What to Know About Medicare Savings Programs

- Medicare savings programs can help you pay Part A and Part B premiums, deductibles, copays, and coinsurance.

- Your income must be at or below specified limits each month.

- Your household resources must also be at or below certain limits.

Full Answer

What are the four Medicare savings programs?

Medicare Savings Programs (MSP) are federally funded programs administered by each individual state. These programs are for people with limited income and resources to help pay some or all of their Medicare premiums, deductibles, copayments, and coinsurance. There are four Medicare Savings Programs: Qualified Medicare Beneficiary.

What is the cheapest Medicare plan?

Medical Savings Account (MSA): The second part is a special type of savings account. The Medicare MSA Plan deposits money in a special savings account for you to use to pay health care expenses. The amount of the deposit varies by plan. You can use this money to pay your Medicare-covered costs before you meet the deductible. How do MSA Plans work?

What are the benefits of Medicare savings program?

Dec 03, 2021 · Medicare Savings Programs (MSPs) help low-income Medicare beneficiaries pay the out-of-pocket expenses associated with Original Medicare. Original Medicare is comprised of Medicare Part A (hospital insurance) and Medicare Part B (outpatient insurance). MSPs are run at the state level by each individual state’s Medicaid program.

What is the best health plan for Medicare?

People with Medicare who face challenges paying for healthcare costs may be able to get help through Medicare Savings Programs (MSPs). Use this toolkit to share information about these cost-saving programs and encourage your followers to see it they qualify for help.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Be a Medicare beneficiary enrolled in Part A and Part B,Be responsible for paying the Part B premium, and.Live in a service area of a plan that has chosen to participate in this program.Nov 24, 2020

How much savings can you have on Medicare?

You may have up to $2,000 in assets as an individual or $3,000 in assets as a couple.

Who qualifies for Medicare premium refund?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B. 2.

What is Texas Medicare savings program?

The Medicare Savings Programs use Medicaid funds to help eligible persons pay for all or some of their out-of-pocket Medicare expenses, such as premiums, deductibles or coinsurance.

Does Medicare look at your bank account?

Medicare plans and people who represent them can't do any of these things: Ask for your Social Security Number, bank account number, or credit card information unless it's needed to verify membership, determine enrollment eligibility, or process an enrollment request.

Can you get Medicare if you have money in the bank?

Assets are any money you have in the bank, and the value of any investments (i.e., stocks, bonds and real estate). However, the house you live in and up to one car you own are not counted as assets when it comes to qualifying for a Medicare Savings Program.Oct 7, 2021

Is Medicare Part B ever free?

Medicare Part B isn't free, and it doesn't cover everything Samantha Silberstein is a Certified Financial Planner, FINRA Series 7 and 63 licensed holder, State of California Life, Accident, and Health Insurance Licensed Agent, and CFA.

Does Medicare give money for food?

Original Medicare (Part A and Part B) generally doesn't pay for meal delivery service. Medicare Part B (medical insurance) typically does not include home delivered meals or personal care as part of its home health service coverage.

Is Medicare Part B reimbursement considered income?

On researching, it seems many employers issue a check separately for the reimbursed premiums; this is then deducted from Medical Expenses claimed, so if they file using the Standard Deduction, it is non-taxable income.May 31, 2019

Who qualifies for QMB?

In order to qualify for QMB benefits you must meet the following income requirements, which can also be found on the Medicare Savings Programs page: Individual monthly income limit $1,060. Married couple monthly income limit $1,430. Individual resource limit $7,730.

What is the income limit for QMB in Texas?

Qualified Medicare Beneficiary (QMB): The income limit is $1,063 a month if single and $1,437 a month if married. QMB pays for Part A and B cost sharing, Part B premiums, and – if a beneficiary owes them – it also pays their Part A premiums.Oct 4, 2020

What does Texas Medicaid QMB cover?

The Qualified Medicare Beneficiary (QMB) Program pays Medicare premiums, deductibles and coinsurance for a person who meets the requirements of this section. To be eligible for QMB coverage, a person must: be entitled to benefits under Medicare Part A; and. meet income and resources requirements.

What is Social Security Medicare Savings Program?

Medicare Savings Programs (MSP) are federally funded programs administered by each individual state. These programs are for people with limited inc...

Who is eligible for Social Security Medicare Savings Program?

Below are general requirements for the MSP: Reside in a state or the District of Columbia. Are age 65 or older. Receive Social Security Disability...

How do I apply for Social Security Medicare Savings Program?

Once you know which benefits you may be eligible for, go to the Medicare Benefits page to apply online.You may also call your State Medicare Progra...

How can I contact someone?

For more information about Medicare, visit CMS’s Medicare page. Visit SSA's Publications Page for detailed information about SSA programs and polic...

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is a medical savings account?

Medical Savings Account (MSA): The second part is a special type of savings account. The Medicare MSA Plan deposits money into your account. You can use money from this savings account to pay your health care costs before you meet the deductible.

What are the benefits of MSA?

Medicare MSA plans cover the Medicare services that all Medicare Advantage Plans must cover. In addition, some Medicare MSA plans may cover extra#N#benefits#N#The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents.#N#for an extra cost, like: 1 Dental 2 Vision 3 Hearing 4 Long-term care not covered by Medicare

What is Medicare MSA?

What's a Medicare MSA Plan? Medicare works with private insurance companies to offer you ways to get your health care coverage. These companies can choose to offer a consumer-directed Medicare Advantage Plan, called a Medicare MSA Plan. These plans are similar to Health Savings Account Plans available outside of Medicare.

What is MSA plan?

Medicare MSA Plans combine a high-deductible insurance plan with a medical savings account that you can use to pay for your health care costs. A type of Medicare health plan offered by a private company that contracts with Medicare.

Does Medicare cover MSA?

Medicare MSA Plans don't cover Medicare Part D prescription drugs. If you join a Medicare MSA Plan and need drug coverage, you'll have to join a Medicare Prescription Drug Plan. To find available plans in your area, you can: Visit the Medicare Plan Finder. Call us at 1-800-MEDICARE (1-800-633-4227).

What is covered benefit?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. for an extra cost, like: Dental.

What is Medicare Part A?

Original Medicare is comprised of Medicare Part A (hospital insurance) and Medicare Part B (outpatient insurance). MSPs are run at the state level by each individual state’s Medicaid program. That means you need to contact your state’s Medicaid office to apply for an MSP. Even if you already take part in a Medicare Savings Program, ...

What is SLMB in Medicare?

The Specified Low-Income Medicare Beneficiary (SLMB) Program helps pay for Medicare Part B premiums only. You must already have Medicare Part A to qualify. You can take part in the SLMB program and other Medicaid programs at the same time. Some states may refer to this as the SLIMB program.

How old do you have to be to qualify for Medicare?

There are four types of Medicare Savings Programs. Three of them are available only if you have Medicare and are at least 65 years old: The Qualified Medicare Beneficiary (QMB) Program helps pay for Medicare Part A premiums and Medicare Part B premiums, deductibles, coinsurance, and copays.

Is Medicaid a separate program from Medicare?

See if you qualify with our state-by-state guide to Medicaid. Medicaid is a separate program from Medicare. Both programs provide health insurance, but Medicare coverage is primarily for seniors while Medicaid eligibility depends largely on your income. It’s possible to take part in both programs at the same time.

Does MSP cover prescriptions?

MSPs can help pay the out-of-pocket expenses associated with Medicare Part A and Medicare Part B. They do not cover prescription drug costs. However, Medicare recipients who qualify for an MSP are also automatically eligible for Medicare Extra Help, which helps pay for a Medicare Part D prescription drug plan.

What is medicaid?

Medicaid is a federal assistance program that provides health insurance for low-income and vulnerable Americans. The program is partially funded by the states and each state can set its own eligibility requirements. Qualifying for Medicaid benefits depends largely on your income, but also on your age, disability status, pregnancy, household size, and your household role.

Who is Derek from Policygenius?

Derek is a personal finance editor at Policygenius in New York City, and an expert in taxes. He has been writing about estate planning, investing, and other personal finance topics since 2017. He especially loves using data to tell a story. His work has been covered by Yahoo Finance, MSN, Business Insider, and CNBC.

What is Medicare savings?

Medicare savings programs help people with lower income pay their Medicare Part A and Part B premiums, deductibles, copays, and coinsurance. To qualify, your monthly income must be at or below a certain limit for each program, and your household resources cannot exceed certain limits.

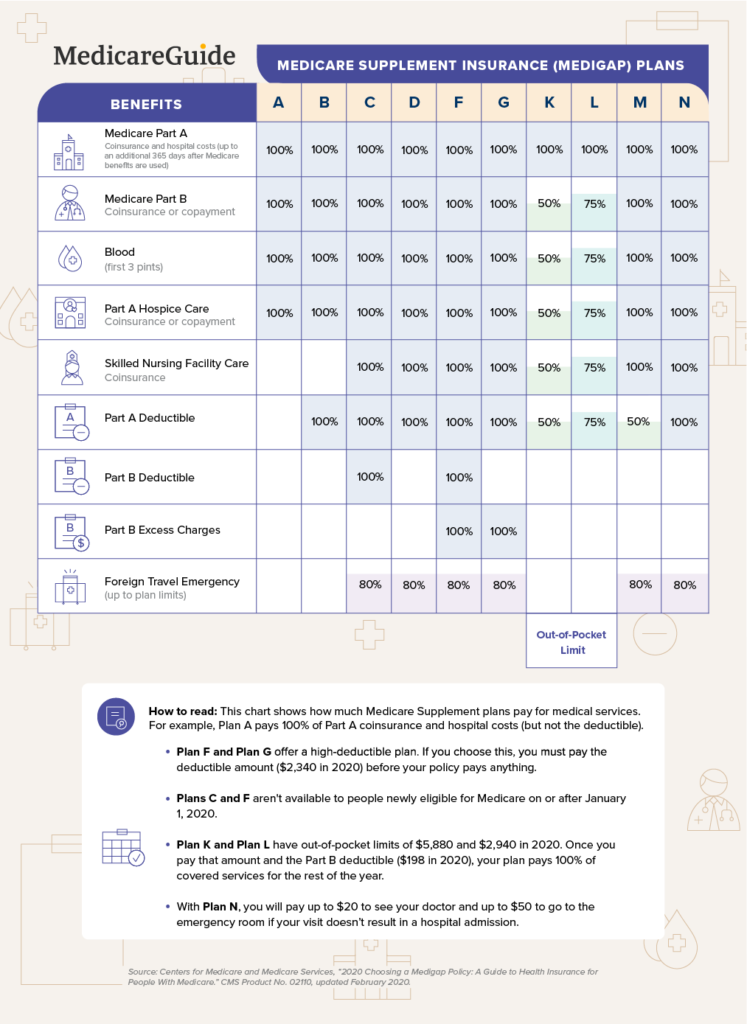

What is a Medigap plan?

Medigap plans are private insurance policies that help you pay your Medicare costs , including copays, coinsurance, and deductibles. You can choose from among 10 plans, and each plan offers the same coverage nationwide.

What is the extra help program?

This program will help you pay all the premiums, deductibles, and coinsurance for a Medicare Part D prescription drug plan.

How old do you have to be to qualify for QDWI?

To qualify for the QDWI program, you must be disabled, working, and under 65 years old. If you went back to work and lost your premium-free Medicare Part A coverage, and if you’re not getting medical help from your state right now, you may be eligible for the QDWI program. You must enroll each year.

How to apply for medicaid?

To apply for the a program, you’ll need to contact your state Medicaid office. You can check online to find your state’s office locations, or call Medicare at 800-MEDICARE. Once you submit your application, you should receive a confirmation or denial within about 45 days. If you’re denied, you can request an appeal.

Does the program for all inclusive care for the elderly require a nursing home?

The Program for All-inclusive Care for the Elderly (PACE) can get you the medical care you need at a PACE center in your area, in your home, or in your community, so you don’t have to go to a nursing home.

How to cut Medicare costs?

You can also cut your Medicare costs by applying for Medicaid, enrolling in PACE, or purchasing a Medigap policy.

What is Medicare Savings Program?

A Medicare Savings Program (MSP) can help pay deductibles, coinsurance, and other expenses that aren’t ordinarily covered by Medicare. We’re here to help you understand the different types of MSPs. Below, we explain who is eligible for these programs and how to get the assistance you need to pay for your Medicare.

What are the different types of Medicare savings programs?

Types of Medicare Savings Programs 1 Qualified Medicare Beneficiary (QMB) Programs pay most of your out-of-pocket costs. These costs include deductibles, copays, coinsurance, and Part B premiums. A QMB will also pay the premium for Part A if you haven’t worked 40 quarters. Those who qualify for the QMB program are also automatically eligible for the Extra Help program for prescription drugs. 2 Specified Low-Income Medicare Beneficiary (SLMB) Programs pay your Part B premium. Like QMBs, those who qualify for SLMBs are automatically eligible for Extra Help. 3 Qualifying Individual (QI) Programs are also known as additional Low-Income Medicare Beneficiary (ALMB) programs. They offer the same benefit of paying the Part B premium, as does the SLMB program, but you can qualify with a higher income. Those who qualify are also automatically eligible for Extra Help. 4 Qualified Disabled and Working Individual (QDWI) Programs cover monthly Part A premiums for qualified individuals under 65 with disabilities who are currently working.

How many types of MSPs are there?

There are four kinds of MSPs. Each type of MSP is tailored to different needs and circumstances. Qualified Medicare Beneficiary (QMB) Programs pay most of your out-of-pocket costs. These costs include deductibles, copays, coinsurance, and Part B premiums. A QMB will also pay the premium for Part A if you haven’t worked 40 quarters.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What is QI in Medicare?

Qualifying Individual (QI) Programs are also known as additional Low-Income Medicare Beneficiary (ALMB) programs. They offer the same benefit of paying the Part B premium, as does the SLMB program, but you can qualify with a higher income. Those who qualify are also automatically eligible for Extra Help.

What is balance billing?

Balance billing refers to the cost for a service that remains after Medicare pays. If you’re a QMB, your providers should not be billing you directly for the balance after Medicare pays them for your service. Yet, if you’re an SLMB or a QI, there is no rule against your doctor’s office sending you a bill for the balance of your service.

What is countable resource?

The term countable resources mean any money in bank accounts (checking or savings), stocks, and bonds. Your home, one car, a burial plot, up to $1,500 already saved for burial expenses, and personal belongings aren’t included when countable resources are considered.

What is MSA in Medicare?

When you have a Medicare MSA plan, the plan provider deposits the money it receives from Medicare into a savings account that you manage. You then become responsible for paying the Medicare-covered portion of your health care costs, instead of the plan. In effect, you must pay 100 percent of the cost for Medicare-covered services up to ...

What is MSA plan?

Medicare MSA plans may offer freedom of choice for people who want more control over their health care dollars and decisions. On the flip side, plan members need to understand how the savings account and deductible work, manage their own medical bills, and keep good records of health care expenses.

What is MSA savings account?

The savings account part of a Medicare MSA plan is self-managed like any other bank savings account. One main difference is that the account is funded with money from Medicare versus by you. Medicare gives Medicare Advantage plan sponsors a set amount of money for each beneficiary covered by the plan. The plan then uses the money ...

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Does Medicare Advantage have a deductible?

All Medicare Advantage plans are required to set an annual out-of-pocket maximum. Savings account withdrawals used to pay for services covered by the plan count toward the deductible. You may use the funds for other qualified medical expenses, but those amounts will not apply to the deductible.

Key Takeaways

Medicaid is a health insurance benefit for people with limited incomes.

What is Medicaid?

Medicaid is a state-run health insurance program that pays for a broad range of medical services for people with low income and resources. Each state runs its own Medicaid program, so eligibility and additional program benefits may vary by state.

Can people with Medicare also have Medicaid?

People who have Medicare can also receive Medicaid, if they meet their state’s eligibility criteria. These people are often called “dual eligibles” or “duals.” Medicaid can cover Medicare co-payments and deductibles and services not covered by Medicare that may be available in your state’s Medicaid program, such as vision, hearing, and dental care.

What are the 4 Medicare Savings Programs?

Medicare Savings Programs (MSPs) are Medicaid-administered programs for people on Medicare who have limited income and resources. These programs help those qualified to afford Medicare. There are four different Medicare Savings Programs, each with different income and resource eligibility limits.

What are the advantages of Medicare Savings Programs?

Seniors and younger adults with disabilities who may not qualify for full Medicaid may still be able to enroll in the Medicare Savings Programs. There are two major advantages to doing so:

Let's keep in touch

Subscribe to receive important updates from NCOA about programs, benefits, and services for people like you.

What are the requirements for MSP?

Generally speaking, the state does not consider the following assets in determining MSP eligibility: 1 Your primary residence 2 One vehicle 3 Burial plot and up to $1,500 in burial expenses 4 Household and personal items

What is a SLMB?

Specified Low-Income Medicare Beneficiary, or SLMB. If you don’t meet the income test for QMB, you may qualify for SLMB. This MSP helps pay your Part B premiums but doesn’t help with Part A premiums or any Medicare cost-sharing expenses. You do qualify for Extra Help with Part D if you qualify for SLMB.

How much is a burial plot in Texas?

Burial plot and up to $1,500 in burial expenses. Household and personal items. In the state of Texas, you cannot qualify for QMB or QI status if you are between the ages of 20 and 64 and institutionalized for mental illness. People of any age who are in prison or jail are automatically disqualified.

Does Texas have Medicare?

Fortunately, people who struggle with health care costs may have options in Texas. Texas Medicare Savings Programs help people cover their out-of-pocket costs under Medicare. Depending on your financial situation, you may get help with your Medicare premiums, deductibles, and cost-sharing expenses. Here’s what you need to know to qualify ...