When does Medicare supplement open enrollment occur?

Dec 22, 2020 · Medicare Supplement Insurance (Medigap) has a six-month open enrollment period (OEP). Your open enrollment period begins when you are both: 65 years old and; Enrolled in Medicare Part B; Unlike the Medicare OEP that happens once …

What to do during Medicare open enrollment?

Aug 06, 2021 · Your Medicare Supplement Open Enrollment Period is unique to you and begins the first day of the month your Medicare Part B is effective. This window lasts for six months and is a once-in-a-lifetime opportunity to enroll in any Medicare Supplement plan without the need to answer health questions and undergo the medical underwriting process.

When is the deadline for Medicare open enrollment?

In general, the best time to enroll in a Medicare Supplement insurance plan is during your Medigap Open Enrollment Period. This is the six-month period that starts on first day of the month that you are both 65 or older and enrolled in Medicare Part B. Throughout this period, you can enroll in any Medigap plan offered in your service area with guaranteed issue.

What happens during Medicare open enrollment?

If you have Original Medicare and would like to enroll in a Medicare Supplement Insurance plan (also called Medigap), the best time to sign up is during your six-month Medigap Open Enrollment Period. Your Medigap Open Enrollment Period starts as soon as you are age 65 or older and are enrolled in Medicare Part B.

What is the open enrollment period for Medicare Supplements?

Under federal law, you have a six-month open enrollment period that begins the month you are 65 or older and enrolled in Medicare Part B. During your open enrollment period, Medigap companies must sell you a policy at the best available rate regardless of your health status, and they cannot deny you coverage.

Can you change Medicare supplement plans anytime?

You can change your Medicare Supplement Plan anytime, just be aware that you might have to answer medical questions if your outside your Open Enrollment Period.

Can you change Medicare supplement plans without underwriting?

During your Medigap Open Enrollment Period, you can sign up for or change Medigap plans without going through medical underwriting. This means that insurance companies cannot deny you coverage or charge you more for a policy based on your health or pre-existing conditions.Nov 22, 2021

Is Medicare open enrollment only once a year?

The Medicare Open Enrollment Period is also known as the Annual Election Period (AEP) for Medicare health and prescription drug plans. It's also called the Fall Open Enrollment Period. This time period happens only once a year.Jul 6, 2021

Can Medicare Supplement plans turn you down?

That's because during this time, you can join any Medicare Supplement insurance plan offered in your service area with guaranteed issue, meaning the Medigap insurance company can't turn you down for coverage or charge you higher premiums because of pre-existing conditions*.

What states allow you to change Medicare Supplement plans without underwriting?

California and Oregon both have “birthday rules” that allow Medigap enrollees a 30-day window following their birthday each year when they can switch, without medical underwriting, to another Medigap plan with the same or lesser benefits.

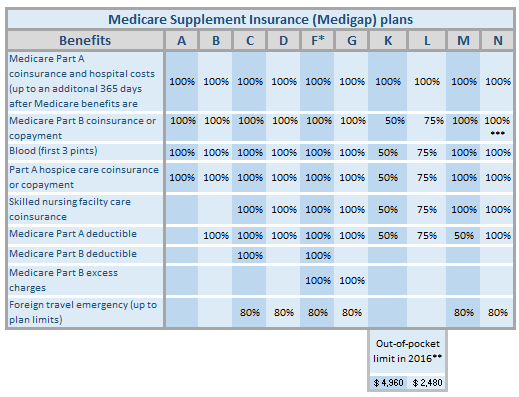

Can I switch from Plan N to Plan G without underwriting?

You can change Medigap carriers, while keeping the same level of coverage, during the months surrounding your Medigap anniversary. For example, you can switch from a Plan G to a Plan G without underwriting, but not from a Plan G to a Plan N.Jan 30, 2021

Can I switch from Medigap to Medicare Advantage without underwriting?

If you leave that Medicare Advantage plan in the first 12 months, you can return to your Medigap plan without underwriting. In that first year ONLY, you will be guaranteed to reinstate your former Medigap plan. Be aware of this window if you try Medicare Advantage and decide you don't like it.Oct 4, 2016

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Do you have to renew Medicare Supplement every year?

Medicare Supplement (Medigap) Plans: You do not have to do anything annually to renew them, and there is no annual open enrollment period for Medicare Supplement plans. They have the benefit of being “guaranteed renewable”. It will continue indefinitely unless you don't pay the premium.May 16, 2018

What happens if I miss Medicare open enrollment?

If you missed your Initial Enrollment Period (IEP) and need to enroll in Medicare, you likely will have to enroll during either a Special Enrollment Period (SEP) or the General Enrollment Period (GEP).

Do you have to enroll in Medicare Part B every year?

For Original Medicare (Parts A and B), there are no renewal requirements once enrolled. Medigap plans ― also known as Medicare Supplement plans ― auto renew annually unless you make a change.Apr 5, 2022

What is Medicare Supplement Open Enrollment Period?

What is Medicare Supplement Open Enrollment? Medicare Supplement Open Enrollment Period is a once in a lifetime window that allows you to enroll in any Medigap plan without answering health questions.

How long does Medicare open enrollment last?

Applying outside your open enrollment window can result in higher premiums, as well as restrict your coverage options. This window only lasts for six months for each new beneficiary, unless you delay enrollment into Part B due to having other creditable coverage.

What happens if you miss your Medigap open enrollment period?

When you miss your Medigap Open Enrollment Period and are denied coverage, there are alternative options. If you have a serious health condition that causes a Medigap carrier not to accept you, you should be able to enroll in a Medicare Advantage plan.

Why do people delay enrolling in Medicare Supplement?

For some; they choose to delay enrolling in Part B due to still working and having creditable coverage with their employer. When they do retire and enroll in Part B, they will initiate their Medicare Supplement Open Enrollment Period.

Does timing affect Medigap coverage?

Timing can affect how much you pay for coverage; how easy coverage is to obtain, and it can significantly determine the options available to you. The Megiap OEP is the only time you’ll ever get that allows you to enroll in any Medigap letter plan. You’ll be able to avoid having to answer any health questions.

Which states have open enrollment?

Some states have unique open enrollment rules, like Connecticut and California. In California, they have a birthday rule that allows you to enroll days surrounding your birthday without answering health questions. In Connecticut, they have a year-round open enrollment window for all beneficiaries.

Can you get insurance if you enroll in one time?

If they enroll as soon as their first eligible, during the one-time individual open enrollment window, these health problems will not prevent them from getting coverage.

How to enroll in Medicare Supplement?

There are some situations when you may still be able to enroll in a Medicare Supplement insurance plan with guaranteed issue. Those situations may include, but aren’t limited to: 1 Your Medigap insurance company goes bankrupt or misled you. 2 Your Medigap coverage ends through no fault of your own. 3 You’re enrolled in Original Medicare and an employer-sponsored group plan, and your employer coverage is ending. 4 You’re enrolled in a Medicare SELECT plan (a type of Medigap plan that uses provider networks), and you move out of your plan’s service area. 5 You’re enrolled in a Medicare Advantage plan and move out of the plan’s service area, or your Medicare Advantage plan leaves the Medicare program. 6 You enrolled in a Medicare Advantage plan at age 65 when you were first eligible for Medicare Part A, but changed your mind within the first year and want to return to Original Medicare. 7 You dropped your Medigap plan to enroll in a Medicare Advantage plan for the first time, but changed your mind within the first year and want to return to Original Medicare.

What is Medicare Supplement Insurance?

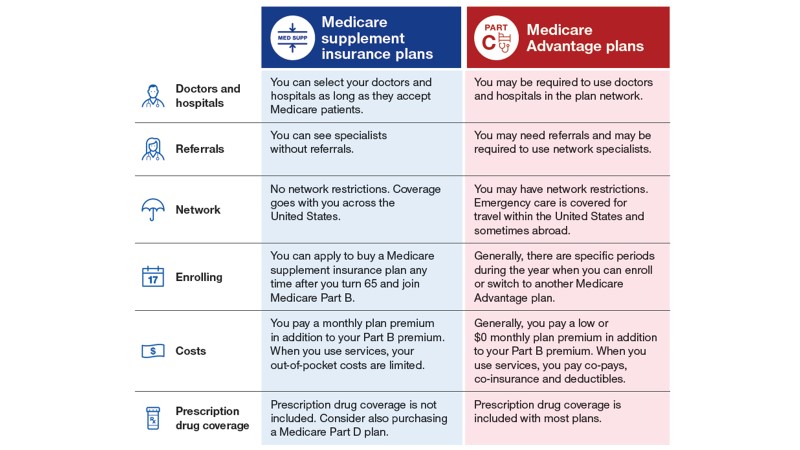

That’s where Medicare Supplement insurance comes in. Also known as Medigap, Medicare Supplement insurance plans work alongside your Original Medicare coverage to help fill in some of those coverage gaps. These plans may pay for certain costs ...

How long is the Medicare Part B period?

This is the six-month period that starts on first day of the month that you are both 65 or older and enrolled in Medicare Part B. Throughout this period, you can enroll in any Medigap plan offered in your service area with guaranteed issue.

Does Medigap end?

Your Medigap coverage ends through no fault of your own. You’re enrolled in Original Medicare and an employer-sponsored group plan, and your employer coverage is ending. You’re enrolled in a Medicare SELECT plan (a type of Medigap plan that uses provider networks), and you move out of your plan’s service area.

Can you switch Medigap plans?

If you’re already enrolled in a Medigap plan, you may not be able to switch plans with guaranteed issue (except in certain situations). Without guaranteed-issue rights, you may be subject to medical underwriting and charged higher premiums based on your health status.

Can you still enroll in Medicare Supplement with guaranteed issue?

Other situations when you may have guaranteed-issue rights. There are some situations when you may still be able to enroll in a Medicare Supplement insurance plan with guaranteed issue. Those situations may include, but aren’t limited to: Your Medigap insurance company goes bankrupt or misled you.

When does Medicare open enrollment end?

The Medicare Advantage Open Enrollment Period starts January 1 and ends March 31 every year. During this period, you can switch Medicare Advantage plans or leave a Medicare Advantage plan and return to Original Medicare.

How long does Medicare initial enrollment last?

Your Initial Enrollment period lasts for seven months : It begins three months before you turn 65.

How long does Medicare last?

It includes your birth month. It extends for another three months after your birth month. If you are under 65 and qualify for Medicare due to dis ability, the 7-month period is based around your 25th month of disability benefits.

What happens if you don't sign up for Medicare?

If you don't sign up during your Initial Enrollment Period and if you aren't eligible for a Special Enrollment Period , the next time you can enroll in Medicare is during the Medicare General Enrollment Period.

When is the best time to enroll in Medicare Supplement?

If you have Original Medicare and would like to enroll in a Medicare Supplement Insurance plan (also called Medigap), the best time to sign up is during your six-month Medigap Open Enrollment Period .

How long does it take to switch back to Medicare?

If you sign up for a Medicare Advantage plan during your Initial Enrollment Period, you can change to another Medicare Advantage plan or switch back to Original Medicare within the first 3 months that you have Medicare.

Can you qualify for a special enrollment period?

Depending on your circumstances, you may also qualify for a Special Enrollment Period (SEP). Medicare Special Enrollment Periods can happen at any time during the year. You may qualify for a Special Enrollment Period for a number of reasons, which can include:

What is open enrollment in Medicare?

There is a lot of confusion about the open enrollment#N#In health insurance, open enrollment is a period during which a person may enroll in or change their selection of health plan benefits. Health plan enrollment is ordinarily subject to restrictions....#N#period for Medicare supplement insurance#N#Medicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare (Medicare Part A and Medicare Part B) health insurance coverage....#N#(aka, Medigap ). In this brief article, we’ll answer the two most common questions, including when is it and how long does it last.

How long do you have to be in Medicare to qualify for medicare?

When you first turn age 65 and qualify for your Medicare benefits, you have a six-month window to enroll in the Medigap plan of your choice without the fear of being turned down or charged more due to a pre-existing condition. You must be enrolled in both Medicare Part A and Medicare Part B, but you have a guaranteed-issue right#N#Guaranteed-issue is a right granted to Medicare beneficiaries and applies to Medicare Supplement insurance (aka, Medigap plans). All states and the federal government enforce this essential right, which protects Medicare beneficiaries from medical underwriting....#N#.

How old do you have to be to get Medigap?

A few states have implemented legislation that makes it easier to switch from one plan to another. Also, some states have made it easier for people under age 65 to get Medigap coverage.

When is Medicare open enrollment?

Each year, there’s a Medicare Advantage Open Enrollment Period from January 1 – March 31. During this time, if you’re in a Medicare Advantage Plan and want to change your health plan, you can do one of these: Switch to a different Medicare Advantage Plan with or without drug coverage.

Is Medicare Advantage open enrollment?

The Medicare Advantage Open Enrollment Period isn’t for people who already have Original Medicare. It’s important to understand and be confident in your Medicare coverage choices. If you have a Medicare Advantage Plan and want to change your plan, check out your options today.

What is open enrollment in Medicare?

What is Medicare Open Enrollment? Understanding Medicare’s enrollment periods for eligible recipients can help you plan for the future. Enrollment periods will allow you to sign up for Medicare coverage when you first qualify, and change plans at certain times during the year if you choose to do so.

How long does Medicare enrollment last?

The Medicare Initial Enrollment Period starts 3 months before a recipient turns 65, then lasts through the month of their 65th birthday and for 3 months after that month. During this period, recipients can enroll in Original Medicare Parts A and B, a Part C Medicare Advantage Plan, or they can enroll in Parts A and B and choose a Medicare ...

What happens if you miss your Medicare enrollment period?

If you miss your Initial Enrollment Period, Medicare has other enrollment periods that you can use to acquire certain types of coverage. The General Enrollment Period, which runs from January 1st through March 31st of each year, allows recipients to join Original Medicare.

How long does it take to enroll in Medigap?

Medigap has a separate Initial Enrollment Period that begins when you turn 65 and are enrolled in Part B. During this 6-month period, you can purchase any Medigap plan sold in your state without being subject to medical underwriting.

When are special enrollment periods activated?

Special Enrollment Periods are also activated when Medicare-contracted plans, such as those offered through Medigap or Part C carriers, are no longer available in your area or you move outside of the coverage area.

Can you drop a Medicare plan if you are already enrolled in a Part C plan?

If a recipient is already enrolled in a Part C plan when Annual Enrollment begins, they can drop the plan and return to Original Medicare or change to a different Part C plan. Any recipients who are enrolled in a Part D plan or drops a Part C plan with Part D benefits can choose a new Part D plan or drop their existing one.