Who pays Medicare surtax?

You can also get Medicare Part A when you turn 65 with no premiums if you:

- Receive Social Security or Railroad Retirement benefits

- Are eligible to receive these benefits but just haven't filed for them yet

- Had Medicare-covered government employment

How to calculate Medicare surtax?

Medicare levy calculator. This calculator helps you estimate your Medicare levy. It includes any reductions or exemptions you are allowed. It can be used for the 2013–14 to 2020–21 income years. For most taxpayers the Medicare levy is 2% of their taxable income. The Medicare levy surcharge (MLS) is a separate levy from Medicare levy.

How to calculate additional Medicare tax properly?

- Normal medicare tax rate for individual is 1.45 % of gross wages or salary

- Normal medicare tax rate for self employed person is 2.9 % of Gross income.

- If wage or self employment income is more than the threshold amount , only then you are liable for additional medicare tax .

When does Medicare surtax apply?

- $250,000 for married filing jointly;

- $125,000 for married filing separately; and

- $200,000 for all other taxpayers.

How do I avoid Medicare surcharges?

What are the best tips to avoid an IRMAA?Inform Medicare if you've had a life changing event that affected your income. ... Avoid certain income-boosting changes to your annual income. ... Utilize Medicare savings accounts. ... Consider a qualified charitable distribution. ... Explore tax-free income streams.

What is the Medicare surtax for 2022?

The 2022 Medicare tax rate is 2.9%. Typically, you're responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%. Your Medicare tax is deducted automatically from your paychecks.

How is Medicare surtax calculated?

It is paid in addition to the standard Medicare tax. An employee will pay 1.45% standard Medicare tax, plus the 0.9% additional Medicare tax, for a total of 2.35% of their income....What is the additional Medicare tax?StatusTax thresholdmarried tax filers, filing separately$125,0003 more rows•Sep 24, 2020

What is the additional Medicare tax for 2020?

The FICA tax rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2020 (or 8.55 percent for taxable wages paid in excess of the applicable threshold).

What is the Medicare surtax rate for 2021?

0.9 percentThe tax rate for the Additional Medicare Tax is 0.9 percent. That means you'll pay 2.35 percent if you receive employment wages.

Does the 3.8 Medicare surtax apply to capital gains?

What Types of Income Are Subject to the Medicare Surtax? Income sources like interest, dividends, capital gains, rental income, royalties, and even some other passive investment income will be counted.

What is the 3.8 Medicare surtax?

The Medicare tax is a 3.8% tax, but it is imposed only on a portion of a taxpayer's income. The tax is paid on the lesser of (1) the taxpayer's net investment income, or (2) the amount the taxpayer's AGI exceeds the applicable AGI threshold ($200,000 or $250,000).

Who pays Medicare surtax?

2022 Medicare Tax Rates The Medicare tax rate is 2.9% of your income. If you work for an employer, you pay half of it, and your employer pays the other half — 1.45% of your wages each. If you are self-employed, you are responsible for the full 2.9%.

What triggers additional Medicare tax?

An individual will owe Additional Medicare Tax on wages, compensation and self-employment income (and that of the individual's spouse if married filing jointly) that exceed the applicable threshold for the individual's filing status.

Medicare Surcharge

Medicare surcharge is a fee that people pay if their adjusted gross income (plus tax-exempt interest) is higher than $85,000 if you’re single or $170,000 if you’re married filing jointly. The vast majority will pay $104.90 every month for Medicare Part B premiums.

Medicare Comes With a Cost

Medicare Part A which pays for healing center administrations, is free if it is possible that you or your life partner paid Medicare finance charges for no less than ten years, however in the event that individuals are not qualified with the expectation of complementary Part A can pay a month to month premium of a few hundred dollars.

You Can Fill the Gap

Recipients of customary Medicare will probably need to agree to accept a Medigap supplemental protection design offered by private insurance agencies to help cover deductibles, co-installments, and different holes.

There Is an All-in-One Option

Recipient can agree to accept conventional Medicare - Parts A, B, and D, and a supplemental medigap arrangement. Another choice for recipient is to go an option course by agreeing to accept Medicare Advantage, which gives restorative and physician recommended medicate scope through private insurance agencies.

High Incomers Pay More

In the event that recipient picks customary Medicare and his or her wage is over a specific edge, he or she will pay more for Parts B and D.

At the Point When to Sign Up

Somebody effectively taking Social Security advantages will be naturally enlisted in Parts A and B. There is a choice to turn down Part B, since it has a month to month cost; if kept, the cost will be deducted from Social Security if there were benefits as of now guaranteed.

A Quartet of Enrollment Periods

On the off chance that a man missed agreeing to accept Part B amid the underlying enlistment time frame and he or she is not working or not secured by life partner's managers scope, that individual can agree to accept Part B amid the general enlistment time frame that keeps running from January 1 to March 31 and scope will start on July 1.

What is Medicare surcharge?

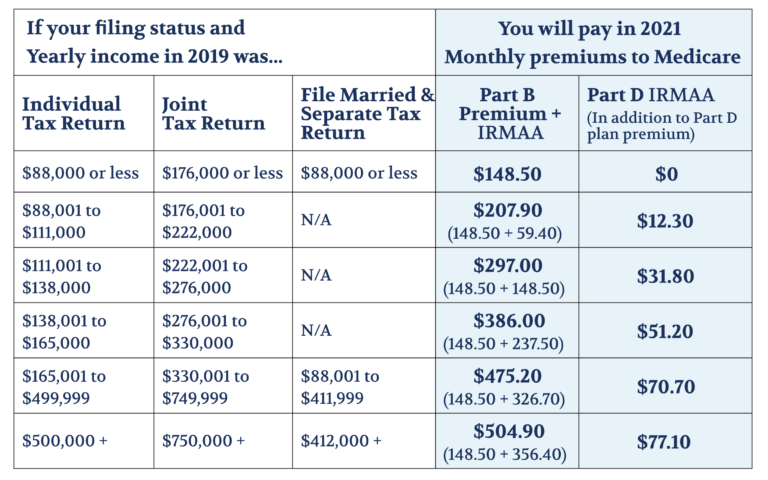

Not everyone knows this, but there are Medicare surcharges (officially called Income Related Monthly Adjustment Amount , or IRMAA) that correspond to income brackets. These additional costs can really add up. It is the highest-earning 5% of Medicare recipients who pay more for their health coverage.

What is the lowest bracket for Medicare?

Lowest Bracket: People in the lowest income bracket will pay their plan’s premium with no Medicare surcharge. The lowest bracket is for those: Filing jointly with income of 176,000 or less/year. Filing as an individual with income of $88,000 or less/year.

What does IRMAA mean on Medicare?

IRMAA stands for Income Related Monthly Adjustment Amount. Medicare.gov explains that, if your modified adjusted gross income as reported on your IRS tax return from two years ago is above a certain amount, you’ll pay the standard premium amount and IRMAA.

How much does Medicare cost in 2021?

The monthly premiums for Medicare Part A range from $0–$471. Most people don’t pay a monthly premium for Part A. If you buy Part A, you’ll pay $471 each month in 2021 if you paid Medicare taxes for less than 30 quarters and $259 each month if you paid Medicare taxes for 30–39 quarters.

Do you pay monthly premiums for Medicare?

You may pay monthly premiums, IRMAA (see below), coinsurance, as well as co-pays and deductibles. Your total out-of-pocket costs for Medicare will vary tremendously depending on the types of coverage you select, your income, where you live, your health status, and healthcare usage.

Is there a surcharge on Medicare Part D?

Medicare Part D — prescription drug coverage — premiums also vary depending on what plan you choose. However, there is a standardized surcharge over and above your premium for higher income earners. This surcharge is usually added to your Part B premium and paid to Medicare.

What is Medicare levy surcharge?

365. A Medicare levy surcharge may apply if you, your spouse and all your dependants did not maintain an appropriate level of private patient hospital cover for the full income year. Use the number of days listed at A to help you complete the Medicare levy surcharge question on your tax return. See also:

How much is a single person liable for MLS?

you may be liable for MLS for the number of days you were single – if your own income for MLS purposes was more than the single surcharge threshold of $90,000. you may be liable for MLS for the number of days you had a spouse or dependent children – if your own income for MLS purposes was more than the family surcharge threshold of $180,000 ...

What is the income threshold for MLS?

The base income threshold (under which you are not liable to pay the MLS) is: $90,000 for singles. $180,000 (plus $1,500 for each dependent child after the first one) for families. However, if you had a spouse for the full year, you do not have to pay the MLS if: your family income exceeds the $180,000 ...

What is MLS in healthcare?

The MLS is designed to encourage people to take out private patient hospital cover and use the private hospital system. This will reduce demand on the public Medicare system.

What information does a private health insurance statement include?

The private health insurance statement you receive from your insurer includes information that relates to the Medicare levy surcharge.

Is a super contribution deductible?

if you have a spouse, their share of the net income of a trust on which the trustee must pay tax (under section 98 of the Income Tax Assessment Act 1936) and which has not been included in their taxable income.

Do you have to pay MLS for Medicare?

If you have to pay Medicare levy, you may have to pay the Medicare levy surcharge (MLS) if you, your spouse and your dependent children do not have an appropriate level of private patient hospital cover and you earn above a certain income.

What is the Medicare surtax?

If your income is above a specific limit, the federal government adds an extra charge to your monthly premium. This charge is known as the Income-Related Monthly Adjustment Amount (IRMAA). Think of IRMAA as a surcharge or a Medicare surtax, as some refer to it.

What does Medicare look for in a tax return?

Medicare looks at the modified adjusted gross income ( MAGI) reported on your IRS tax return from 2 years ago to determine if you pay higher monthly premiums for Part B and Part D.

What is the difference between Medicare Part B and Part D?

Medicare is made up of several parts. Most have monthly premiums, which is the amount you pay each month for coverage. Part B has a standard premium amount that most people pay each month. That amount changes from year to year , but it's generally consistent for most Medicare enrollees .

Do you get a quarterly bill if you don't take Social Security?

If the amount isn't taken from your payment, you should receive a quarterly bill in the mail. And if you're not taking Social Security retirement benefits, you'll get a bill in the mail for the standard Part B premium amount, plus any IRMAA you owe.

Is it important to get Medicare?

So as part of your retirement income planning, it's important to get the Medicare decisions right. Many older Americans are working longer and continuing to earn income well into their 60s and 70s. This income can help boost their retirement security, but it may also mean they face higher Medicare premiums.

Do charitable donations count as income?

Taking a distribution from a qualified retirement account to make these kinds of charitable donations does not count as income when it comes to IRMAA.

Is a Medicare savings account tax exempt?

An MSA is like a health savings account (HSA). Contributions made to an MSA are tax-exempt, and withdrawals are tax-free, if the money taken out is spent on qualified health care expenses. Moving money into an MSA could potentially lower your taxable income.

What is the Medicare surcharge for 2022?

In 2022, individuals with modified adjusted gross income of $91,000 or more and married couples with MAGIs of $182,000 or more will pay additional surcharges ranging from an extra $68 per month to an extra $408.20 per month on top of the standard Part B premium. Married couples where both spouses are enrolled in Medicare pay twice as much.

What is the 15% increase in Medicare?

The 15% increase in the Part B standard monthly premium is one of the largest annual hikes in the history of the Medicare program. When the Medicare program started in 1966, the initial Part B premium was $3 per month.

How much of Medicare Part B premium is required?

By law, the Medicare Part B monthly premium must equal 25% of the estimated total Part B costs for enrollees 65 and older and must maintain adequate reserves in case actual costs are higher than anticipated.

How much is Medicare Part B in 2022?

The standard Medicare Part B premium, which covers doctors visits and other outpatient services, will increase to $170.10 per month in 2022, up $21.60 from this year’s monthly premium of $148.50, the Centers for Medicare and Medicaid Services announced late Friday.

Will Medicare pay higher Part B premiums?

Medicare beneficiaries will pay higher Part B premiums and income-related surcharges next year, partially as a result of Covid-related health care expenses during the pandemic and the recent approval of a new Alzheimer drug.

Will Medicare Part B premiums increase in 2022?

The increase in the 2022 Medicare Part B premium and annual deductibles reflect rising prices and utilization across the health care system during the pandemic and anticipated increases in the intensity of care provided, according to CMS. In addition, Medicare needs to build in contingency reserves “due to the uncertainty regarding the potential use of the Alzheimer’s drug Aduhelm by people with Medicare,” the CMS announcement explained.

Points to know

The Medicare surtax applies to taxpayers above certain income thresholds.

What's the Medicare surtax?

The Affordable Care Act of 2010 included a provision for a 3.8% "net investment income tax," also known as the Medicare surtax, to fund Medicare expansion.

How is the tax calculated?

If the tax applies to you, you'll need to calculate the following 2 amounts using IRS Form 8960. You'll owe the 3.8% tax on the lesser amount.

How is the Medicare surtax reported?

If you owe the tax, you'll report it on your Form 1040 (and also include Form 8960, as stated above). If you believe you'll be subject to the tax, you may want to make quarterly estimated tax payments to avoid potential penalties. Talk to a tax advisor about your specific situation.

Is there any way to reduce the tax?

You can sell some securities at a loss to offset investment gains if you think you might be subject to the surtax this tax year. And when planning for the future, you can also choose investments that are naturally more tax-efficient.

Get more from Vanguard. Call 1-800-962-5028 to speak with an investment professional

Get more from Vanguard. Call 1-800-962-5028 to speak with an investment professional.

Investor Education

Vanguard funds not held in a brokerage account are held by The Vanguard Group, Inc., and are not protected by SIPC. Brokerage assets are held by Vanguard Brokerage Services, a division of Vanguard Marketing Corporation, member FINRA and SIPC.

What is Medicare surtax?

0 1 minute read. Medicare surtax is the additional Medicare tax that applies to taxpayers with income above a certain threshold. The income threshold depends on the filing status of the taxpayer. Medicare surtax was first introduced in 2010 with the Affordable Care Act of 2010 and applies to investment income.

What is modified adjusted gross income?

The Modified Adjusted Gross Income refers to the household AGI. You won’t be able to find MAGI on your tax return (s), so don’t even bother looking at bit but you can take your Adjusted Gross Income and add back certain deductions and tax-exempt interest income.

How much does Medicare cover?

The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%. Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with ...

What percentage of Medicare premiums do Medicare beneficiaries pay?

The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%.

How long does it take to pay Medicare premiums if income is higher than 2 years ago?

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. IRMAA is re-evaluated every year as your income changes.

How much does Medicare premium jump?

If your income crosses over to the next bracket by $1, all of a sudden your Medicare premiums can jump by over $1,000/year. If you are married and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

How much is Medicare Part B 2021?

The standard Medicare Part B premium is $148.50/month in 2021. A 40% surcharge on the Medicare Part B premium is about $700/year per person or about $1,400/year for a married couple both on Medicare. In the grand scheme, when a couple on Medicare has over $176k in income, they are probably already paying a large amount in taxes.

How to file an appeal for Medicare Part B premium?

You file an appeal by filling out the form SSA-44 to show that although your income was higher two years ago, you had a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Do Medicare beneficiaries pay a surcharge?

Higher-income Medicare beneficiaries also pay a surcharge for Part D. The income brackets are the same. The surcharges are relatively smaller in dollars.

How many people are covered by Medicare?

It’s made up of several parts. In 2019, Medicare covered about 61.5 million Americans and is predicted to increase to 75 million by 2027.

What is Medicare Part C?

Medicare Part C. Part C is also referred to as Medicare Advantage. These plans often cover services that original Medicare (parts A and B) don’t cover, such as dental, vision, and hearing. Part C is not affected by IRMAA.

How to contact Medicare directly?

SSA. To get information about IRMAA and the appeals process, the SSA can be contacted directly at 800-772-1213.

What happens if IRMAA is applied to my Medicare?

If the SSA decides that an IRMAA applies to your Medicare premiums, you’ll receive a predetermination notice in the mail. This will inform you about your specific IRMAA and will also include information such as:

What is the state health insurance program?

The State Health Insurance Assistance Program (SHIP) provides free assistance with your Medicare questions. You can find out how to contact your state’s SHIP program here. Medicaid. Medicaid is a joint federal and state program that assists people who have a lower income or resources with their medical costs.

What is a Part D insurance plan?

Part D is prescription drug coverage. Like Part C plans, Part D plans are sold by private companies. Part D is affected by IRMAA. As with Part B, a surcharge can be added to your monthly premium, based on your yearly income. This is separate from the surcharge that can be added to Part B premiums.

Does IRMAA apply to Medicare?

Each year, the SSA reevaluates whether an IRMAA should apply to your Medicare premiums. So, depending on your income, an IRMAA could be added, updated, or removed.