A Medicare Part C HMO plan costs about $23 per month, while local PPO plans average $43 per month. The most expensive plans are Regional PPO plans, which average $80 per month, and Private Fee-for-Service (PFFS) plans, which average $77 per month. Find Cheap Medicare Plans in Your Area Currently insured?

Full Answer

How much does Medicare Part a cost?

Medicare costs at a glance. Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $437 each month. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $437. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $240.

What is the true cost of Medicare administration?

Sanders said, "Private insurance companies in this country spend between 12 and 18 percent on administration costs. The cost of administering the Medicare program, a very popular program that works well for our seniors, is 2 percent. We can save approximately $500 billion a year just in administration costs."

What is operating cost?

Operating cost is a total figure that include direct costs of goods sold ( COGS) from operating expenses (which exclude direct production costs), and so includes everything from rent, payroll, and other overhead costs to raw materials and maintenance expenses.

How much can you pay out-of-pocket for Medicare?

There’s no yearly limit on what you pay out-of-pocket, unless you have supplemental coverage, like a Medicare Supplement Insurance ( An insurance policy you can buy to help lower your share of certain costs for Part A and Part B services (Original Medicare).

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How are administrative costs calculated?

Administrative costs are calculated using faulty arithmetic. But most important, because Medicare patients are older, they are substantially sicker than the average insured patient — driving up the denominator of such calculations significantly.

What are the government agencies that administer Medicare?

First, other government agencies help administer the Medicare program. The Internal Revenue Service collects the taxes that fund the program; the Social Security Administration helps collect some of the premiums paid by beneficiaries (which are deducted from Social Security checks); the Department of Health and Human Services helps to manage accounting, auditing, and fraud issues and pays for marketing costs, building costs, and more. Private insurers obviously don't have this kind of outside or off-budget help. Medicare's administration is also tax-exempt, whereas insurers must pay state excise taxes on the premiums they charge; the tax is counted as an administrative cost. In addition, Medicare's massive size leads to economies of scale that private insurers could also achieve, if not exceed, were they equally large.

Is Medicare tax exempt from state taxes?

Private insurers obviously don't have this kind of outside or off-budget help. Medicare's administration is also tax-exempt, whereas insurers must pay state excise taxes on the premiums they charge; the tax is counted as an administrative cost.

Is Medicare more expensive than private insurance?

And by that measure, even with all the administrative advantages Medicare has over private coverage, the program's administrative costs are actually significantly higher than those of private insurers.

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

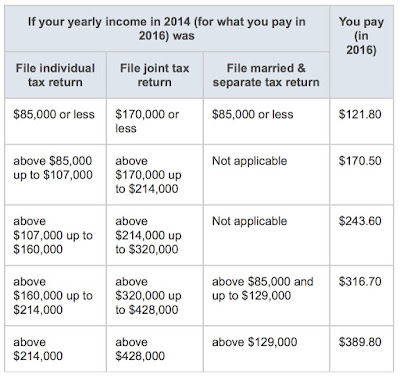

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $170.10 per month. The maximum cost of Medicare Part B premiums is $578.30 per month in 2022, and that's for individuals reporting half a million dollars or more in income in 2020.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022.

Examples of Medicare Cost to Charge Ratio in a sentence

For each provider, the Medicare Cost to Charge Ratio for each Delaware Medicaid Level of Reimbursement is multiplied by the billed amount submitted by the provider to determine Medicare-defined cost.

Related to Medicare Cost to Charge Ratio

Fixed Charge Coverage Ratio means with respect to any specified Person for any period, the ratio of the Consolidated Cash Flow of such Person for such period to the Fixed Charges of such Person for such period.

What is administrative cost?

Administrative costs are the expenses incurred by medical insurers that are not strictly medical, such as marketing, customer service, billing, claims review, quality assurance, information technology and profits. Is the gap between private and public health insurance providers’ administrative costs really that high?

Why are administrative expenses higher in commercial markets?

Historically, administrative expenses were much higher in the commercial market because insurers did a lot of underwriting, or using the health status of individuals or groups to determine their premiums. The Affordable Care Act was designed to curb that spending.

Is Medicare Advantage competitive with Medicare?

Glied pointed out that private Medicare Advantage plans are "pretty competitive with traditional Medicare," but also tend to operate at higher administrative costs. "They bring costs down in other ways but they have to use administrative spending to do that," Glied said.

Is Medicare a single payer?

Experts told us that a single-payer system for the United States would have lower administrative costs than today’s private insurance, but it likely wouldn’t be able to achieve administrative costs as low as the existing Medicare program.

Does Medicare piggyback on Social Security?

But because much of Medicare piggybacks off Social Security, other administrative costs such as enrollment, payment and keeping track of patients are left to the Social Security system.

Background

Section 1886 (d) (5) (A) of the Act provides for Medicare payments to Medicare-participating hospitals in addition to the basic prospective payments for cases incurring extraordinarily high costs.

Cost-to-Charge Ratios

As explained above, hospital-specific cost-to-charge ratios are applied to the covered charges for a case to determine whether the costs of the case exceed the fixed-loss outlier threshold.

What is operating cost?

Operating costs are associated with the maintenance and administration of a business on a day-to-day basis. Operating costs include direct costs of goods sold (COGS) and other operating expenses—often called selling, general, and administrative (SG&A) —which includes rent, payroll, and other overhead costs, as well as raw materials ...

What are the components of operating costs?

Operating costs will also include the cost of goods sold, which are the expenses directly tied to the production of goods and services.

Why are variable costs less volatile?

Typically, companies with a high proportion of variable costs relative to fixed costs are considered to be less volatile, as their profits are more dependent on the success of their sales. In the same way, the profitability and risk for the same companies are also easier to gauge. 2.

What are variable costs?

Variable Costs. Variable costs, like the name implies, are comprised of costs that vary with production. Unlike fixed costs, variable costs increase as production increases and decrease as production decreases. Examples of variable costs include raw material costs and the cost of electricity.

What are operating costs in addition to COGS?

Common operating costs in addition to COGS may include rent, equipment, inventory costs, marketing, payroll, insurance, and funds allocated for research and development. Operating costs can be found and analyzed by looking at a company's income statement. 1:28.

Why are both costs accounted for differently in a company's books?

Both costs are accounted for differently in a company's books, allowing analysts to determine how costs are associated with revenue-generating activities and whether the business can be run more efficiently. 2. Generally speaking, a company’s management will seek to maximize profits for the company.

What is fixed cost?

A fixed cost is one that does not change with an increase or decrease in sales or productivity and must be paid regardless of the company’s activity or performance. For example, a manufacturing company must pay rent for factory space, regardless of how much it is producing or earning.

What is the second computation for Medicare?

The second computation includes hospital patient days used by patients who, for those days, were eligible for medical assistance under a state plan approved under title XIX (Medicaid), but who were not entitled to Medicare Part A. This number is divided by the total number of hospital patient days for that same period.

What percentage of inpatient care revenue comes from state and local governments?

The alternate special exception method is for large urban hospitals that can demonstrate that more than 30 percent of their total net inpatient care revenues come from State and local governments for indigent care (other than Medicare or Medicaid).

What percentage of Medicare DSH is uncompensated?

Additional Payment for Uncompensated Care: The remainder, equal to 75 percent of what otherwise would have been paid as Medicare DSH will become available for an uncompensated care payments after the amount is reduced for changes in the percentage of individuals that are uninsured.

When did CMS 1498-R become effective?

All other provisions of CMS Ruling 1498-R remain in effect. The amended Ruling became effective on April 22, 2015. To view the amended Ruling, please visit the link below in the downloads section. ...

Does CMS have HETAs?

CMS has developed a limited view of the HIPAA Eligibility Transaction System (HETS) to allow hospitals that receive Medicare DSH payments to view Medicare enrollment information for their hospital inpatients.

Can a hospital verify Medicare?

In addition, hospitals can verify Medicare enrollment for their hospital inpatients, including whether a patient is entitled to Medicare Part A benefits, enrolled in a Medicare managed care plan, or has Medicare as a secondary insurance.

Does Medicare DSH pay for uncompensated care?

Each Medicare DSH hospital will receive an uncompensated care payment based on its share of insured low income days (that is, the sum of Medicaid days and Medicare SSI days) reported by Medicare DSH hospitals. Each hospital’s uncompensated care payment is the product of three factors. These three factors are: ...