in to close second is Medicare Supplement Plan N, which I happen to love.

The Top Medicare Supplement Companies

While there are many companies out there that offer Medicare supplement plans, not all of them have competitive premiums.

What is the name of the insurance company that offers Medicare Supplement Plans?

Blue Cross Blue Shield. BlueCross Blue Shield (known as Anthem in some states, as well as BCBS) is one of the biggest names in insurance. They have a website specifically dedicated to Medicare Supplement Plans, so you don't have to worry about sorting through health insurance information that doesn't apply to you.

What about once you've selected your Medicare Supplement Plan?

What about once you've selected your Medicare Supplement Plan? According to our agent, all servicing is handled directly with Aetna - or whichever insurance company you choose. She suggested that customers check in with Medicare-Plans in the future to do price comparisons as rates may change. If you like a "don't call me, I'll call you" arrangement, that might be ideal. But, if you want a broker that will give you support once you've enrolled, or that will keep track of rates and other changes on your behalf, you won't find that with this service.

What is SelectQuote Senior?

SelectQuote Senior is one of several brokers that refers prospective clients to various insurance companies for Medicare Supplement Plans. You'll get quotes for 20+ different providers through this service, depending on which companies are issuing policies where you live. Those companies may include Aetna, Cigna, Anthem and Humana; all insurers with whom they partner are at least A- rated. The business itself has an "A+" rating and accreditation from the BBB, which means that in the company's 36 years in operation, they've done a good job of treating their clients fairly and honestly.

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company?

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company? First, there's no guarantee that any insurance company will always have the most affordable plan for your needs. United Medicare Advisors gives you access to a vast range of companies. They constantly monitor premiums and plans so that you can get the provider and the plan that best fits your needs.

How to find Medicare premiums with United Medicare Advisors?

When it comes to finding plans and premiums with United Medicare Advisors, they provide a simple online form where you enter contact information such as your name, phone number, and email address. This same information is required by almost all Medicare Supplement Plan sites.

How much is the BCBS discount?

There is also a household discount of 5% if more than one household member is enrolled in a BCBS Medicare Supplement Plan. That discount is lower than many other insurers, who typically offer anywhere from 7% to 15% off, and sometimes that applies even if no one else is currently enrolled with you.

What is the Learn About Medicare tab?

Under the Learn About Medicare tab, you can find information on Medicare Supplement, Medicare Advantage, Prescription Drug Plans, and Medicare Parts A and B. They provide access to blogs covering health care news, retirement, and health wellness.

What Is Medicare Plan G?

Medicare Plan G is a supplemental insurance policy that offers additional coverage beyond your Original Part A and Part B Medicare policy. Some people choose to get supplemental policies instead of a Medicare Advantage Plan (otherwise known as Medicare Part C).

What Does Medicare Plan G Cover?

This supplemental insurance plan is one of the most comprehensive Medigap options available. After all, approximately 13% of Original Medicare policyholders choose to supplement their coverage with Medicare Plan G, making it the second most popular Medigap choice.

Are My Prescriptions Covered by Plan G?

A Medicare Plan G policy covers any prescription drugs you receive at the hospital or doctor’s office. However, a Plan G policy will not cover the prescriptions you receive from the pharmacy.

How Much Are Premiums for Plan G?

Since health insurance companies offer Medicare Plan G policies instead of the government, there are variable premium costs for Plan G coverage. However, one of the aspects that sets Plan G apart from the popular Plan F is a lower monthly premium.

What Is My Deductible for Plan G?

When you enroll in a Medicare Plan G policy, you may have the option between a regular deductible and a high deductible plan. High deductible plans are only available in certain states. The deductible you choose can impact the cost of your monthly premium.

What Is the Difference Between Plan N and Plan G?

Plan N is becoming a more popular option as seniors search for lower premiums. If you are in good health and don’t mind some cost-sharing to offset your low monthly payment, Plan N may be right for you.

Why Medicare Plan G Is Right for You?

Finding the best Medigap coverage takes time and research. However, if you’re looking for the best of the best in 2020 and beyond, Medicare Plan G provides affordable premiums and minimal out-of-pocket costs.