Key Takeaways

- Medicare taxes fund hospital, hospice, and nursing home expenses for elderly and disabled individuals.

- In 2021, the Medicare tax rate is 2.9%, which is split between an employee and their employer.

- Self-employed individuals are responsible for both portions of Medicare tax but only on 92.35% of business earnings.

How much do tax payers pay for Medicare?

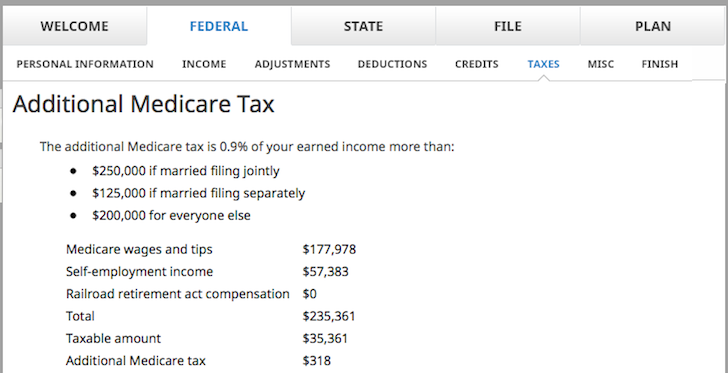

If your income means you’re subject to the Additional Medicare Tax, your Medicare tax rate is 2.35%. However, this Medicare surtax only applies to your income in excess of $200,000. If you make $250,000 a year, you’ll pay a 1.45% Medicare tax on the first $200,000, and 2.35% on the remaining $50,000.

What income is subject to Medicare tax?

Feb 24, 2022 · Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an...

Does Medicare count as health insurance for taxes?

Mar 31, 2022 · The Medicare tax is used to fund approximately 88% of Medicare Part A services for seniors and people with disabilities. These funds are used to pay for current services and also “prepay” your premiums for Part A when you become eligible for Medicare. Medicare Part A premiums are broken down into three categories, outlined below.

How much do I pay for Medicare tax?

Mar 16, 2022 · What Are Medicare Taxes? The current Medicare tax rate is 1.45 percent of your wages and is withheld from your paycheck. Your employer matches your contribution by paying another 1.45 percent. If you are self-employed, you have to pay the full 2.9 percent of your net income as the Medicare portion of your FICA taxes. Connect With a Medicare Expert

Is the Medicare tax mandatory?

Generally, if you are employed in the United States, you are required to pay the Medicare tax regardless of your or your employer’s citizenship. Th...

Are tips subject to Additional Medicare Tax?

Tips are subject to Additional Medicare Tax in certain situations. If the amount of tips, when combined with other wages, exceeds the minimum thres...

Is there a wage base limit for Medicare tax?

The wage base limit is the maximum wage that’s subject to the tax for that year. There is no wage base limit for Medicare tax. All your covered wag...

What is the Medicare tax used for?

The Medicare tax funds Medicare Part A, which provides hospital insurance to eligible Americans over age 65 and individuals with disabilities.

Can I opt out of Medicare tax?

While you may choose not to receive Medicare benefits once you reach the qualifying age, you cannot opt out of paying the Medicare tax.

Do I get Medicare tax back?

If you are an American citizen or resident, you will not get any of the money you paid toward Medicare back as part of any tax refund. On the other...

Who is exempt from paying Medicare tax?

Nonresident aliens who meet specific criteria are exempt from the Medicare Tax. For example Nonresident alien students, teachers, researchers, and...

What is Medicare tax?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee’s paycheck or paid as a self-employment tax. 1.

How much does a W-2 pay?

W-2 employees pay 1.45% and their employer covers the remaining 1.45%. Self-employed individuals, as they are considered both an employee and an employer, must pay the full 2.9%. Unlike Social Security tax, there is no income limit to which Medicare tax is applied. 7. An individual’s Medicare wages are subject to Medicare tax.

Who is Kathryn Flynn?

Medicare Tax. Kathryn Flynn is a personal finance writer and editor with special expertise in 529 plans, student loans, budgeting, investing, tax planning, and insurance.

Do employers have to pay Medicare taxes?

Under the Federal Insurance Contributions Act (FICA ), employers are required to withhold Medicare tax and Social Security tax from employees’ paychecks. Likewise, the Self-Employed Contributions Act (SECA) mandates that self-employed workers pay Medicare tax and Social Security tax as part of their self-employment tax. 1. ...

The Basics of Medicare Tax

The Medicare tax is generally withheld from your paycheck as part of your FICA taxes — what are usually called “payroll taxes.” FICA stands for Federal Insurance Contributions Act. FICA taxes include money taken out to pay for older Americans’ Social Security and Medicare benefits.

Why Do You Have to Pay a Medicare Tax?

The Medicare tax helps fund the Hospital Insurance (HI) Trust Fund. It’s one of two trust funds that pay for Medicare.

Additional Medicare Tax

The Affordable Care Act added an extra Medicare surtax for people with higher incomes starting in January 2013.

Medicare Tax for Self-Employed Workers

If you are self-employed, you are responsible for the entire 2.9 percent share of your earned income for the Medicare tax. This is covered through a self-employment (SE) tax. The self-employment tax covers your entire 15.3 percent of FICA taxes, paying your share of Social Security and Medicare taxes.

The main points

Medicare taxes help pay for older and handicapped people’s hospitals, hospices, and nursing home care.

How is the Medicare tax calculated?

Every person who works in the United States must contribute to this system. Federal law requires employers to deduct Medicare and Social Security taxes from employee paychecks (FICA). Similar conditions arise under the SECA, making it mandatory for self-employed workers to pay Medicare and Social Security taxes as part of their self-employment tax.

Medicare tax rates for 2021

The Medicare tax rate will be 2.9% in 2021, with the payment burden that employees and employers will share equally. W-2 employees contribute 1.45%, with their employer covering the rest. Self-employed individuals must pay the total 2.9% tax because they are both an employee and an employer. There is no upper-income limit.

There is a tax on Medicare premiums

There is an additional Medicare tax and a net investment income tax to fund Medicare expansion. Both introduced in 2014 under the Affordable Care Act (ACA). However, both are for high earners and are based on their tax bracket. A taxpayer can be subject to both Medicare surtaxes.

People who get additional benefits pay a supplemental Medicare levy

Additionally, anyone with income above certain thresholds (including wages and compensation and self-employment income) pays an additional amount. The individuals are earning more than $200,000 and married couples applying together making more than $250,000 pay Medicare tax more than others.

Net investment income is taxable

The net investment income tax, commonly known as the “unearned income Medicare contribution surtax,”. It is a 3.8% additional tax on net investment income in addition to existing taxes. Additionally, there is no employer-paid share of this premium.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA tax?

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.