To become a Medicare insurance agent, you must first get a health insurance license in the state you currently live in (this is called your resident state health insurance producer license). You can use the link below for WebCE to obtain your study material needed before you scheduled your insurance exam.

How do I get a Medicare license?

Jun 02, 2020 · To become a Medicare insurance agent, you must first get a health insurance license in the state you currently live in (this is called your resident state health insurance producer license). You can use the link below for WebCE to obtain your study material needed before you scheduled your insurance exam.

What is a life and health insurance license?

Finally have a name that matches exactly with the name used to register for the exam; The passing score required on each exam is 70%. In fact, Prometric notifies the Department of Insurance of your exam results within 2 business days. 3. Becoming a licensed Medicare Agent – Apply for License

What are the designations for life and health insurance agents?

My card is lost or damaged — Log into (or create) your Medicare account to print an official copy of your Medicare card. You can also call us at 1-800-MEDICARE (1-800-633-4227) to order a replacement card. TTY users can call 1-877-486-2048. My name changed — Your Medicare card shows the name you have on file with Social Security.

What is a Medicare provider and supplier organization?

Get Medicare costs. Find local help. Medicare card issues. Mail you get about Medicare. GovDelivery.

What is a Medicare FMO?

What license do I need to sell Medicare insurance in Florida?

What is a Medicare advisor?

Is selling Medicare lucrative?

What is a 440 license in Florida?

How do I become a certified Medicare agent in Florida?

- Get your health insurance license.

- Complete AHIP Certification.

- Get errors and omissions insurance (E&O insurance)

- Contract with a Medicare Field Marketing Organization (FMO)

- Get contracted and appointed with multiple Medicare companies.

- Complete your annual certifications.

Why do Medicare advisors call?

Do Medicare advisors call you?

Who is the best person to talk to about Medicare?

Which type of insurance agents make the most money?

While there are many kinds of insurance (ranging from auto insurance to health insurance), the most lucrative career in the insurance field is for those selling life insurance.

Can you make millions selling insurance?

Can you sell life insurance and Medicare at the same time?

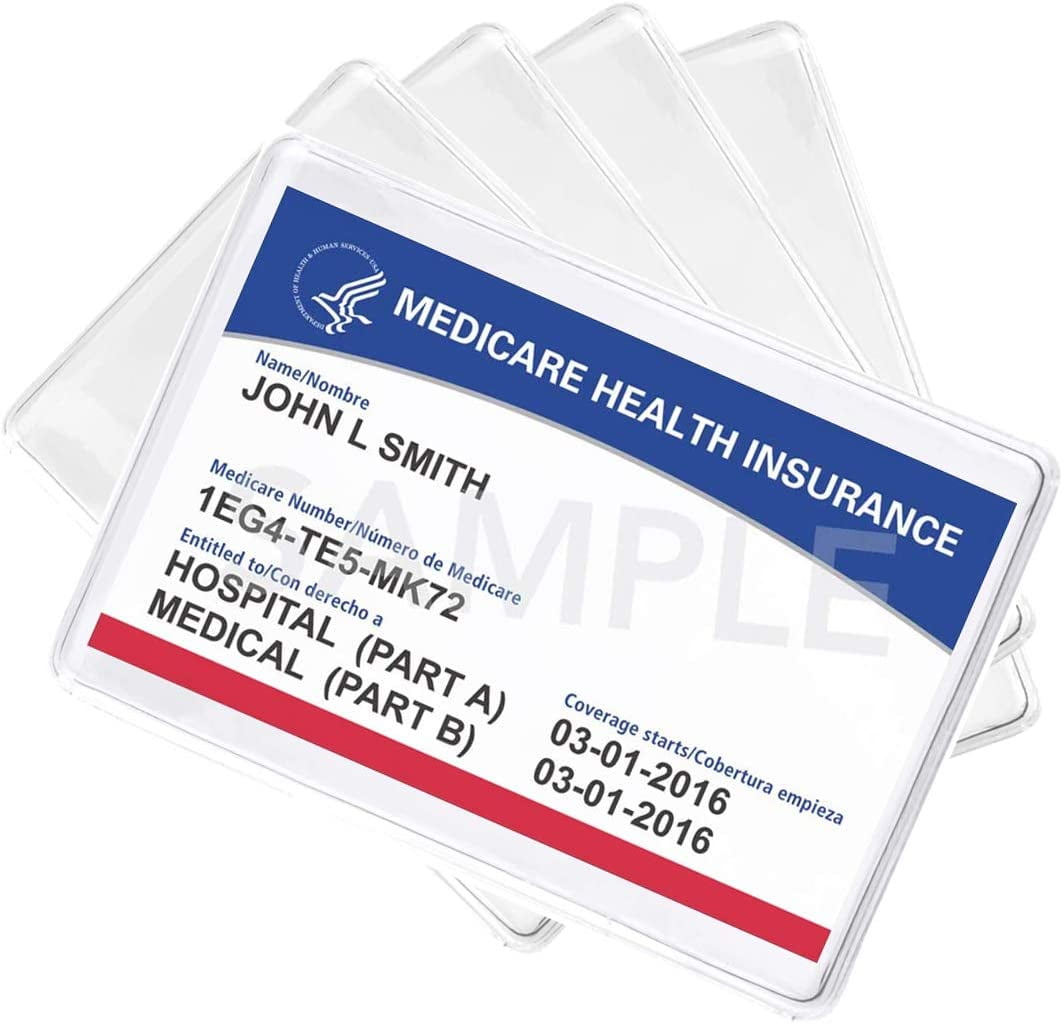

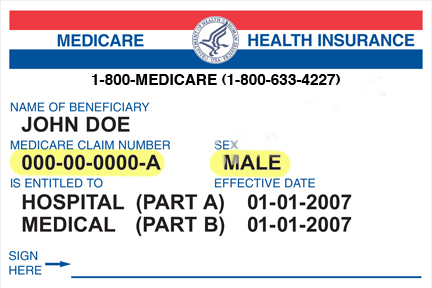

Protect your Medicare Number like a credit card

Only give personal information, like your Medicare Number, to health care providers, your insurers or health plans, or people you trust that work with Medicare, like your#N#State Health Insurance Assistance Program (SHIP)#N#State Health Insurance Assistance Program (SHIP)#N#A state program that gets money from the federal government to give free local health insurance counseling to people with Medicare.#N#..

Carrying your card

You’ll need the information on your Medicare card to join a Medicare health or drug plan or buy#N#Medicare Supplement Insurance (Medigap),#N#Medicare Supplement Insurance (Medigap)#N#An insurance policy you can buy to help lower your share of certain costs for Part A and Part B services (Original Medicare).#N#so keep your Medicare card in a safe place..

How do you get another Medicare card?

My card is lost or damaged — Log into (or create) your Medicare account to print an official copy of your Medicare card. You can also call us at 1-800-MEDICARE (1-800-633-4227) to order a replacement card. TTY users can call 1-877-486-2048.

What is Medicare enrollment?

The Medicare Enrollment Application Eligible Ordering, Certifying, and Prescribing Physicians and Other Eligible Professionals (Physicians, including dentists and other eligible NPPs), use to enroll to order items or certify Medicare patient services. This includes those physicians and other eligible NPPs who don't and won't send furnished patient services claims to a MAC.

What is Medicare enrollment application?

Medicare Enrollment Application is the form for Re-assignment of Medicare Benefits. It explains how to request a re-assignment of a right to bill the Medicare Program and get Medicare payments. Only individual physicians and NPPs can reassign their right to bill the Medicare Program.

How much is the Medicare application fee for 2021?

Application Fee Amount. The enrollment application fee sent January 1, 2021, through December 31, 2021, is $599. For more information, refer to the Medicare Application Fee webpage. How to Pay the Application Fee ⤵. Whether you apply for Medicare enrollment online or use the paper application, you must pay the application fee online:

Do health care providers have to enroll in Medicare?

Health care providers must enroll in the Medicare Program to get paid for providing covered services to Medicare patients. Learn how to determine if you’re eligible to enroll and how to do it.

Does Medicare require EFT?

If enrolling in Medicare, revalidating, or making certain changes to their enrollment, CMS requires E FT. The most efficient way to enroll in EFT is to complete the PECOS EFT information section. When submitting a PECOS web application:

How long does it take to change Medicare enrollment?

Providers and suppliers must report a change of ownership or control, a change in practice location, and final adverse legal actions (such as revocation or suspension of a federal or state license) within 30 days of the change and report all other changes within 90 days of the change.

What is Medicare revocation?

A Medicare-imposed revocation of Medicare billing privileges. A suspension, termination, or revocation of a license to provide health care by a state licensing authority or the Medicaid Program. A conviction of a federal or state felony within the 10 years preceding enrollment, revalidation, or re-enrollment.

What does HCP stand for?

HCP – Healthcare Compliance Professional#N#Not available to just anyone, agents seeking this designation must hold a position that requires them to manage regulatory requirements set forth by the Affordable Care Act.

Is end of life planning the same as health insurance?

End-of-life planning often means investing in financial products as well as life insurance, so a large portion of life insurance agents is equipped to offer both.

Why are agent designations so popular?

The most common agent designations tend to be popular because they cover a wide range of subjects. However, it isn’t uncommon for an insurance producer to choose a course that will distinguish him or her by gaining knowledge on a particular niche subject.

Where does Natasha McLachlan live?

Natasha McLachlan is a writer who currently lives in Southern California. She is an alumna of California College of the Arts, where she obtained her B.A. in Writing and Literature. Her current work revolves around insurance guides and informational articles.

Who is Laura Walker?

Written by Natasha McLachlan. Content Writer . Laura Walker graduated college with a BS in Criminal Justice with a minor in Political Science. She married her husband and began working in the family insurance business in 2005.

What is a CIC?

CIC – Certified Insurance Counselor. This is one of the most popular designations, as it has been around for forty years. Not limited to just home and auto insurance, the CIC designation also covers commercial casualty and commercial property insurance, life and health insurance, and agency management.

What is a RHU?

RHU – Registered Health Underwriter#N#One of the more comprehensive designations, insurance producers who have completed this course will have a broad knowledge of multiple aspects of the health insurance industry including but not limited to Medicare, Medicaid, managed care plans, individual and group medical, and group dental and voluntary benefits plans.

How Do I Get Licensed to Sell Medicare?

Selling Medicare is a great line of work for individuals who are professional, outgoing, and self-motivated. It can also be a very lucrative line of work if you’re willing to work as hard as you can and set ambitious goals for yourself. However, in order to sell Medicare, you need to first obtain your license by taking the following steps.

Step 1: Pre-Licensing

The first step to becoming a licensed Medicare agent is to complete a pre-licensing course. You can usually choose to take this course in a traditional classroom setting or online in a self-study format if you prefer.

Step 2: The State Licensing Exam

The next step to becoming a licensed Medicare agent is to pass the state licensing exam. The exam can be taken at various testing centers throughout your state, however, each state has its own insurance licensing exam and the requirements may vary, so be sure to read those specific to your state of residence when preparing for the test.

Step 3: Apply for Your License

Once you’ve passed the state licensing exam, you can officially apply for your license —Congratulations! Most states have a reciprocal agreement which means that once you’ve obtained your license in one state, you can get an additional license in another state without having to sit for that state’s exam.

Get Started Today

To learn more about becoming an independent insurance agent, contact MCC Brokerage today. Or, click here to read some articles about what independent insurance agents do, how much money they can make, and where they can get comprehensive job training.

What is a health insurance license?

Health Insurance License. Health insurance licensure will allow you to write health insurance products offered within your state. With a health insurance license, you are recognized as qualified to explain, sell, and write health insurance products.

What is a life and health license?

Obtaining a life and health insurance license permits you to begin selling and retaining life and/or health insurance policies within a specific state. It qualifies you as a life insurance agent legally able to explain, sell, and process that line of insurance. Both of these types of insurance lines protect a claimant from loss relating ...

How much does it cost to renew an insurance license?

Most states have a renewal period of about two (2) years and have renewal fees ranging from $15 – $200 per line.

How many hours do you need to renew your license?

The average number of hours to be completed is sixteen (16) – thirty (30) hours per line. These courses must be completed prior to your license’s date of expiration or a penalty fine will be added to your renewal fee.

What is life insurance?

Life insurance policies ensure the policyholder and their beneficiaries will receive a stated benefit upon the event of a death. Life insurance policies can vary based on the length of time covered, and with that, the premiums and amount of coverage vary.

What is the difference between term and whole life insurance?

Whereas whole life insurance policies cover the lifetime of the insured, but at higher premiums.

How to prepare for life insurance exam?

How To Prepare For the Life And Health Insurance Exam. Understanding that the insurance exam is a proctored, multiple-choice exam can inform your study habits. The proctored nature of this exam means an individual is present while you take the assessment, either in person or monitoring via a computer. This ensures there are no additional aids used ...

How to become an insurance agent in New York?

Once you’ve passed your exams and completed the licensing application, you are now a licensed insurance agent in New York. A common question we hear is, “I have my insurance license, now what?” Here are a few things you can do or need to know: 1 Get a job in the insurance field. Check out StateRequirement’s Insurance Jobs board. 2 If you’re going to sell advanced life insurance products, you’ll need to have the proper securities licenses. Series 6 , Series 7, and Series 63 are the most common among insurance agents, but you’ll need to begin with the SIE (Securities Industry Essentials) exam. Find out which licenses you need with our Securities Licensing Guide. 3 Every two years, you’ll need to renew your insurance license. Check out our guides on New York Insurance License Renewal and New York Insurance Continuing Education for more details.

Is it hard to get an insurance license?

Insurance license tests are intentionally difficult, but not impossible by any means. You should study to the point of comfortability with the information before you attempt the test. Failing the exam isn’t the end of the world, but keep in mind that you will need to pay the fee each time you attempt the test.

How long is the Property and Casualty exam?

The Property and Casualty exam is One hundred fifty (150) questions long, and you have two hours and thirty minutes (2:30) to complete the test. Here is a copy of the Property and Casualty Test Outline, provided by PSI. You must score 70% or higher on each of these tests to pass.